This version of the form is not currently in use and is provided for reference only. Download this version of

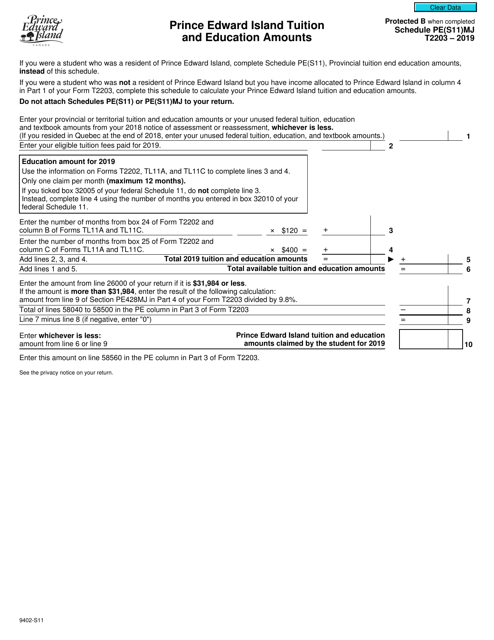

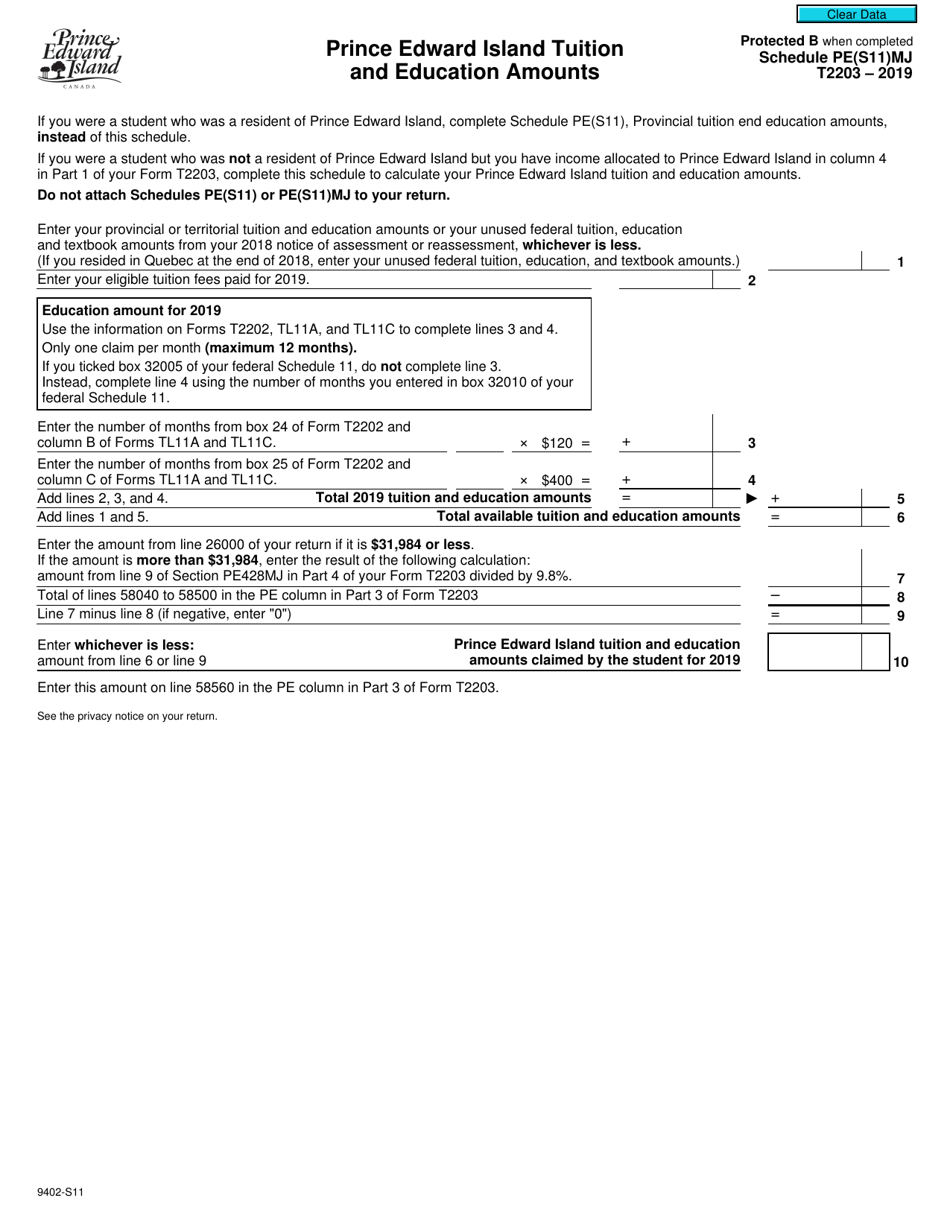

Form T2203 (9402-S11) Schedule PE(S11)MJ

for the current year.

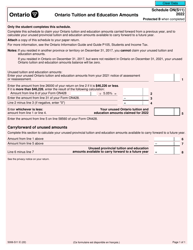

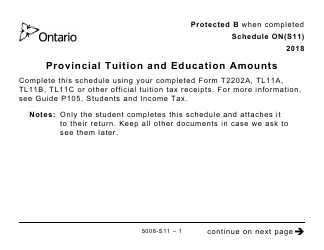

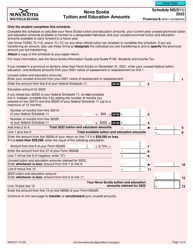

Form T2203 (9402-S11) Schedule PE(S11)MJ Prince Edward Island Tuition and Education Amounts - Canada

Form T2203 (9402-S11) Schedule PE(S11)MJ Prince Edward Island Tuition and Education Amounts - Canada is used to calculate and claim the provincial tuition and education amounts in Prince Edward Island. This form is specifically for residents of Prince Edward Island who are eligible to claim these amounts on their Canadian income tax return.

The form T2203 (9402-S11) Schedule PE(S11)MJ Prince Edward Island Tuition and Education Amounts - Canada is filed by students who attended a designated educational institution in Prince Edward Island and are claiming tuition and education amounts on their Canadian tax return.

FAQ

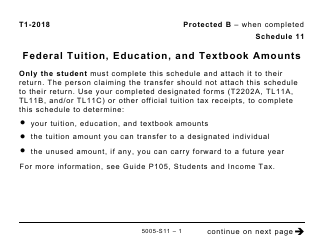

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to claim tuition and education amounts for Prince Edward Island (PE) residents.

Q: Who can use Form T2203?

A: Only residents of Prince Edward Island (PE) in Canada can use Form T2203.

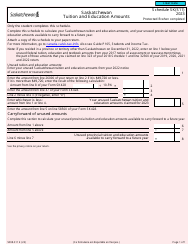

Q: What is Schedule PE(S11)MJ?

A: Schedule PE(S11)MJ is the specific schedule within Form T2203 used for reporting Prince Edward Island (PE) tuition and education amounts.

Q: What are tuition and education amounts?

A: Tuition and education amounts refer to the expenses paid for post-secondary education, such as tuition fees, textbooks, and other eligible expenses.

Q: Why would I claim tuition and education amounts?

A: By claiming tuition and education amounts, you may be eligible for tax credits or deductions that can reduce the amount of income tax you owe.

Q: How do I complete Schedule PE(S11)MJ?

A: To complete Schedule PE(S11)MJ, you need to enter the relevant information about your tuition and education expenses as instructed on the form.

Q: When is Form T2203 due?

A: Form T2203 is usually due on or before the tax filing deadline, which is April 30th for most individuals.

Q: Can I claim tuition and education amounts for other provinces?

A: No, Form T2203 Schedule PE(S11)MJ is specifically for claiming tuition and education amounts for Prince Edward Island (PE) residents only.

Q: Can I carry forward unused tuition and education amounts?

A: Yes, you may be able to carry forward unused tuition and education amounts to future years if you are unable to claim them in the current tax year.