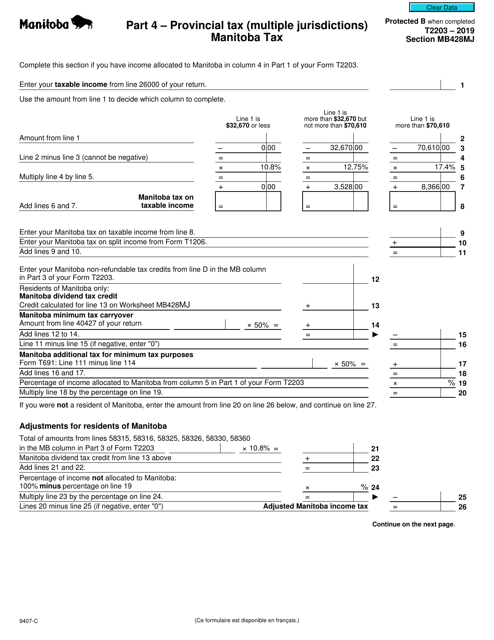

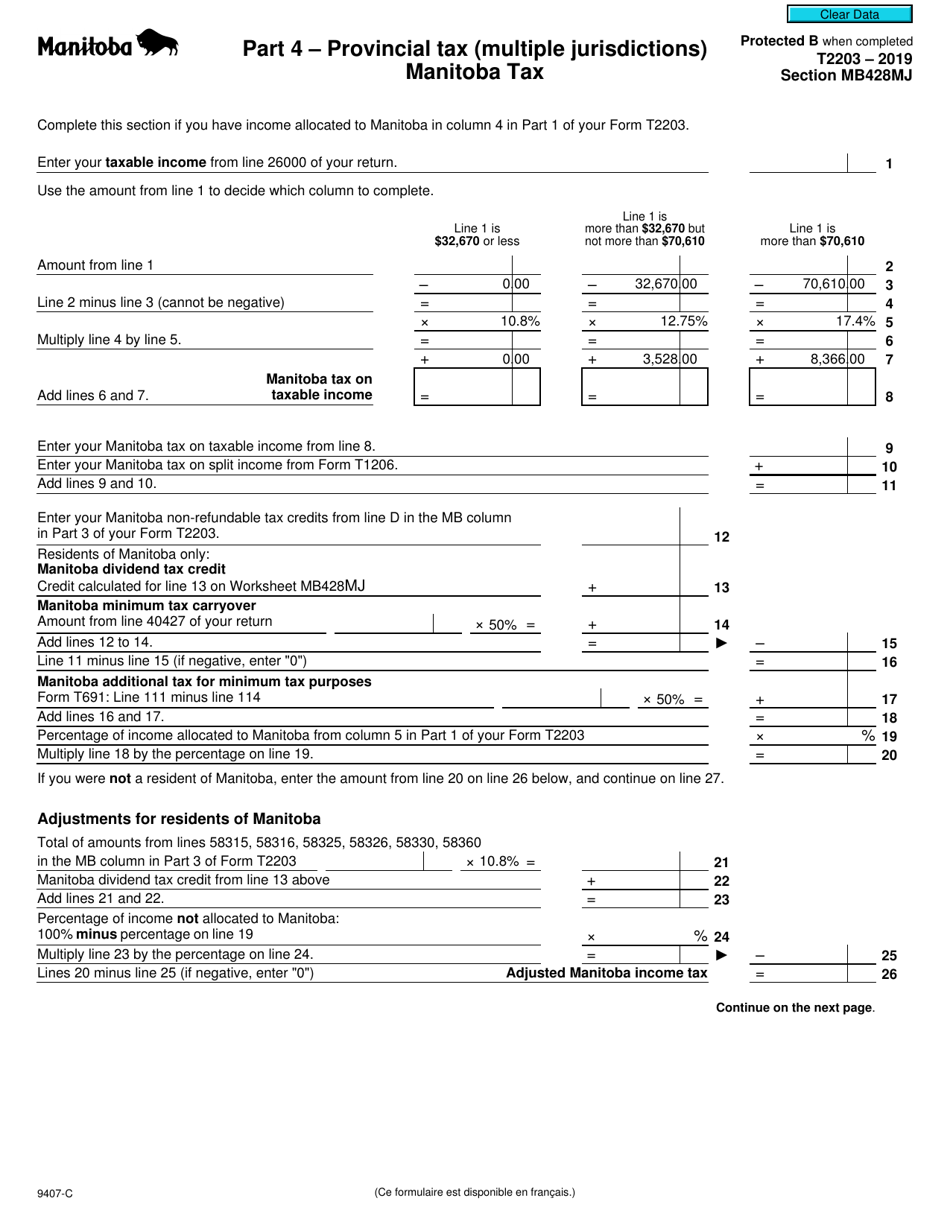

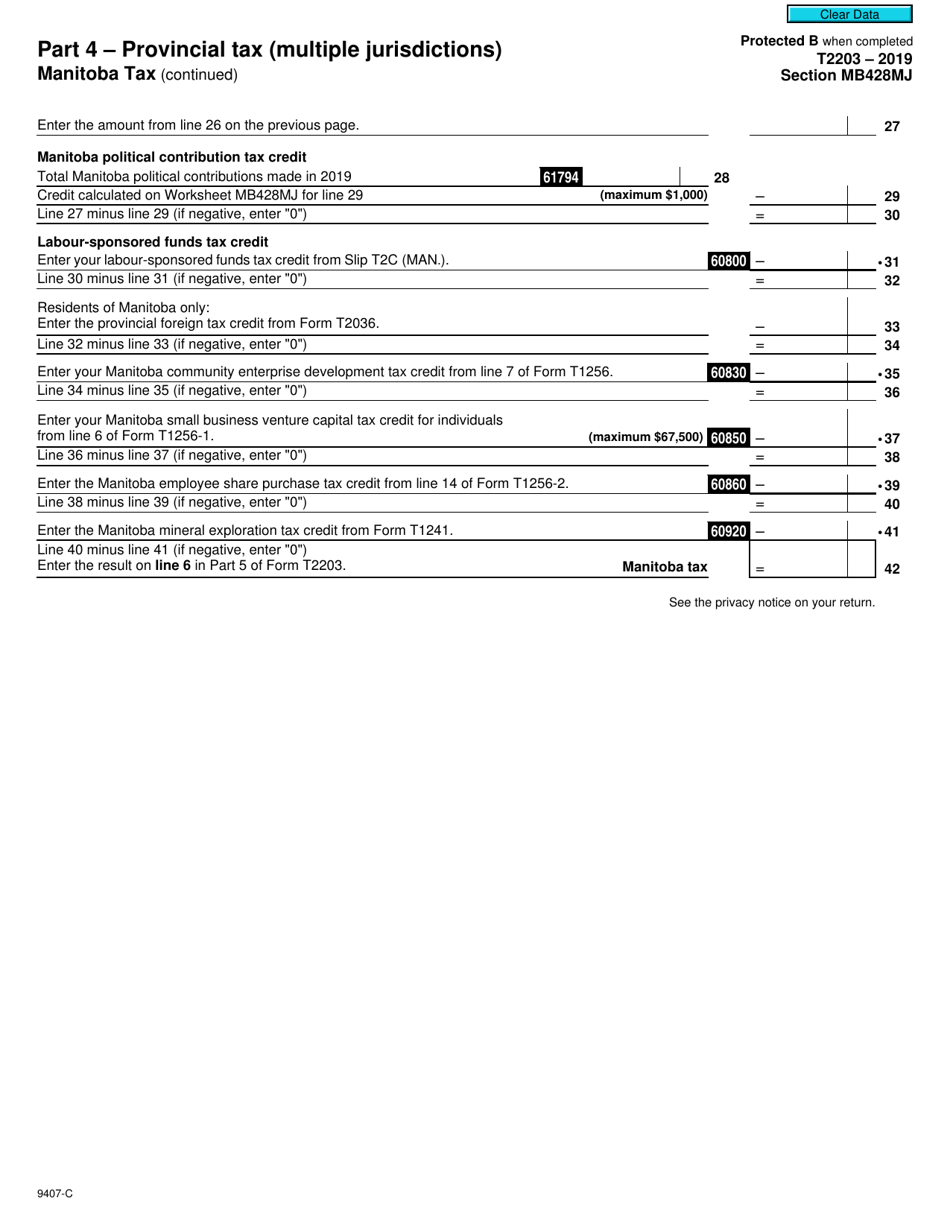

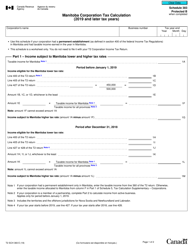

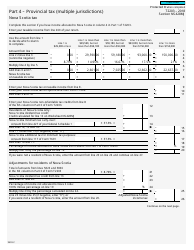

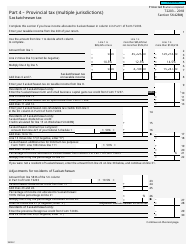

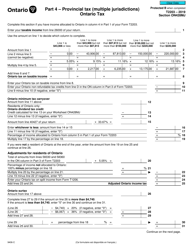

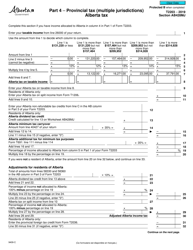

Form T2203 (9407-C) Section MB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Manitoba Tax - Canada

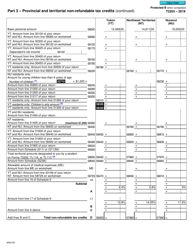

Form T2203 (9407-C) Section MB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Manitoba Tax is used for reporting provincial tax information specific to the province of Manitoba in Canada. It is typically used by individuals who are residents of Manitoba and need to calculate and pay their provincial taxes.

The individual residing in Manitoba, Canada, would file the Form T2203 (9407-C) Section MB428MJ Part 4 for provincial taxes in multiple jurisdictions.

FAQ

Q: What is Form T2203?

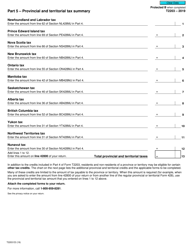

A: Form T2203 is a tax form used in Canada to calculate provincial tax liabilities in multiple jurisdictions.

Q: What is Section MB428MJ?

A: Section MB428MJ is a section of Form T2203 specifically for reporting provincial tax in Manitoba.

Q: What is Part 4 of Section MB428MJ?

A: Part 4 of Section MB428MJ is the section of the form where you report your Manitoba tax liabilities.

Q: What is Provincial Tax?

A: Provincial tax is a tax levied by the provincial government in addition to federal taxes.

Q: What are Multiple Jurisdictions?

A: Multiple jurisdictions refer to situations where individuals may owe provincial tax in more than one province.

Q: What is Manitoba Tax?

A: Manitoba tax refers to the provincial tax owed by residents of Manitoba.