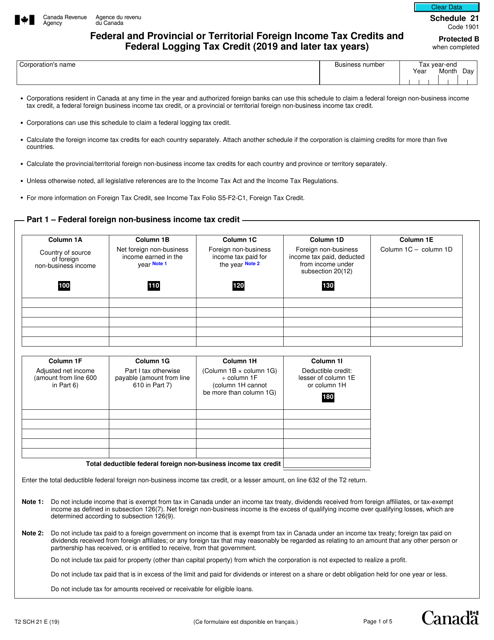

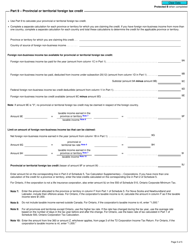

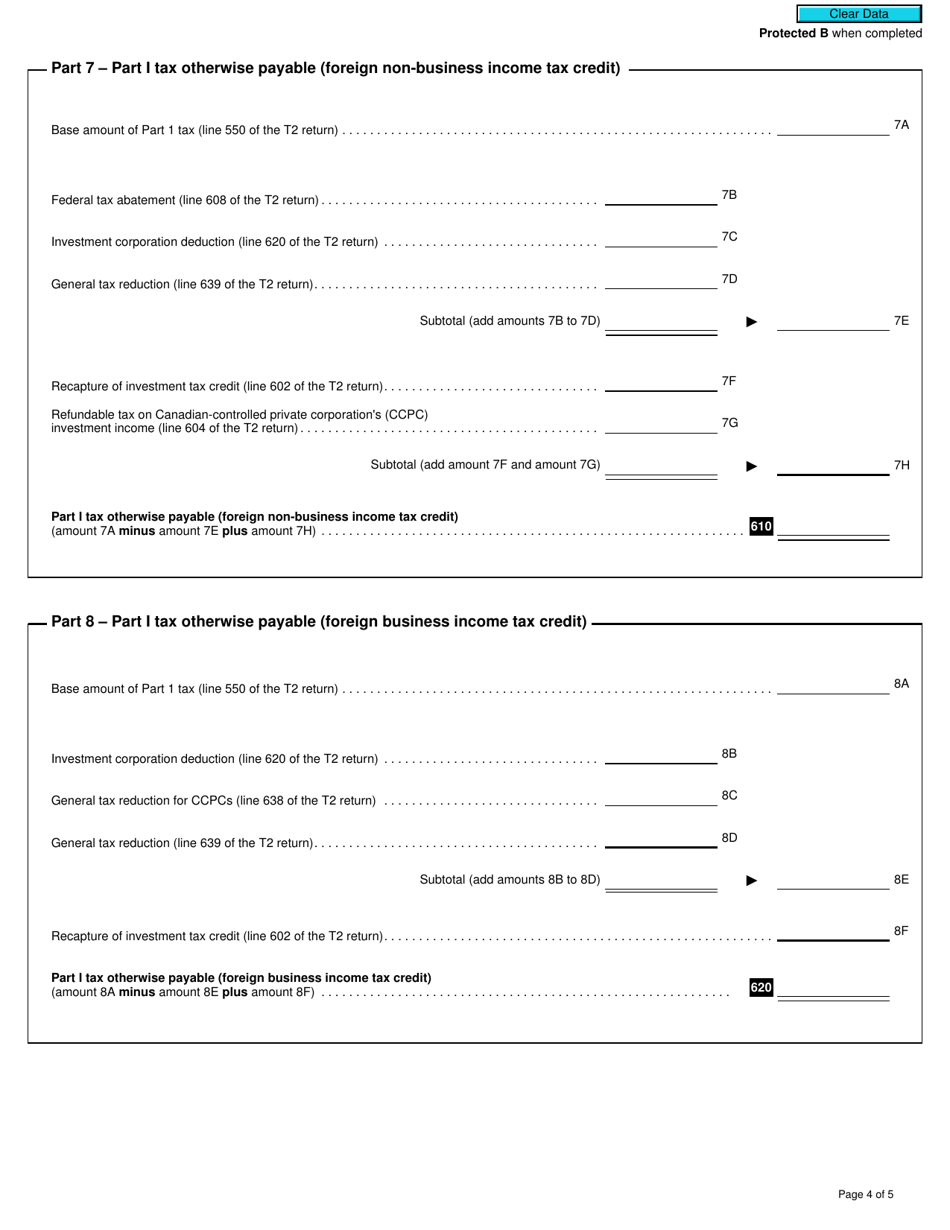

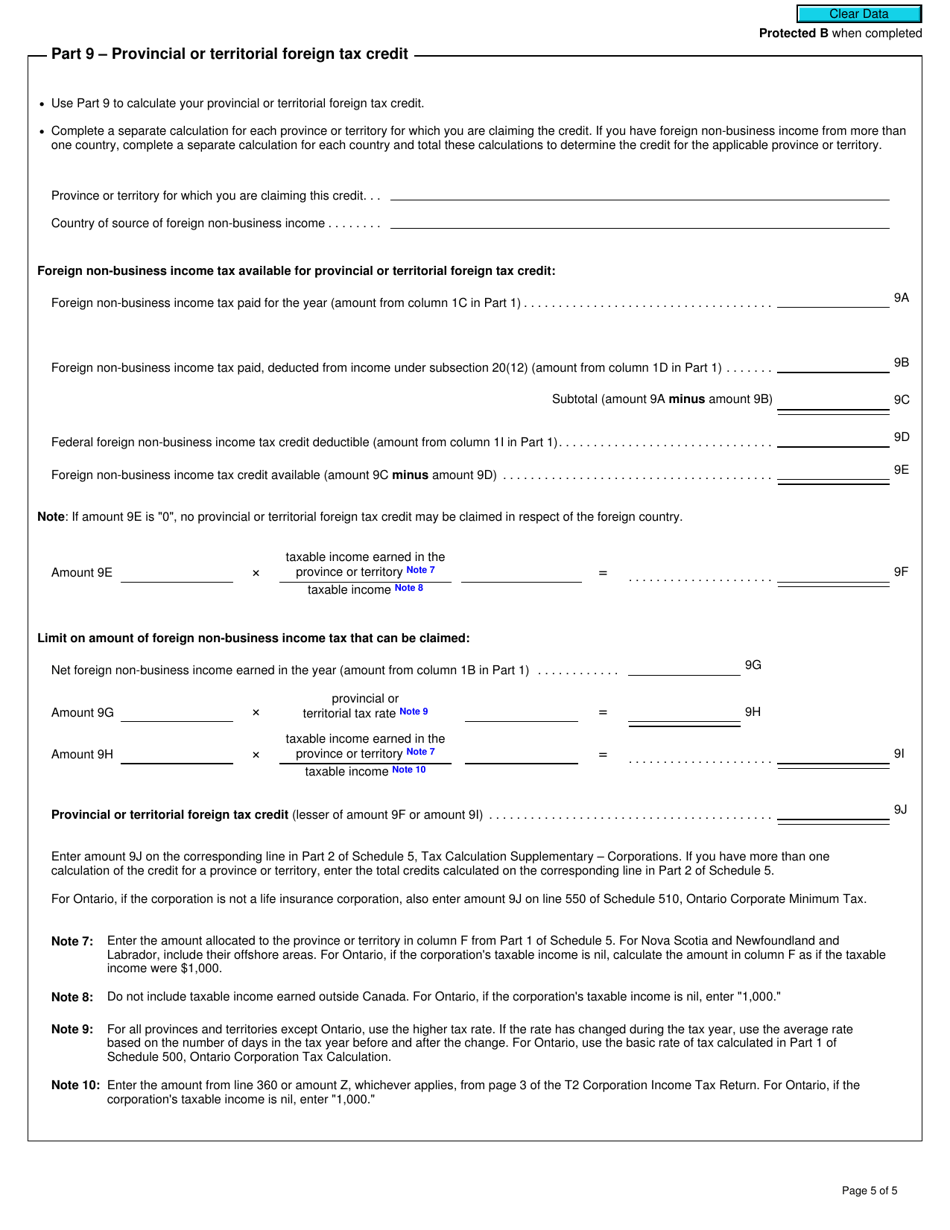

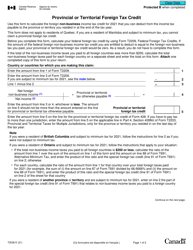

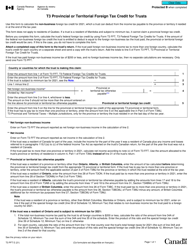

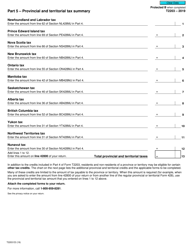

Form T2 Schedule 21 Federal and Provincial or Territorial Foreign Income Tax Credits and Federal Logging Tax Credit (2019 and Later Tax Years) - Canada

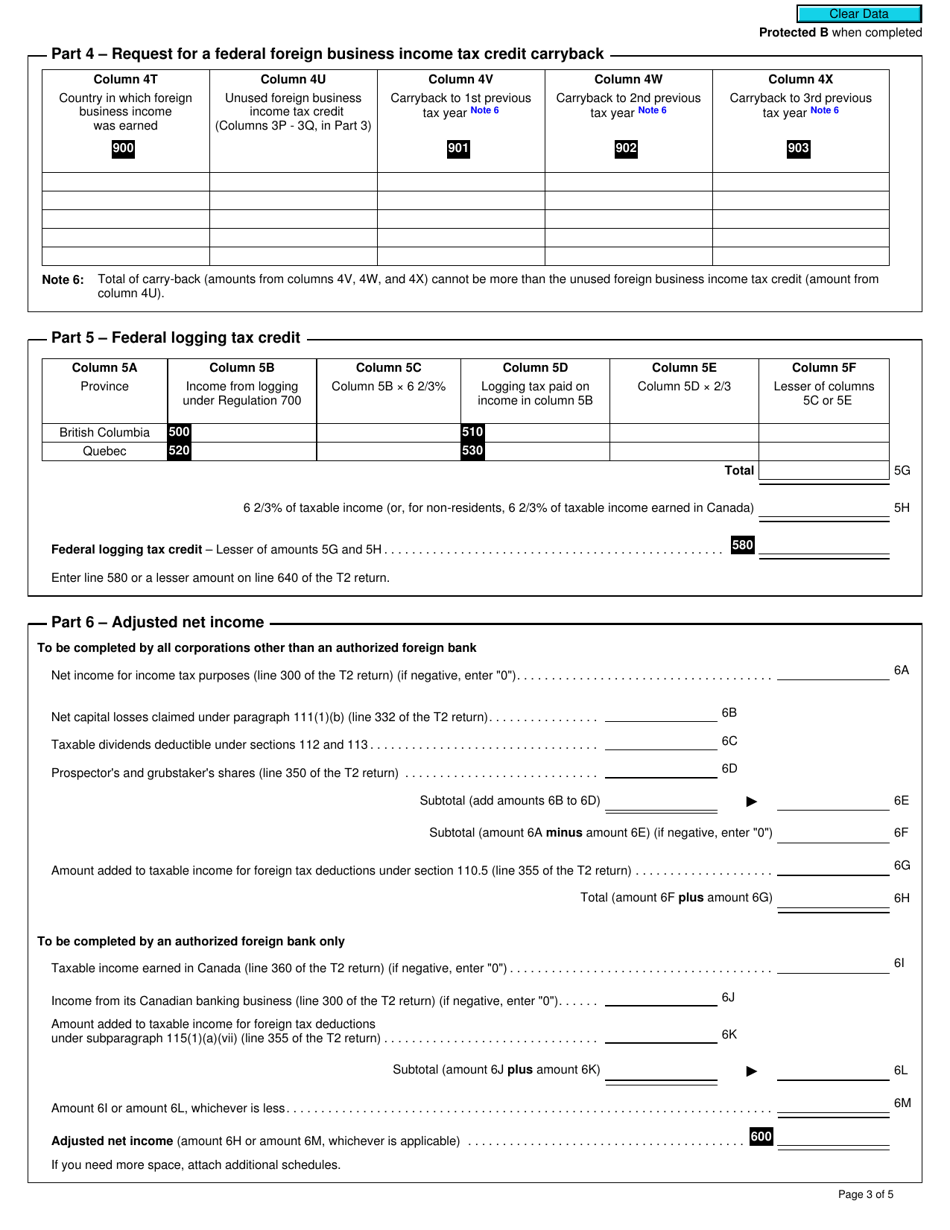

Form T2 Schedule 21 is used by corporations in Canada to claim federal and provincial/territorial tax credits related to foreign incometaxes paid as well as the federal logging tax credit. It is used for the 2019 tax year and later.

The Form T2 Schedule 21 Federal and Provincial or Territorial Foreign Income Tax Credits and Federal Logging Tax Credit for the tax years 2019 and later is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 21?

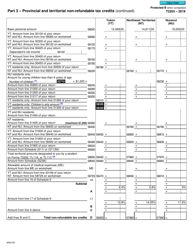

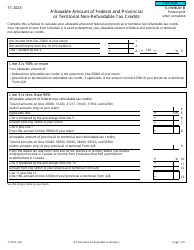

A: Form T2 Schedule 21 is a tax form used in Canada to report federal and provincial or territorial foreign income tax credits and federal logging tax credits.

Q: What is the purpose of Form T2 Schedule 21?

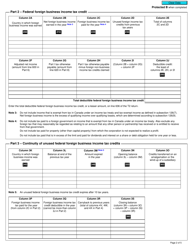

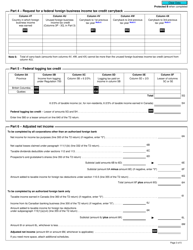

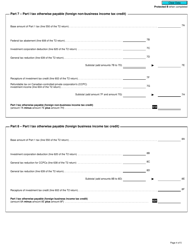

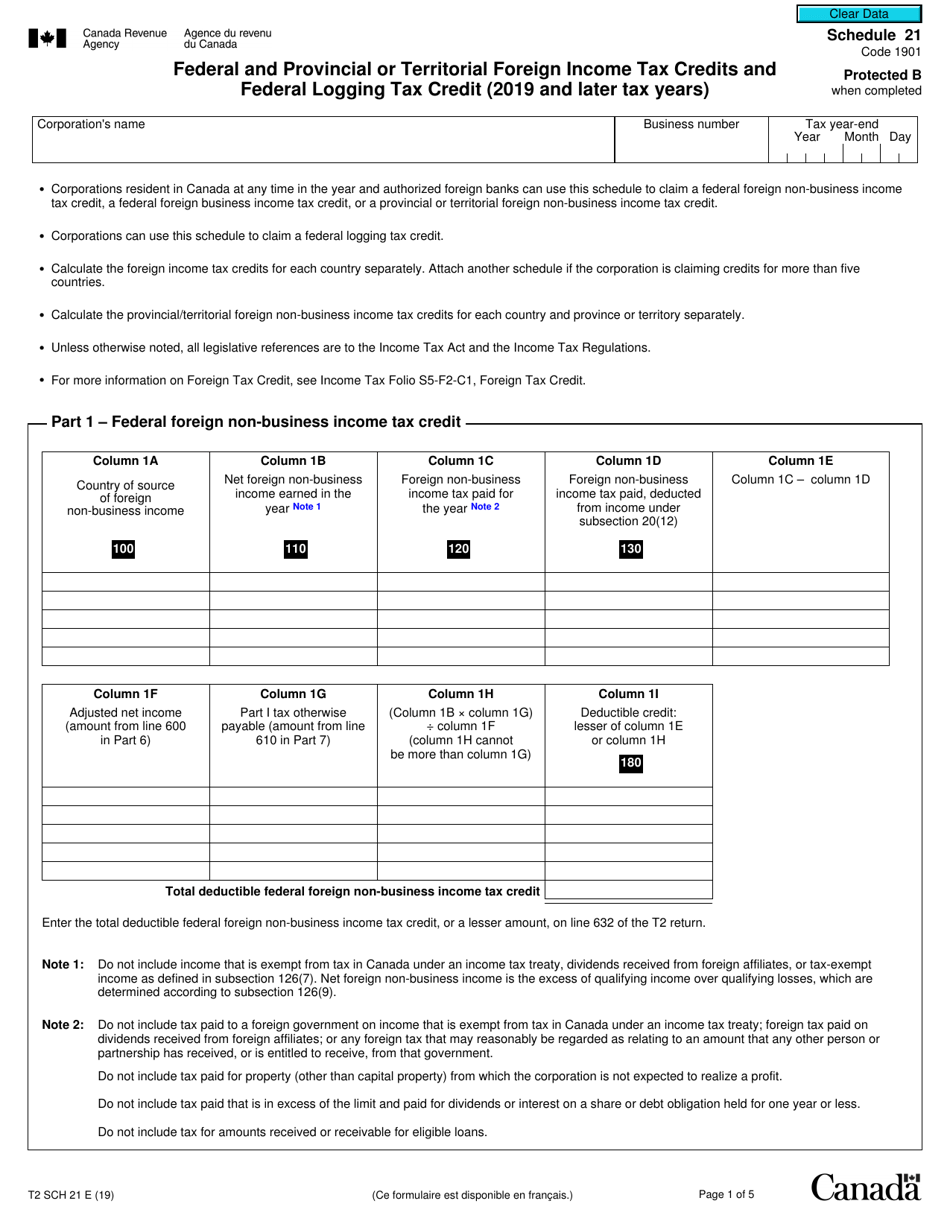

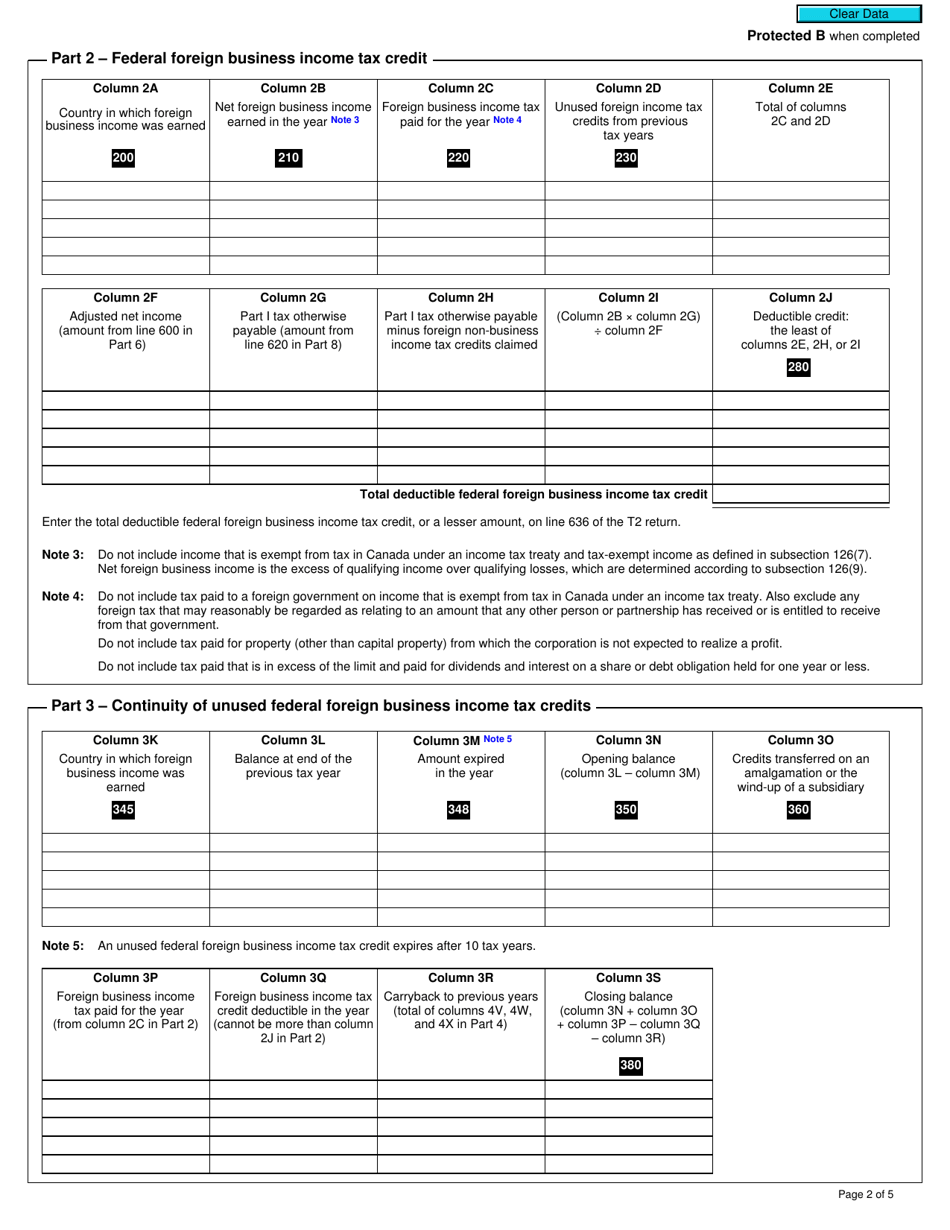

A: The purpose of Form T2 Schedule 21 is to calculate and claim foreign income tax credits and federal logging tax credits.

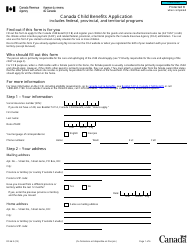

Q: Who needs to file Form T2 Schedule 21?

A: Corporations in Canada that have foreign income tax credits and federal logging tax credits may need to file Form T2 Schedule 21.

Q: What are federal and provincial or territorial foreign income tax credits?

A: Federal and provincial or territorial foreign income tax credits are credits that can be claimed by a corporation to reduce their Canadian tax liability on income earned from foreign sources.

Q: What is the federal logging tax credit?

A: The federal logging tax credit is a credit that can be claimed by a corporation engaged in the business of logging to reduce their Canadian tax liability.

Q: Which tax years does Form T2 Schedule 21 apply to?

A: Form T2 Schedule 21 applies to tax years starting in 2019 and later.