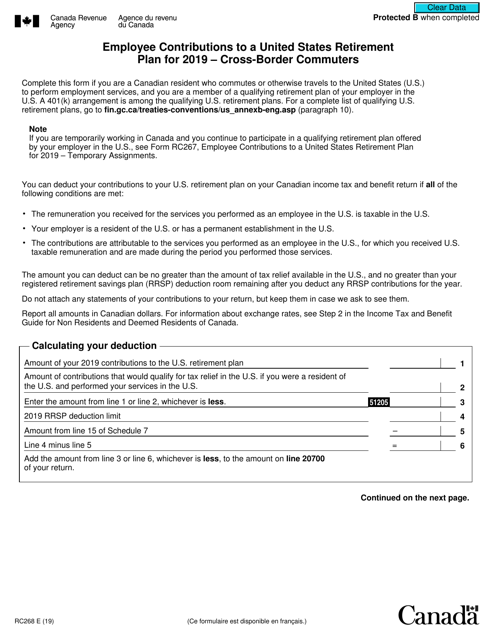

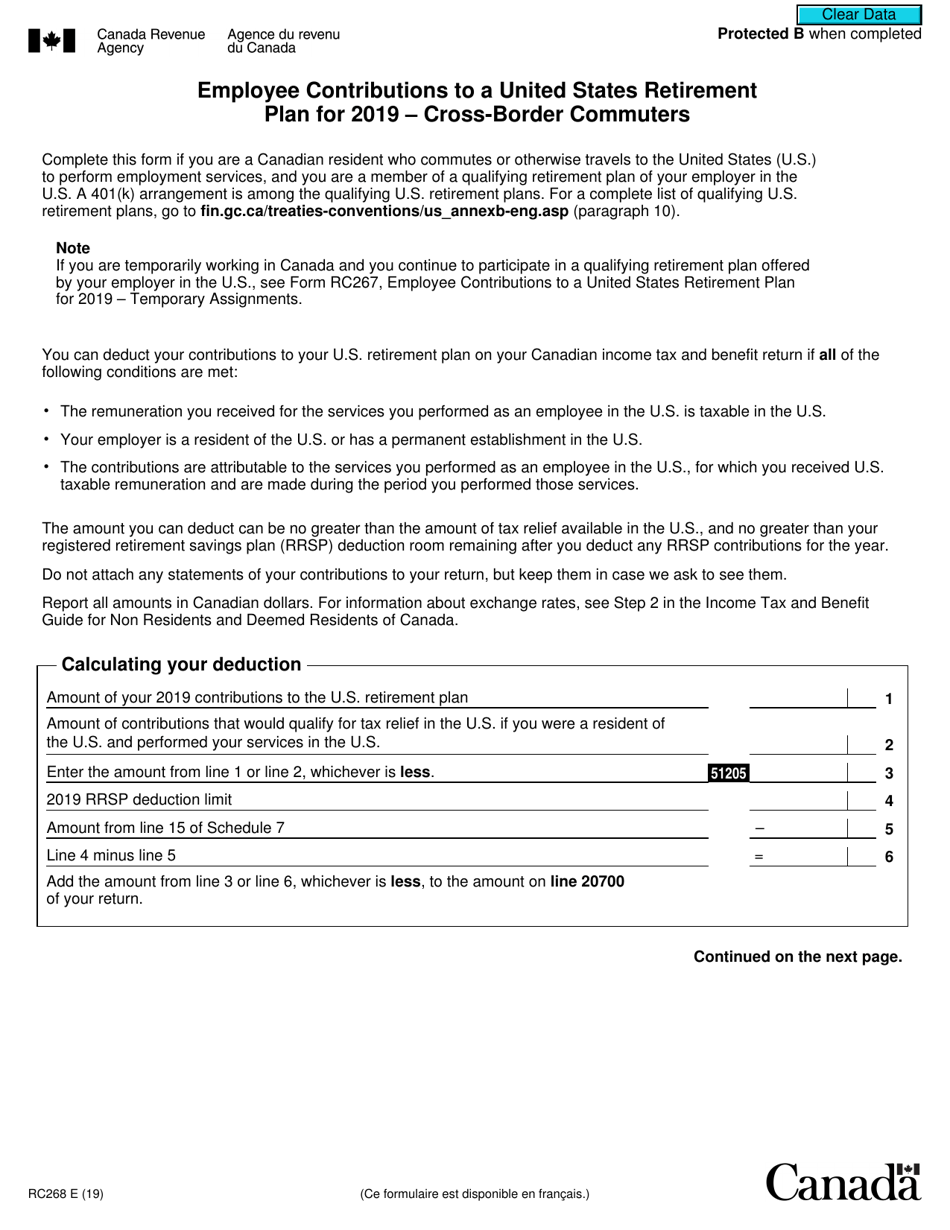

Form RC268 Employee Contributions to a United States Retirement Plan - Cross-border Commuters - Canada

Form RC268 Employee Contributions to a United States Retirement Plan - Cross-border Commuters - Canada is used by Canadian residents who commute to work in the United States. This form is used to report their contributions made to a United States retirement plan.

FAQ

Q: What is Form RC268?

A: Form RC268 is a form used by Canadian residents who work in the United States and make contributions to a US retirement plan.

Q: Who is required to fill out Form RC268?

A: Canadian residents who are cross-border commuters and contribute to a retirement plan in the United States need to fill out Form RC268.

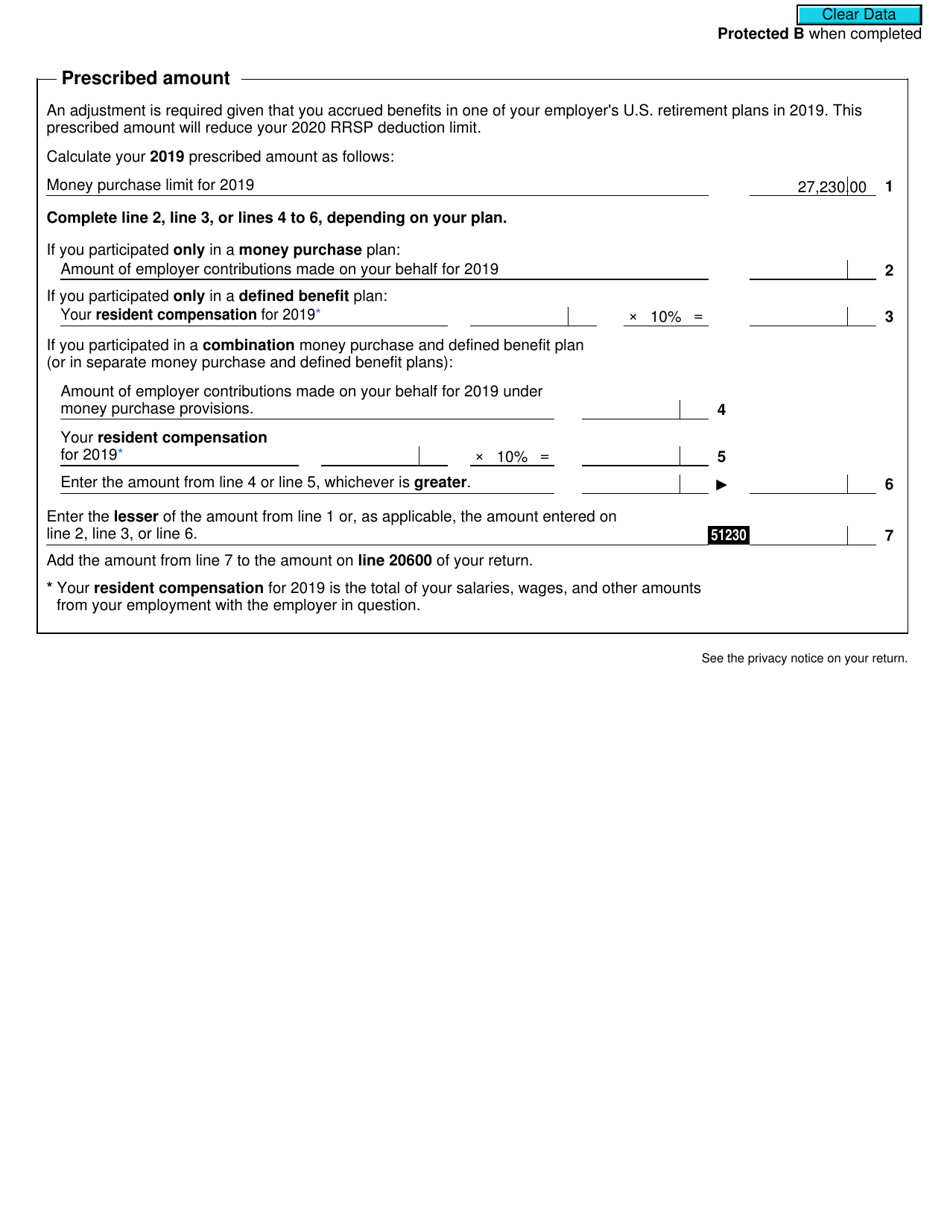

Q: What information is required on Form RC268?

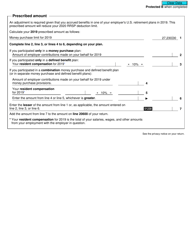

A: Form RC268 requires information about the individual's employment in the United States, details about the retirement plan contributions, and any US income tax paid.

Q: When should Form RC268 be filed?

A: Form RC268 should be filed annually by Canadian residents who make contributions to a US retirement plan before the deadline for filing income tax returns in Canada.

Q: What is the purpose of Form RC268?

A: The purpose of Form RC268 is to report the contributions made by Canadian residents to a retirement plan in the United States and determine the eligibility for applicable tax credits or deductions.

Q: Are US retirement plan contributions taxable in Canada?

A: The tax treatment of US retirement plan contributions for Canadian residents depends on the specific tax treaty between Canada and the United States. Consulting with a tax professional is recommended.

Q: Can Form RC268 be filed electronically?

A: As of now, Form RC268 cannot be filed electronically and must be filed by mail to the CRA.

Q: What are the consequences if Form RC268 is not filed?

A: Failure to file Form RC268 may result in penalties and could also lead to potential tax issues or complications in the future.

Q: Can I claim a tax credit or deduction for US retirement plan contributions?

A: The availability of tax credits or deductions for US retirement plan contributions depends on the specific provisions of the tax treaty between Canada and the United States. Consulting with a tax professional is recommended.