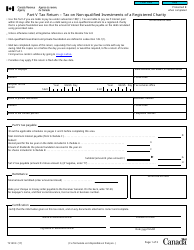

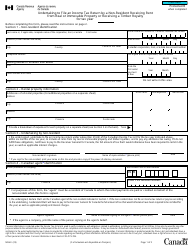

This version of the form is not currently in use and is provided for reference only. Download this version of

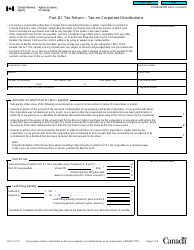

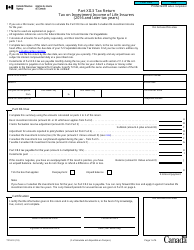

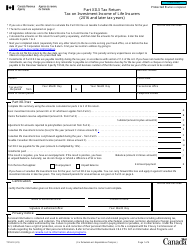

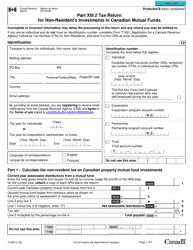

Form T1262

for the current year.

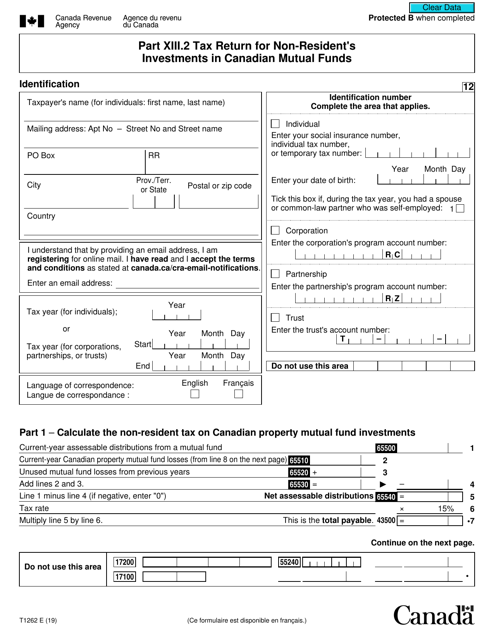

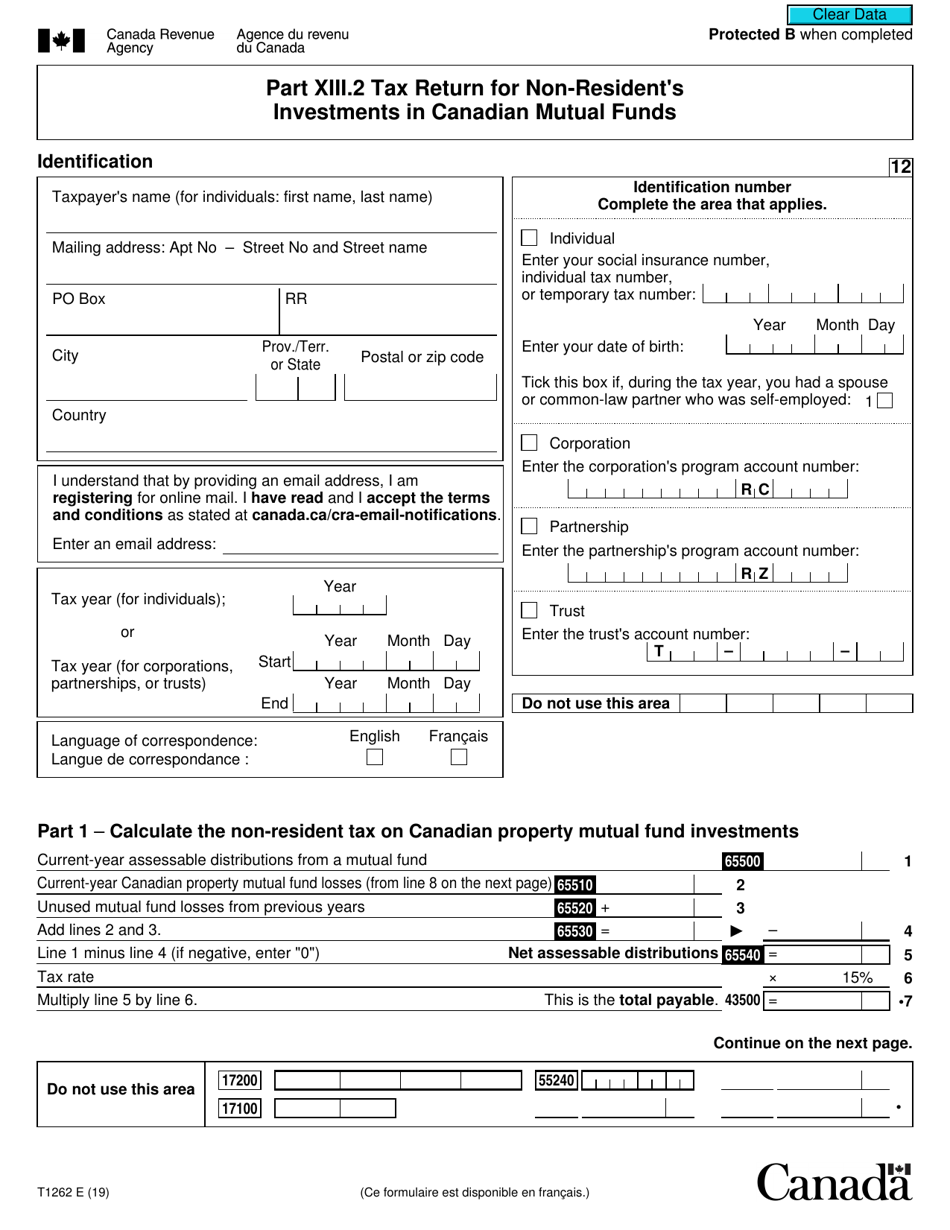

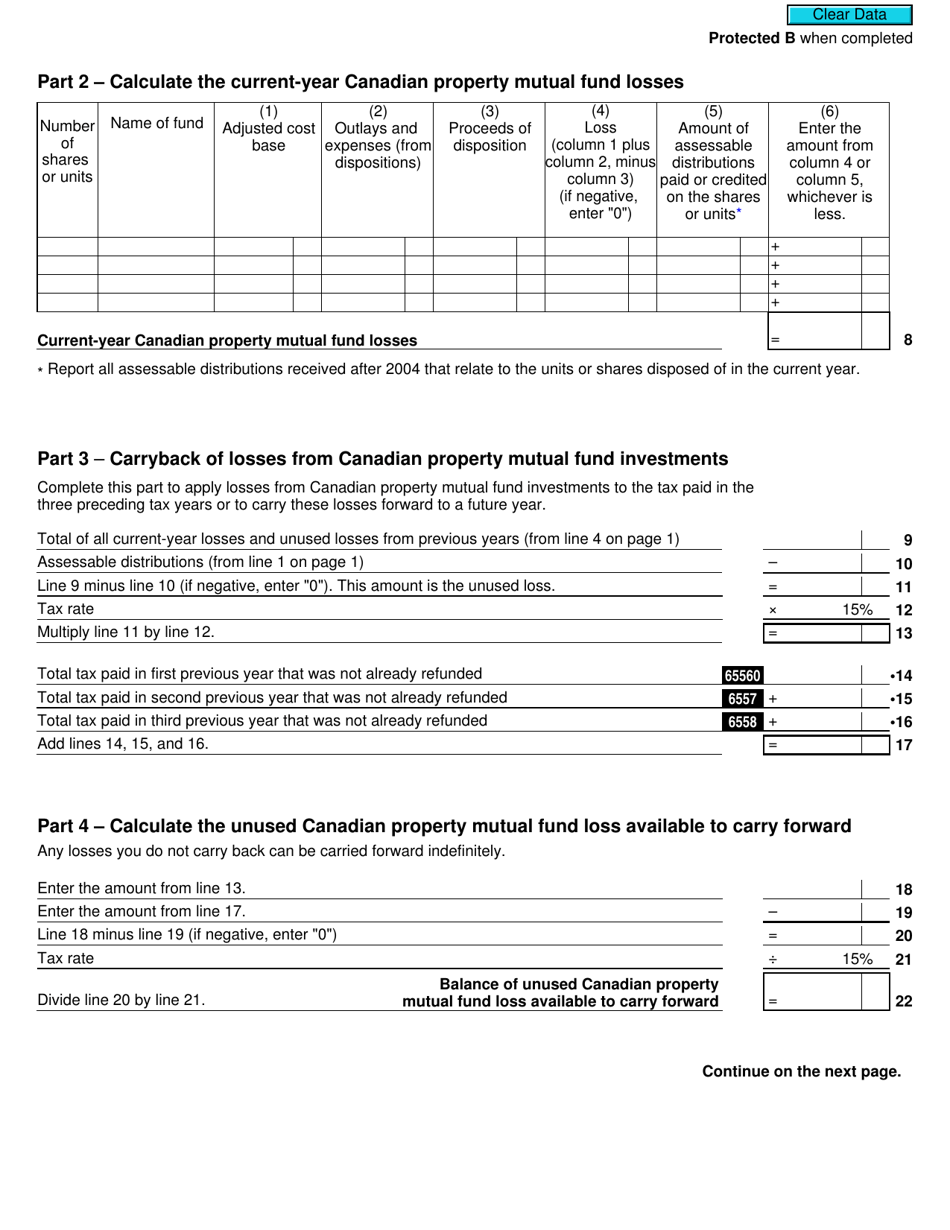

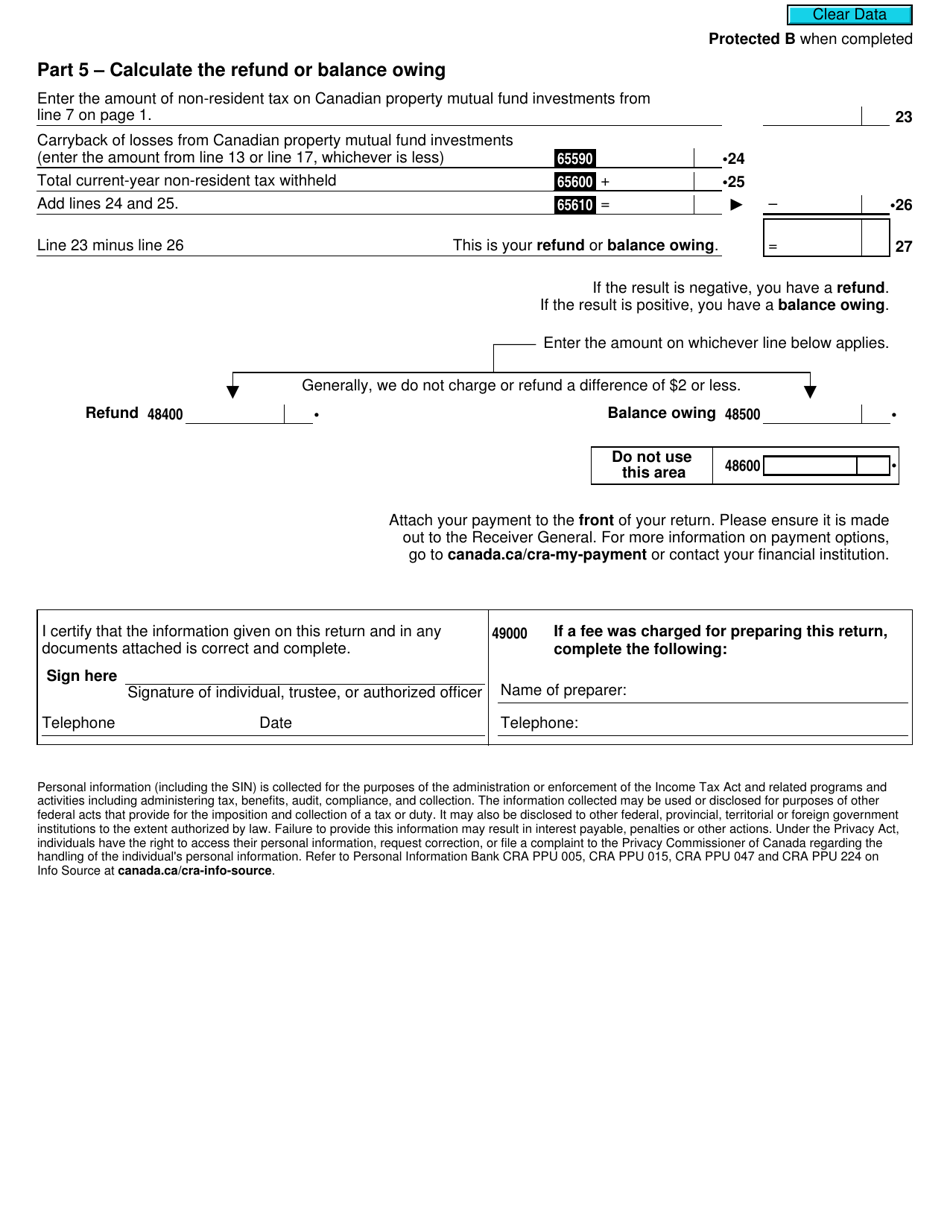

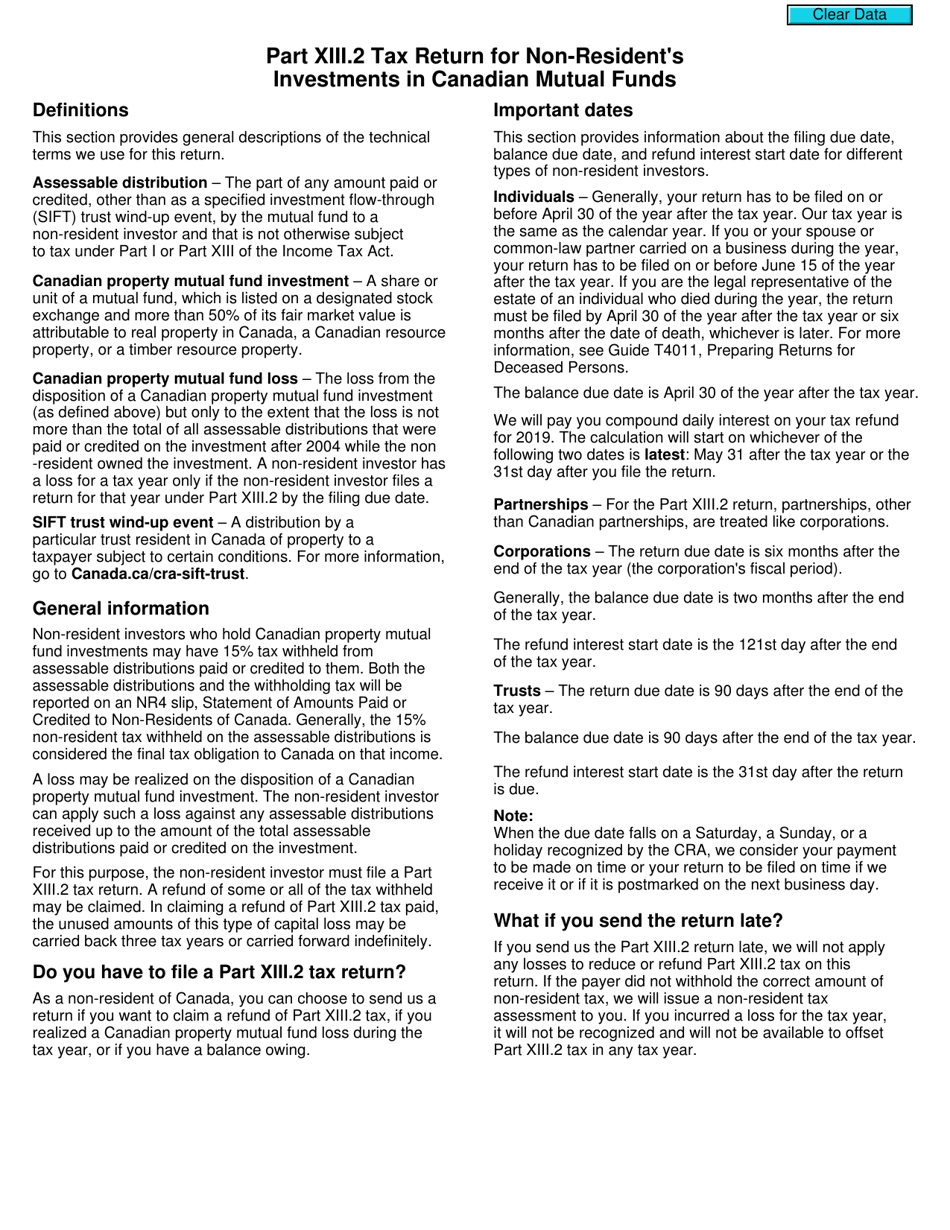

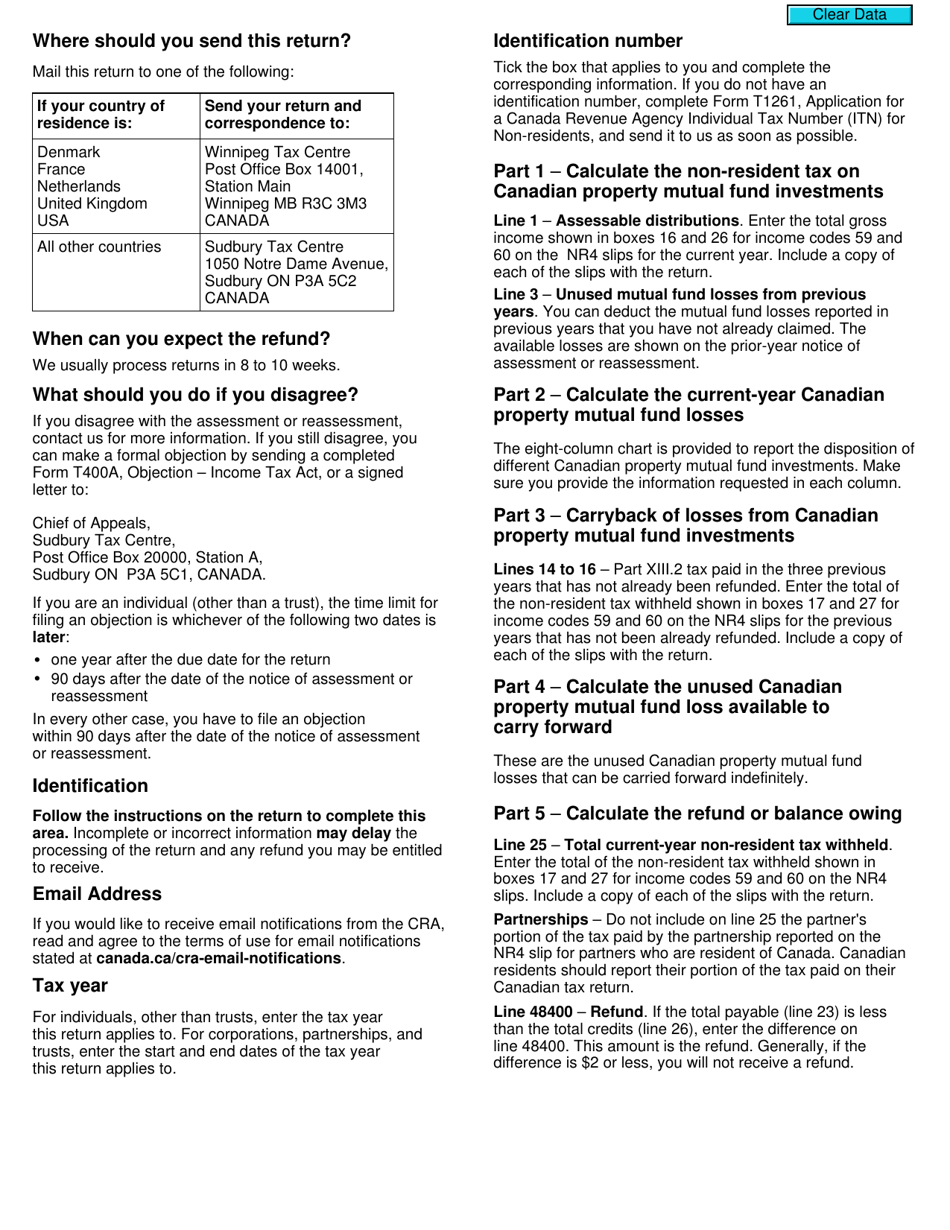

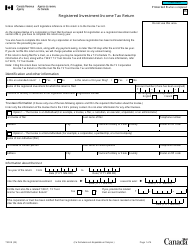

Form T1262 Tax Return for Non-resident's Investments in Canadian Mutual Funds - Canada

Form T1262 is used by non-residents of Canada to report their investments in Canadian mutual funds. It helps the Canadian tax authorities track and ensure proper reporting of income earned from these investments.

The non-resident investor files the Form T1262 tax return for investments in Canadian mutual funds in Canada.

FAQ

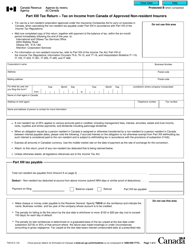

Q: What is Form T1262?

A: Form T1262 is a tax return used by non-residents to report their investments in Canadian mutual funds.

Q: Who needs to file Form T1262?

A: Non-residents who have investments in Canadian mutual funds need to file Form T1262.

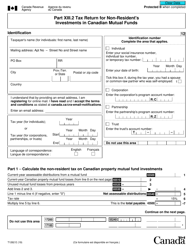

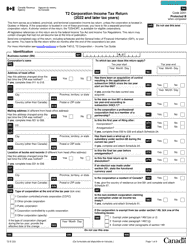

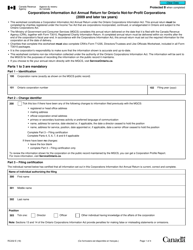

Q: What information is required on Form T1262?

A: Form T1262 requires information such as the mutual fund name, account number, income earned, and taxes paid.

Q: When is the deadline to file Form T1262?

A: The deadline to file Form T1262 is generally on or before June 30th of the following year.

Q: What happens if I don't file Form T1262?

A: If you do not file Form T1262, you may be subject to penalties or other consequences imposed by the CRA.

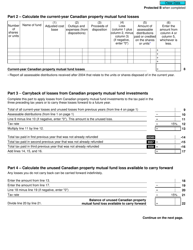

Q: Can I get a refund on taxes paid on Canadian mutual funds?

A: Non-residents may be eligible for a refund on taxes paid on their Canadian mutual funds, depending on their tax treaty with Canada.

Q: Do I need to file any other tax forms as a non-resident with Canadian mutual fund investments?

A: Non-residents with Canadian mutual fund investments may also need to file other tax forms, such as T1135 – Foreign Income Verification Statement.

Q: Can I claim any deductions or credits on Form T1262?

A: Non-residents generally cannot claim deductions or credits on Form T1262, but each individual's situation may vary.