This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1136

for the current year.

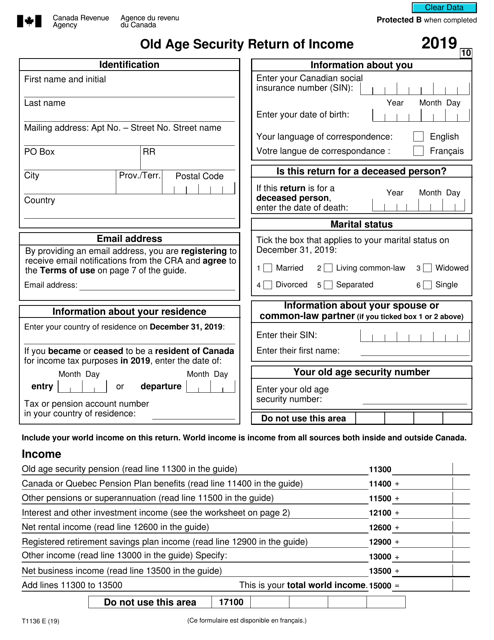

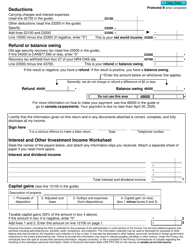

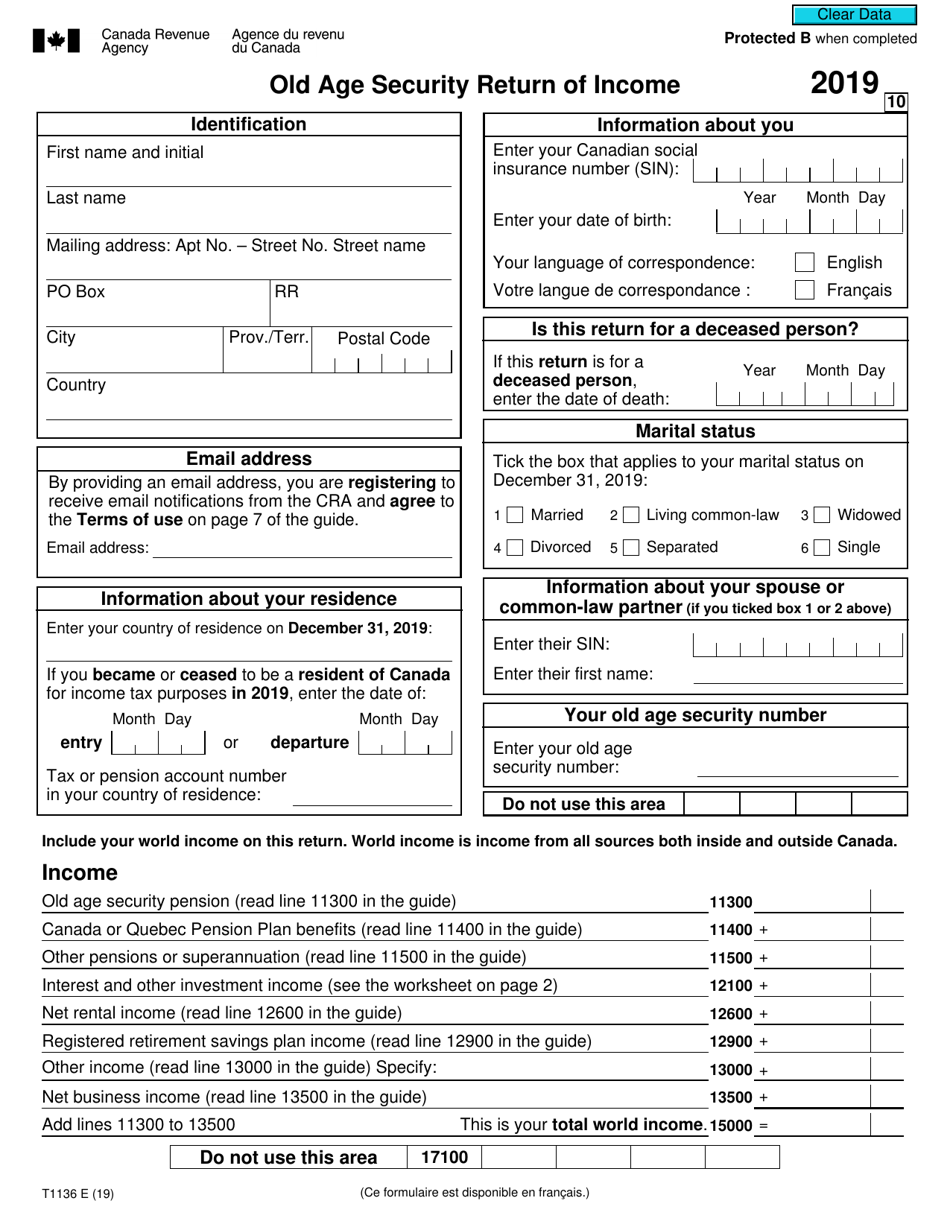

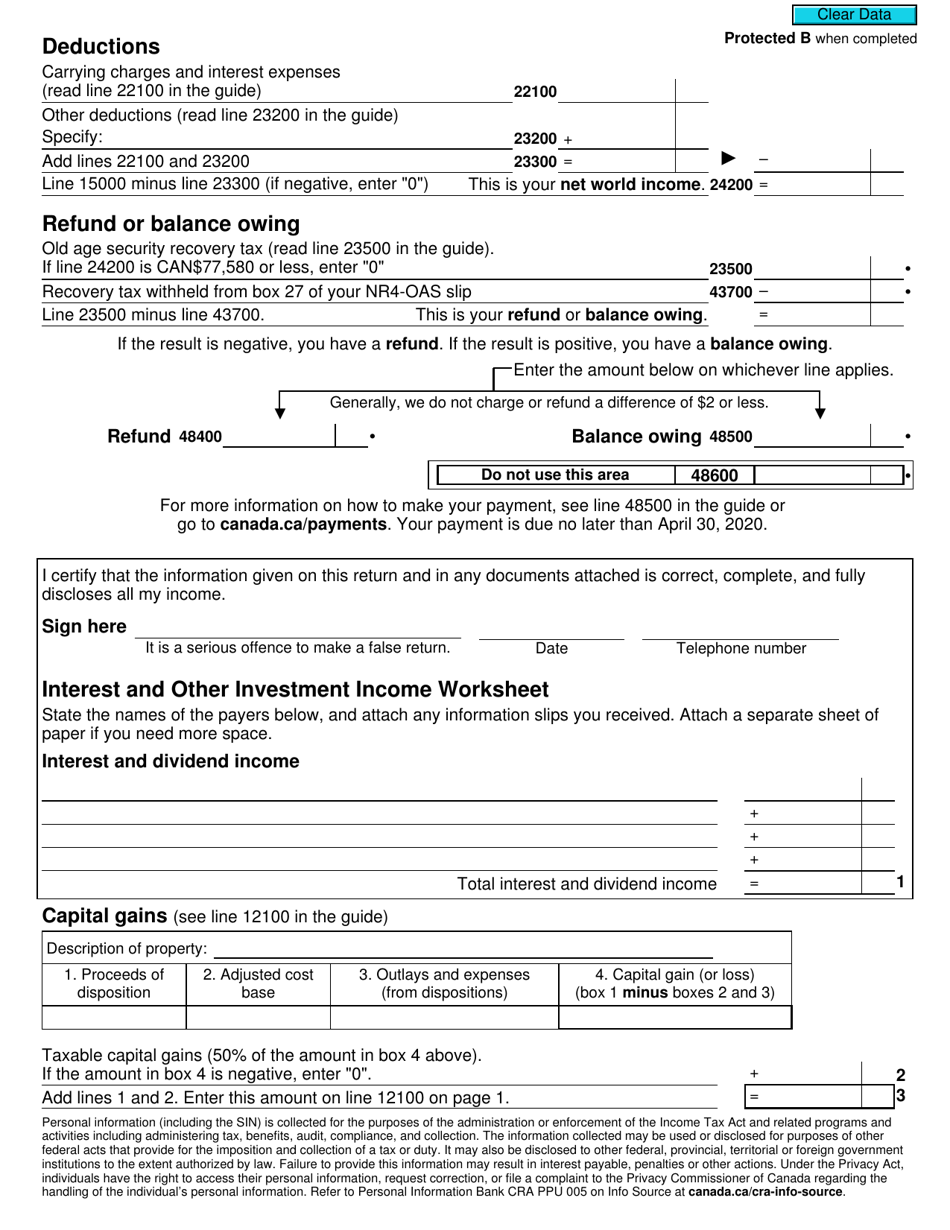

Form T1136 Old Age Security Return of Income - Canada

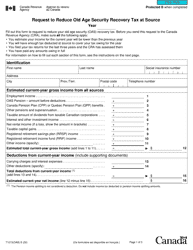

Form T1136, also known as the Old Age Security Return of Income, is used by Canadian residents to report their income in order to determine their eligibility for the Old Age Security (OAS) pension. The OAS is a monthly payment provided by the Canadian government to eligible individuals who are 65 years of age or older and is subject to income-based clawback.

The Form T1136 Old Age Security Return of Income in Canada is filed by individuals who receive Old Age Security (OAS) benefits and have a specific cumulative income threshold.

FAQ

Q: What is Form T1136?

A: Form T1136 is the Old Age Security Return of Income form in Canada.

Q: Who needs to file Form T1136?

A: Canadian residents who receive Old Age Security benefits and have a net income above a certain threshold need to file Form T1136.

Q: What is the purpose of Form T1136?

A: Form T1136 is used to calculate and report the net income of individuals receiving Old Age Security benefits in Canada.

Q: When is Form T1136 due?

A: Form T1136 is due on or before April 30th of the following year.