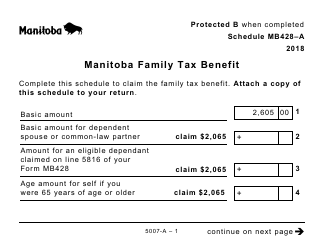

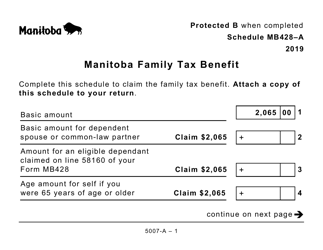

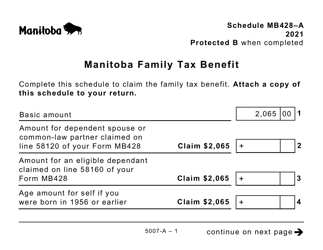

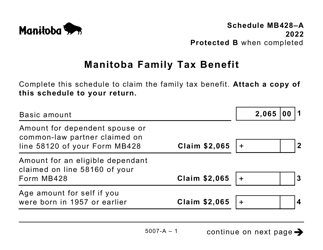

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9407-A) Schedule MB428-A MJ

for the current year.

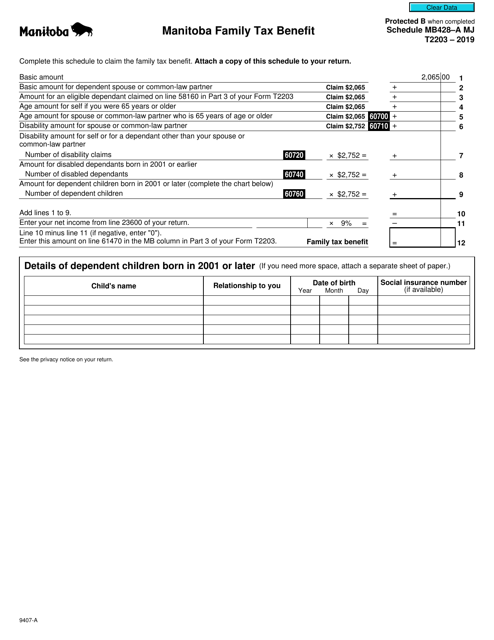

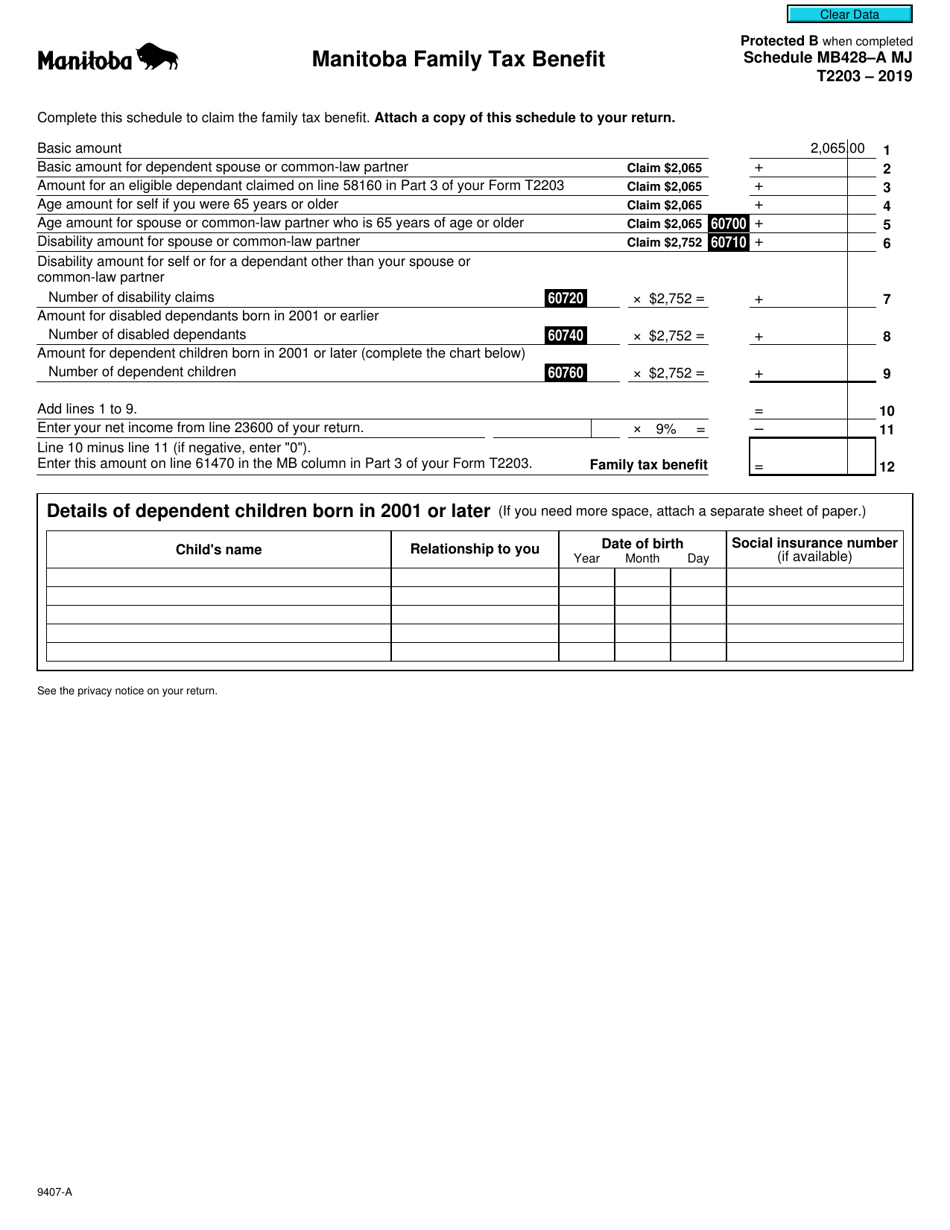

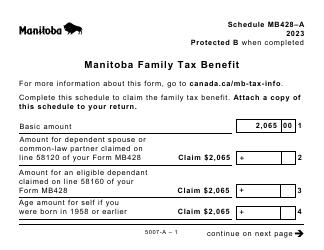

Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit - Canada

Form T2203 (9407-A) Schedule MB428-A MJ, Manitoba Family Tax Benefit, is a form used in Canada to apply for the Manitoba Family Tax Benefit program. This program provides financial assistance to eligible low-income families in Manitoba. The form helps determine if you are eligible for the benefit and calculates the amount of assistance you may be eligible to receive.

The Form T2203 (9407-A) Schedule MB428-A MJ Manitoba Family Tax Benefit in Canada is typically filed by residents of the province of Manitoba who are applying for the Manitoba Family Tax Benefit.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is Schedule MB428-A?

A: Schedule MB428-A is a part of the Manitoba Family Tax Benefit.

Q: What is MJ?

A: MJ stands for Manitoba.

Q: What is the Manitoba Family Tax Benefit?

A: The Manitoba Family Tax Benefit is a tax benefit for families in Manitoba, Canada.

Q: How can I file the Manitoba Family Tax Benefit?

A: You can file the Manitoba Family Tax Benefit by completing Form T2203 and Schedule MB428-A.