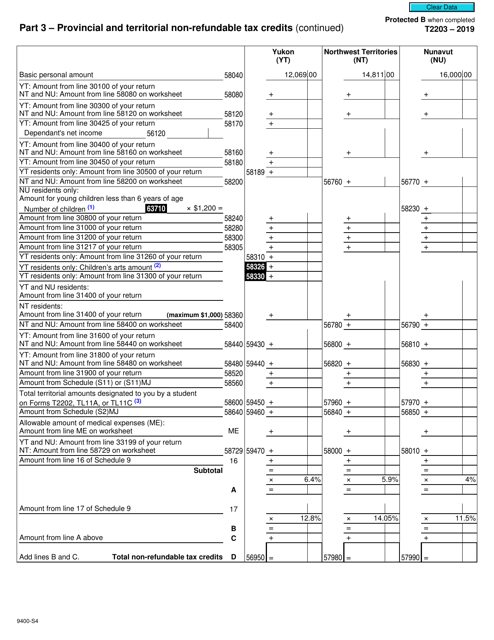

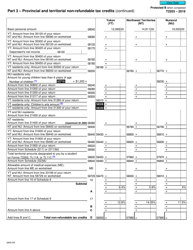

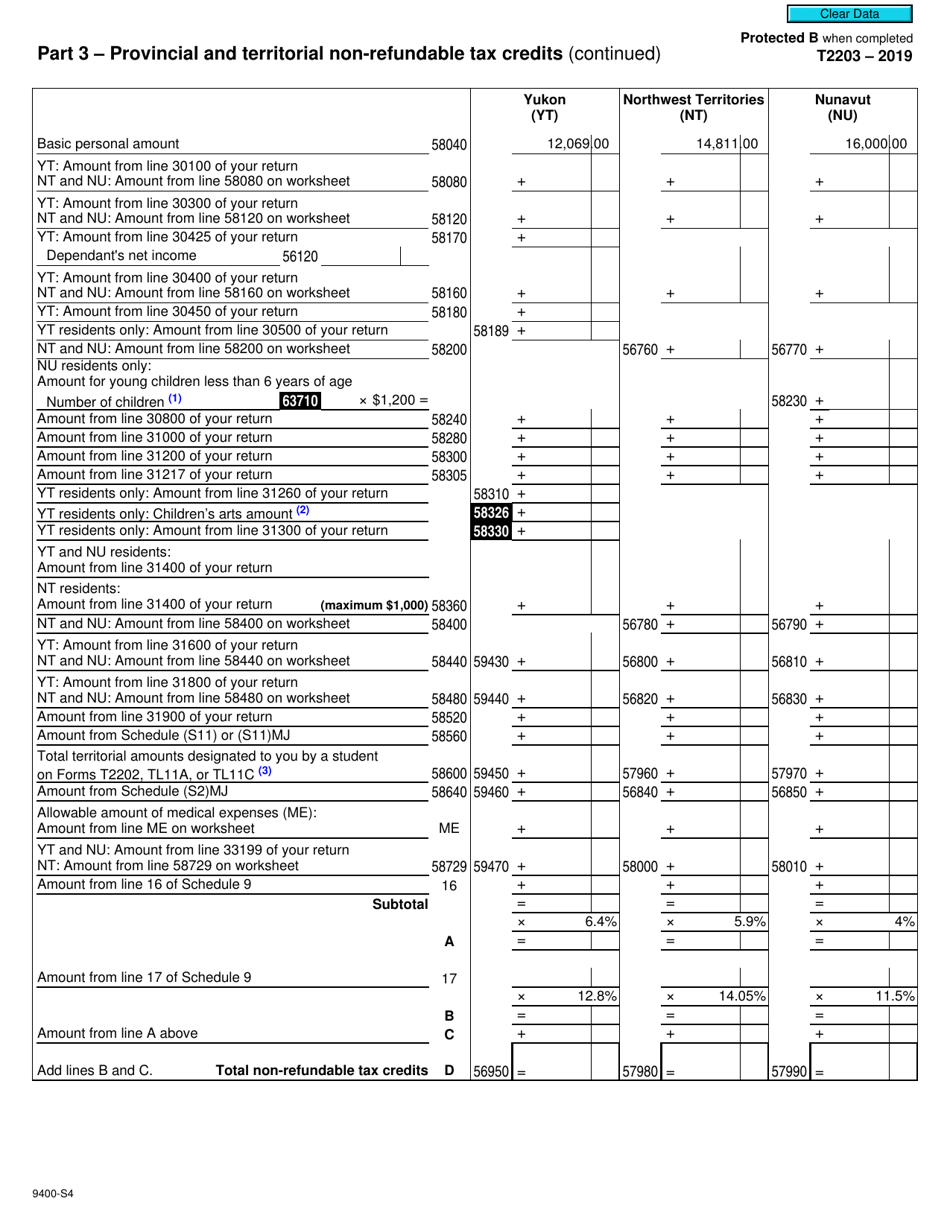

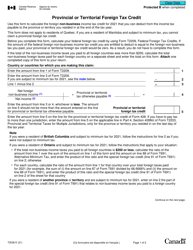

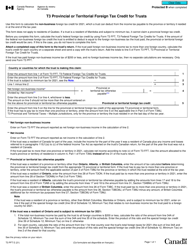

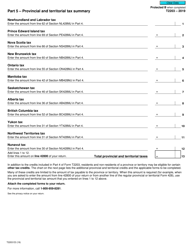

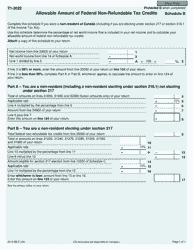

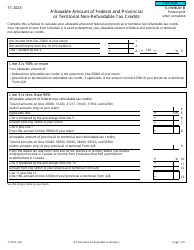

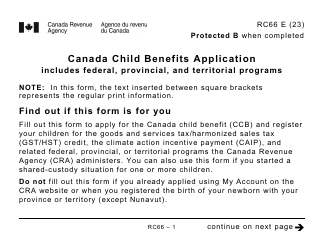

Form T2203 (9400-S4) Part 3 Provincial and Territorial Non-refundable Tax Credits (Yk, Nt, Nu) - Canada

Form T2203 (9400-S4) Part 3 Provincial and Territorial Non-refundable Tax Credits (Yk, Nt, Nu) in Canada is used to claim provincial or territorial non-refundable tax credits specifically for the Yukon, Northwest Territories, and Nunavut. These tax credits are provided by the respective provincial and territorial governments and can help reduce the amount of taxes owed by individuals or businesses in these regions.

The form T2203 (9400-S4) Part 3 Provincial and Territorial Non-refundable Tax Credits (Yk, Nt, Nu) in Canada is typically filed by individuals who are residents of the Yukon (Yk), Northwest Territories (Nt), or Nunavut (Nu). This form is used to claim non-refundable tax credits specific to these provinces and territories.

FAQ

Q: What is Form T2203?

A: Form T2203 is the form used by residents of Yukon (YK), Northwest Territories (NT), and Nunavut (NU) in Canada to claim provincial and territorial non-refundable tax credits.

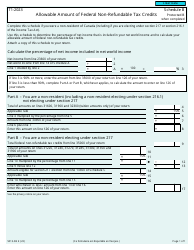

Q: What is a non-refundable tax credit?

A: A non-refundable tax credit is a type of tax credit that reduces the amount of tax you owe, but if the credit is more than your tax liability, you do not receive a refund for the difference.

Q: Who is eligible to use Form T2203?

A: Residents of Yukon (YK), Northwest Territories (NT), and Nunavut (NU) in Canada who want to claim provincial and territorial non-refundable tax credits are eligible to use Form T2203.

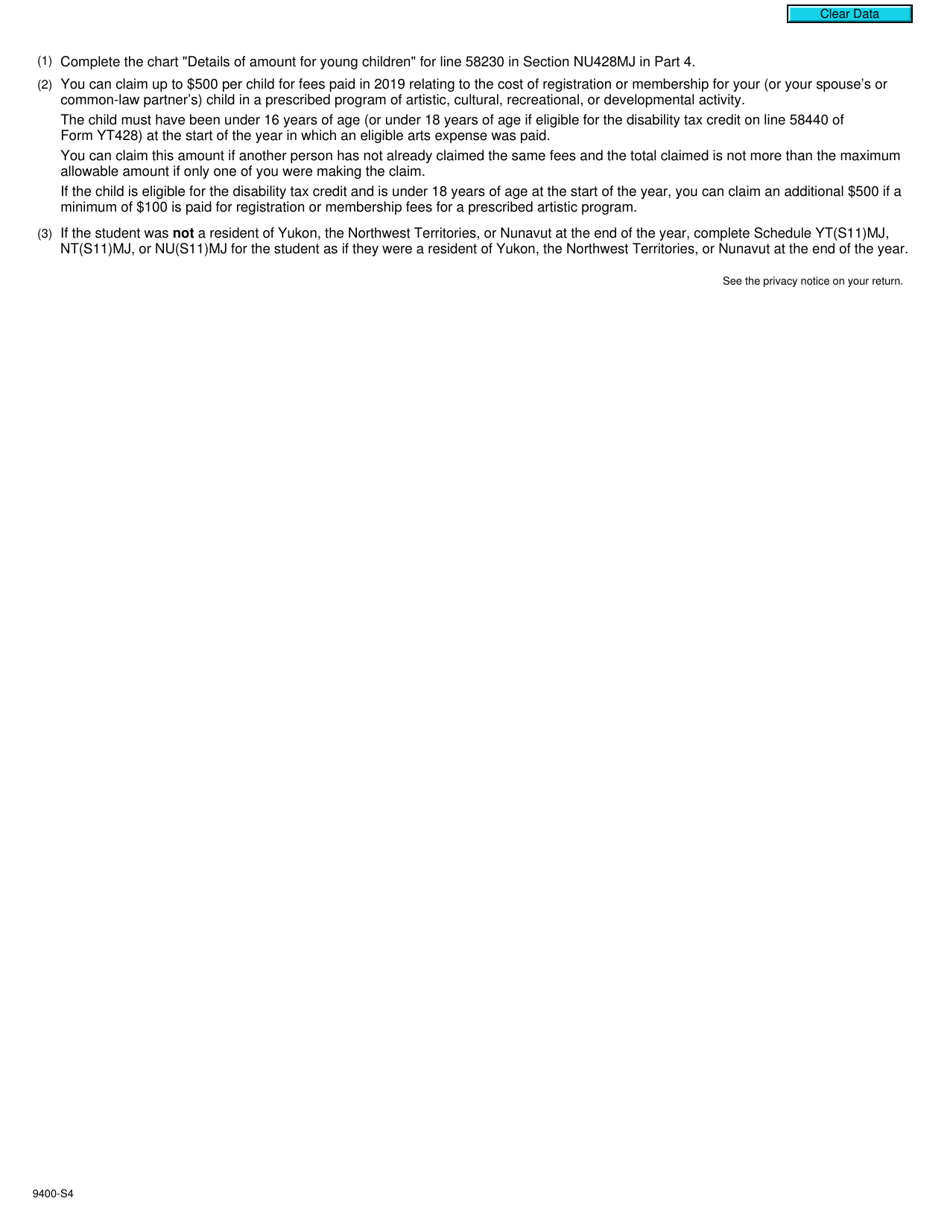

Q: What types of non-refundable tax credits can be claimed on Form T2203?

A: Form T2203 is used to claim various non-refundable tax credits related to Yukon (YK), Northwest Territories (NT), and Nunavut (NU), such as education and textbook amounts, public transit amounts, and mineral exploration tax credits.

Q: How do I fill out Form T2203?

A: To fill out Form T2203, you need to enter the relevant information regarding your provincial and territorial non-refundable tax credits, including the credit amount and the jurisdiction it pertains to. The form also requires your personal information and Social Insurance Number (SIN). It is recommended to review the CRA's guide for completing the form.

Q: When is Form T2203 due?

A: Form T2203 is generally due on or before the same deadline as your federal income tax return, which is April 30th of the following year. However, if you or your spouse or common-law partner is self-employed, the deadline is June 15th.

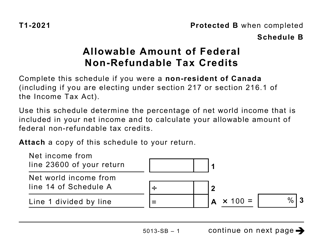

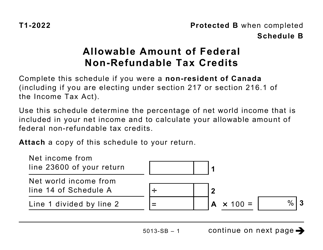

Q: Can I claim both federal and provincial/territorial non-refundable tax credits?

A: Yes, you can claim both federal and provincial/territorial non-refundable tax credits. Form T2203 is specifically used to claim provincial and territorial non-refundable tax credits, while other forms are used for federal credits.

Q: How will claiming non-refundable tax credits affect my tax return?

A: Claiming non-refundable tax credits can help reduce the amount of tax you owe or increase your refund. These credits are subtracted directly from your tax liability, so the more credits you claim, the less tax you have to pay.

Q: What should I do if I need help with Form T2203 or have further questions about tax credits?

A: If you need help with Form T2203 or have further questions about tax credits, it is recommended to contact the Canada Revenue Agency (CRA) directly. They can provide guidance and assistance regarding your specific situation.