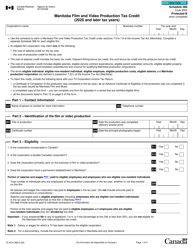

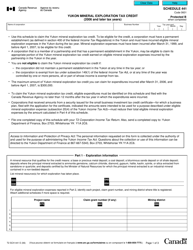

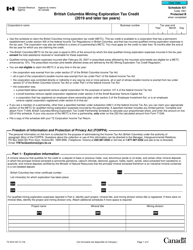

This version of the form is not currently in use and is provided for reference only. Download this version of

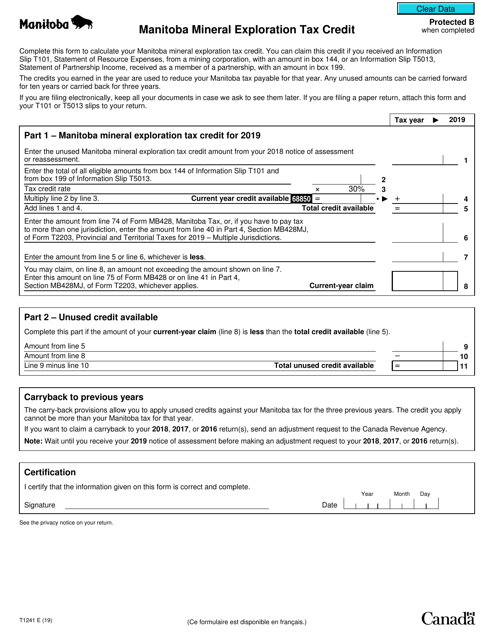

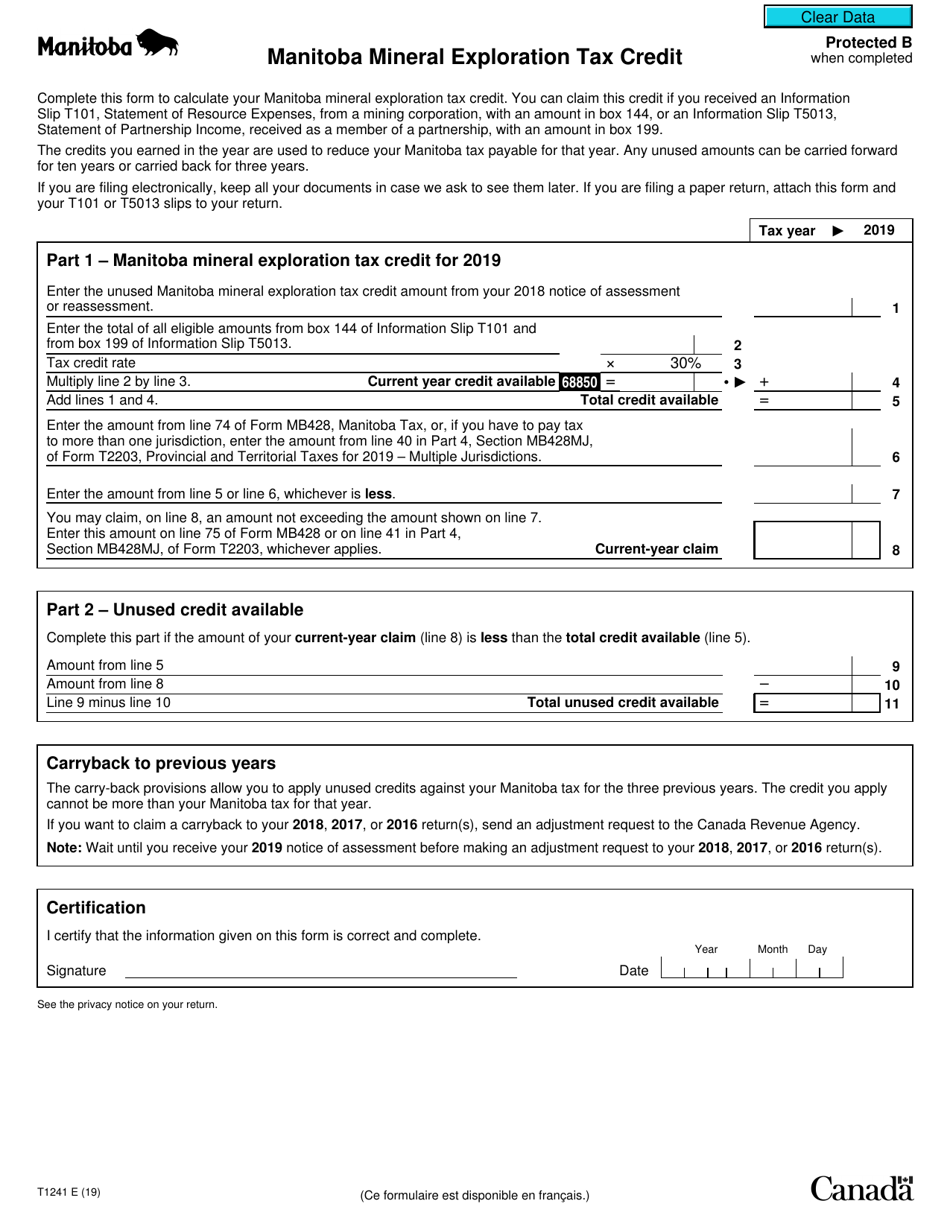

Form T1241

for the current year.

Form T1241 Manitoba Mineral Exploration Tax Credit - Canada

Form T1241, the Manitoba Mineral Exploration Tax Credit, is a tax credit available to individuals or corporations conducting mineral exploration activities in Manitoba, Canada. It is designed to encourage and support mineral exploration within the province. The credit can be claimed against income tax payable and can help offset the costs associated with exploration activities.

The Form T1241 Manitoba Mineral Exploration Tax Credit in Canada is filed by individuals or corporations engaged in mineral exploration activities in Manitoba.

FAQ

Q: What is Form T1241?

A: Form T1241 is a tax form used in Canada for claiming the Manitoba Mineral Exploration Tax Credit.

Q: What is the Manitoba Mineral Exploration Tax Credit?

A: The Manitoba Mineral Exploration Tax Credit is a tax credit offered by the province of Manitoba in Canada to individuals or corporations engaged in mineral exploration activities.

Q: Who can claim the Manitoba Mineral Exploration Tax Credit?

A: Individuals or corporations engaged in mineral exploration activities in Manitoba can claim the tax credit.

Q: What expenses are eligible for the Manitoba Mineral Exploration Tax Credit?

A: Eligible expenses for the tax credit include certain exploration and development expenses incurred in Manitoba for the purpose of discovering minerals.

Q: How much is the Manitoba Mineral Exploration Tax Credit?

A: The tax credit is calculated as a percentage of eligible expenses and can vary each year. It is non-refundable but can be carried forward to future years.

Q: When is the deadline for filing Form T1241?

A: The deadline for filing Form T1241 is typically the same as the deadline for filing the individual or corporate tax return, which is April 30th for individuals and six months after the end of the fiscal year for corporations.

Q: Are there any restrictions or limitations on claiming the Manitoba Mineral Exploration Tax Credit?

A: There may be certain restrictions and limitations on claiming the tax credit, such as maximum claim amounts and specific criteria that must be met. It is advisable to consult the CRA or a tax professional for detailed information.

Q: Can I claim the Manitoba Mineral Exploration Tax Credit if I am not a resident of Manitoba?

A: No, the tax credit is specifically for individuals or corporations engaged in mineral exploration activities in Manitoba.

Q: Is the Manitoba Mineral Exploration Tax Credit available for previous years?

A: The availability of the tax credit for previous years depends on the specific legislation and rules in place. It is advisable to consult the CRA or a tax professional for information on previous years' eligibility.