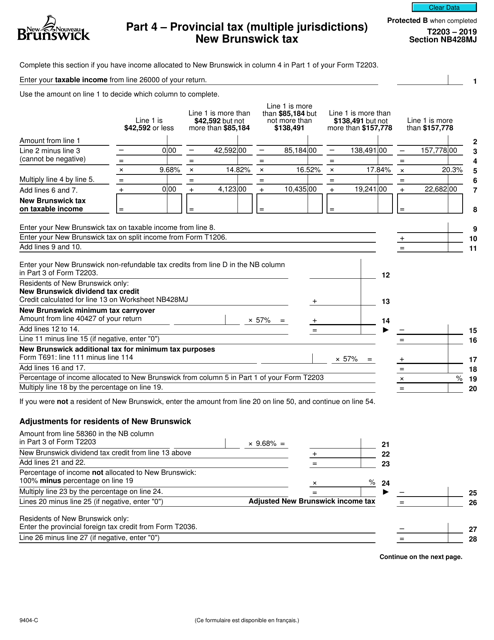

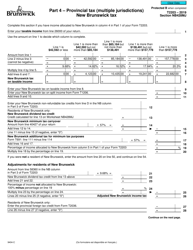

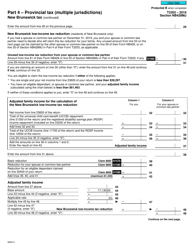

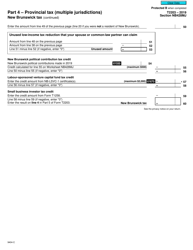

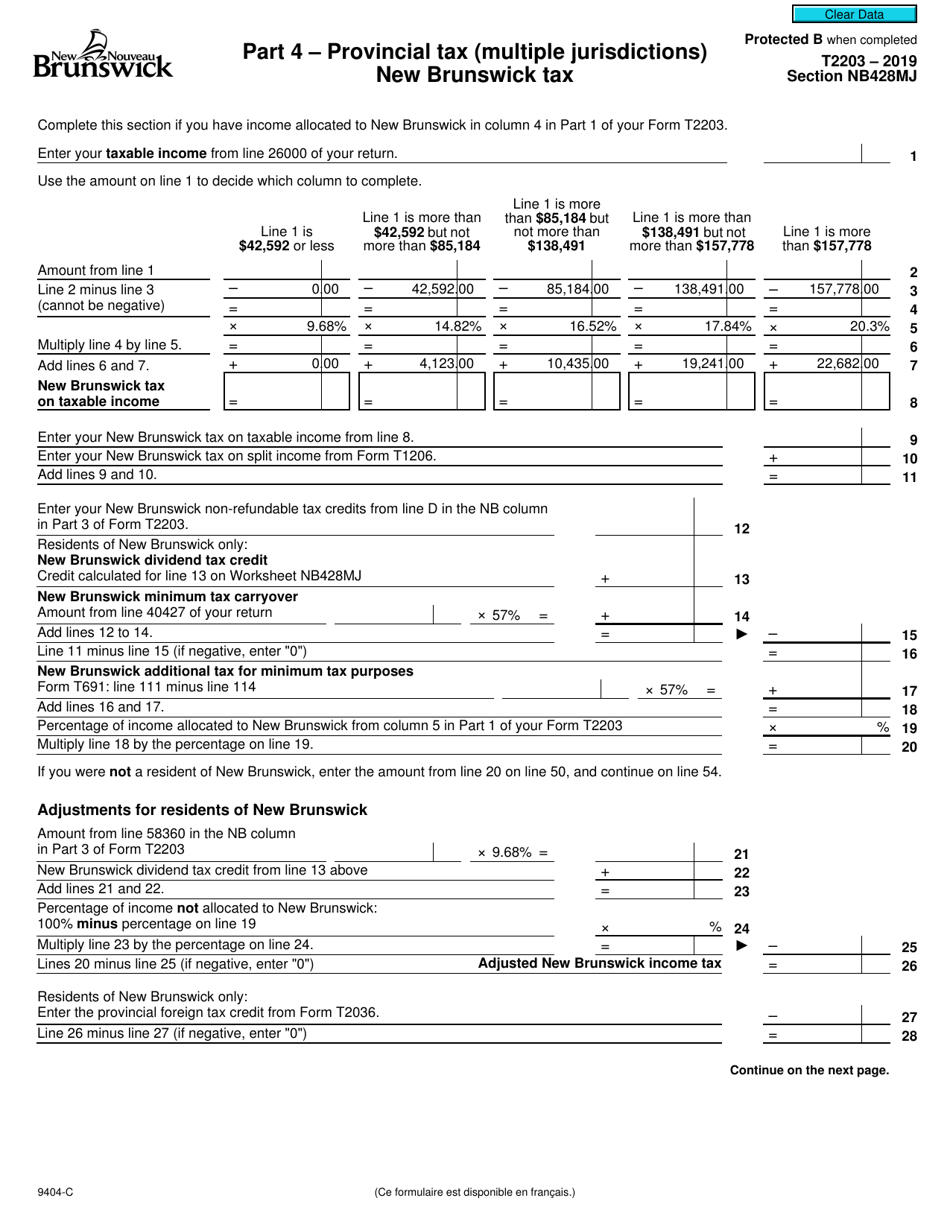

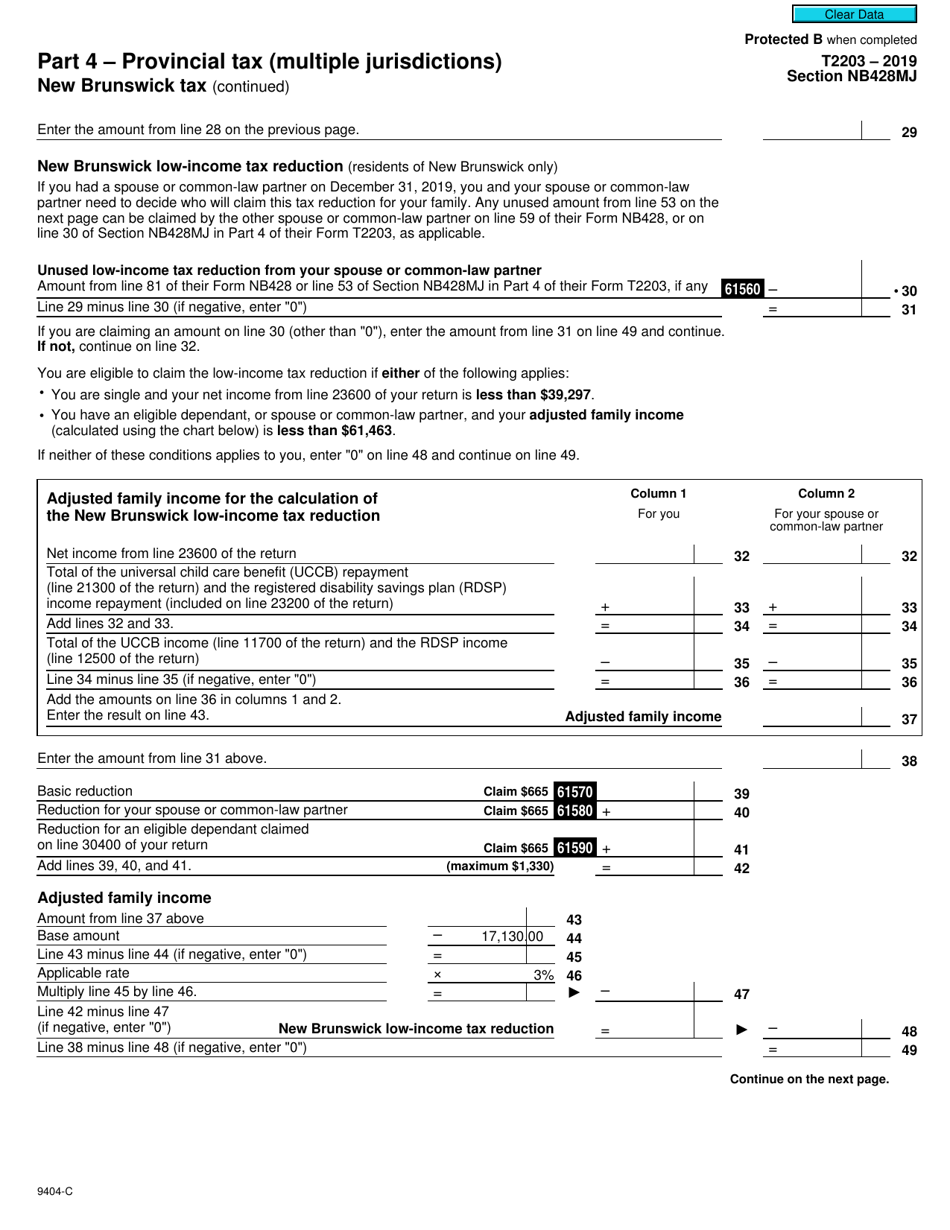

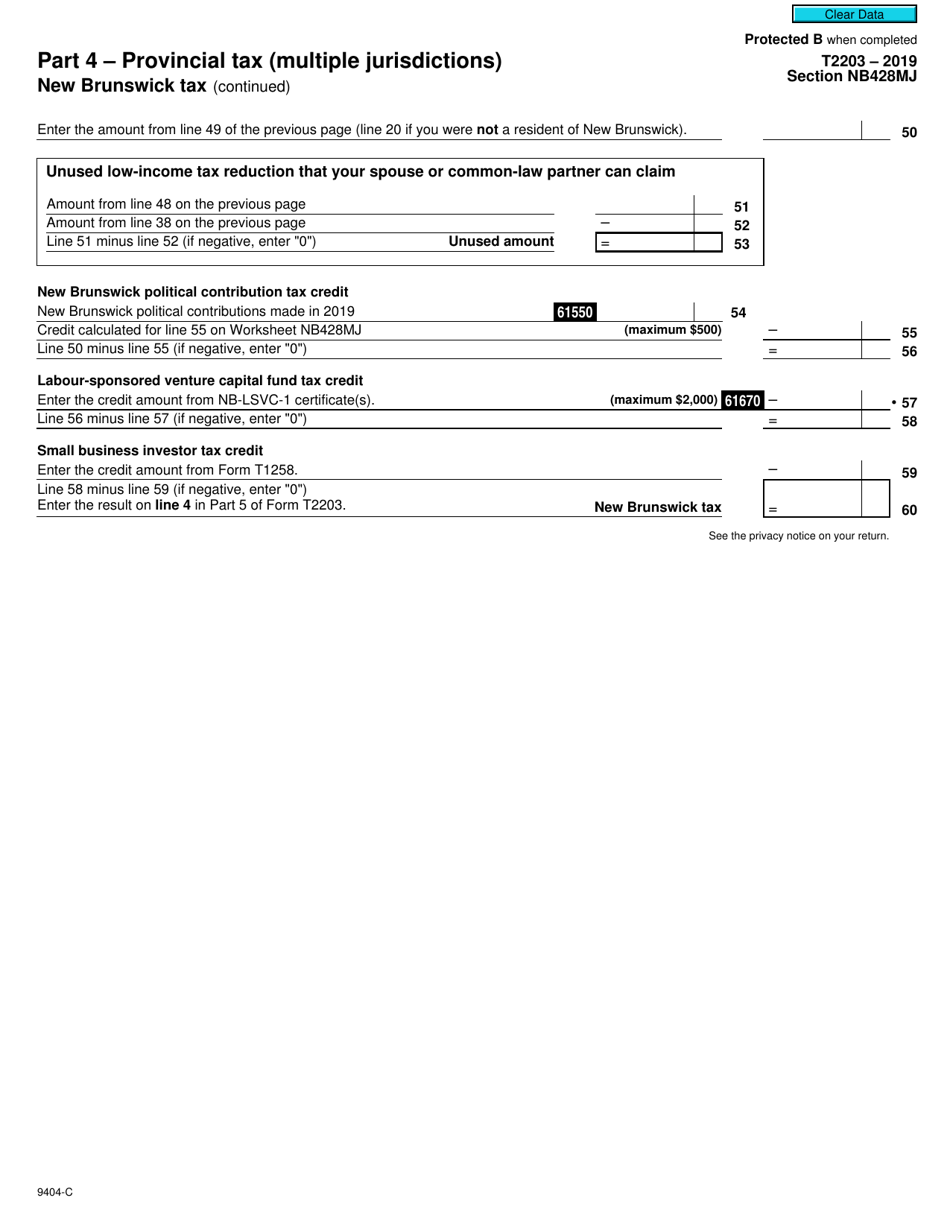

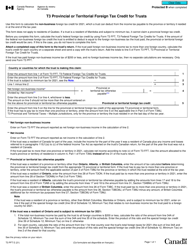

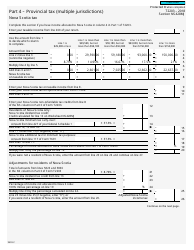

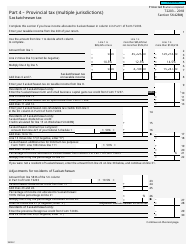

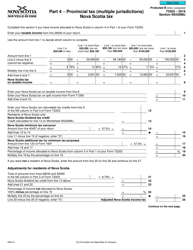

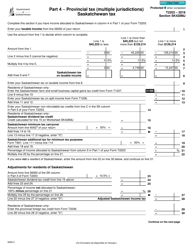

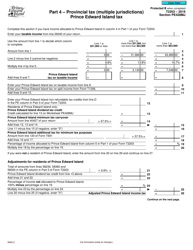

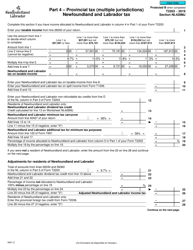

Form T2203 (9404-C) Section NB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) New Brunswick Tax - Canada

Form T2203 (9404-C) Section NB428MJ Part 4 is used for reporting and calculating provincial tax for residents of New Brunswick, a province in Canada. This form is specifically for individuals who have income from multiple jurisdictions within New Brunswick and need to reconcile their provincial taxes. It allows taxpayers to determine their provincial tax liabilities and ensure that they are paying the correct amount based on their income from various sources within the province.

The Form T2203 (9404-C) Section NB428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) New Brunswick Tax is typically filed by individuals residing in the province of New Brunswick in Canada. This form is used to report and calculate the provincial tax owed to the New Brunswick government. It is specifically designed for residents who have income from multiple jurisdictions.

FAQ

Q: What is Form T2203 (9404-C)?

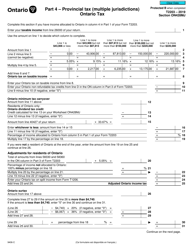

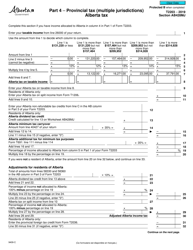

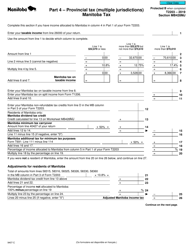

A: Form T2203 (9404-C) is the form used to calculate Provincial Tax (Multiple Jurisdictions) in Canada.

Q: What is Section NB428MJ of Form T2203 (9404-C)?

A: Section NB428MJ of Form T2203 (9404-C) specifically relates to the New Brunswick Tax.

Q: What is Provincial Tax?

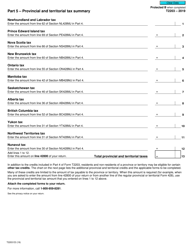

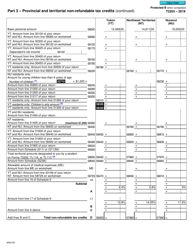

A: Provincial Tax refers to the taxes imposed by individual provinces or territories within Canada.

Q: What is New Brunswick Tax?

A: New Brunswick Tax is the tax specific to the province of New Brunswick.

Q: Why is Provincial Tax calculated separately?

A: Provincial Tax is calculated separately because each province has its own tax rates and rules.

Q: What information is required to fill out Part 4 of Section NB428MJ?

A: To fill out Part 4 of Section NB428MJ, you will need to provide details related to your New Brunswick Tax obligations.

Q: Are there any specific instructions for filling out Part 4?

A: Yes, the specific instructions for filling out Part 4 of Section NB428MJ can be found in the official guide provided by the Canada Revenue Agency (CRA).

Q: Do I need to fill out Form T2203 (9404-C) if I don't have any New Brunswick Tax obligations?

A: If you don't have any New Brunswick Tax obligations, you may not need to fill out Part 4 of Section NB428MJ. However, it's best to consult with a tax professional or refer to the official guidelines to confirm.

Q: What should I do if I have questions about Form T2203 (9404-C) or my New Brunswick Tax obligations?

A: If you have questions about Form T2203 (9404-C) or your New Brunswick Tax obligations, it's recommended to reach out to the Canada Revenue Agency (CRA) or seek assistance from a tax professional.