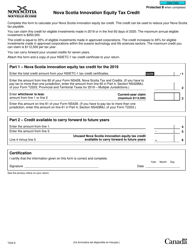

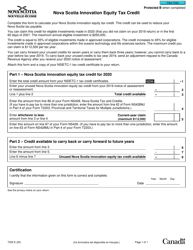

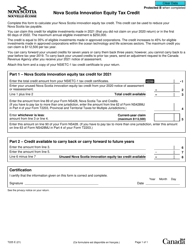

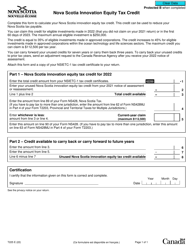

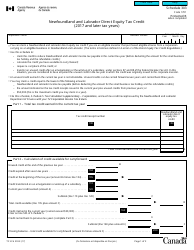

This version of the form is not currently in use and is provided for reference only. Download this version of

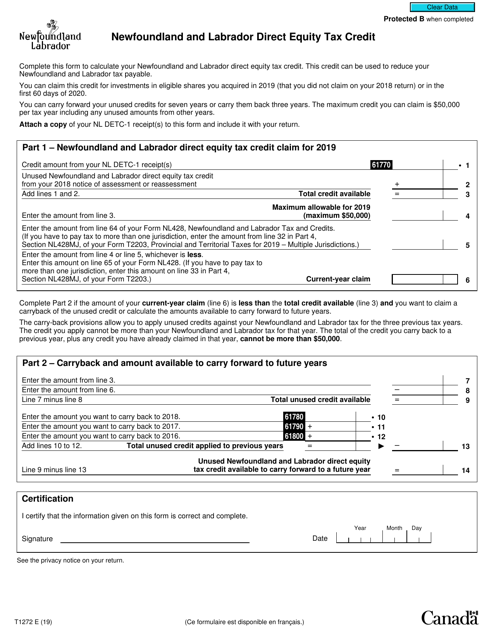

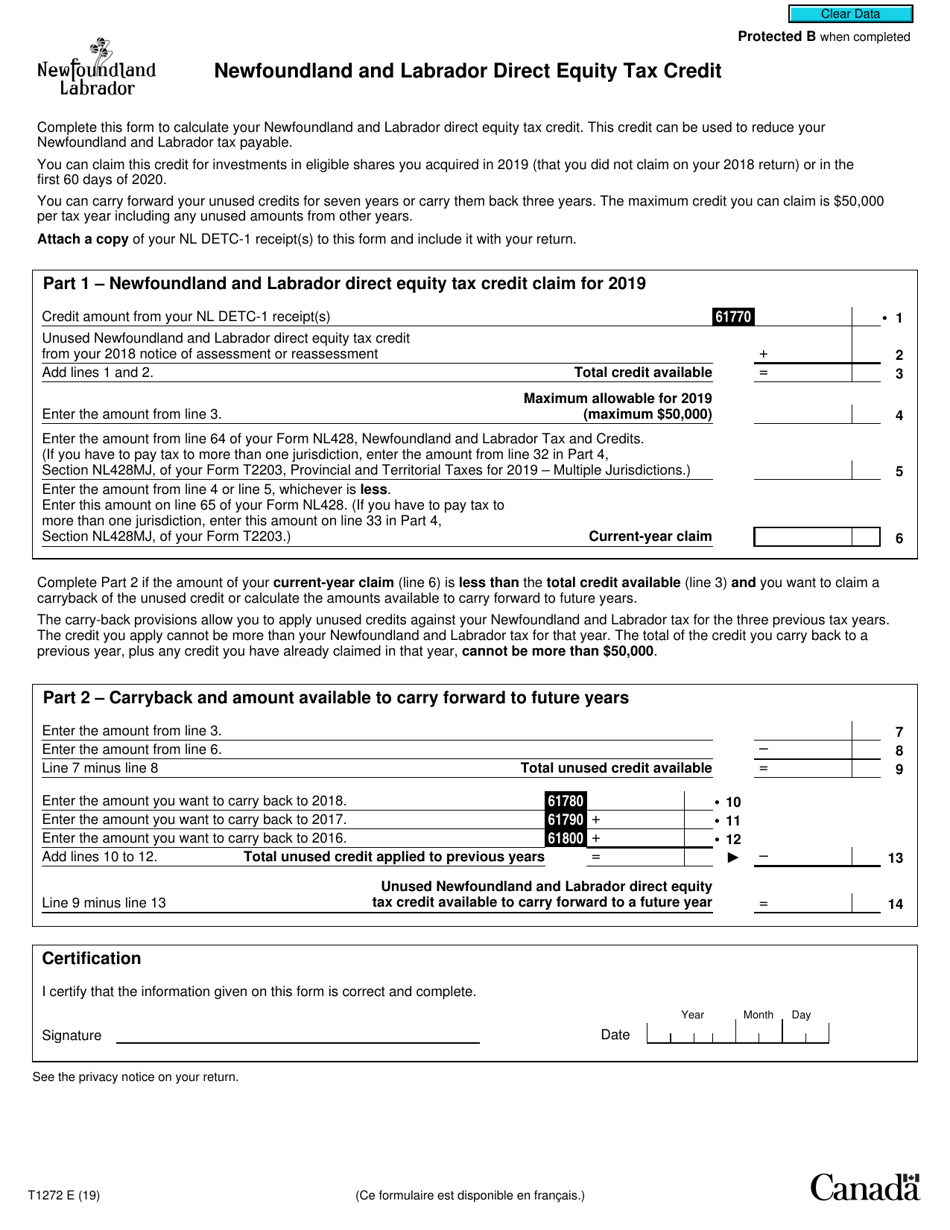

Form T1272

for the current year.

Form T1272 Newfoundland and Labrador Direct Equity Tax Credit - Canada

Form T1272 is used in Canada for claiming the Newfoundland and Labrador Direct Equity Tax Credit. This credit is available to qualified individuals who have invested in eligible corporations in Newfoundland and Labrador. The form helps taxpayers calculate and claim the tax credit they are entitled to.

The individual or corporation who wishes to claim the Newfoundland and Labrador Direct Equity Tax Credit files Form T1272.

FAQ

Q: What is Form T1272?

A: Form T1272 is a tax form used in Newfoundland and Labrador to claim the Direct Equity Tax Credit.

Q: What is the Direct Equity Tax Credit?

A: The Direct Equity Tax Credit is a tax credit provided by the government of Newfoundland and Labrador to individuals who invest in eligible provincially-registered businesses.

Q: Who is eligible for the Direct Equity Tax Credit?

A: Individuals who are residents of Newfoundland and Labrador and who invest in eligible provincially-registered businesses are eligible for the Direct Equity Tax Credit.

Q: How do I claim the Direct Equity Tax Credit?

A: To claim the Direct Equity Tax Credit, you need to complete Form T1272 and submit it with your income tax return.

Q: What is the benefit of the Direct Equity Tax Credit?

A: The Direct Equity Tax Credit provides a refundable tax credit of 35% of the amount invested in eligible provincially-registered businesses.

Q: Are there any restrictions on the Direct Equity Tax Credit?

A: Yes, there are certain restrictions on the Direct Equity Tax Credit, such as a maximum annual investment limit and a minimum holding period for the investment.

Q: Is the Direct Equity Tax Credit available in other provinces?

A: No, the Direct Equity Tax Credit is specific to Newfoundland and Labrador.

Q: Are there any similar tax credits available in other provinces?

A: There may be similar tax credits available in other provinces, but they would have different names and eligibility criteria.

Q: Can I claim the Direct Equity Tax Credit for investments made in previous years?

A: No, the Direct Equity Tax Credit can only be claimed for investments made in the current tax year.