This version of the form is not currently in use and is provided for reference only. Download this version of

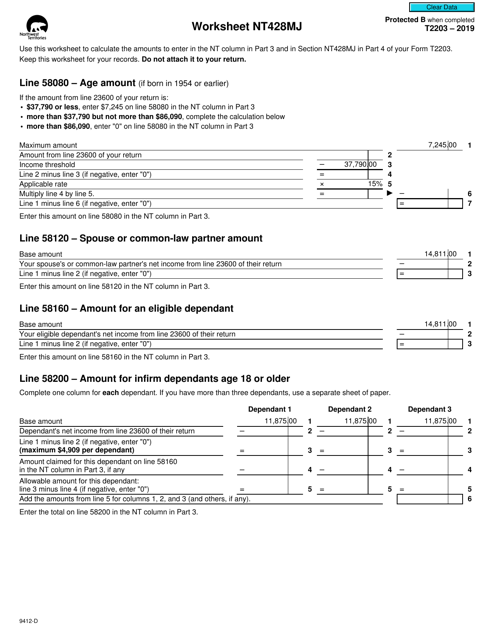

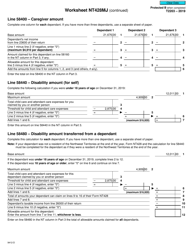

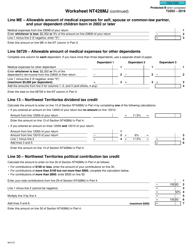

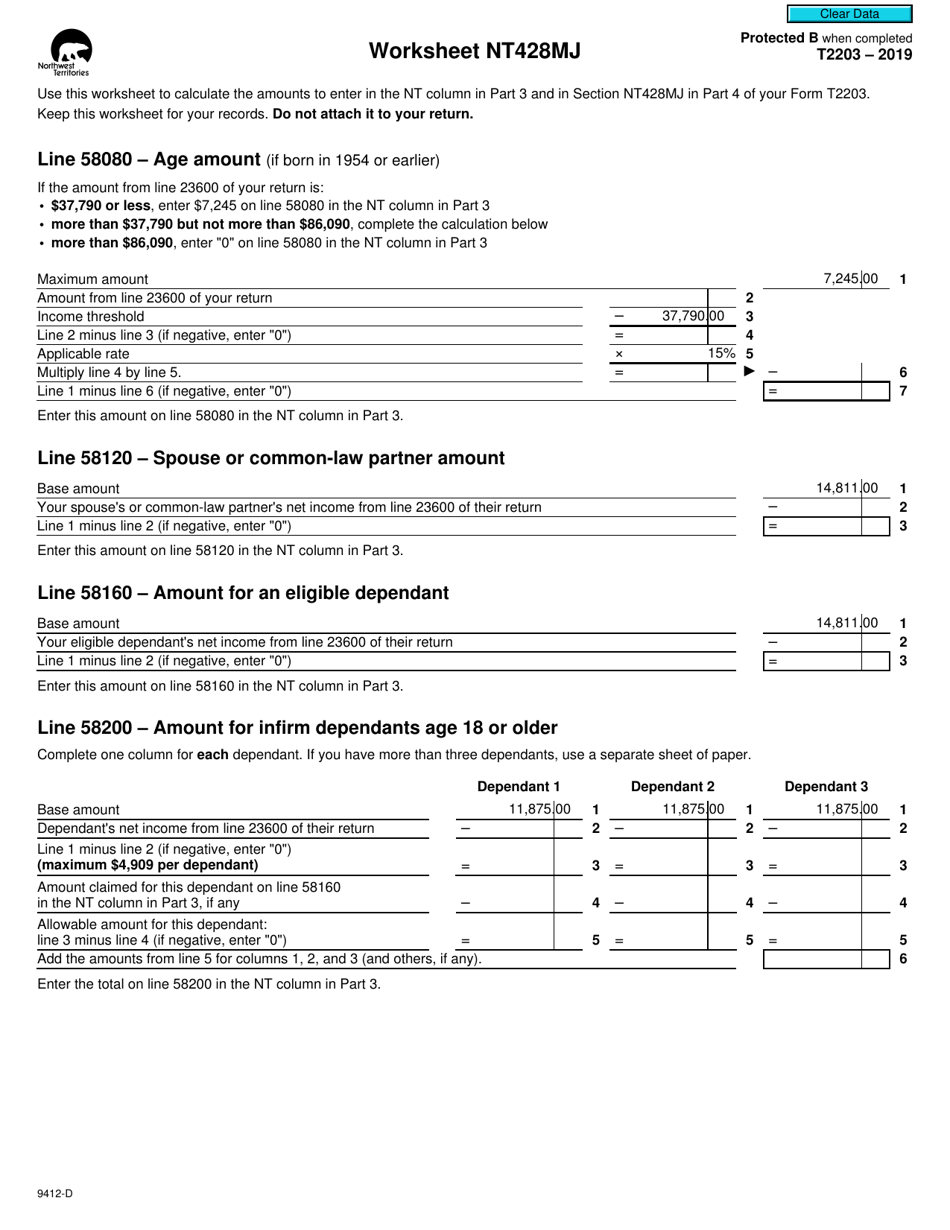

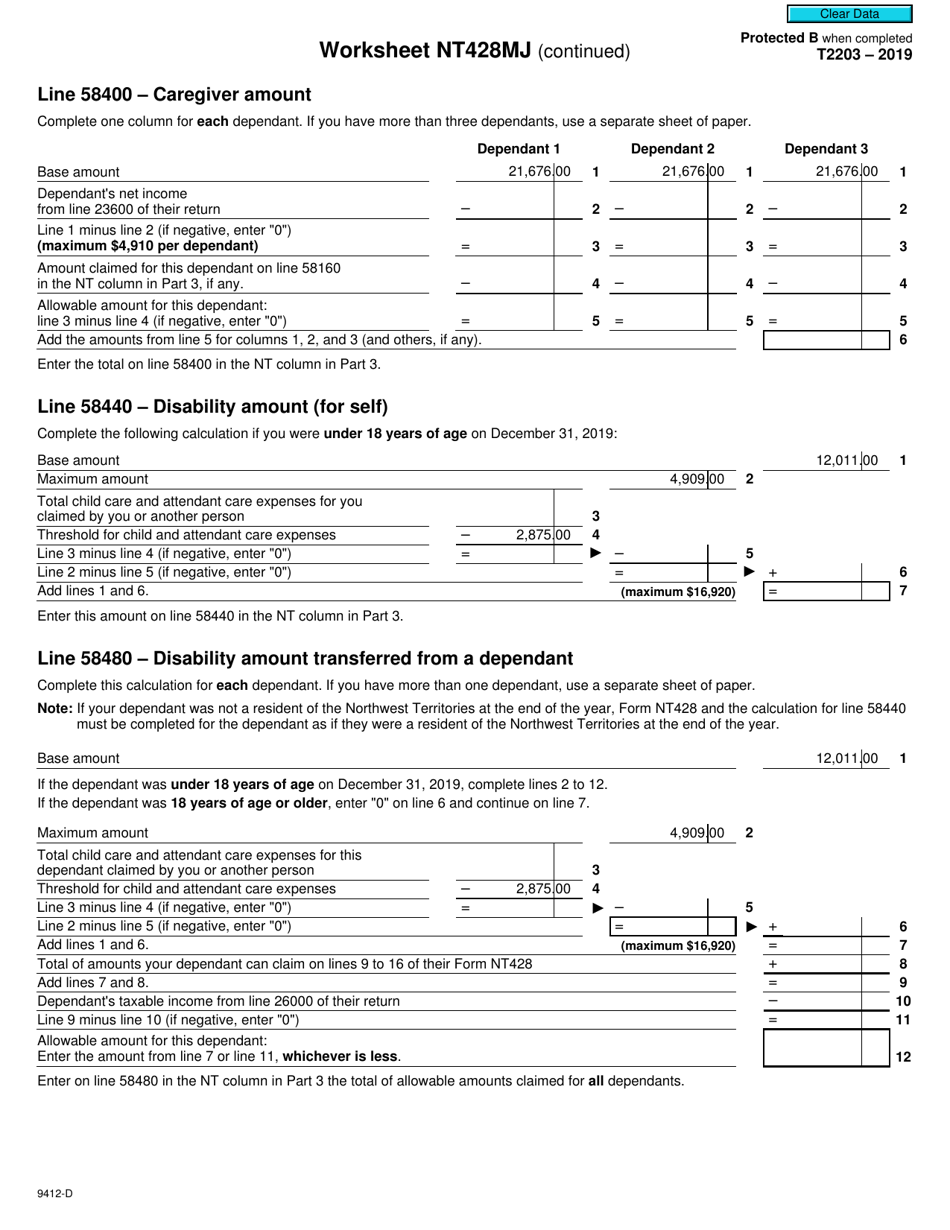

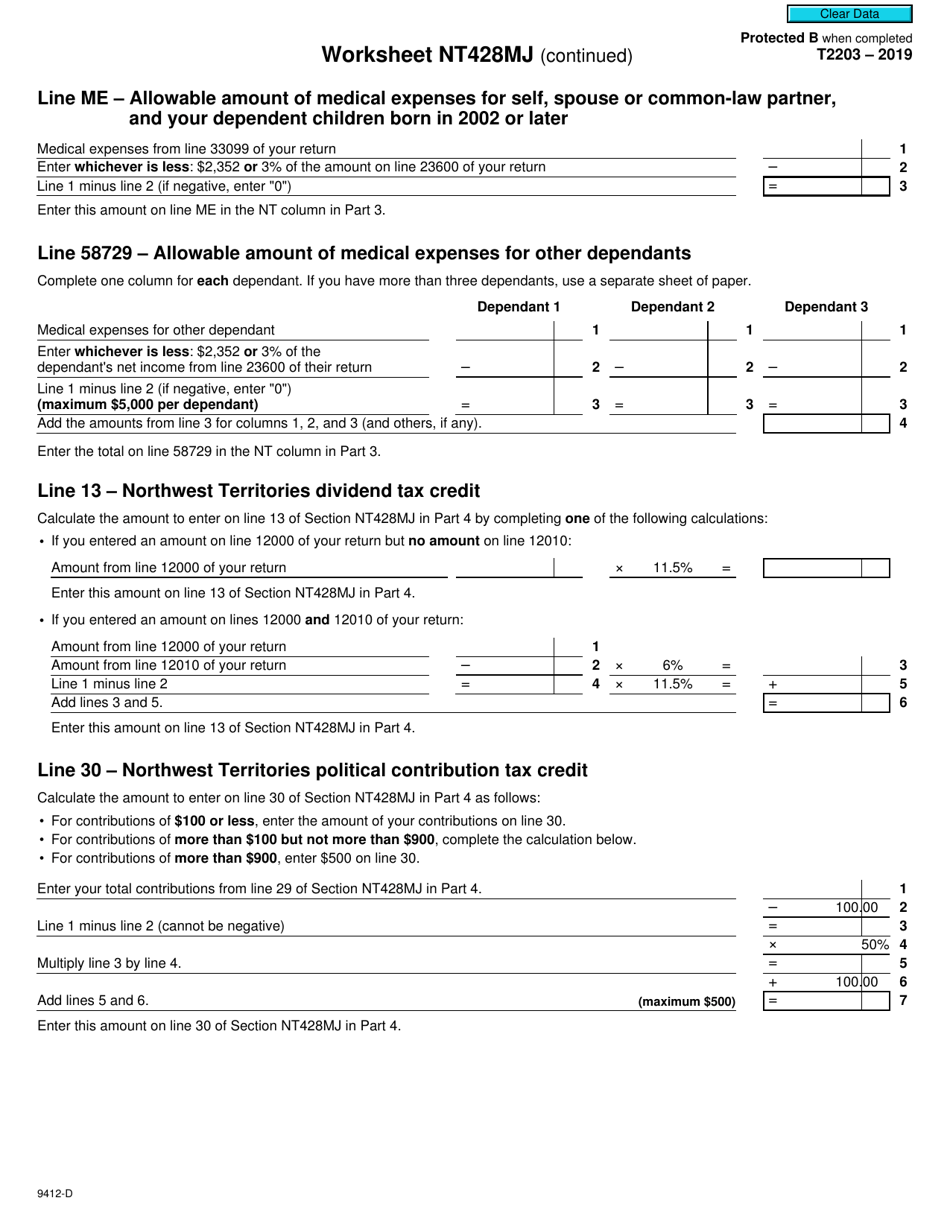

Form T2203 (9412-D) Worksheet NT428MJ

for the current year.

Form T2203 (9412-D) Worksheet NT428MJ Northwest Territories - Canada

Form T2203 (9412-D) Worksheet NT428MJ is a specific document used in the Northwest Territories of Canada for tax purposes. It is used to calculate the territorial tax credit, which allows residents of the Northwest Territories to claim certain tax credits specific to their region. The worksheet helps individuals calculate the amount of tax credit they are eligible for based on their income and other factors. This information is used when filing their tax return to accurately claim the Northwest Territories tax credit.

The Form T2203 (9412-D) Worksheet NT428MJ for Northwest Territories - Canada is typically filed by individuals who are residents of the Northwest Territories and need to report their income and tax information to the Canada Revenue Agency (CRA). It is used to calculate provincial tax credits and may be used in conjunction with the federal Form T1 Income Tax Return.

FAQ

Q: What is Form T2203 (9412-D) Worksheet NT428MJ?

A: Form T2203 (9412-D) Worksheet NT428MJ is a tax form used for reporting income and expenses in the Northwest Territories of Canada.

Q: Who needs to fill out Form T2203 (9412-D) Worksheet NT428MJ?

A: Residents of the Northwest Territories who earned income or incurred expenses during the tax year may need to fill out Form T2203 (9412-D) Worksheet NT428MJ.

Q: What information is required on Form T2203 (9412-D) Worksheet NT428MJ?

A: Form T2203 (9412-D) Worksheet NT428MJ requires information about your income, deductions, and credits, such as employment income, self-employment income, investment income, eligible expenses, and other relevant details.

Q: Are there any penalties for not filing Form T2203 (9412-D) Worksheet NT428MJ?

A: Yes, there may be penalties for not filing Form T2203 (9412-D) Worksheet NT428MJ or for filing it late. It is recommended to file your taxes on time to avoid any potential penalties or interest charges.

Q: Can I claim tax credits on Form T2203 (9412-D) Worksheet NT428MJ?

A: Yes, you may be eligible to claim certain tax credits on Form T2203 (9412-D) Worksheet NT428MJ, such as the Northern Residents Deductions, Home Accessibility Tax Credit, or other applicable credits. Consult the instructions or seek professional advice to determine the tax credits you can claim.

Q: Do I need to attach supporting documents with Form T2203 (9412-D) Worksheet NT428MJ?

A: You should keep all supporting documents related to your income, deductions, and credits in case they are requested by the tax authorities. However, you generally do not need to submit these documents when filing Form T2203 (9412-D) Worksheet NT428MJ. It is important to retain them for reference purposes.