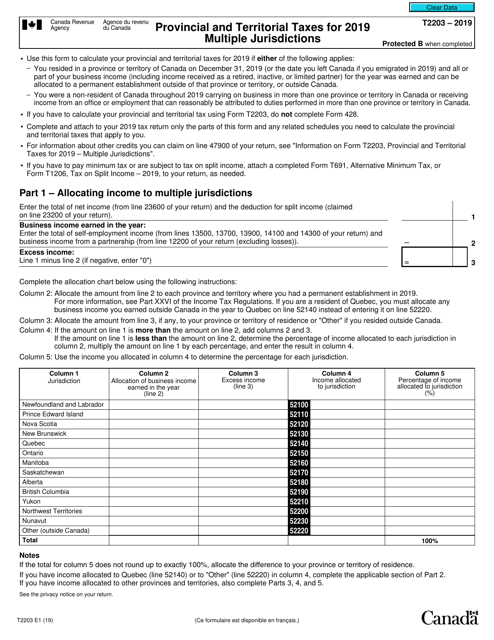

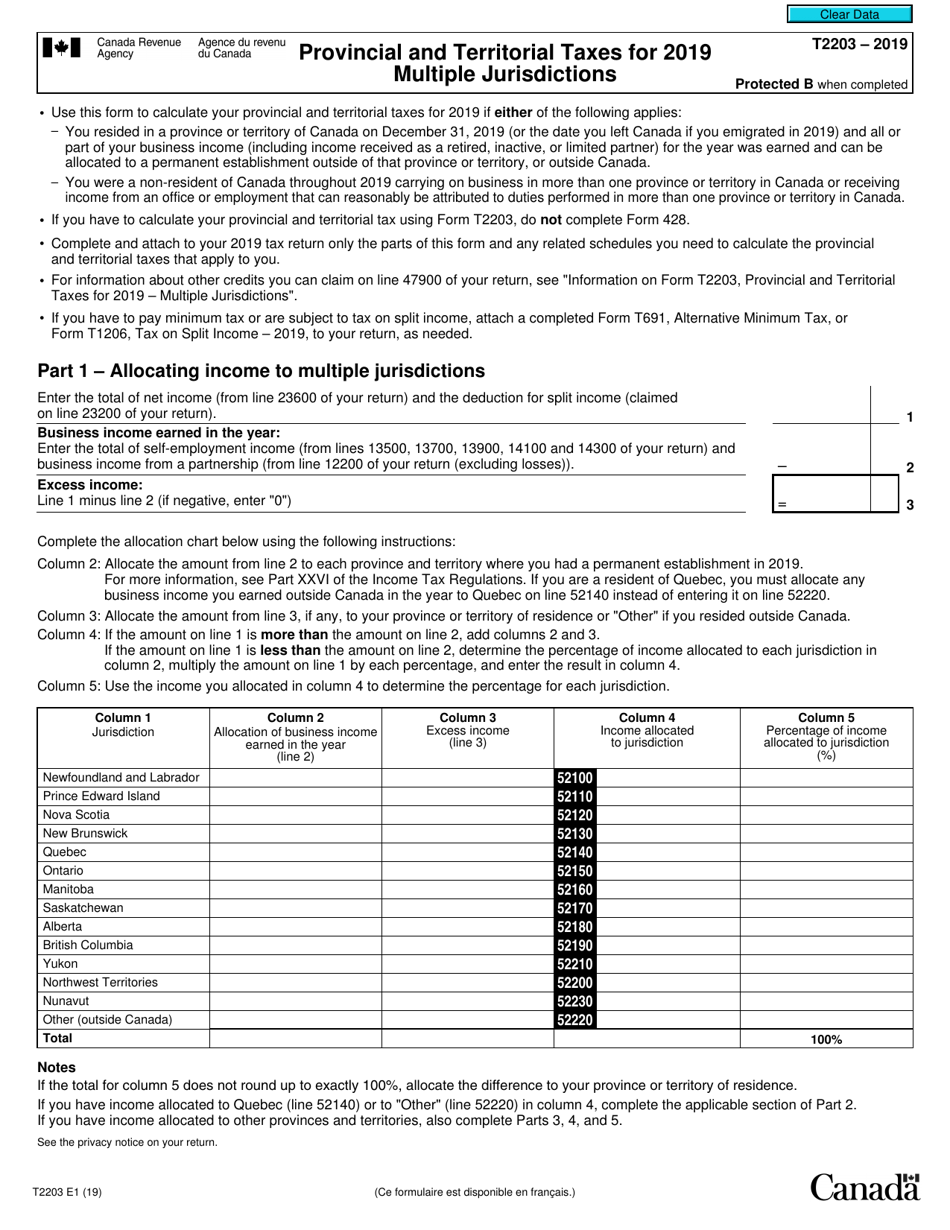

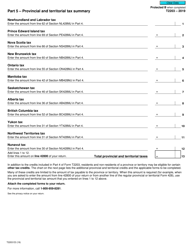

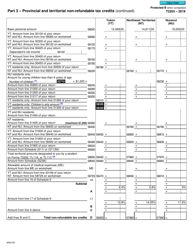

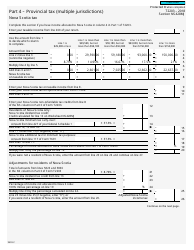

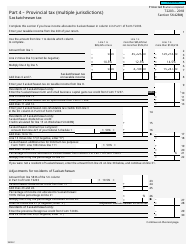

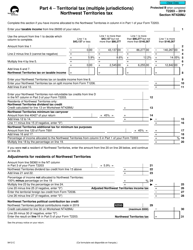

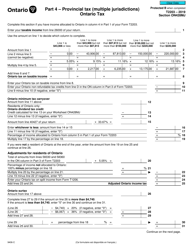

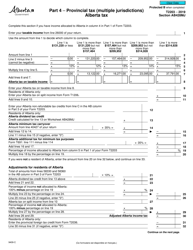

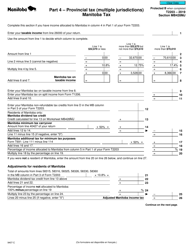

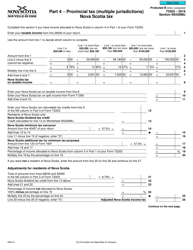

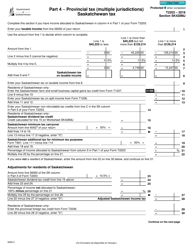

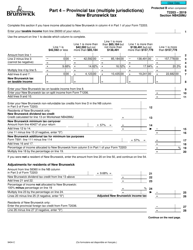

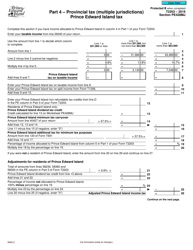

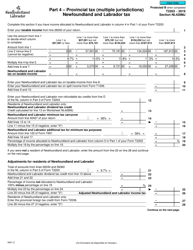

Form T2203 Provincial and Territorial Taxes for Multiple Jurisdictions - Canada

Form T2203 Provincial and Territorial Taxes for Multiple Jurisdictions in Canada is used to calculate and report the taxes owed to multiple provinces or territories. It is used by individuals who have earned income in more than one province or territory during the tax year. This form helps ensure that the correct amount of provincial or territorial taxes is paid based on the income earned in each jurisdiction.

In Canada, individuals who have income from multiple provinces or territories file Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to calculate and declare provincial and territorial taxes for multiple jurisdictions.

Q: Who needs to file Form T2203?

A: Any individual or business in Canada who has income from multiple provinces or territories needs to file Form T2203.

Q: What does Form T2203 calculate?

A: Form T2203 calculates the amount of tax owed to each provincial or territorial jurisdiction based on the individual or business's income.

Q: How is Form T2203 different from other tax forms?

A: Form T2203 is specifically designed for individuals or businesses with income from multiple provinces or territories. It is used to allocate the tax liability among the different jurisdictions.

Q: When is the deadline to file Form T2203?

A: The deadline to file Form T2203 is the same as the deadline for filing your federal income tax return, which is usually April 30th.

Q: Do I have to file Form T2203 if I only have income from one province or territory?

A: No, Form T2203 is only required if you have income from multiple provinces or territories. If you only have income from one jurisdiction, you would file the appropriate provincial or territorial tax form.

Q: Can I file Form T2203 electronically?

A: Yes, you can file Form T2203 electronically through the CRA's Netfile system or through a certified tax software.

Q: What happens if I don't file Form T2203?

A: If you have income from multiple provinces or territories and do not file Form T2203, you may face penalties or interest charges from the CRA.