This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1170

for the current year.

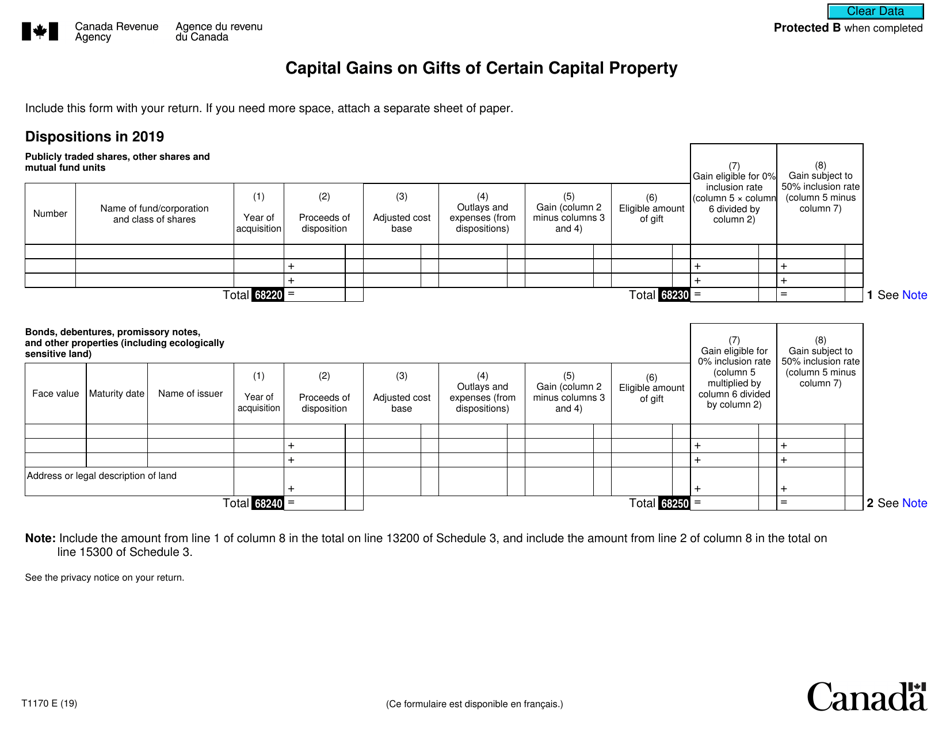

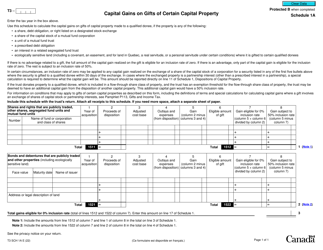

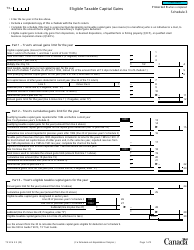

Form T1170 Capital Gains on Gifts of Certain Capital Property - Canada

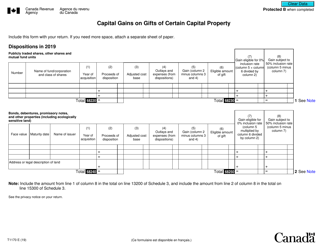

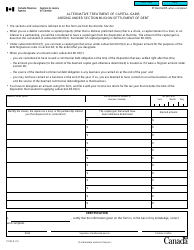

Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada is used to report any capital gains or losses resulting from the donation of certain capital property as a gift. It is designed to calculate the taxable portion of the capital gain and to determine the amount eligible for a charitable tax credit.

The donor files the Form T1170 Capital Gains on Gifts of Certain Capital Property in Canada.

FAQ

Q: What is Form T1170?

A: Form T1170 is a form used in Canada for reporting capital gains on gifts of certain capital property.

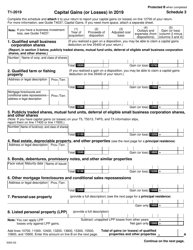

Q: What is capital gains?

A: Capital gains are the profits made from selling or disposing of a capital asset, such as real estate or stocks, at a higher price than what was paid for it.

Q: What is considered as certain capital property?

A: Certain capital property includes listed personal property, such as artwork or collectibles, and shares of private corporations.

Q: When do I need to file Form T1170?

A: You need to file Form T1170 if you have disposed of certain capital property as a gift and have realized capital gains on it.

Q: Do I have to pay taxes on capital gains from gifts?

A: Yes, you may be subject to taxes on the capital gains from gifts of certain capital property. Form T1170 helps you report and calculate the amount of tax owed.

Q: Can I claim a tax deduction for gifts of certain capital property?

A: No, you cannot claim a tax deduction for gifts of certain capital property.