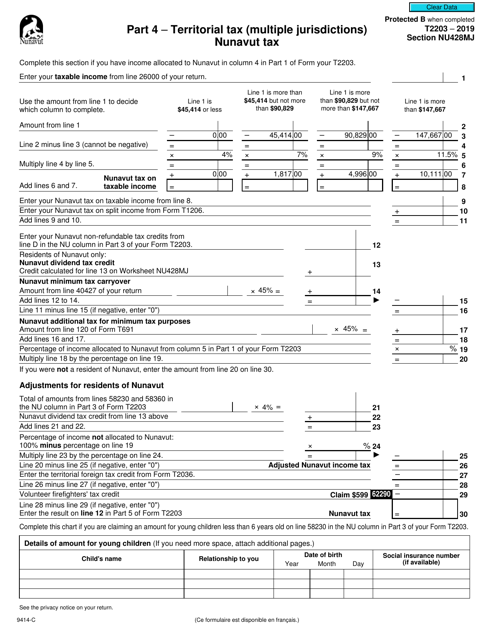

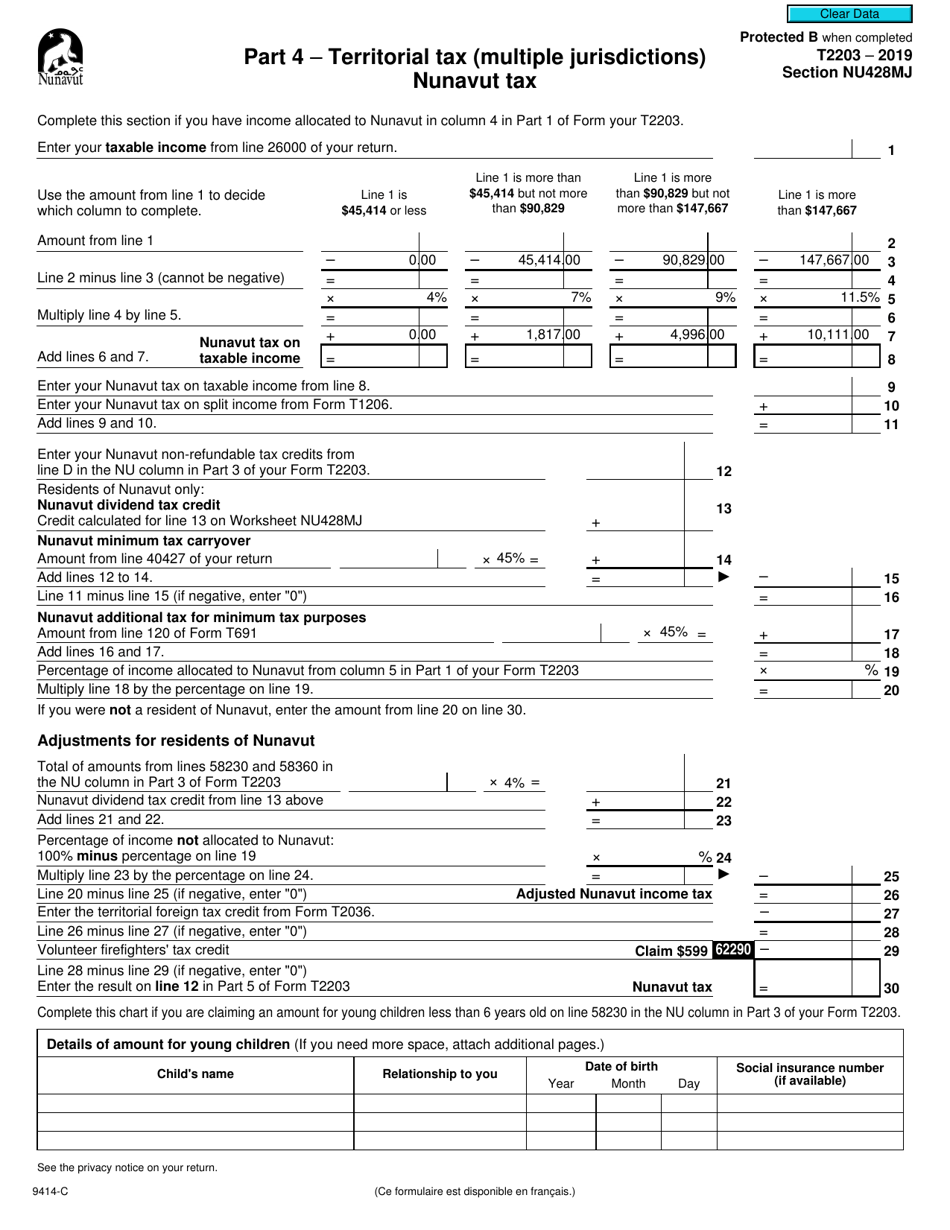

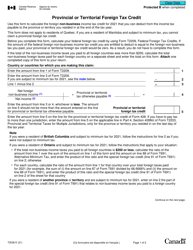

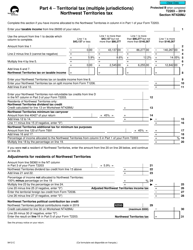

Form T2203 (9414-C) Section NU428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Nunavut Tax - Canada

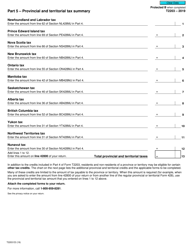

Form T2203 (9414-C) Section NU428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Nunavut Tax in Canada is used to calculate and pay provincial tax owed by individuals who reside in the Nunavut territory. It is specifically designed for taxpayers who have income from multiple jurisdictions within Nunavut and need to determine their tax liability accordingly. This form helps ensure that individuals meet their tax obligations in relation to their income earned within Nunavut and helps in ensuring the proper allocation of tax revenue within the territory.

Form T2203 (9414-C) Section NU428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Nunavut Tax in Canada is filed by individuals or businesses who are residents of Nunavut and need to report their territorial tax obligations. This form is specifically designed for taxpayers in Nunavut, a territory in Canada, to calculate and pay their territorial taxes.

FAQ

Q: What is Form T2203 (9414-C)?

A: Form T2203 (9414-C) is a Canadian tax form that is used to calculate territorial tax for multiple jurisdictions, such as Nunavut.

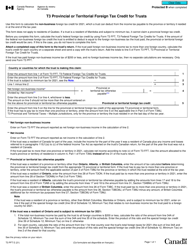

Q: What is territorial tax?

A: Territorial tax is a type of tax that is based on the specific territory or region where the taxpayer resides or conducts business.

Q: What is Nunavut Tax?

A: Nunavut Tax is the specific tax applied to individuals or businesses operating in the territory of Nunavut in Canada.

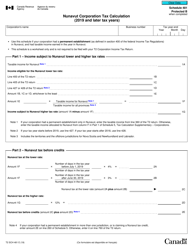

Q: How is Nunavut Tax calculated?

A: Nunavut Tax is calculated using the information provided on Form T2203 (9414-C) section NU428MJ, part 4. This form takes into account various factors such as income, deductions, and credits to determine the amount of tax owed in Nunavut.

Q: Is Nunavut Tax deductible on federal tax returns?

A: No, Nunavut Tax is not deductible on federal tax returns. It is separate from federal taxes and must be paid to the territorial government.

Q: Who is required to file Form T2203 (9414-C)?

A: Individuals or businesses who are residents or have income in multiple jurisdictions, including Nunavut, may be required to file Form T2203 (9414-C) to calculate their territorial tax obligations.

Q: Are there any penalties for not filing Form T2203 (9414-C) correctly?

A: Yes, there can be penalties for not filing Form T2203 (9414-C) correctly or failing to include accurate information. It is important to ensure that the form is completed accurately to avoid any penalties or additional tax liabilities.