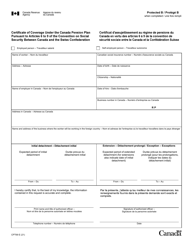

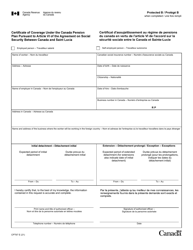

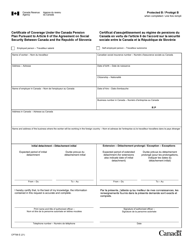

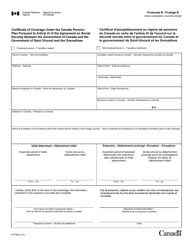

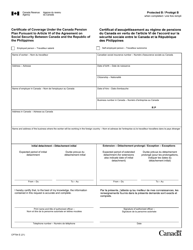

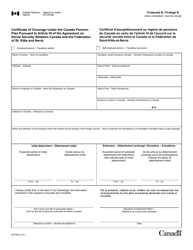

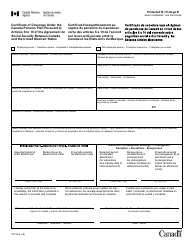

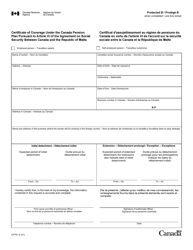

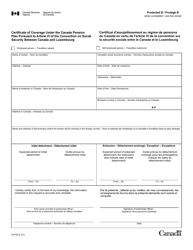

This version of the form is not currently in use and is provided for reference only. Download this version of

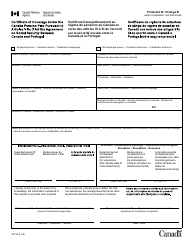

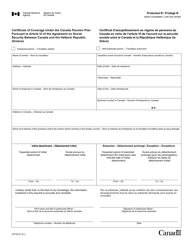

Form RC269

for the current year.

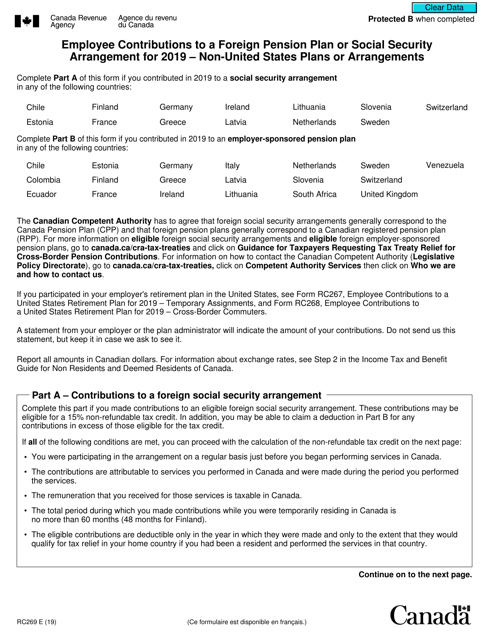

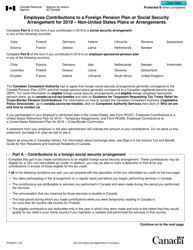

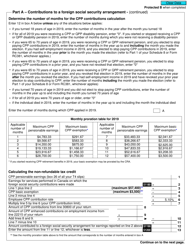

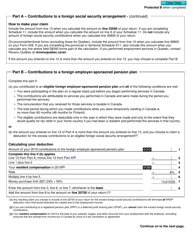

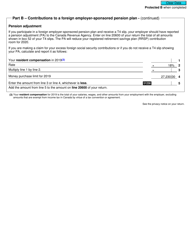

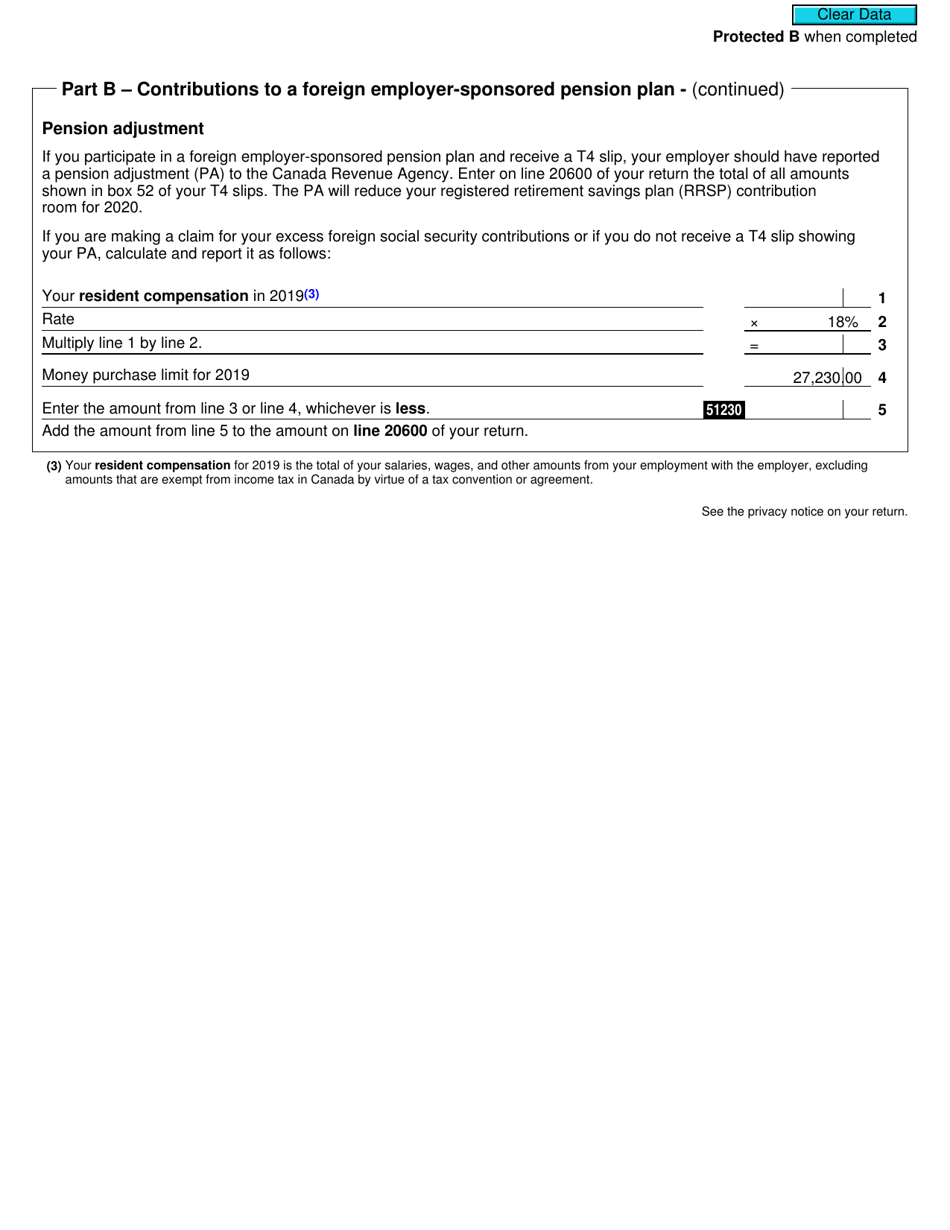

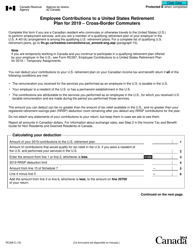

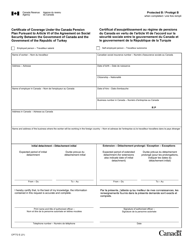

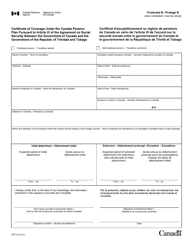

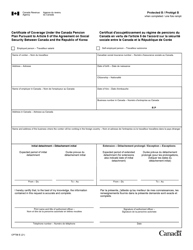

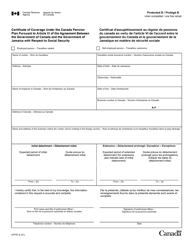

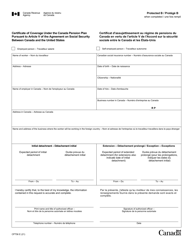

Form RC269 Employee Contributions to a Foreign Pension Plan or Social Security Arrangement - Non-united States Plans or Arrangements - Canada

The Form RC269 is used by individuals in the United States to report their contributions to a foreign pension plan or social security arrangement in Canada. It helps ensure that individuals are properly reporting and accounting for any contributions made to non-United States plans or arrangements in Canada.

Employers or employees who have made contributions to a foreign pension plan or social security arrangement in Canada file the Form RC269.

FAQ

Q: What is Form RC269?

A: Form RC269 is a tax form used by individuals in the United States who contribute to a foreign pension plan or social security arrangement in Canada.

Q: Who needs to file Form RC269?

A: Individuals in the United States who contribute to a foreign pension plan or social security arrangement in Canada need to file Form RC269.

Q: What is the purpose of Form RC269?

A: The purpose of Form RC269 is to report contributions made to a foreign pension plan or social security arrangement in Canada.

Q: When is Form RC269 due?

A: Form RC269 is due on or before the deadline for filing your individual income tax return in the United States.

Q: Can the foreign tax paid on the contributions be claimed as a foreign tax credit?

A: Yes, the foreign tax paid on the contributions to a foreign pension plan or social security arrangement in Canada can be claimed as a foreign tax credit.