This version of the form is not currently in use and is provided for reference only. Download this version of

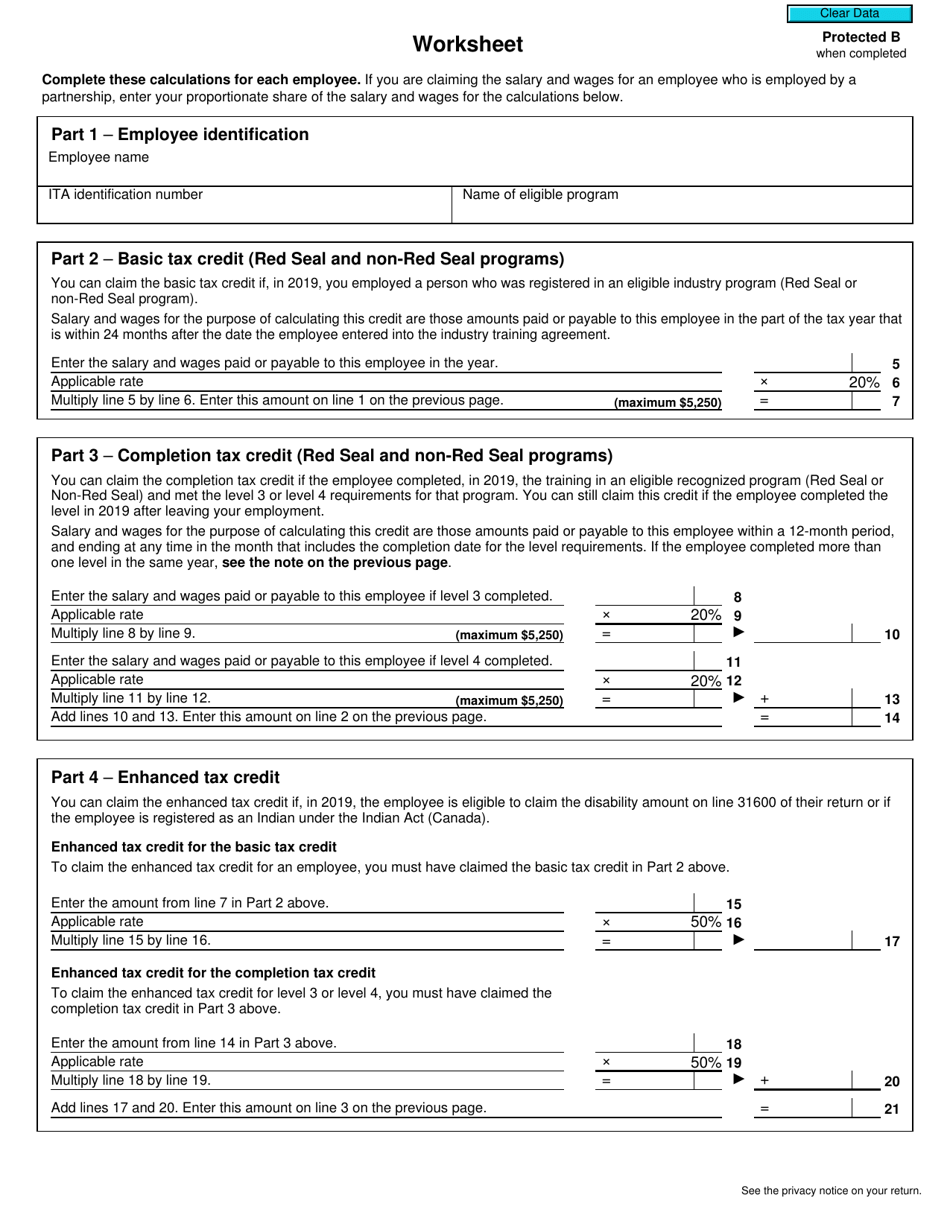

Form T1014-2

for the current year.

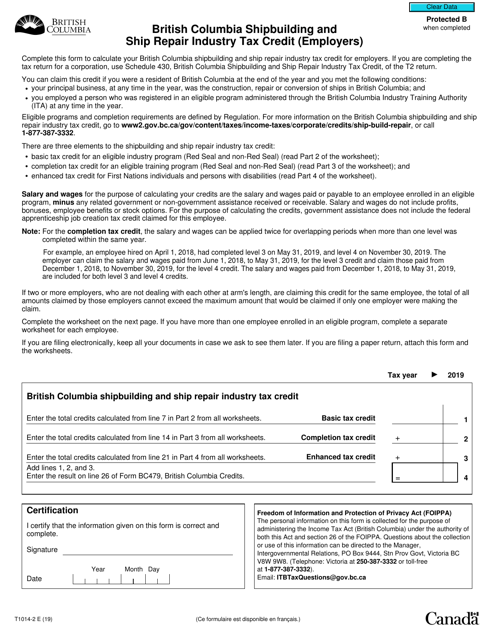

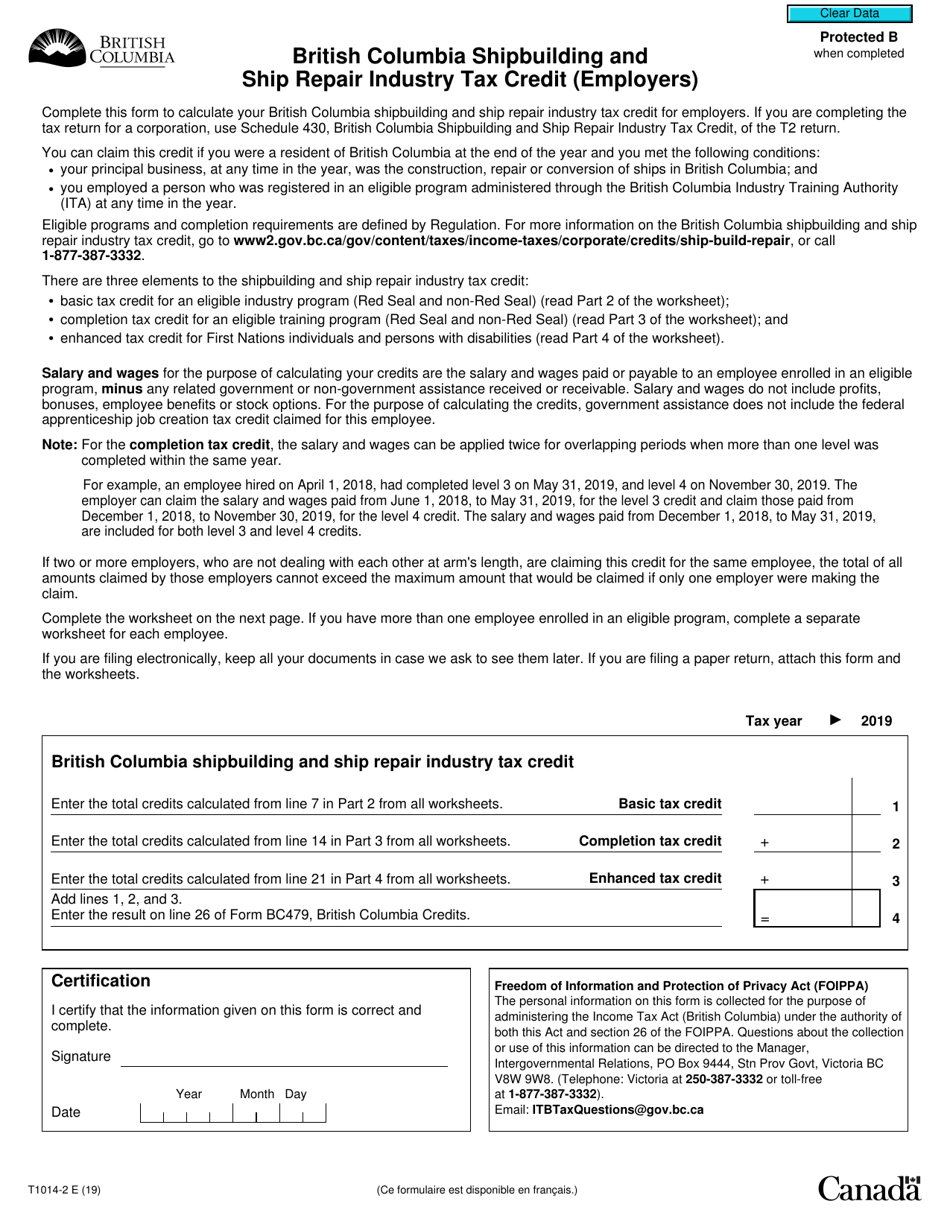

Form T1014-2 British Columbia Shipbuilding and Ship Repair Industry Tax Credit (Employers) - Canada

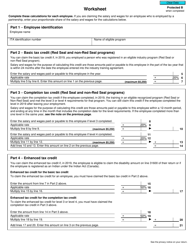

The Form T1014-2 is used by employers in the British Columbia Shipbuilding and Ship Repair industry to claim the Shipbuilding and Ship Repair Industry Tax Credit in Canada. This tax credit is intended to support and encourage businesses in this particular industry.

The employer in the shipbuilding and ship repair industry in British Columbia, Canada, files the Form T1014-2.

FAQ

Q: What is Form T1014-2?

A: Form T1014-2 is a tax form for the British Columbia Shipbuilding and Ship Repair Industry Tax Credit (Employers) in Canada.

Q: What does the British Columbia Shipbuilding and Ship Repair Industry Tax Credit (Employers) provide?

A: The tax credit provides benefits to employers in the shipbuilding and ship repair industry in British Columbia, Canada.

Q: Who is eligible for the tax credit?

A: Employers in the shipbuilding and ship repair industry in British Columbia may be eligible for the tax credit.

Q: How can employers claim the tax credit?

A: Employers can claim the tax credit by completing and submitting Form T1014-2 with their tax return.