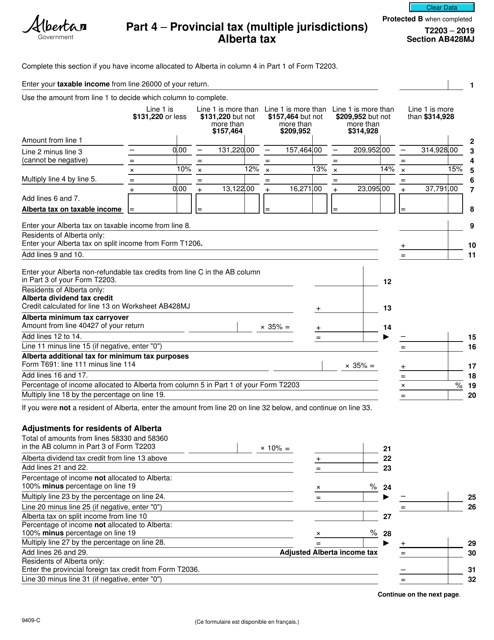

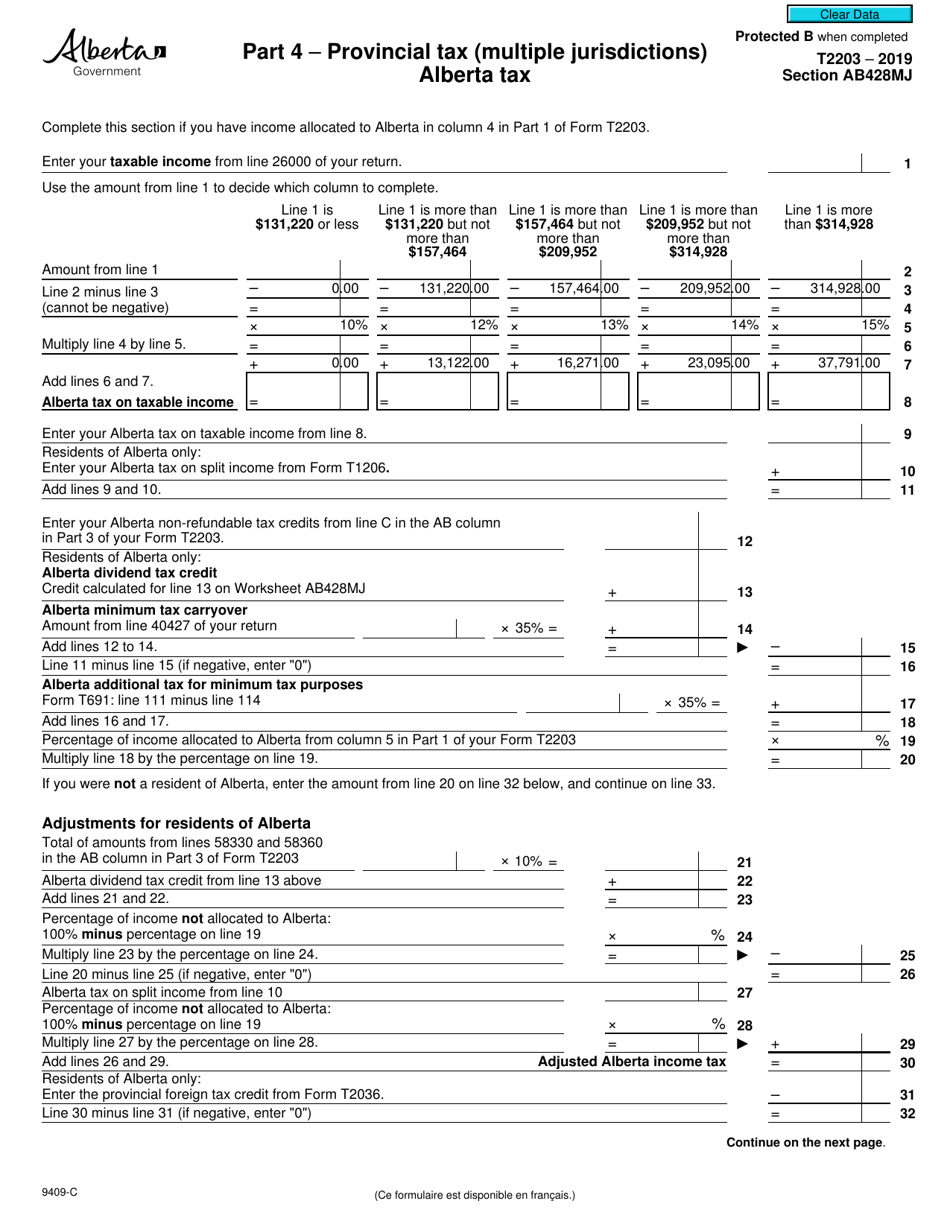

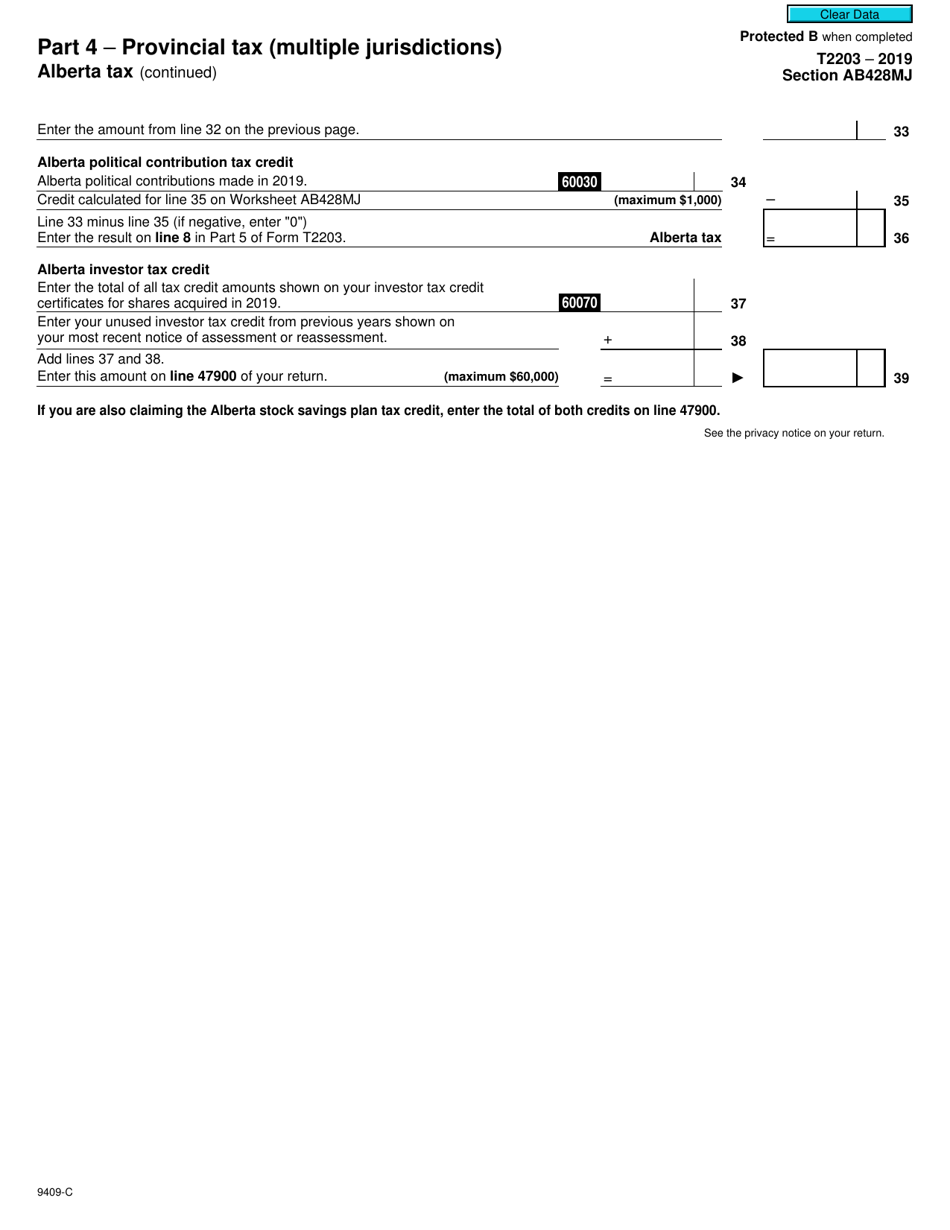

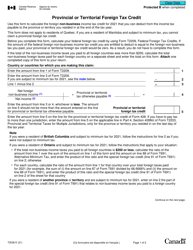

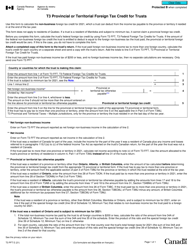

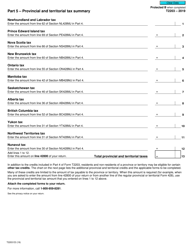

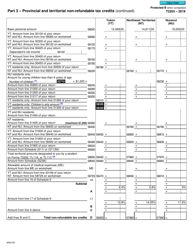

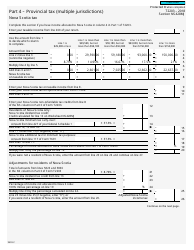

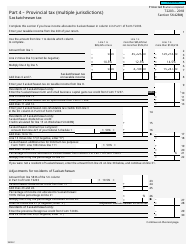

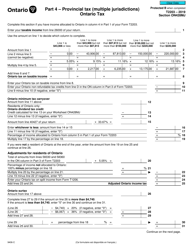

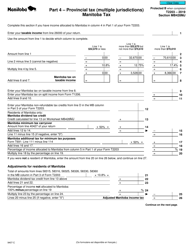

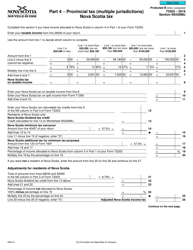

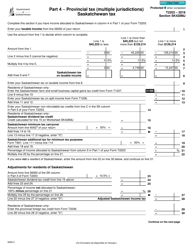

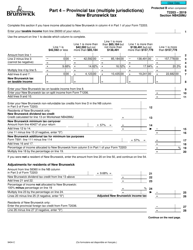

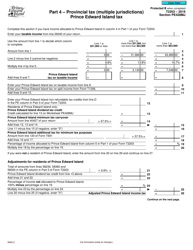

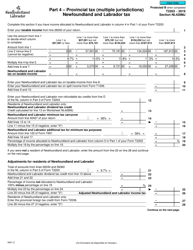

Form T2203 (9409-C) Section AB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Alberta Tax - Canada

Form T2203 (9409-C) Section AB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Alberta Tax - Canada is a form used to calculate the provincial tax (Alberta tax) owed by individuals who reside in Alberta, Canada. It is used to report and pay the provincial income tax, which is separate from the federal income tax, to the provincial government.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to calculate provincial tax.

Q: What is section AB428MJ?

A: Section AB428MJ is a specific section of Form T2203 that deals with provincial tax in multiple jurisdictions.

Q: What is Part 4 of Section AB428MJ?

A: Part 4 of Section AB428MJ focuses specifically on Alberta tax.

Q: What is Alberta tax?

A: Alberta tax refers to the provincial tax applicable to individuals living in Alberta, Canada.