This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2017

for the current year.

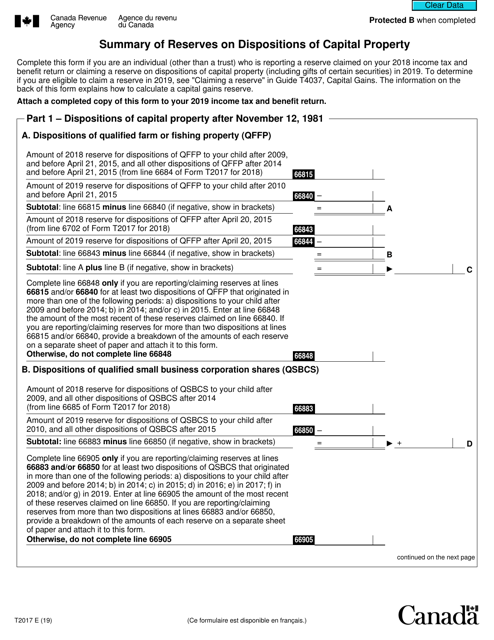

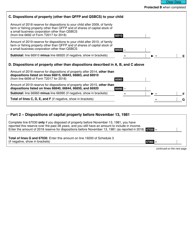

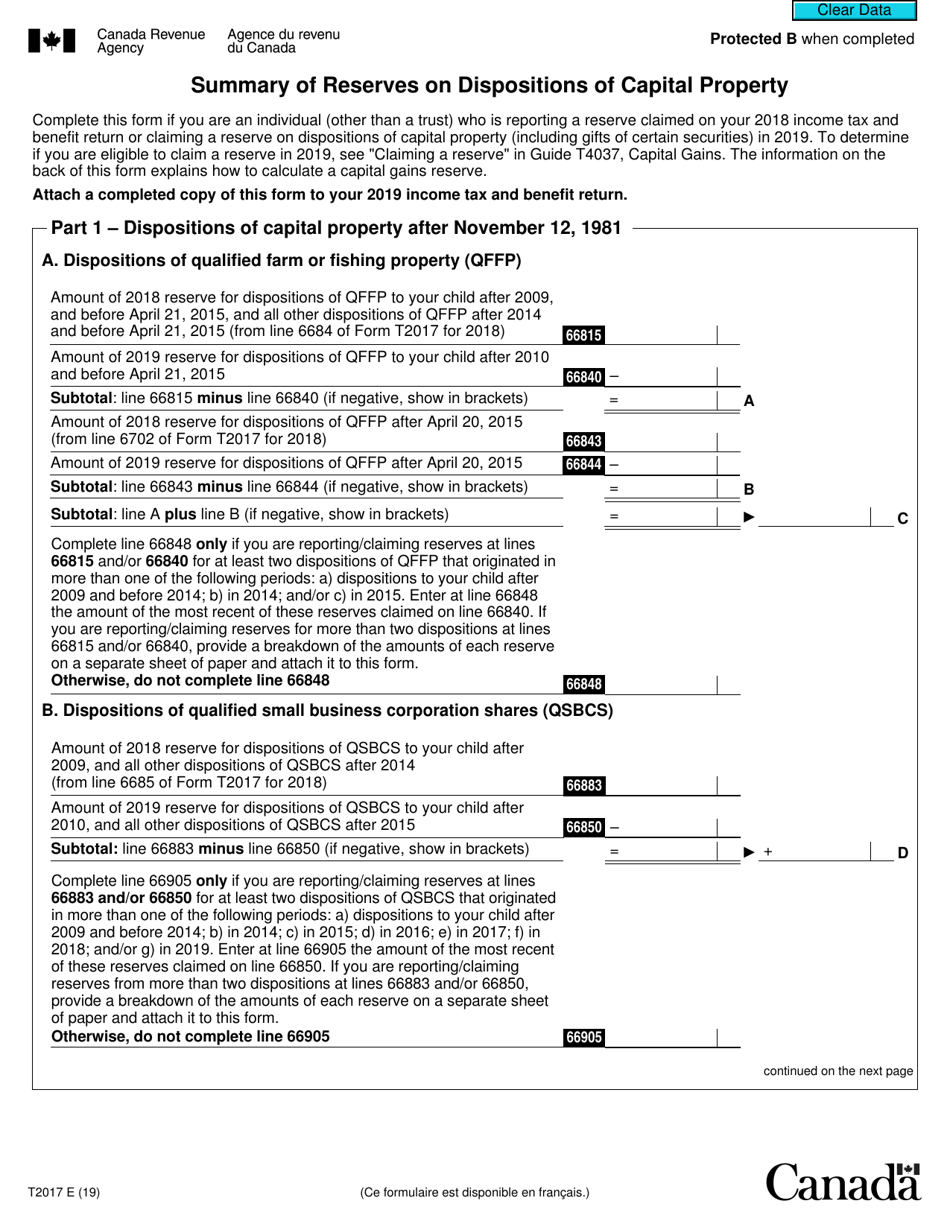

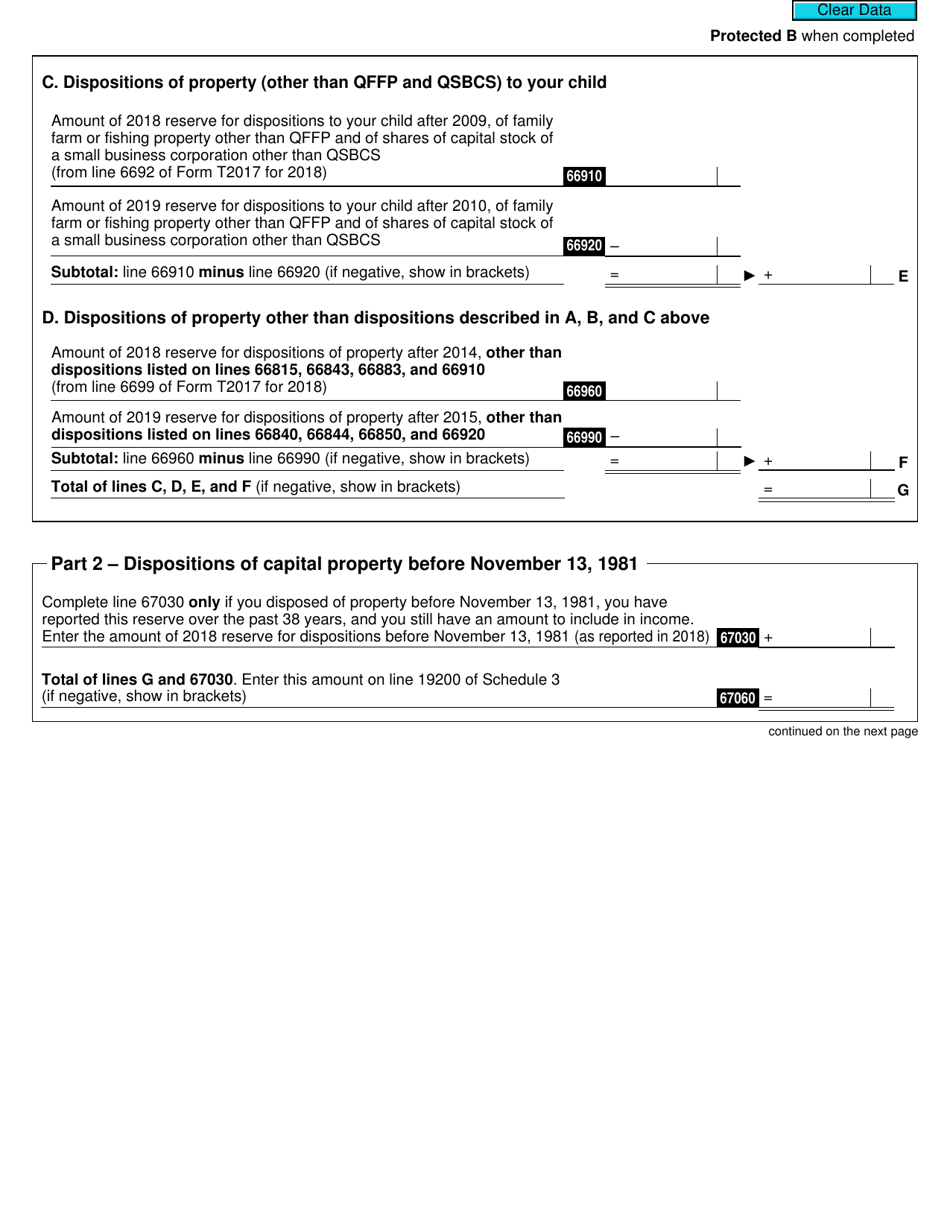

Form T2017 Summary of Reserves on Dispositions of Capital Property - Canada

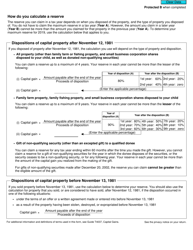

Form T2017 Summary of Reserves on Dispositions of Capital Property in Canada is used to report the details of reserves created for the sale of capital property. This form is filed by individuals or businesses to report the deferred income from the sale of capital property and determine the taxable portion of the gain.

The Form T2017 Summary of Reserves on Dispositions of Capital Property in Canada is filed by taxpayers who have disposed of capital property and have claimed tax reserves.

FAQ

Q: What is Form T2017?

A: Form T2017 is the summary of reserves on dispositions of capital property in Canada.

Q: What is a reserve on disposition?

A: A reserve on disposition is an amount that can be deducted from the proceeds of the property disposition to defer taxation.

Q: Who needs to file Form T2017?

A: Individuals, corporations or trusts who have disposed of capital property and have taken a reserve on the disposition need to file Form T2017.

Q: How do I report a reserve on disposition?

A: You can report a reserve on disposition by completing Form T2017 and including it with your income tax return.

Q: What information is required on Form T2017?

A: Form T2017 requires information such as the taxpayer's identification number, the description of the property, the reserve balance, and the reasons for the reserve.

Q: When is the deadline to file Form T2017?

A: Form T2017 must be filed by the individual's income tax filingdue date, which is generally April 30th for most taxpayers.

Q: Are there any penalties for not filing Form T2017?

A: Yes, there can be penalties for not filing Form T2017, such as late filing penalties and interest charges on any tax owing.

Q: Do I need to keep a copy of Form T2017 for my records?

A: Yes, it is important to keep a copy of Form T2017 and any supporting documents for your records in case of future audit or review by the CRA.