This version of the form is not currently in use and is provided for reference only. Download this version of

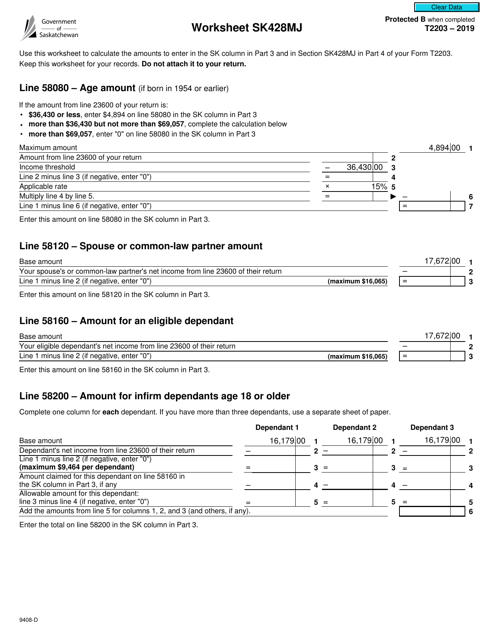

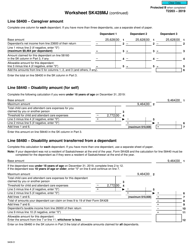

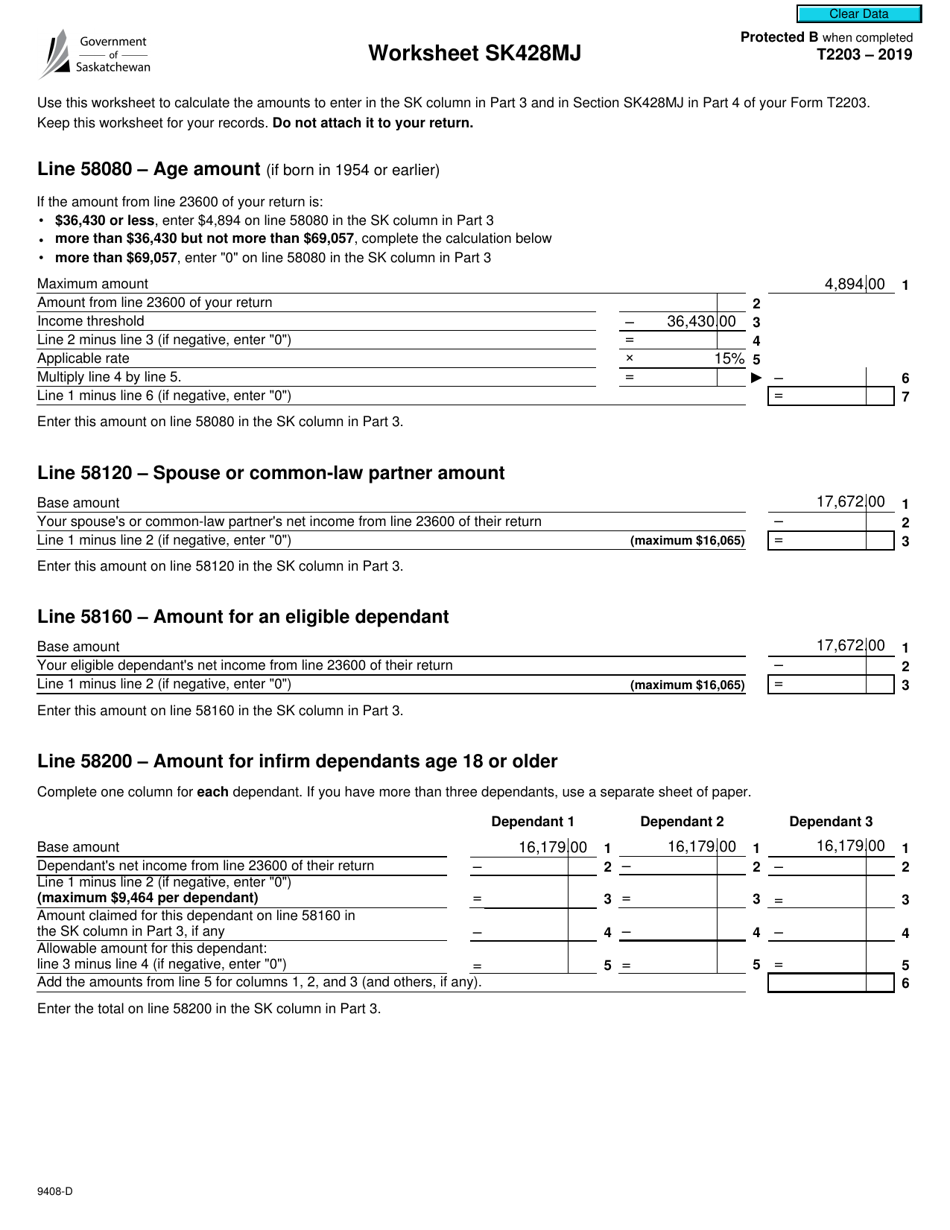

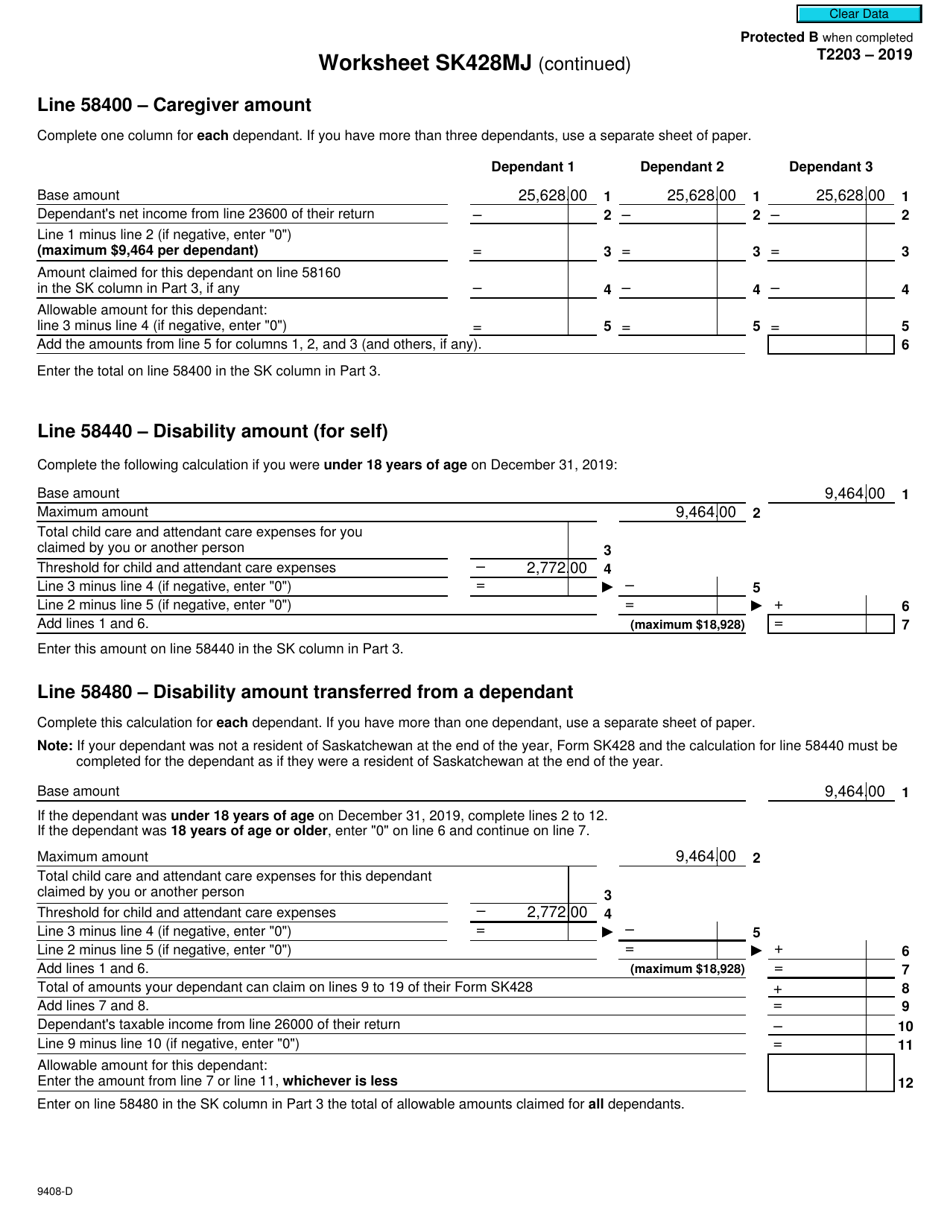

Form T2203 (9408-D) Worksheet SK428MJ

for the current year.

Form T2203 (9408-D) Worksheet SK428MJ Saskatchewan - Canada

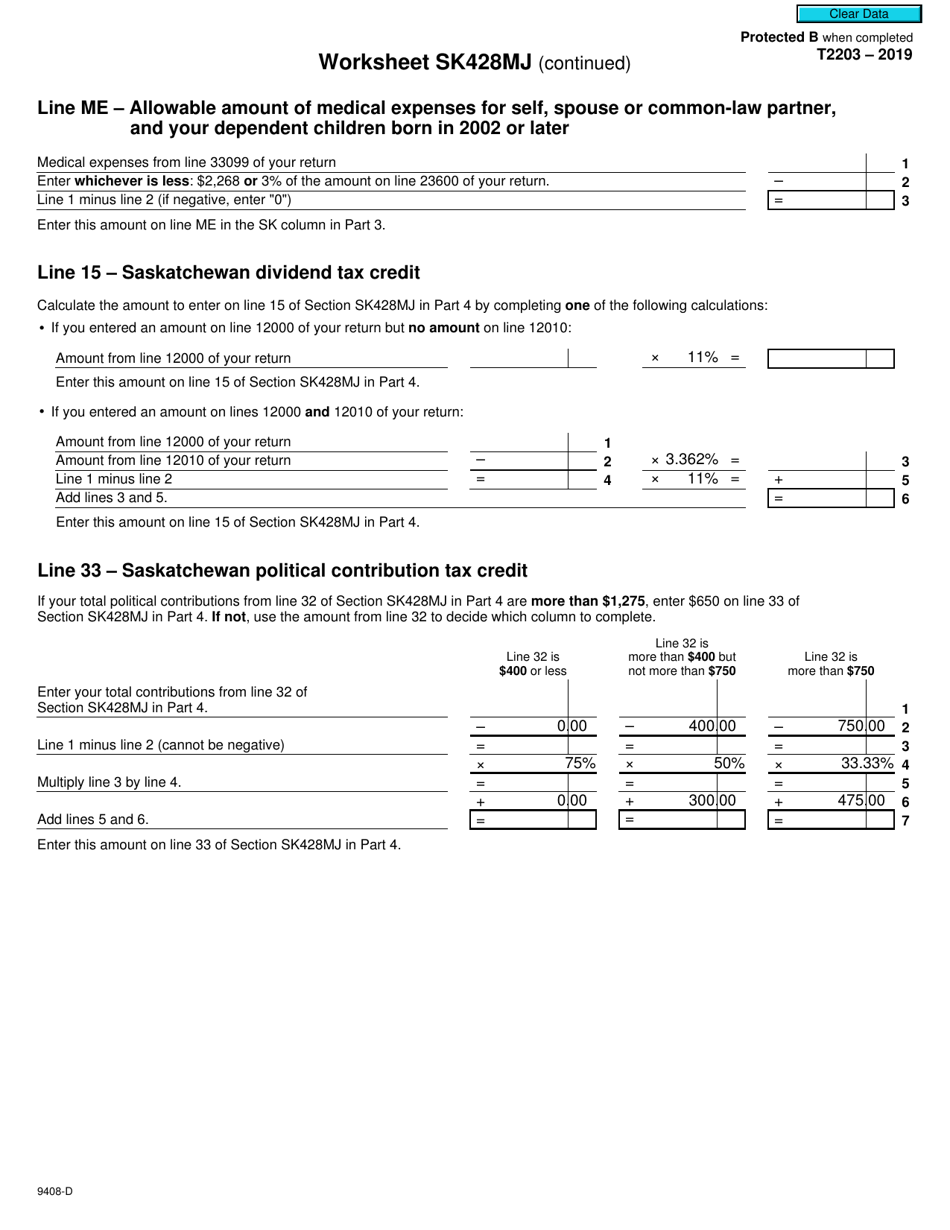

Form T2203 (9408-D) Worksheet SK428MJ is used for individuals who are residents of Saskatchewan, Canada, to calculate their provincial tax credits. This form helps taxpayers determine the amount of provincial tax they may be eligible to claim on their personal income tax return. It includes calculations for various tax credits, such as the Saskatchewan Pension Plan, tuition and education amounts, and the graduate retention program. By completing this worksheet, taxpayers can accurately determine their provincial tax obligations and claim any applicable credits.

The Form T2203 (9408-D) Worksheet SK428MJ is filed by residents of Saskatchewan, Canada who are looking to claim provincial tax credits. This form is used to calculate and report the amount of provincial tax credits that can be deducted from the total tax payable.

FAQ

Q: What is Form T2203 (9408-D) Worksheet SK428MJ?

A: Form T2203 (9408-D) Worksheet SK428MJ is a tax form used in the province of Saskatchewan, Canada. It is specifically designed to help Saskatchewan residents calculate their provincial tax credits and deductions.

Q: Who needs to fill out Form T2203 (9408-D) Worksheet SK428MJ?

A: Residents of Saskatchewan, Canada who want to claim provincial tax credits and deductions need to fill out Form T2203 (9408-D) Worksheet SK428MJ when filing their personal income tax return.

Q: What information is required to fill out Form T2203 (9408-D) Worksheet SK428MJ?

A: To fill out Form T2203 (9408-D) Worksheet SK428MJ, you will need to provide your personal information, such as your name, address, and social insurance number. You will also need to include information about your income, deductions, and tax credits.

Q: How do I fill out Form T2203 (9408-D) Worksheet SK428MJ?

A: To fill out Form T2203 (9408-D) Worksheet SK428MJ, follow the instructions provided on the form. Make sure to accurately enter all the required information, double-check your calculations, and attach the completed form to your personal income tax return.

Q: What should I do with Form T2203 (9408-D) Worksheet SK428MJ after filling it out?

A: After filling out Form T2203 (9408-D) Worksheet SK428MJ, you should keep a copy for your records and attach the original form to your personal income tax return when you file it with the Canada Revenue Agency (CRA).