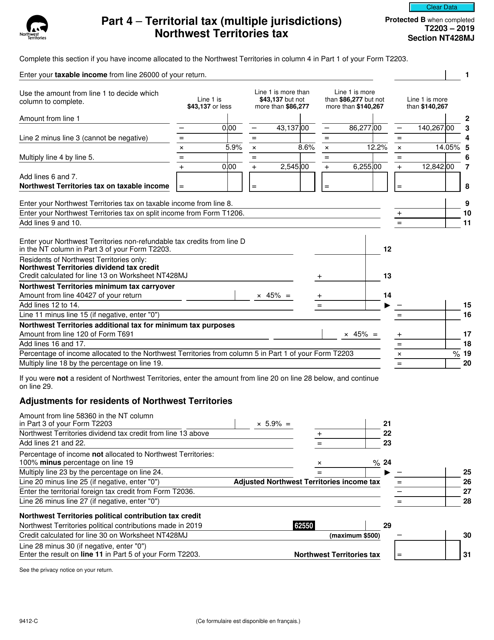

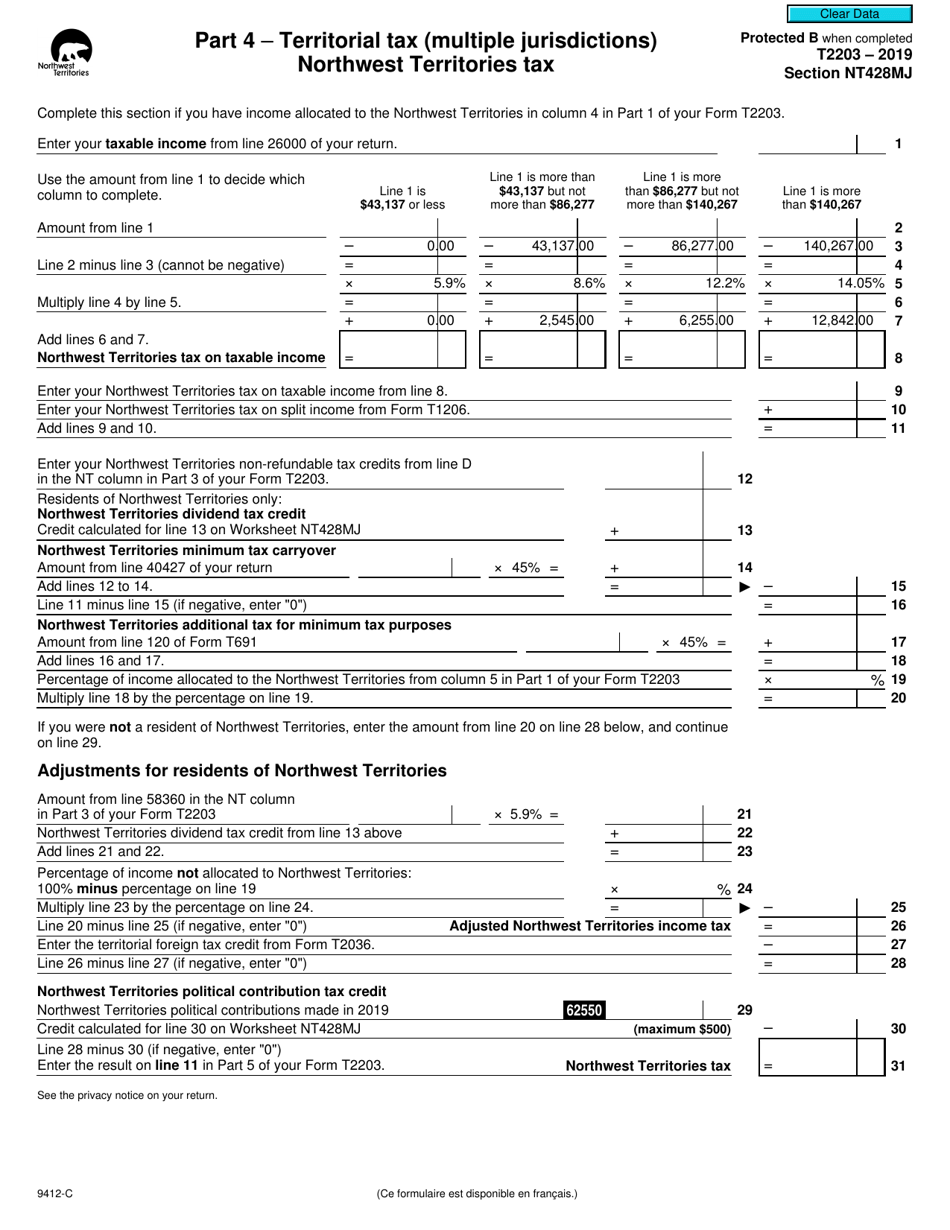

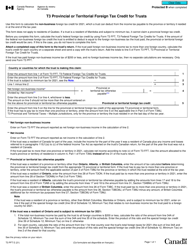

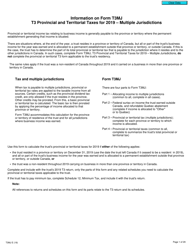

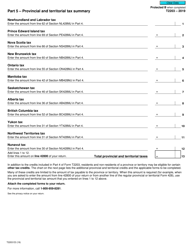

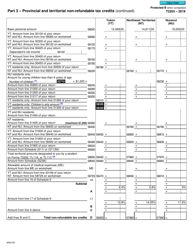

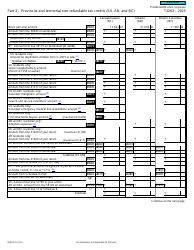

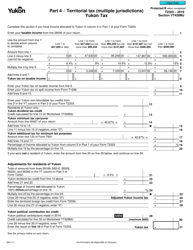

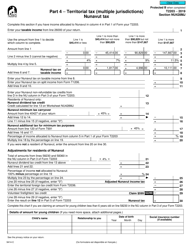

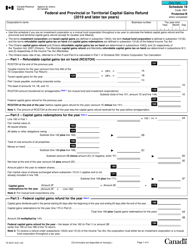

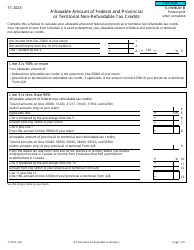

Form T2203 (9412-C) Part NT428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Northwest Territories Tax - Canada

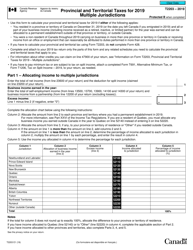

Form T2203 (9412-C) Part NT428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Northwest Territories Tax - Canada is used for calculating and reporting the territorial tax owed to the government of the Northwest Territories in Canada. It is specifically for individuals who reside in the Northwest Territories and have income from multiple jurisdictions.

FAQ

Q: What is Form T2203 (9412-C)?

A: Form T2203 (9412-C) is a tax form that is used in Canada to report territorial tax information.

Q: What is Part NT428MJ on Form T2203 (9412-C)?

A: Part NT428MJ refers to the specific section of the form that is used to report territorial tax information for the Northwest Territories.

Q: What is Territorial Tax?

A: Territorial Tax is a tax system used in Canada to administer taxes in the territories, such as the Northwest Territories.

Q: What is Northwest Territories Tax?

A: Northwest Territories Tax refers to the specific tax obligations and regulations for individuals and businesses in the Northwest Territories of Canada.