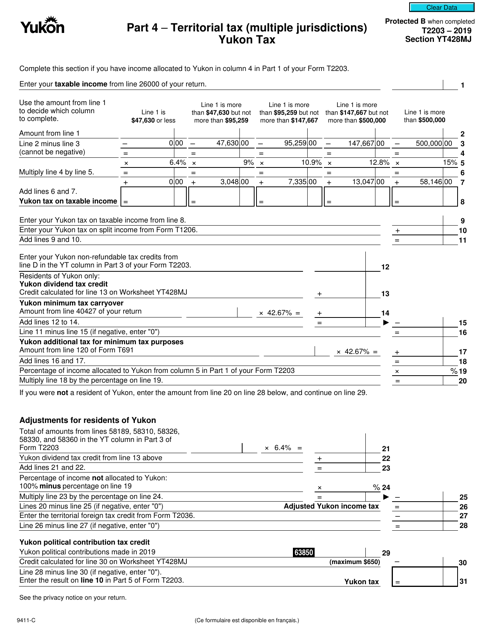

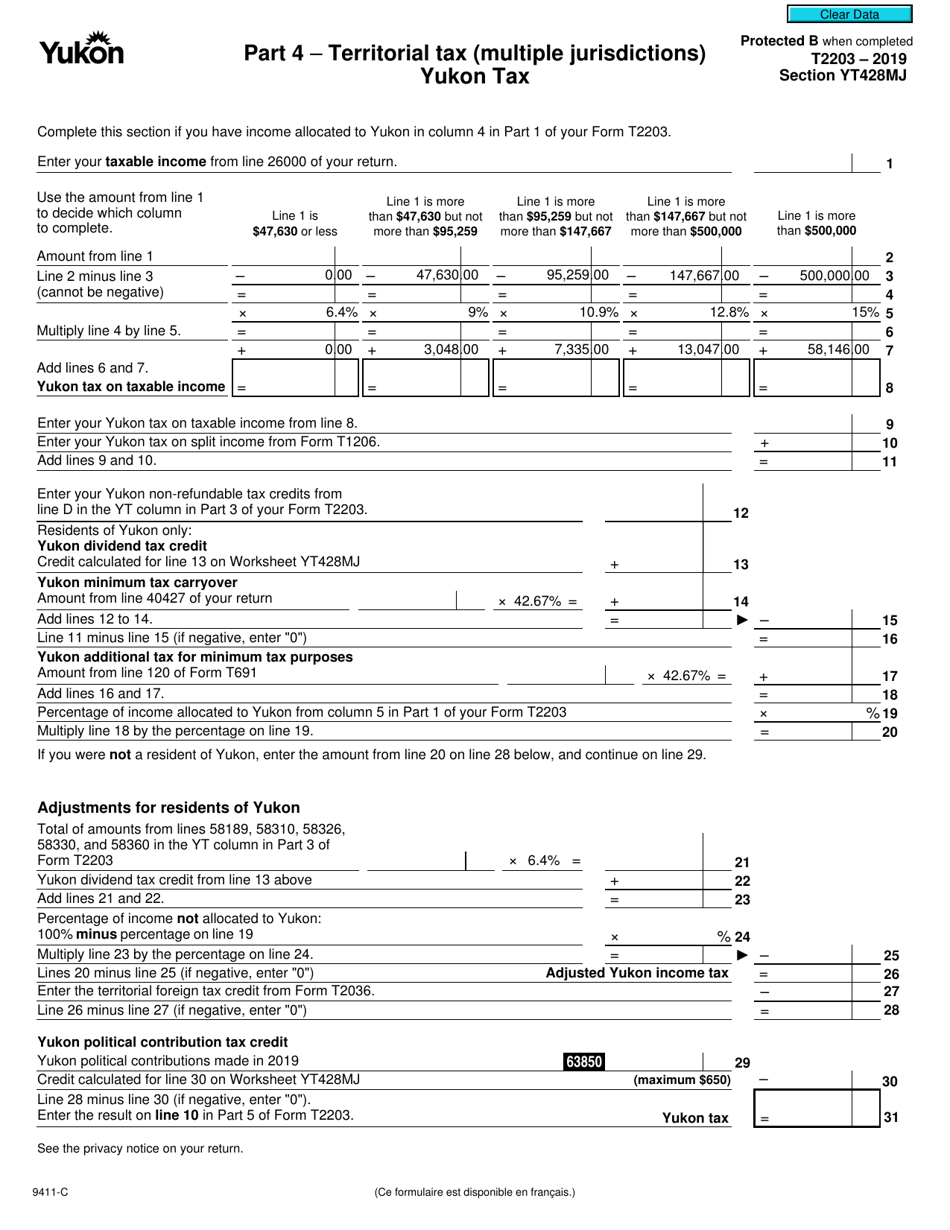

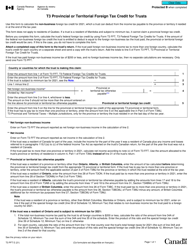

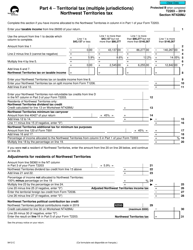

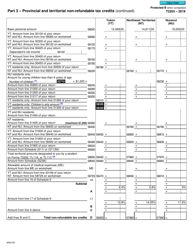

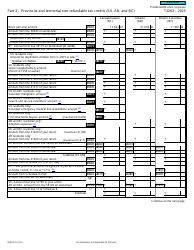

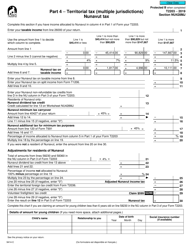

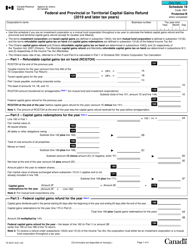

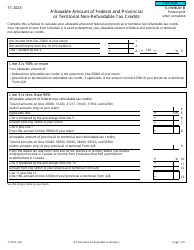

Form T2203 (9411-C) Section YT428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) Yukon Tax - Canada

The form T2203 (9411-C) Section YT428MJ Part 4 - Territorial Tax (Multiple Jurisdictions) for Yukon Tax in Canada is filed by individuals or businesses who are residents of the Yukon Territory.

FAQ

Q: What is Form T2203?

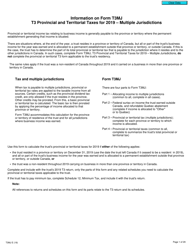

A: Form T2203 is a tax form used in Canada.

Q: What is the purpose of Form T2203?

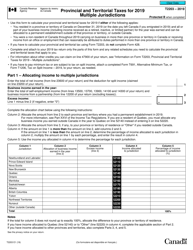

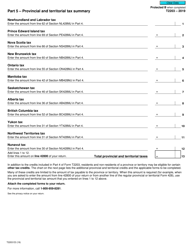

A: Form T2203 is used to calculate territorial tax for multiple jurisdictions in Canada.

Q: What does Section YT428MJ refer to?

A: Section YT428MJ refers to the specific part of the tax form that pertains to the Yukon territory.

Q: What is Part 4 of Form T2203?

A: Part 4 of Form T2203 is the section that deals with territorial tax, specifically for multiple jurisdictions.

Q: What is Territorial Tax?

A: Territorial tax is a tax system used in Canada where each province or territory has its own tax rates and rules.

Q: What is the Yukon Tax?

A: The Yukon Tax refers to the specific territorial tax requirements and regulations for the Yukon territory in Canada.