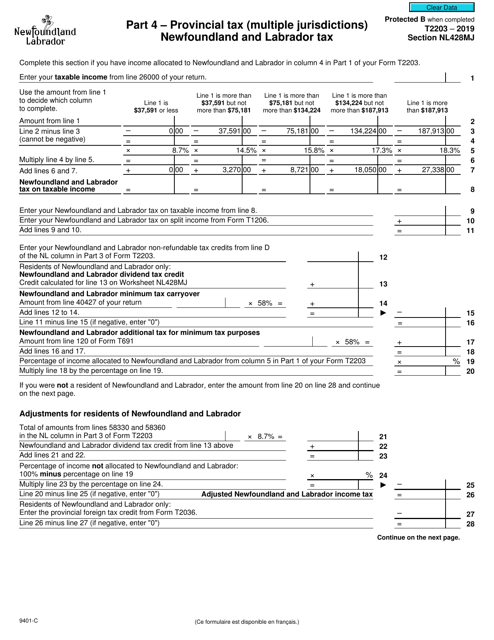

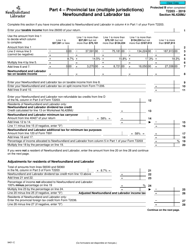

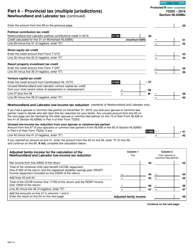

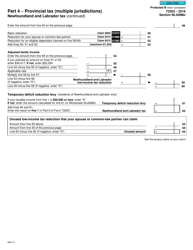

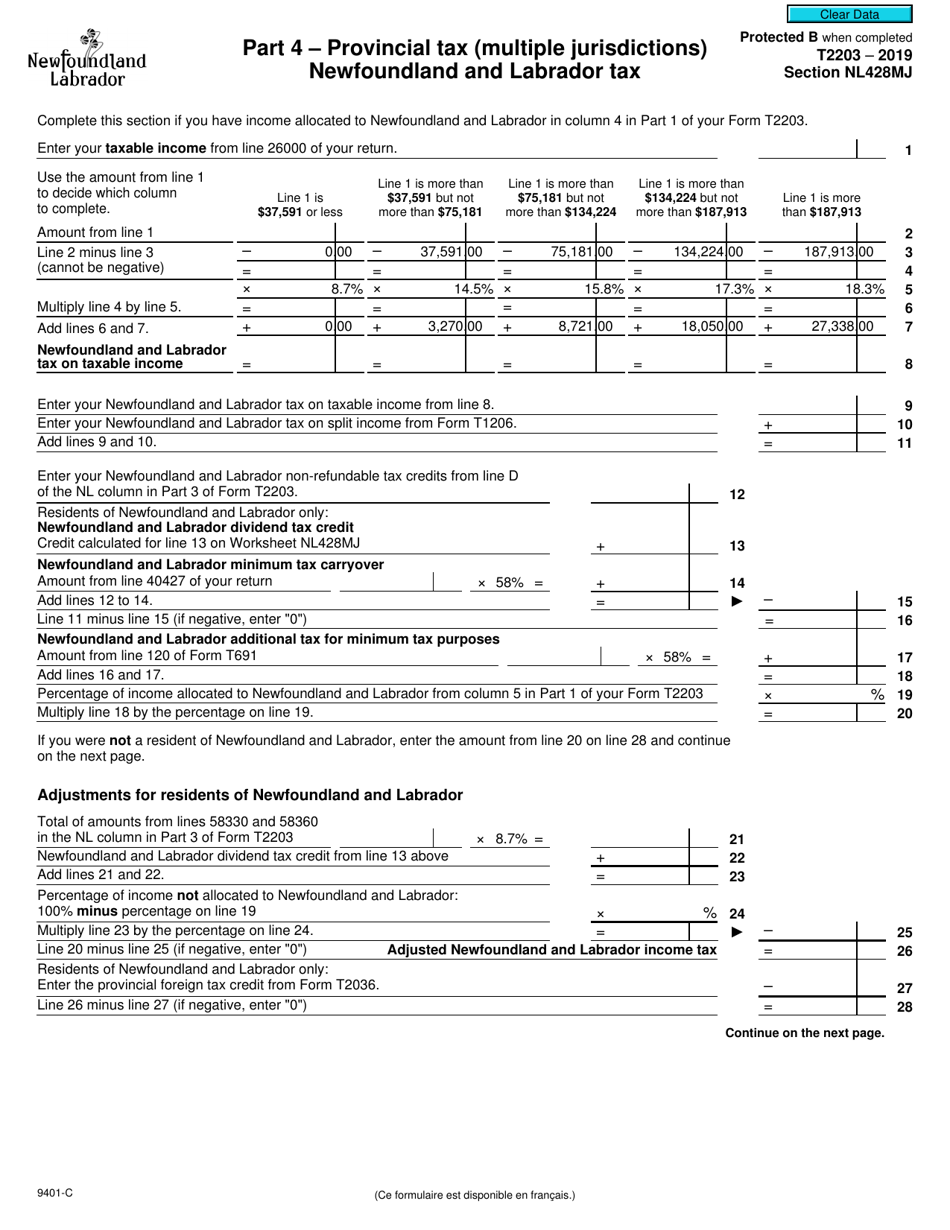

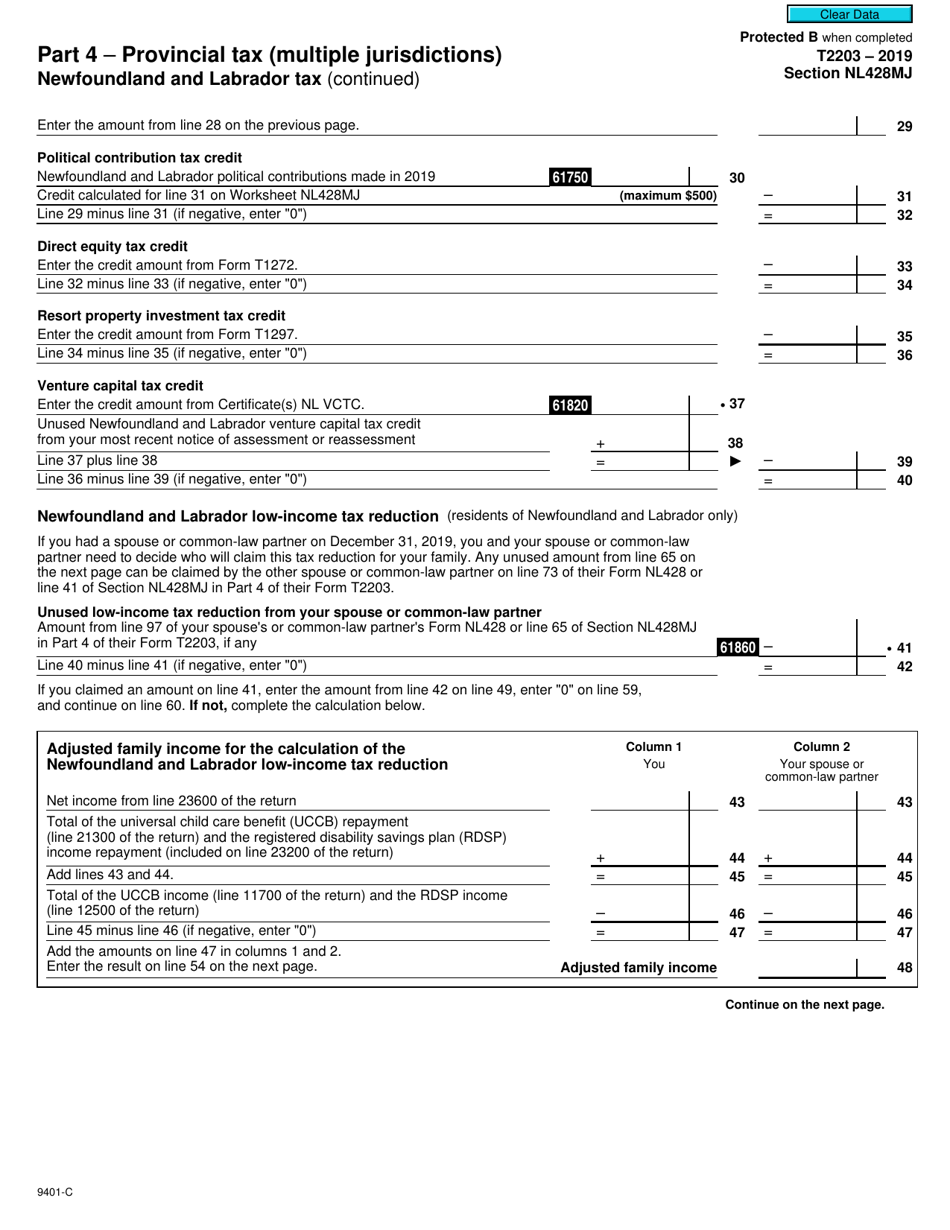

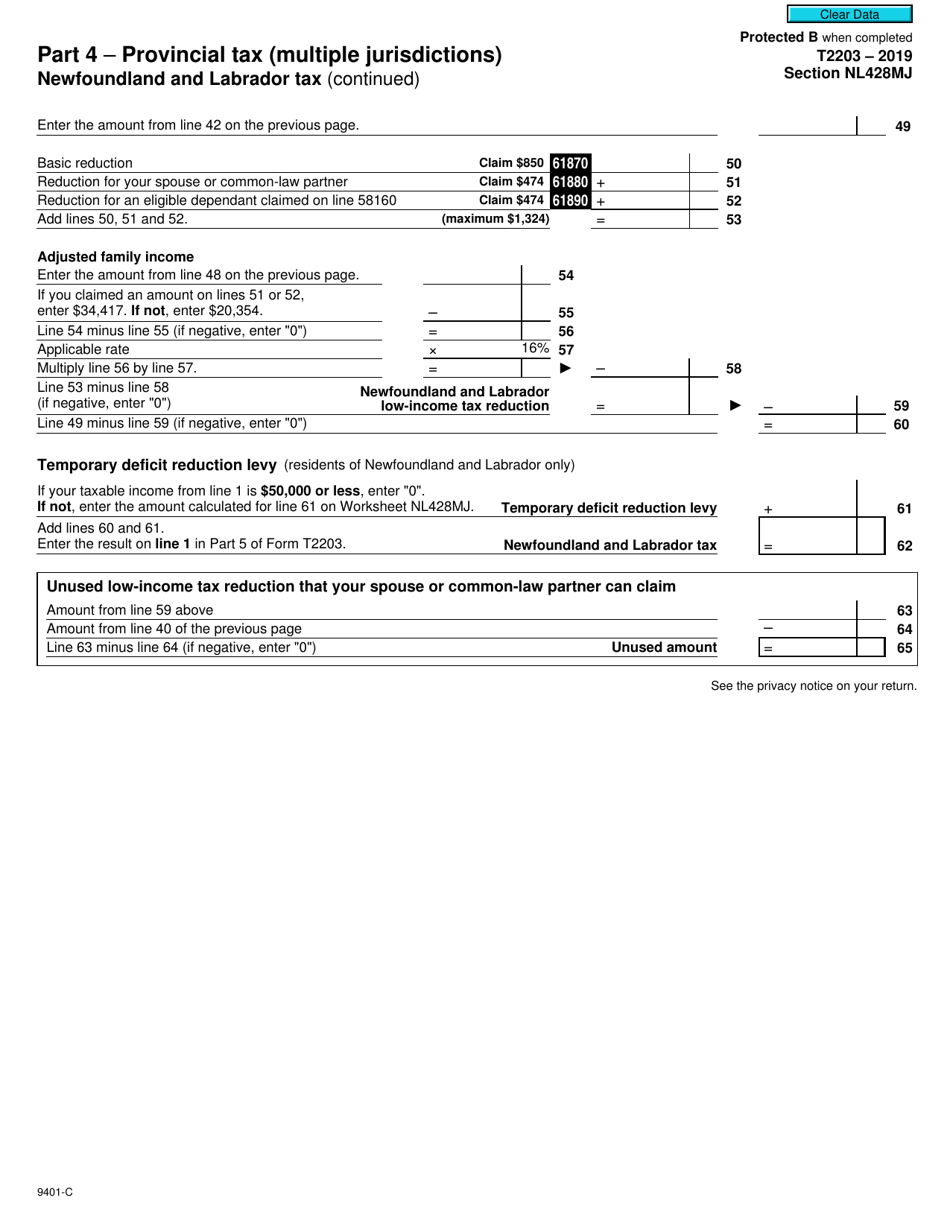

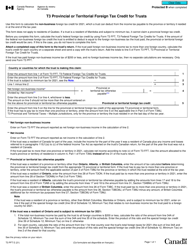

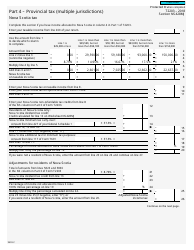

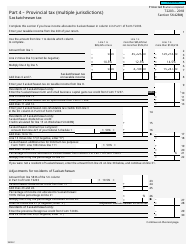

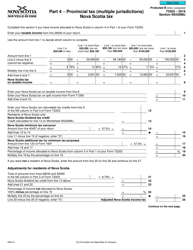

Form T2203 (9401-C) Section NL428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Newfoundland and Labrador Tax - Canada

Form T2203 (9401-C) Section NL428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Newfoundland and Labrador Tax - Canada is used to calculate and report the provincial tax owed by residents of Newfoundland and Labrador to the Canadian government.

The Form T2203 (9401-C) Section NL428MJ Part 4 - Provincial Tax (Multiple Jurisdictions) Newfoundland and Labrador Tax in Canada is filed by individuals who are residents of Newfoundland and Labrador and owe provincial taxes in multiple jurisdictions.

FAQ

Q: What is Form T2203?

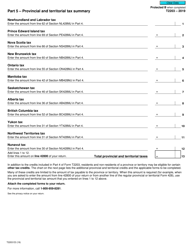

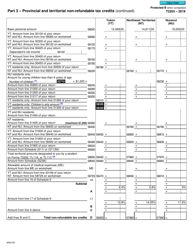

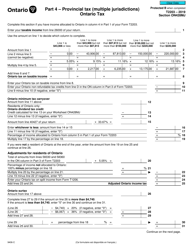

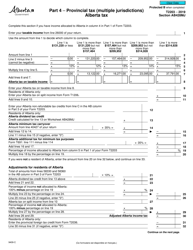

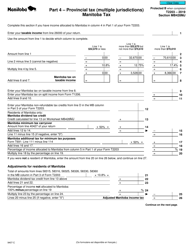

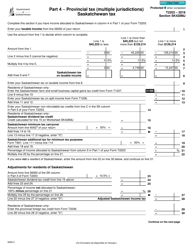

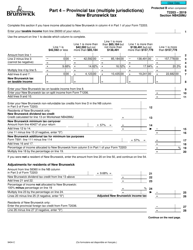

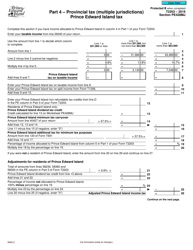

A: Form T2203 is a tax form used in Canada to report Provincial Tax (Multiple Jurisdictions).

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate and report the provincial tax for multiple jurisdictions in Canada.

Q: What is NL428MJ on Form T2203?

A: NL428MJ refers to the specific section for Newfoundland and Labrador Tax on Form T2203.

Q: What is Part 4 on Form T2203?

A: Part 4 on Form T2203 is the section where you enter the details and calculations for provincial tax in Newfoundland and Labrador.

Q: What is Provincial Tax?

A: Provincial tax is the tax imposed by the provincial government in Canada.

Q: Is Newfoundland and Labrador Tax considered a provincial tax?

A: Yes, Newfoundland and Labrador Tax is a provincial tax.

Q: What is the purpose of reporting provincial tax on Form T2203?

A: Reporting provincial tax on Form T2203 helps the Canada Revenue Agency determine the correct amount of tax owed for each province.