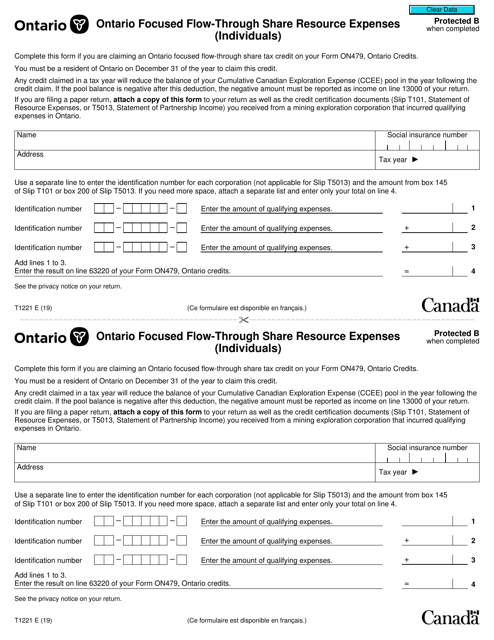

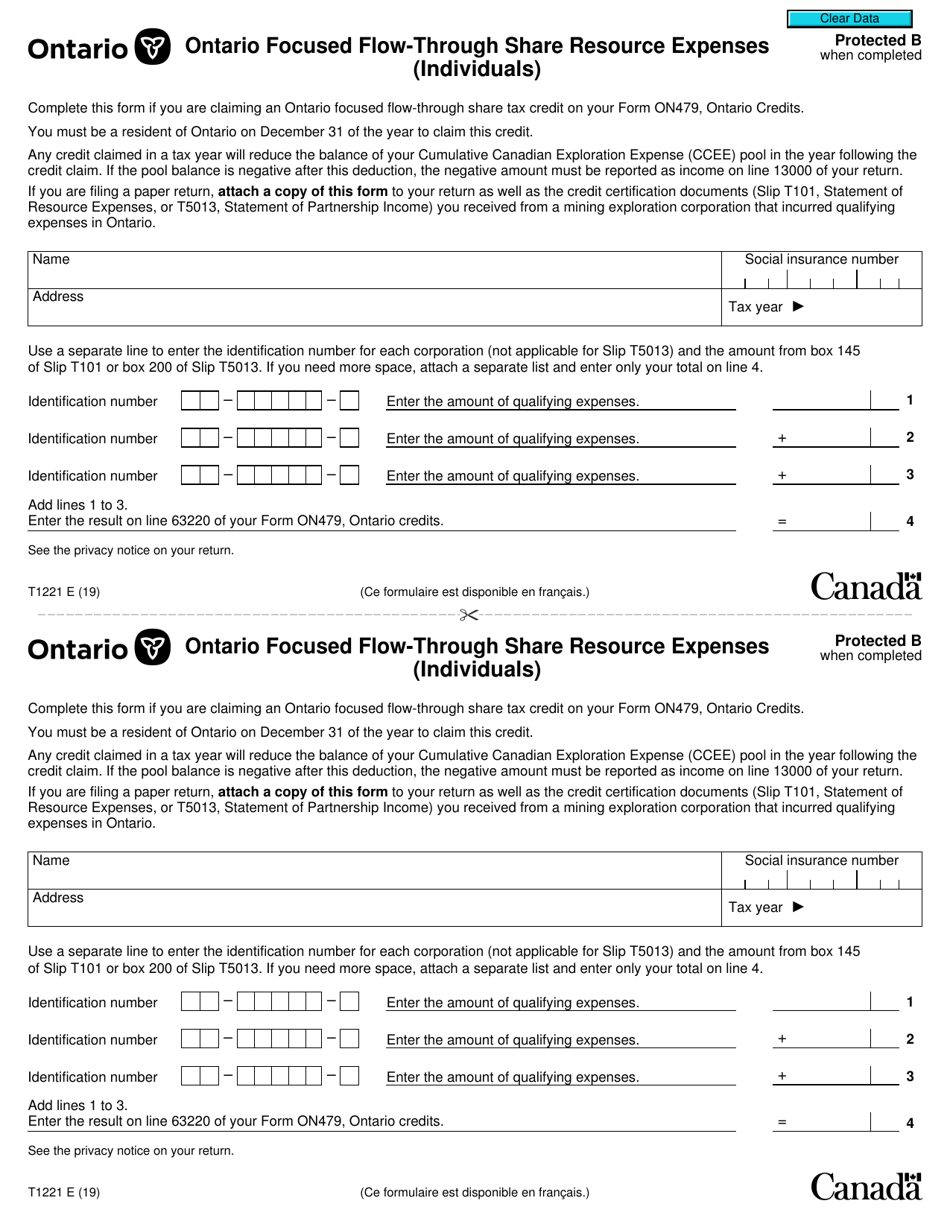

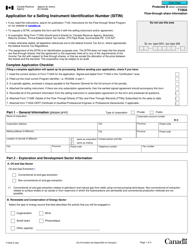

Form T1221 Ontario Focused Flow-Through Share Resource Expenses (Individuals) - Canada

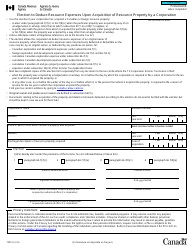

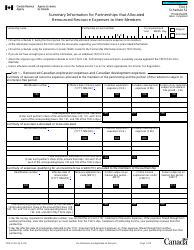

Form T1221 Ontario Focused Flow-Through Share Resource Expenses (Individuals) is a tax form used in Canada to claim deductions for expenses related to investments in flow-through shares in Ontario. This form is specific to individuals who have invested in these types of shares and want to claim the associated resource expenses as deductions on their tax return.

The Form T1221 Ontario Focused Flow-Through Share Resource Expenses (Individuals) in Canada is filed by individuals who have invested in flow-through shares related to Ontario focused resource expenses.

FAQ

Q: What is Form T1221?

A: Form T1221 is a tax form used in Canada to report focused flow-through share resource expenses for individuals.

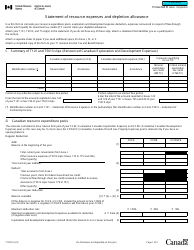

Q: What are focused flow-through share resource expenses?

A: Focused flow-through share resource expenses are expenses related to the exploration and development of mineral resources.

Q: Who needs to file Form T1221?

A: Individuals who have incurred focused flow-through share resource expenses in Ontario need to file Form T1221.

Q: What is the purpose of Form T1221?

A: The purpose of Form T1221 is to calculate and report the amount of deductible focused flow-through share resource expenses.

Q: How do I fill out Form T1221?

A: You need to provide information about the flow-through shares received, the resource expenses incurred, and any related deductions.

Q: When is the deadline to file Form T1221?

A: The deadline to file Form T1221 is the same as the individual income tax return deadline, which is usually April 30th.