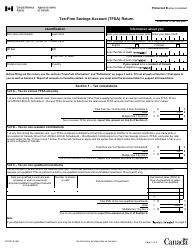

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243

for the current year.

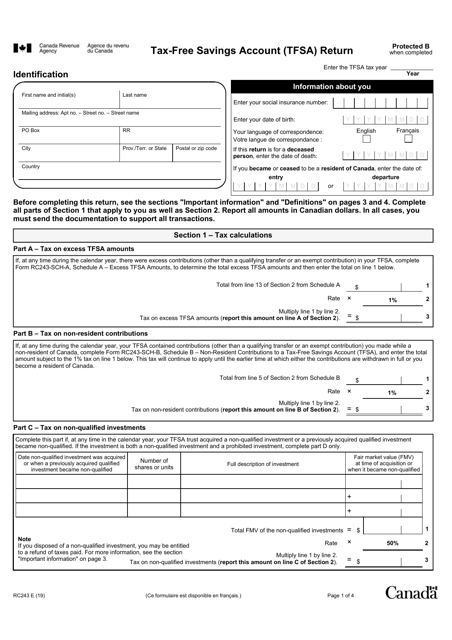

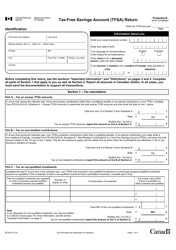

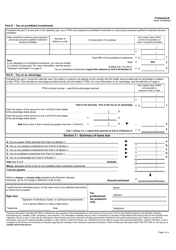

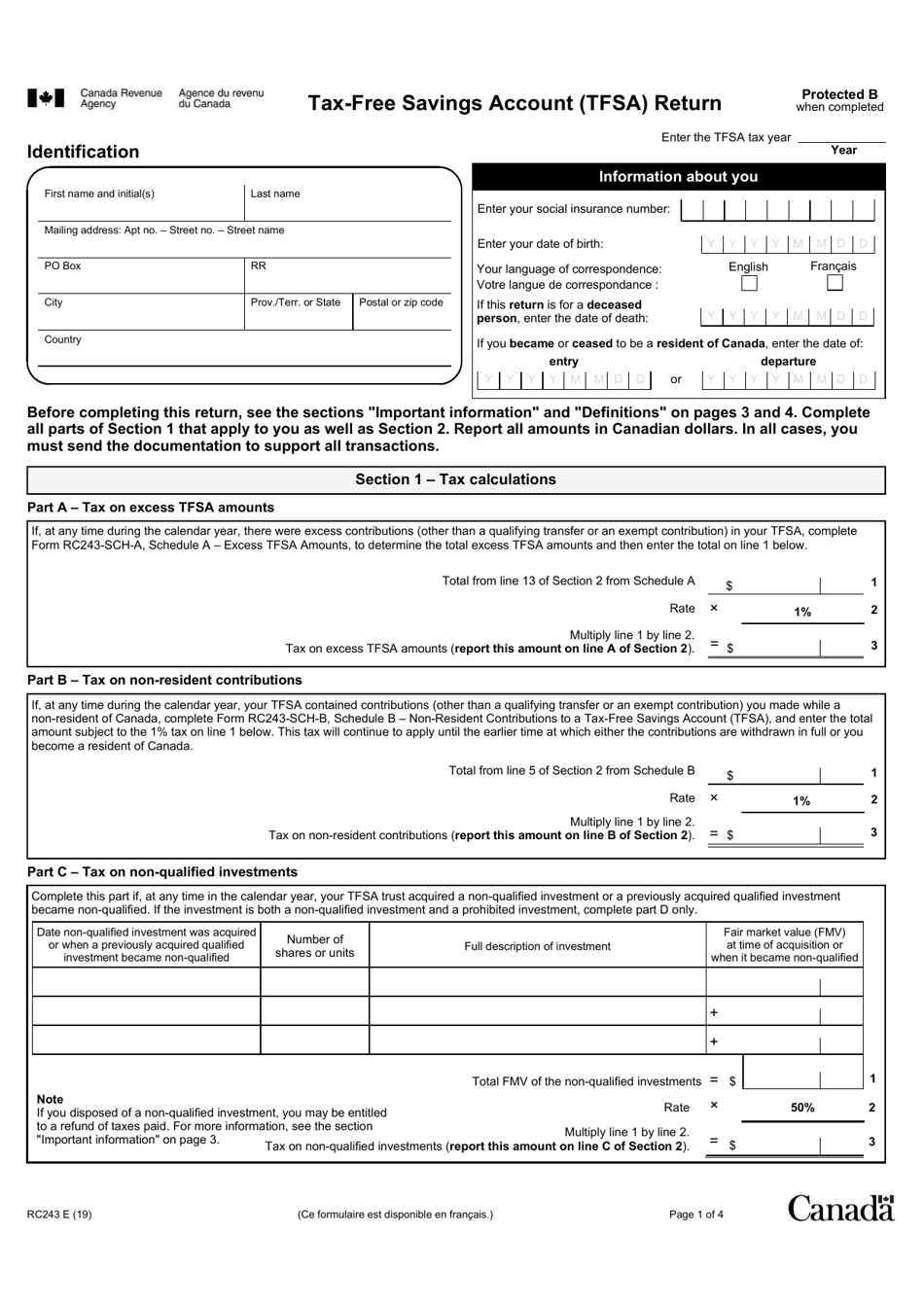

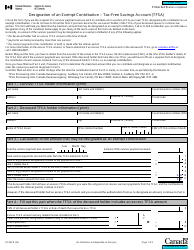

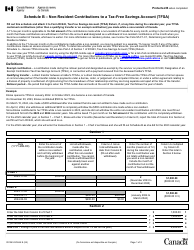

Form RC243 Tax-Free Savings Account (Tfsa) Return - Canada

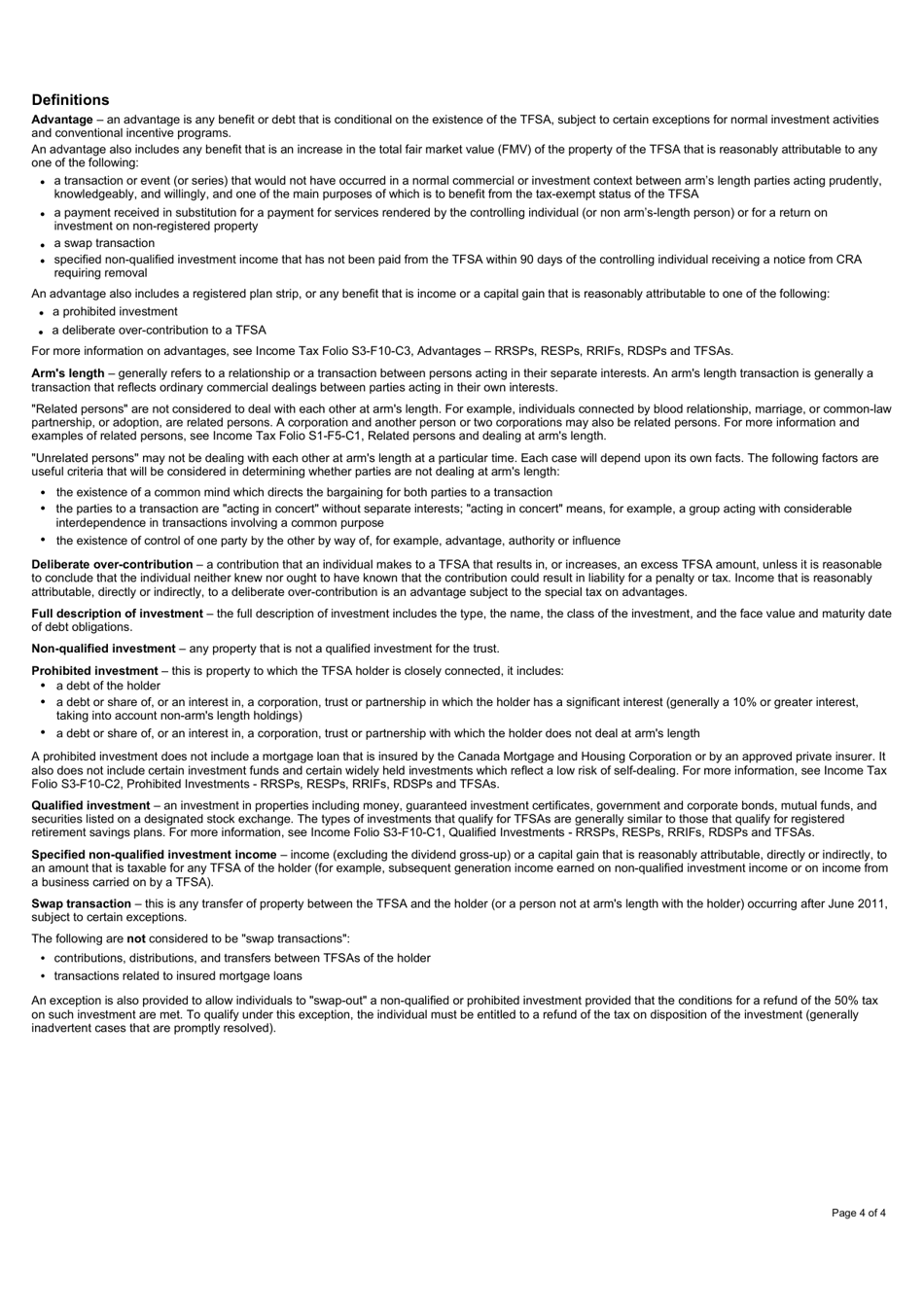

Form RC243 Tax-Free Savings Account (TFSA) Return is used by Canadian residents to report their contributions, withdrawals, and other transactions related to their TFSA on their annual tax return. It helps the Canada Revenue Agency (CRA) track and ensure compliance with the TFSA rules and regulations.

Individuals who have made contributions to a Tax-Free Savings Account (TFSA) in Canada need to file the Form RC243 TFSA Return.

FAQ

Q: What is Form RC243?

A: Form RC243 is the Tax-Free Savings Account (TFSA) Return in Canada.

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a type of savings account in Canada where you can contribute money and any income earned in the account is tax-free.

Q: Do I need to file Form RC243?

A: Yes, you need to file Form RC243 if you have a Tax-Free Savings Account (TFSA) in Canada.

Q: What information do I need to provide in Form RC243?

A: You need to provide information about your TFSA contributions, withdrawals, and the fair market value of your TFSA in Form RC243.

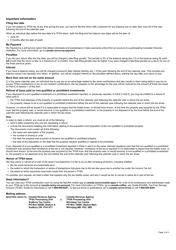

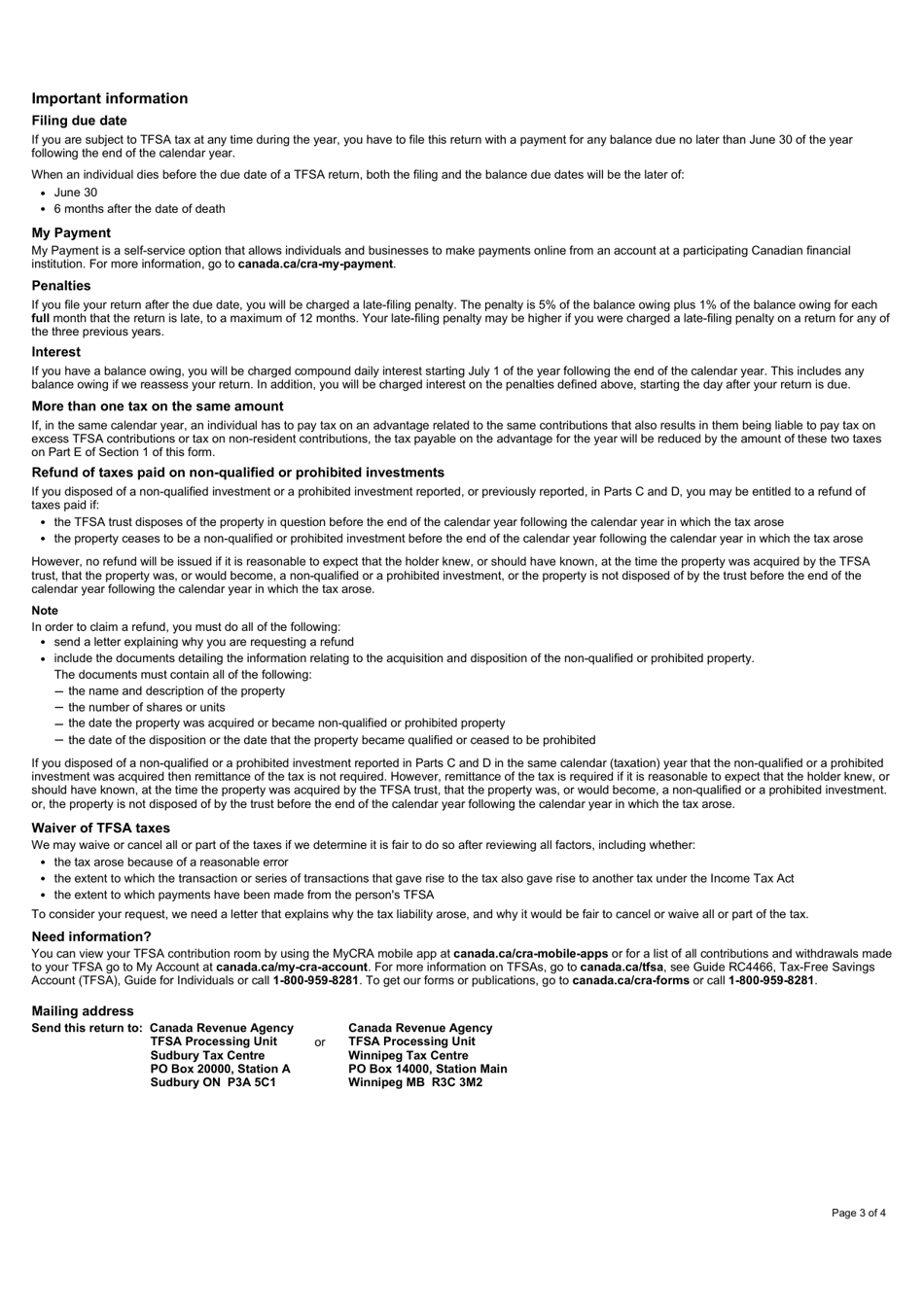

Q: What is the deadline to file Form RC243?

A: The deadline to file Form RC243 is usually June 30th of the following year.

Q: Can I file Form RC243 by mail?

A: Yes, you can file Form RC243 by mail by sending it to the address provided on the form or to your local tax centre.

Q: What happens if I don't file Form RC243?

A: If you don't file Form RC243 for your Tax-Free Savings Account (TFSA), you may face penalties or be subject to an audit by the CRA.