This version of the form is not currently in use and is provided for reference only. Download this version of

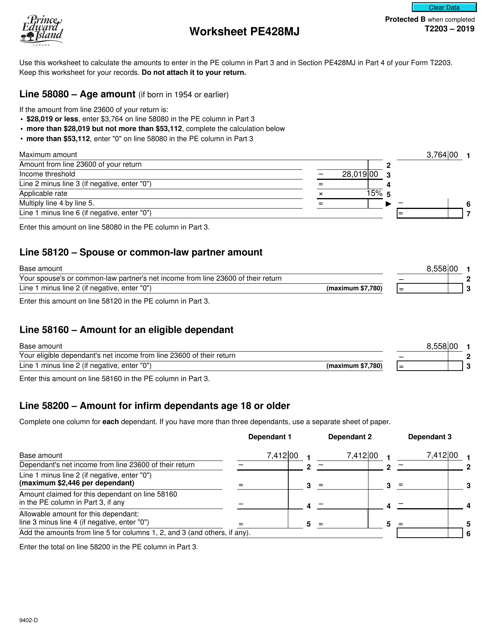

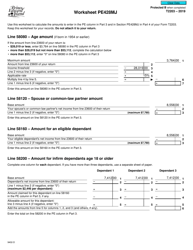

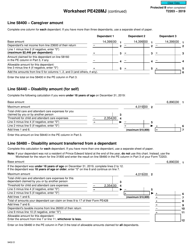

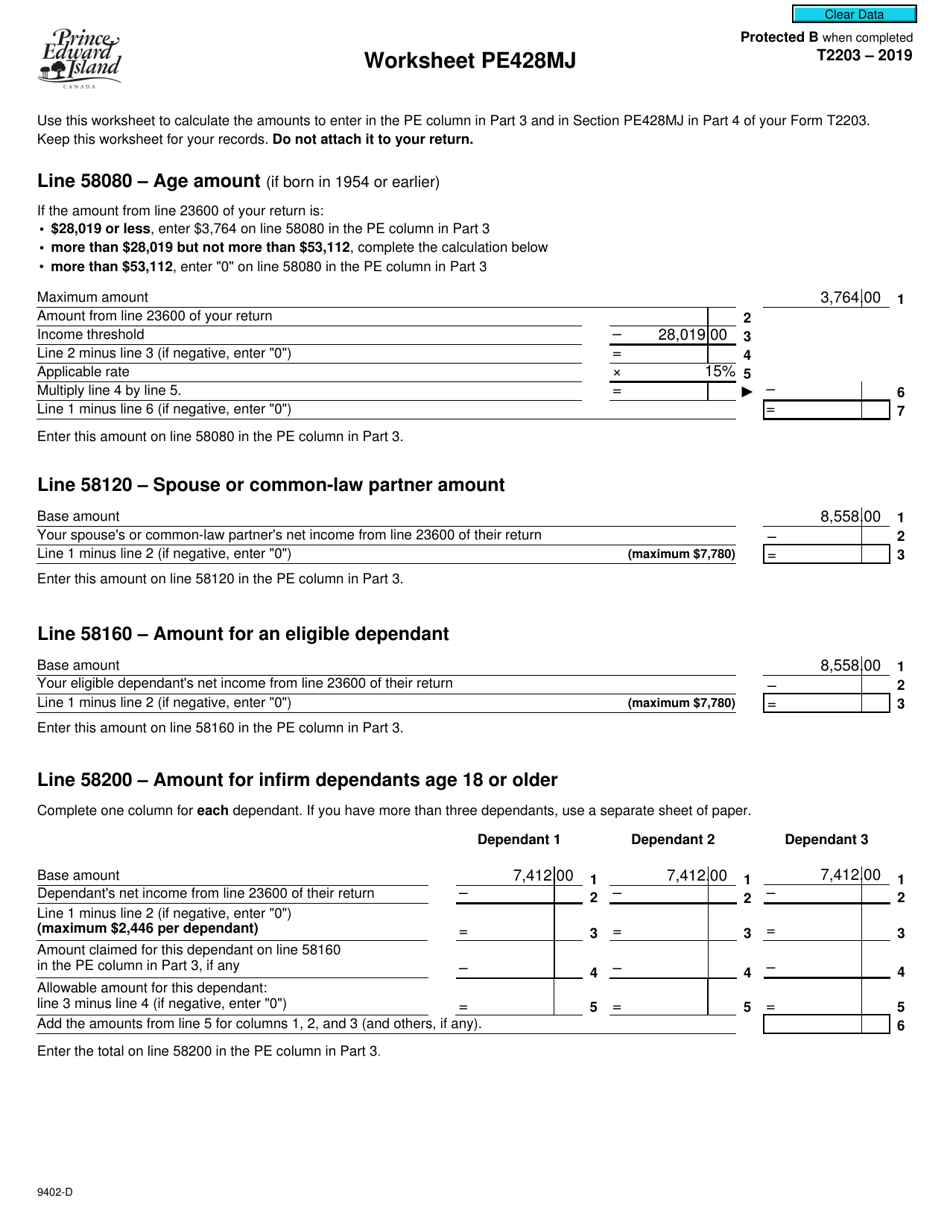

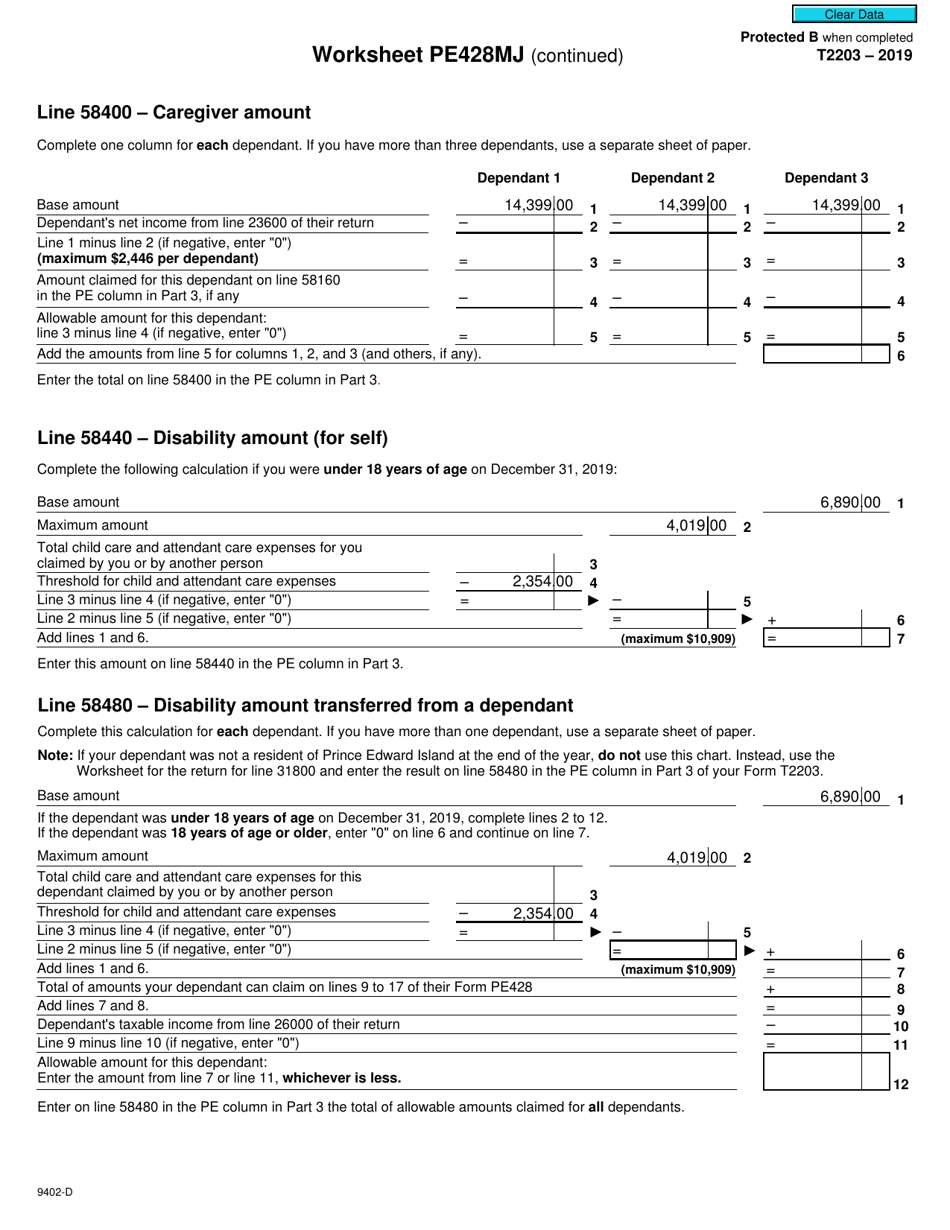

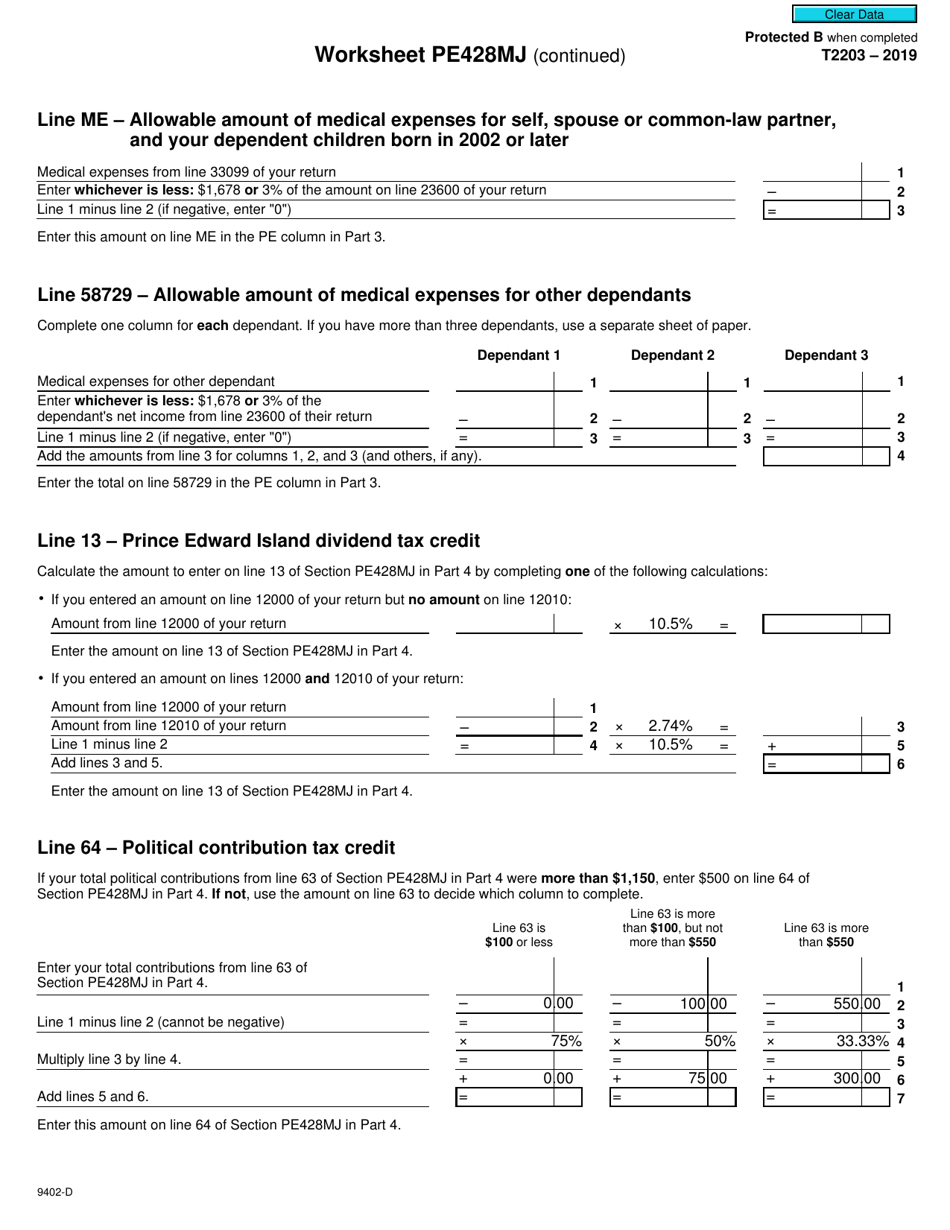

Form T2203 (9402-D) Worksheet PE428MJ

for the current year.

Form T2203 (9402-D) Worksheet PE428MJ Prince Edward Island - Canada

The Form T2203 (9402-D) Worksheet PE428MJ is used in Prince Edward Island, Canada for calculating provincial tax credits for individuals.

The Form T2203 (9402-D) Worksheet PE428MJ in Prince Edward Island, Canada is filed by individuals who are claiming provincial tax credits.

FAQ

Q: What is Form T2203?

A: Form T2203 is a worksheet used in Canada to calculate the provincial tax credits for Prince Edward Island (PEI).

Q: Who should use Form T2203?

A: Form T2203 should be used by residents of Prince Edward Island (PEI) who want to claim the provincial tax credits.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate the provincial tax credits for Prince Edward Island (PEI) residents.

Q: What information is required to fill out Form T2203?

A: To fill out Form T2203, you will need to provide your personal information, income details, and any eligible expenses or deductions.

Q: When is the deadline to file Form T2203?

A: The deadline to file Form T2203 is the same as the deadline to file your federal income tax return, which is usually April 30th.

Q: What if I am unable to file Form T2203 by the deadline?

A: If you are unable to file Form T2203 by the deadline, you may be subject to late filing penalties and interest charges.

Q: Are there any other provincial tax forms I need to file?

A: Depending on your province of residence, you may be required to file additional provincial tax forms in addition to Form T2203.