This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1256

for the current year.

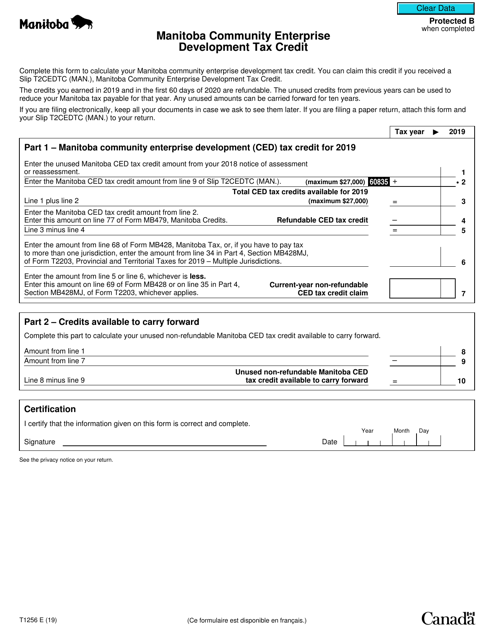

Form T1256 Manitoba Community Enterprise Development Tax Credit - Canada

Form T1256, the Manitoba Community Enterprise Development Tax Credit, is a tax credit available to eligible investors in Manitoba who invest in a qualifying community enterprise. It is designed to encourage investment in Manitoba-based businesses that contribute to community economic development. The tax credit provided by this form can help offset the tax liability of eligible investors.

The Form T1256 Manitoba Community Enterprise Development Tax Credit in Canada is typically filed by individuals or corporations who are claiming the tax credit for investments made in qualifying Manitoba community enterprises.

FAQ

Q: What is Form T1256?

A: Form T1256 is a tax form used in Canada to claim the Manitoba Community Enterprise Development Tax Credit.

Q: What is the Manitoba Community Enterprise Development Tax Credit?

A: The Manitoba Community Enterprise Development Tax Credit is a tax credit available to individuals and corporations that invest in eligible community enterprise projects in Manitoba.

Q: Who is eligible to claim the Manitoba Community Enterprise Development Tax Credit?

A: Both individuals and corporations can be eligible to claim the tax credit if they invest in eligible community enterprise projects in Manitoba.

Q: What is the purpose of the Manitoba Community Enterprise Development Tax Credit?

A: The tax credit is designed to encourage investment in community development projects and support local economic growth in Manitoba.

Q: How do I claim the Manitoba Community Enterprise Development Tax Credit?

A: To claim the tax credit, you need to complete Form T1256 and include it with your income tax return. The form requires information about the investment and the community enterprise project.

Q: Are there any restrictions on the amount of tax credit that can be claimed?

A: Yes, there are limits on the amount of tax credit that can be claimed. The maximum annual tax credit for individuals is $3,000 and for corporations is $15,000.