This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1159

for the current year.

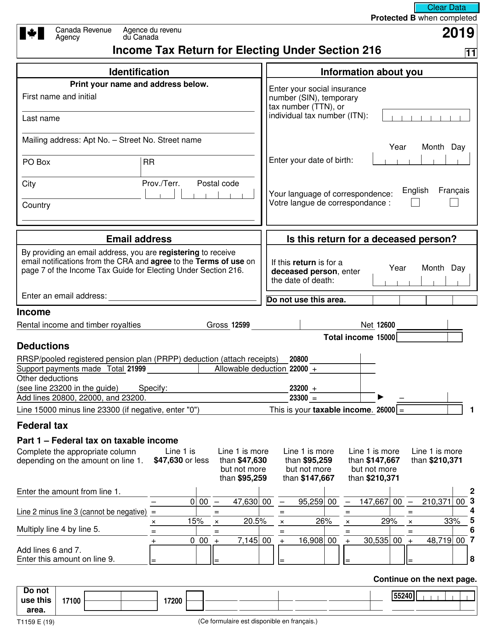

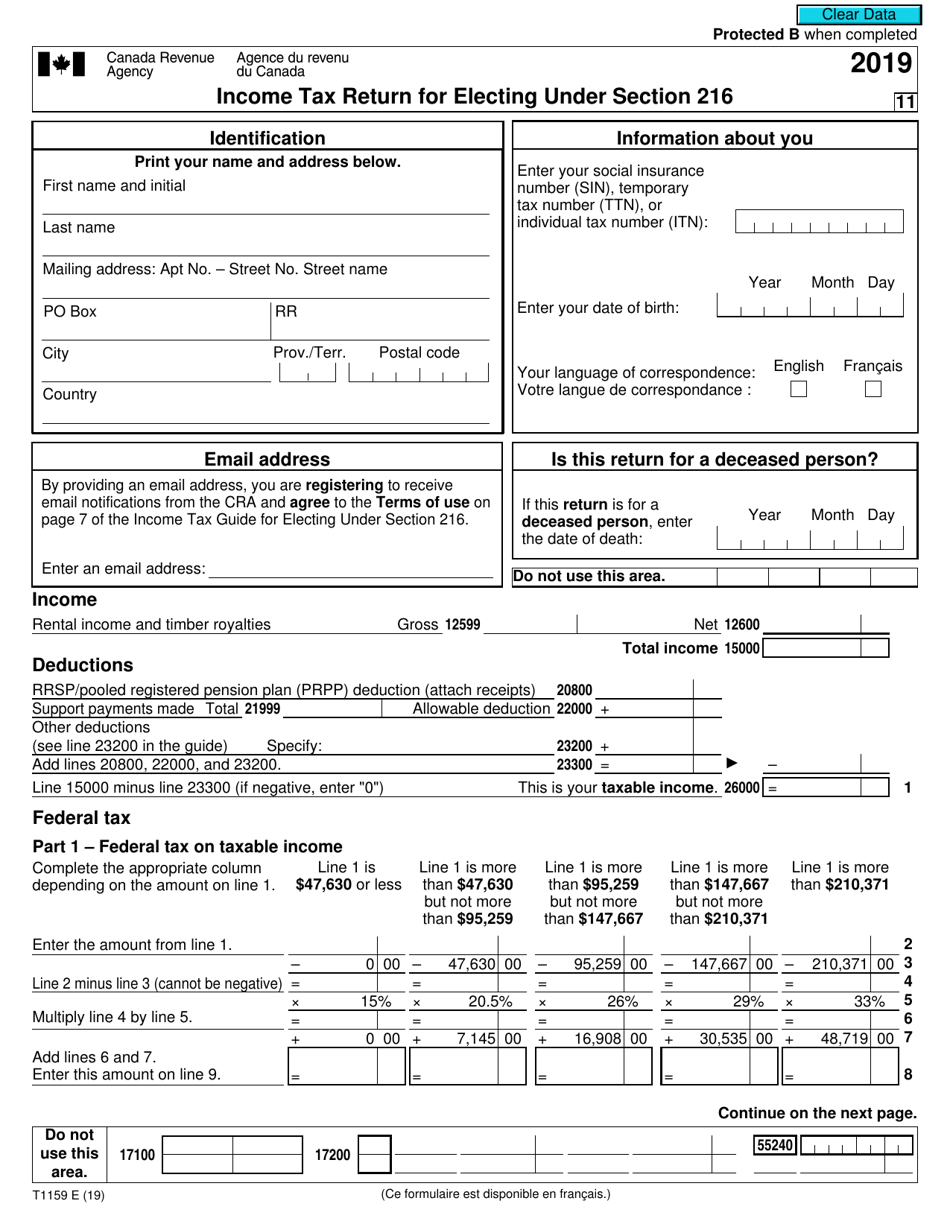

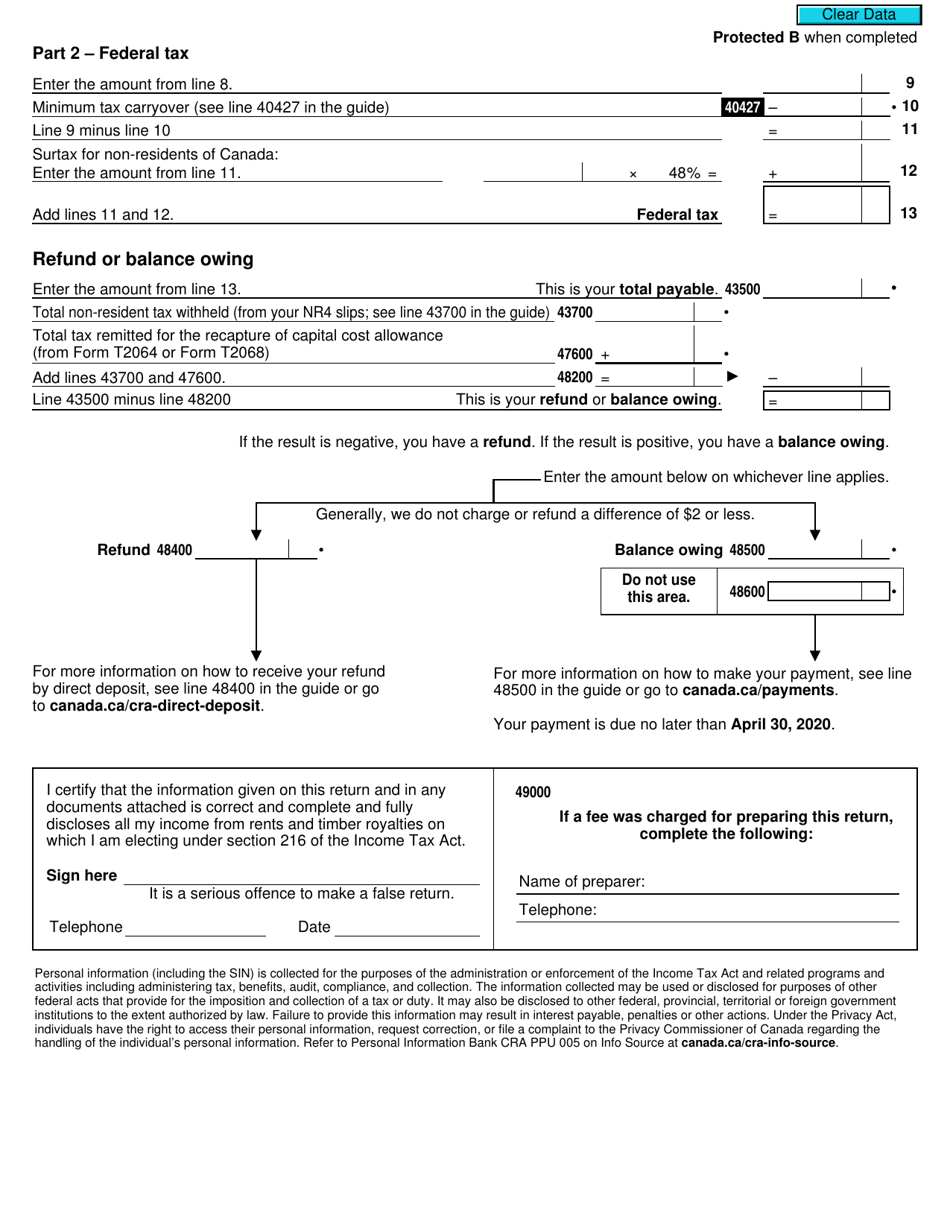

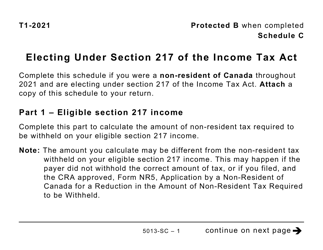

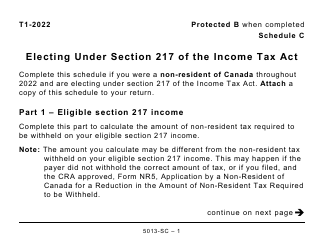

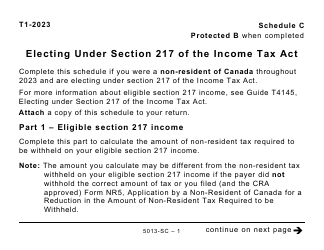

Form T1159 Income Tax Return for Electing Under Section 216 - Canada

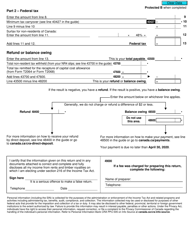

Form T1159 is used by non-residents of Canada who have rental income from Canadian properties and want to elect under section 216 of the Income Tax Act. This form is used to calculate and report the rental income, deductions, and taxes owed by non-residents. It allows non-residents to pay tax on their rental income at a flat rate, rather than at the regular progressive tax rates.

Individuals who are non-residents of Canada but earn rental income from Canadian real property can file the Form T1159 Income Tax Return for Electing Under Section 216. This form allows them to elect to be taxed under Section 216 of the Canadian Income Tax Act, which treats their rental income and expenses differently for tax purposes.

FAQ

Q: What is Form T1159?

A: Form T1159 is an Income Tax Return form for electing under Section 216 in Canada.

Q: What is Section 216?

A: Section 216 is a provision in the Canadian tax laws that allows non-residents of Canada to elect to be taxed at a lower rate on their Canadian rental income.

Q: Who needs to file Form T1159?

A: Individuals who are non-residents of Canada and receive rental income from Canadian properties need to file Form T1159 if they wish to elect under Section 216.

Q: What information is required on Form T1159?

A: Form T1159 requires you to provide your personal information, details of your rental income, deductions, and credits.

Q: When is Form T1159 due?

A: Form T1159 is due on or before June 30 of the year following the taxation year.