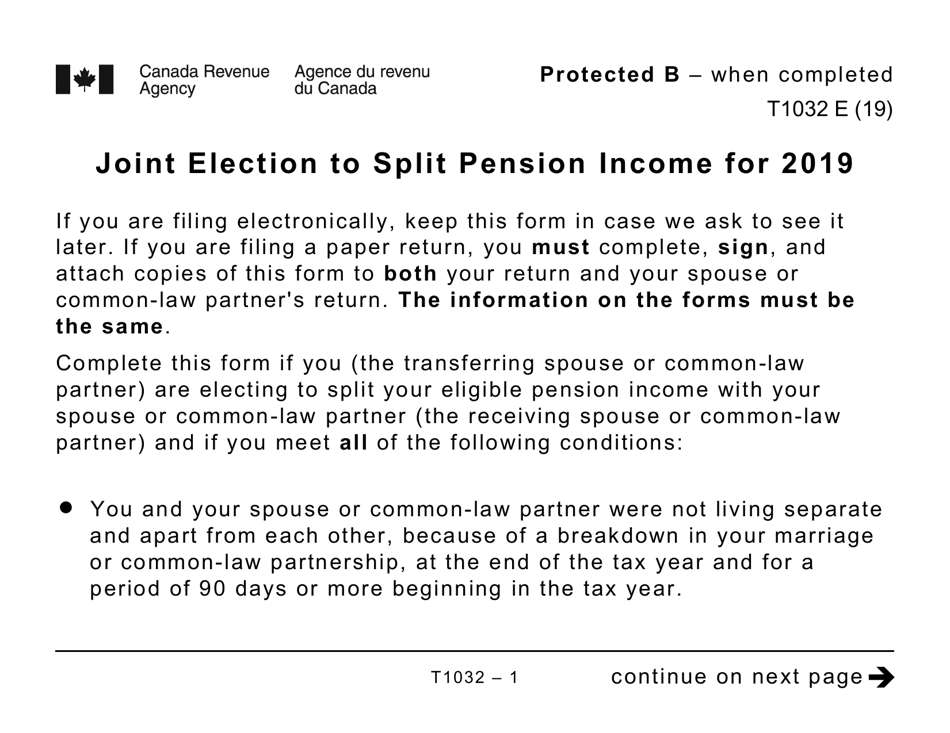

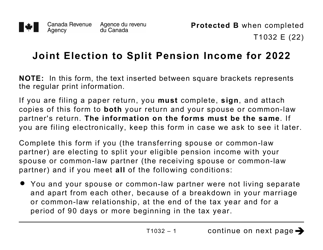

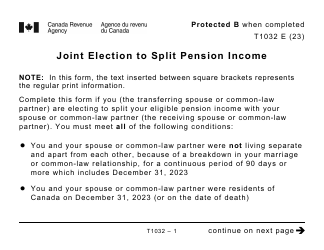

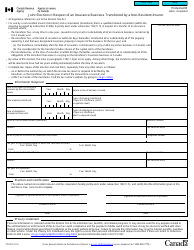

Form T1032 Joint Election to Split Pension Income - Large Print - Canada

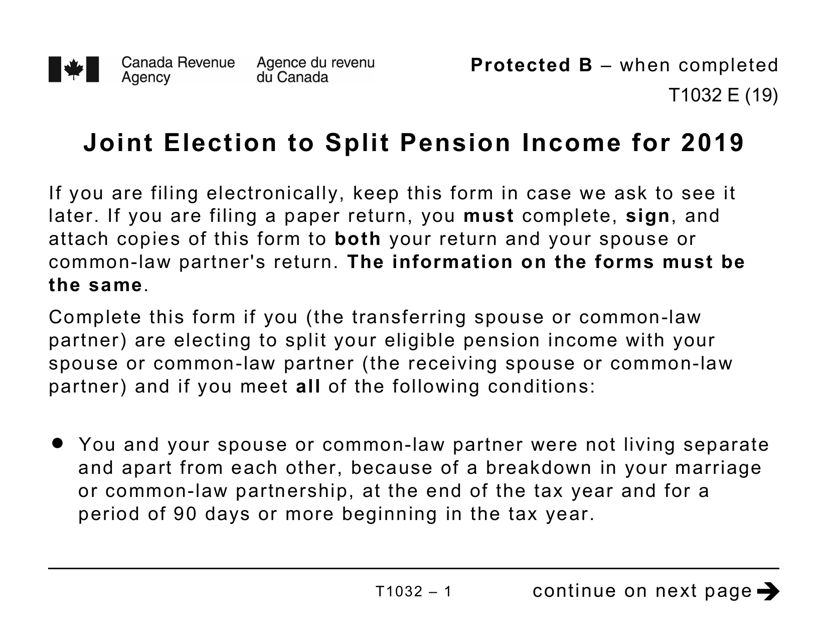

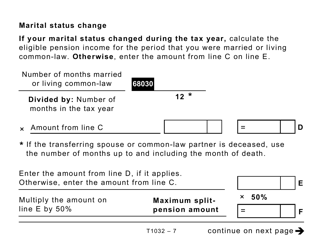

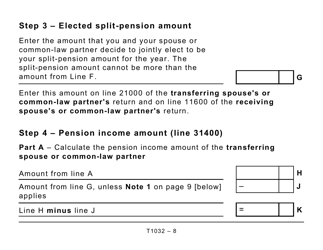

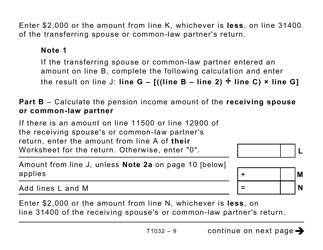

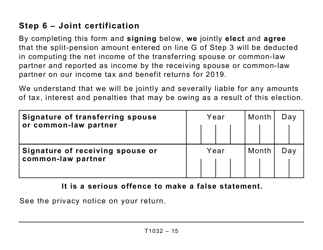

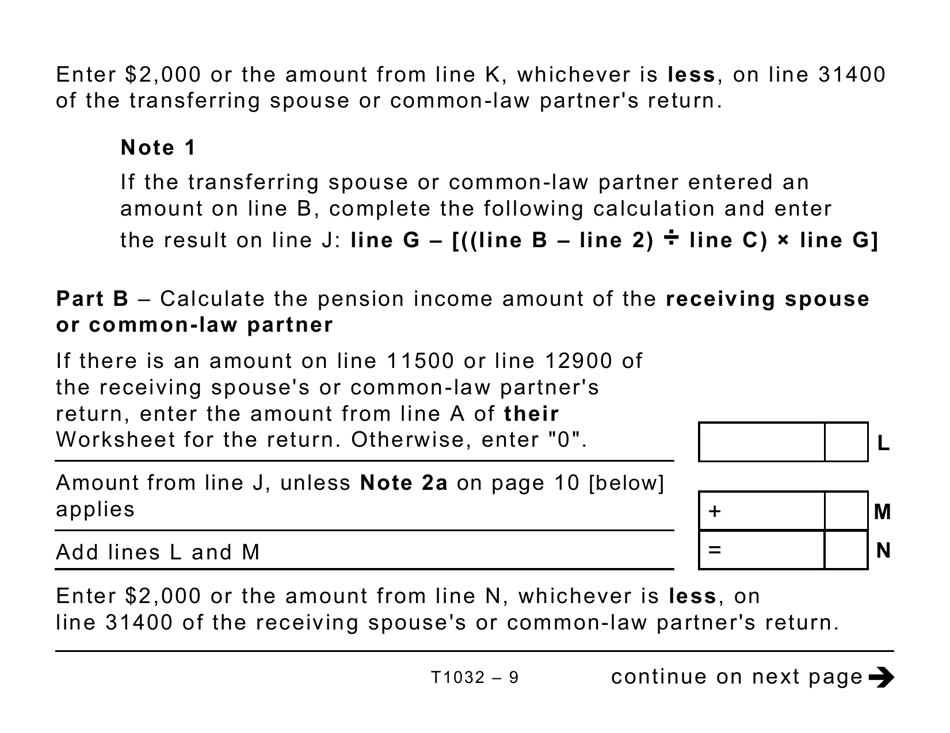

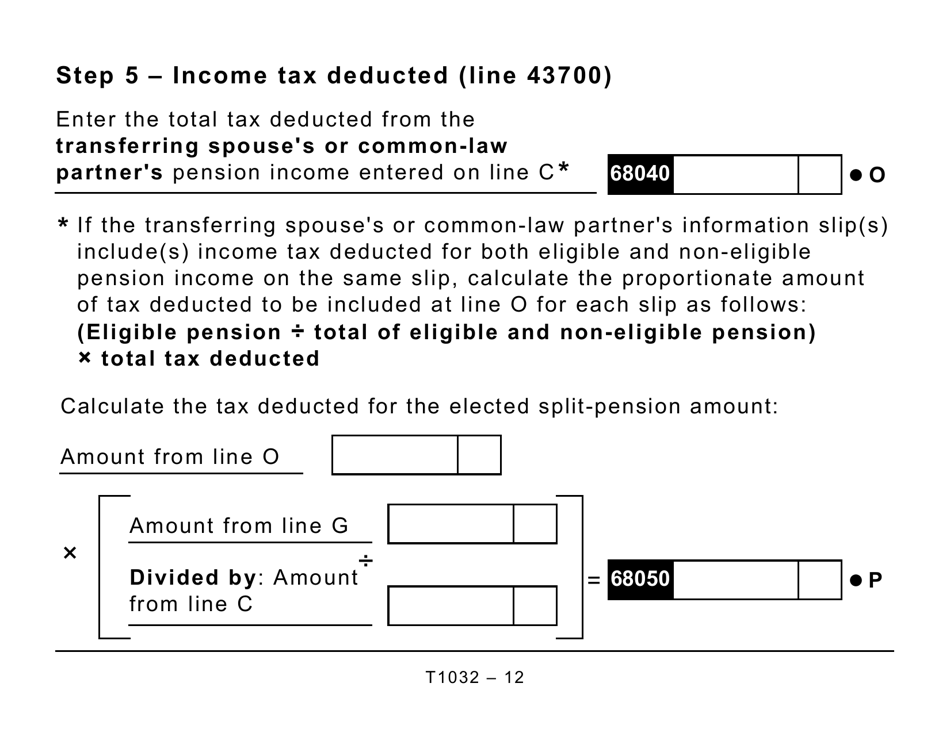

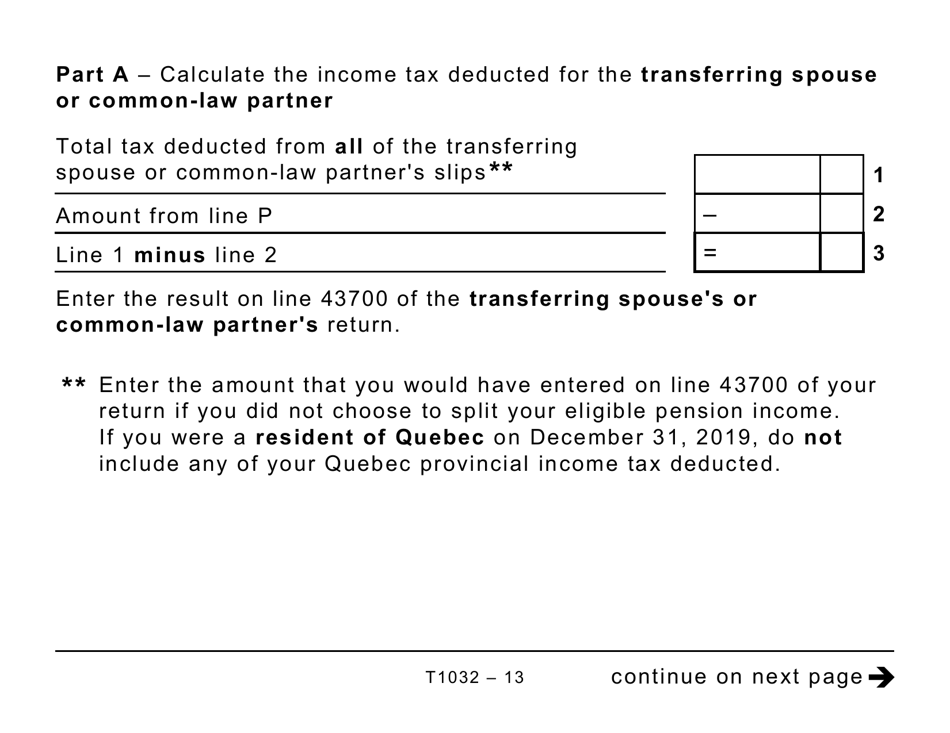

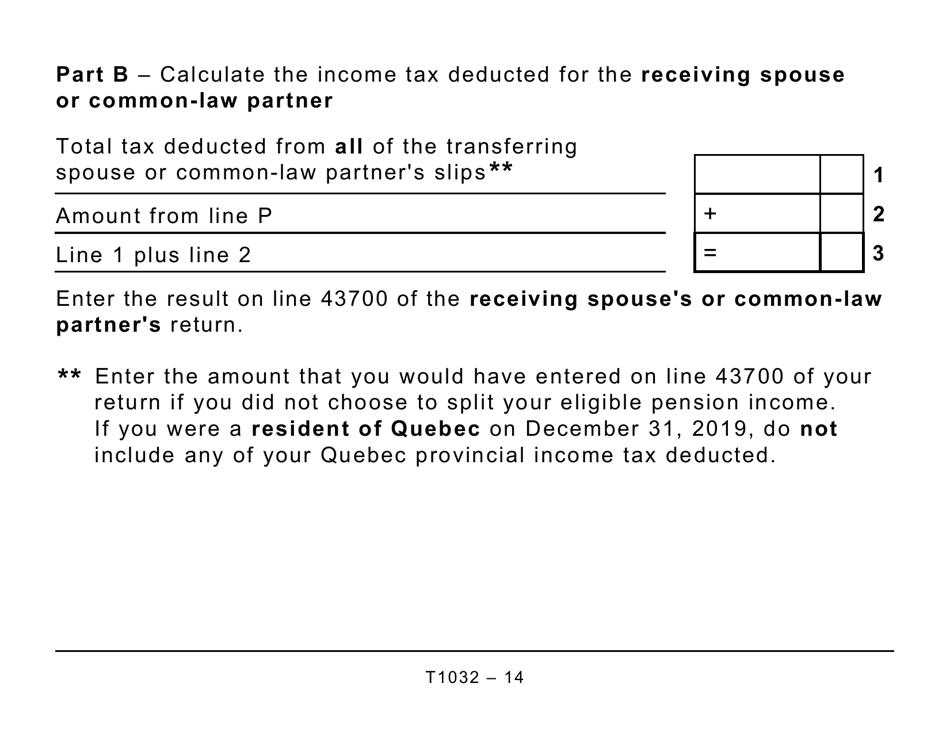

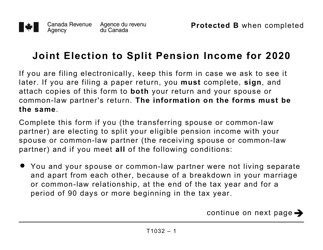

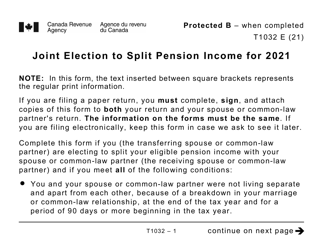

Form T1032 Joint Election to Split Pension Income - Large Print - Canada is used to authorize the splitting of eligible pension income between spouses or common-law partners in Canada for tax purposes. This form allows the pension recipient to allocate a portion of their eligible pension income to their spouse or common-law partner, potentially reducing their overall tax liabilities.

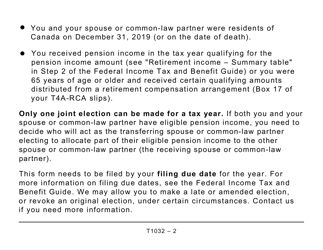

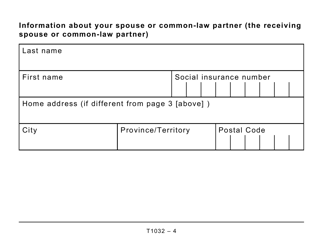

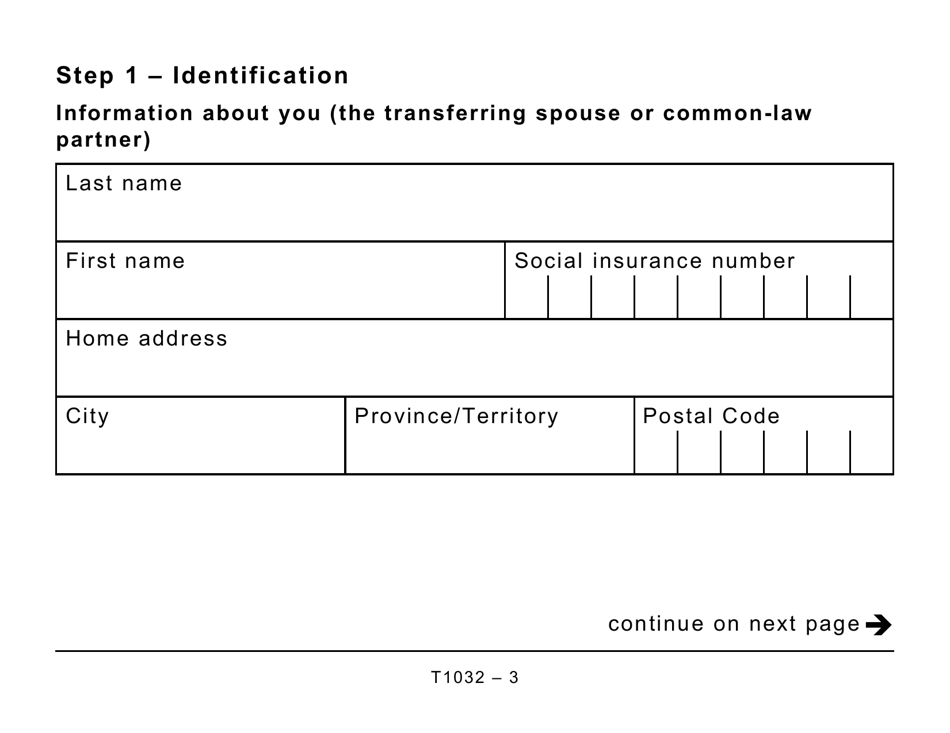

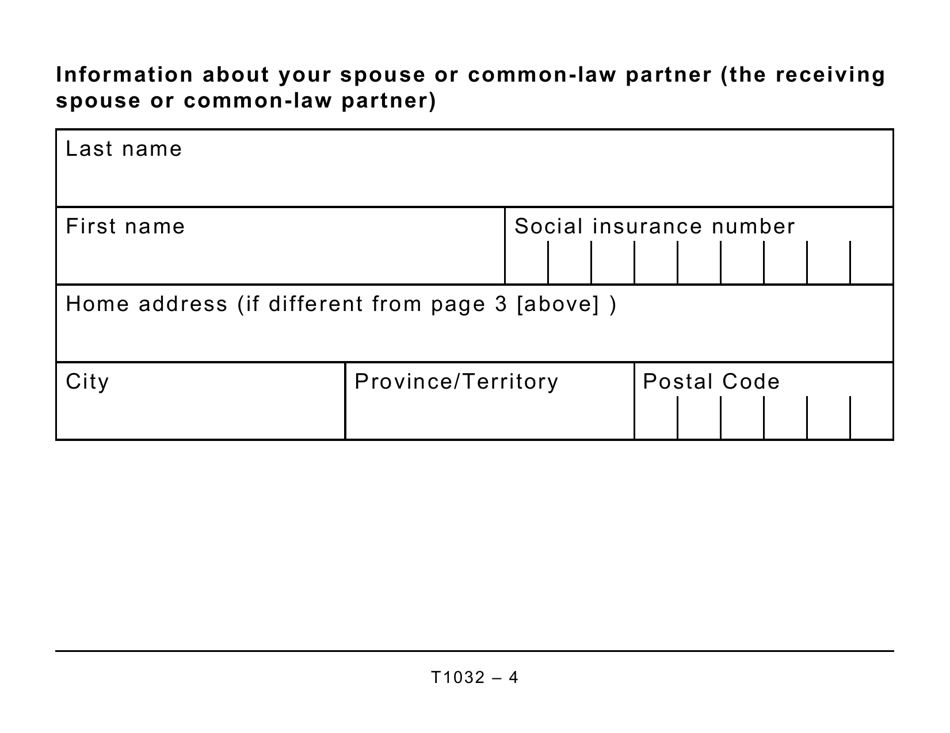

The Form T1032 Joint Election to Split Pension Income - Large Print in Canada is typically filed by both the pension recipient and their spouse or common-law partner.

FAQ

Q: What is Form T1032?

A: Form T1032 is a Joint Election to Split Pension Income form used in Canada.

Q: What is the purpose of Form T1032?

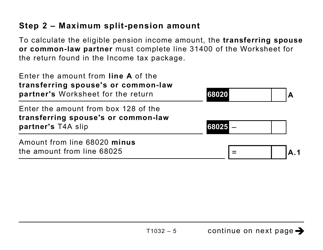

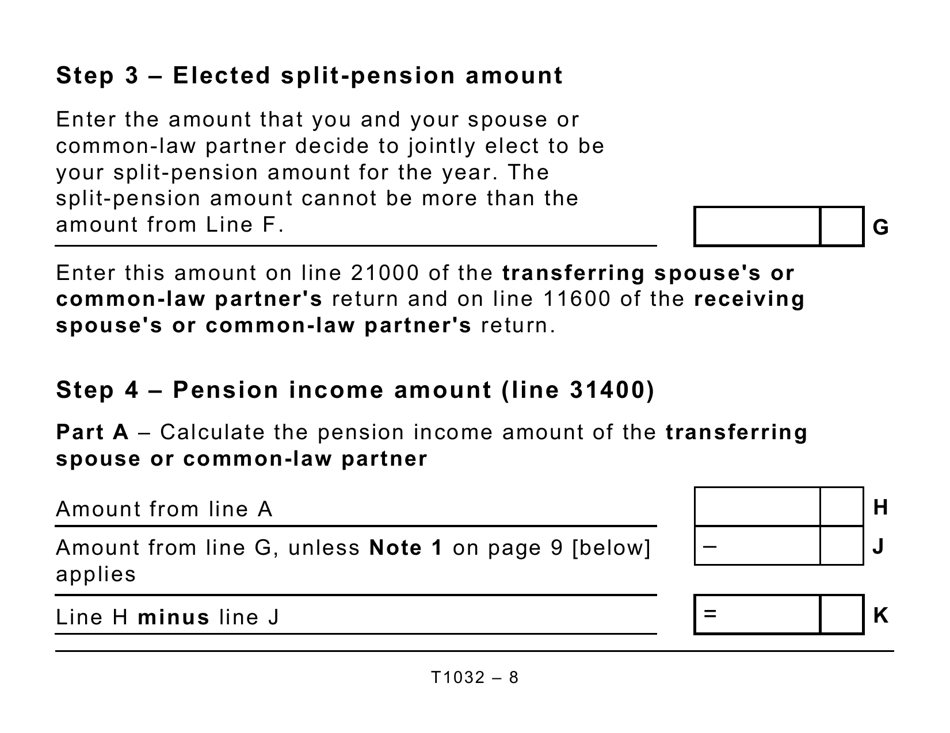

A: The purpose of Form T1032 is to allow individuals to elect to split pension income with their spouse or common-law partner for tax purposes.

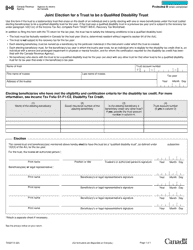

Q: Who can use Form T1032?

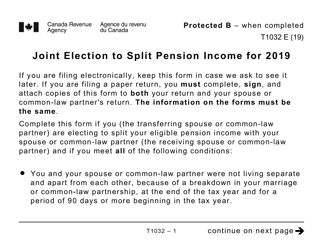

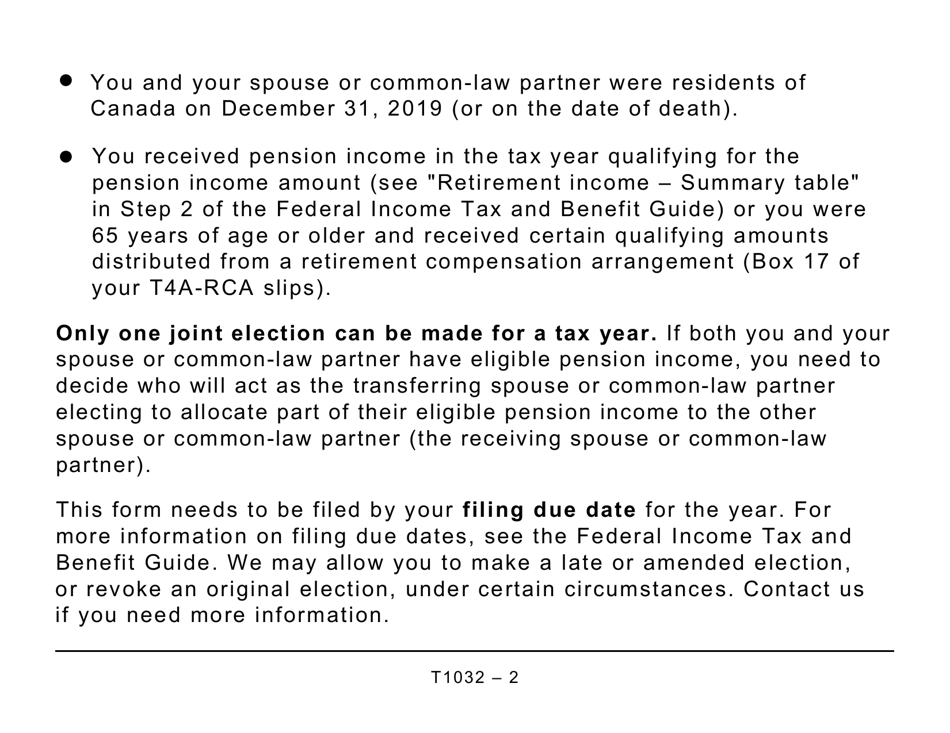

A: Form T1032 can be used by individuals who are receiving eligible pension income and want to split it with their spouse or common-law partner.

Q: What is eligible pension income?

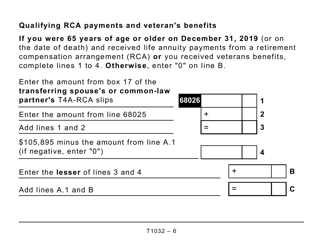

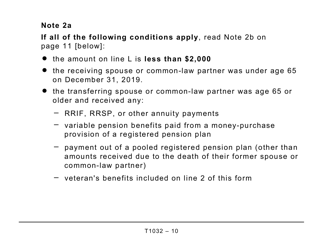

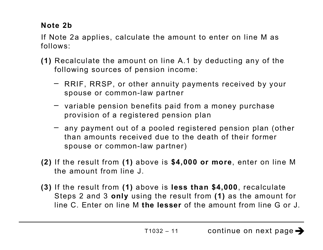

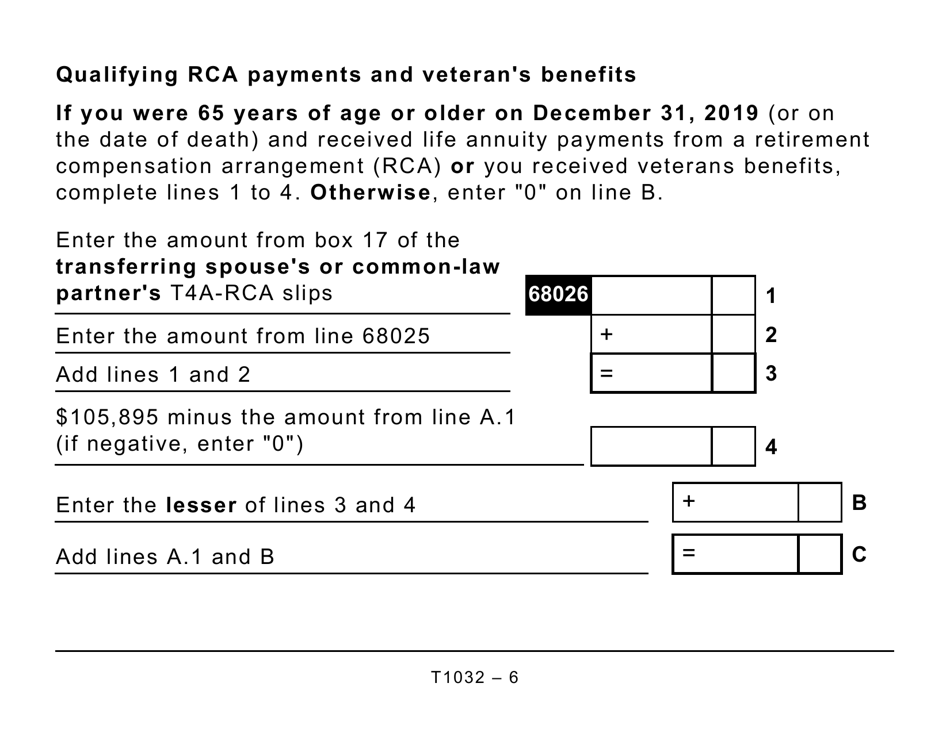

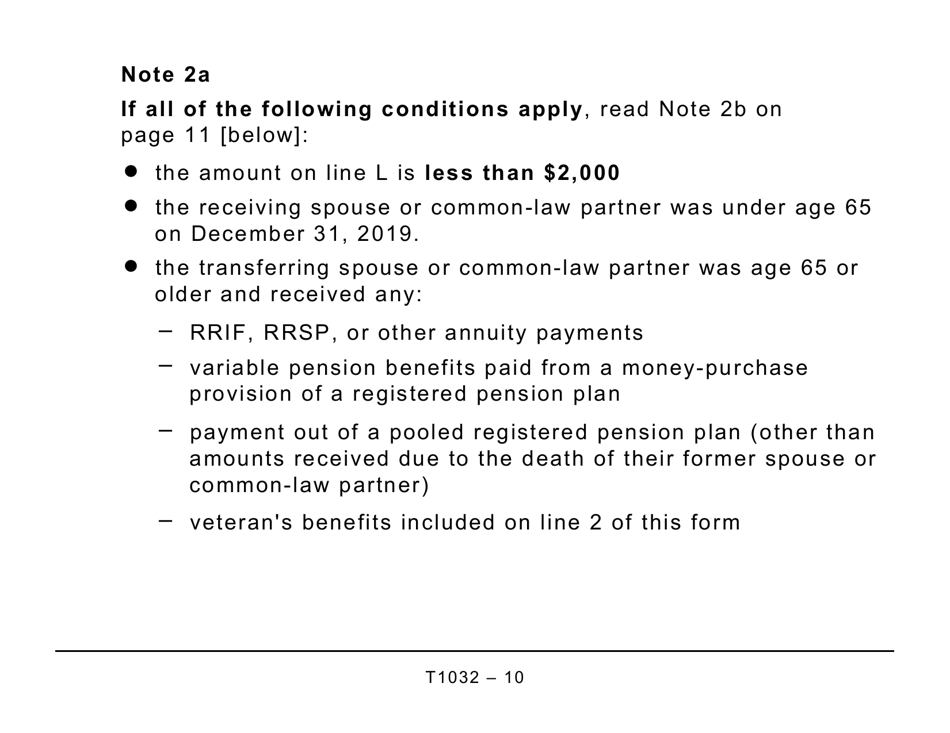

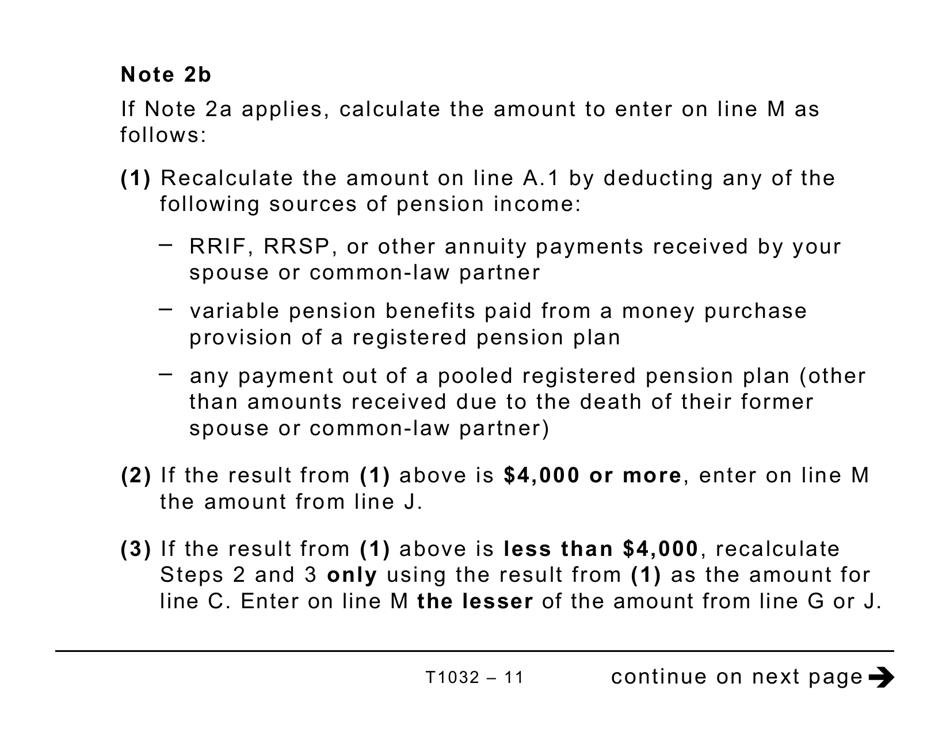

A: Eligible pension income includes annuity payments from registered pension plans, registered retirement income funds (RRIFs), and certain other types of pension income.

Q: Can I use Form T1032 if I am not married?

A: Yes, you can use Form T1032 if you have a spouse or common-law partner, regardless of whether you are legally married or not.

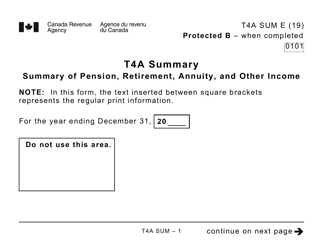

Q: When should I file Form T1032?

A: You should file Form T1032 with your income tax return for the year in which you want to split your pension income.

Q: What are the benefits of splitting pension income?

A: Splitting pension income can help reduce the overall tax burden for couples, especially if one spouse has a significantly higher income than the other.

Q: Are there any limitations or restrictions on pension income splitting?

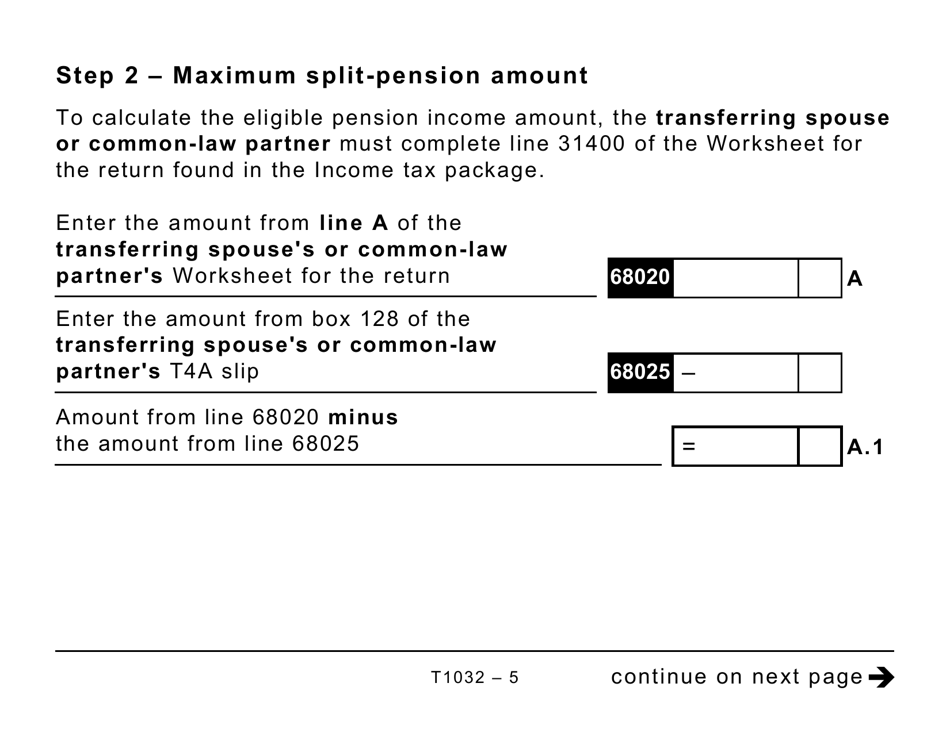

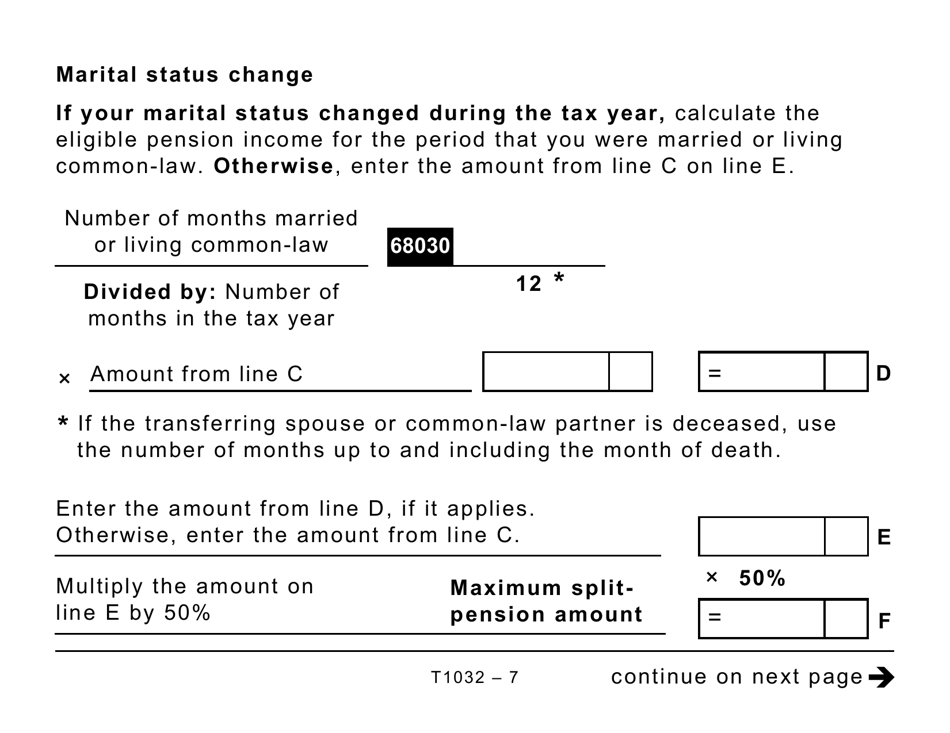

A: Yes, there are certain limitations and restrictions on pension income splitting, including maximum amounts that can be split and specific rules for different types of pension income.

Q: Do I need to include any supporting documents with Form T1032?

A: In some cases, you may need to include supporting documents, such as copies of pension income statements, with Form T1032. It is recommended to consult the CRA guidelines or seek professional advice for specific requirements.