This version of the form is not currently in use and is provided for reference only. Download this version of

Form TL2

for the current year.

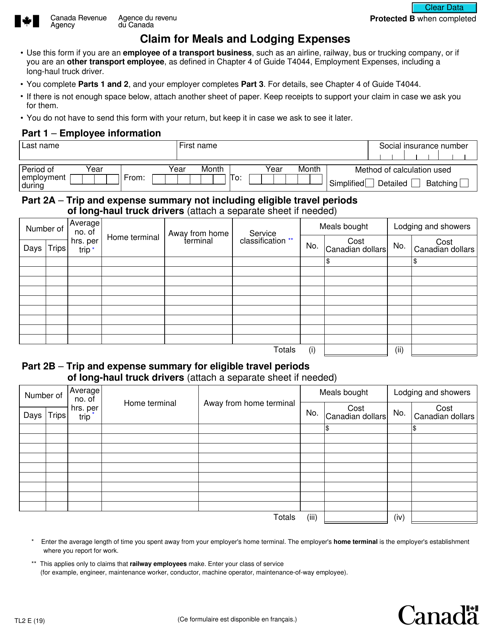

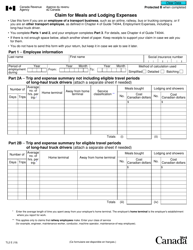

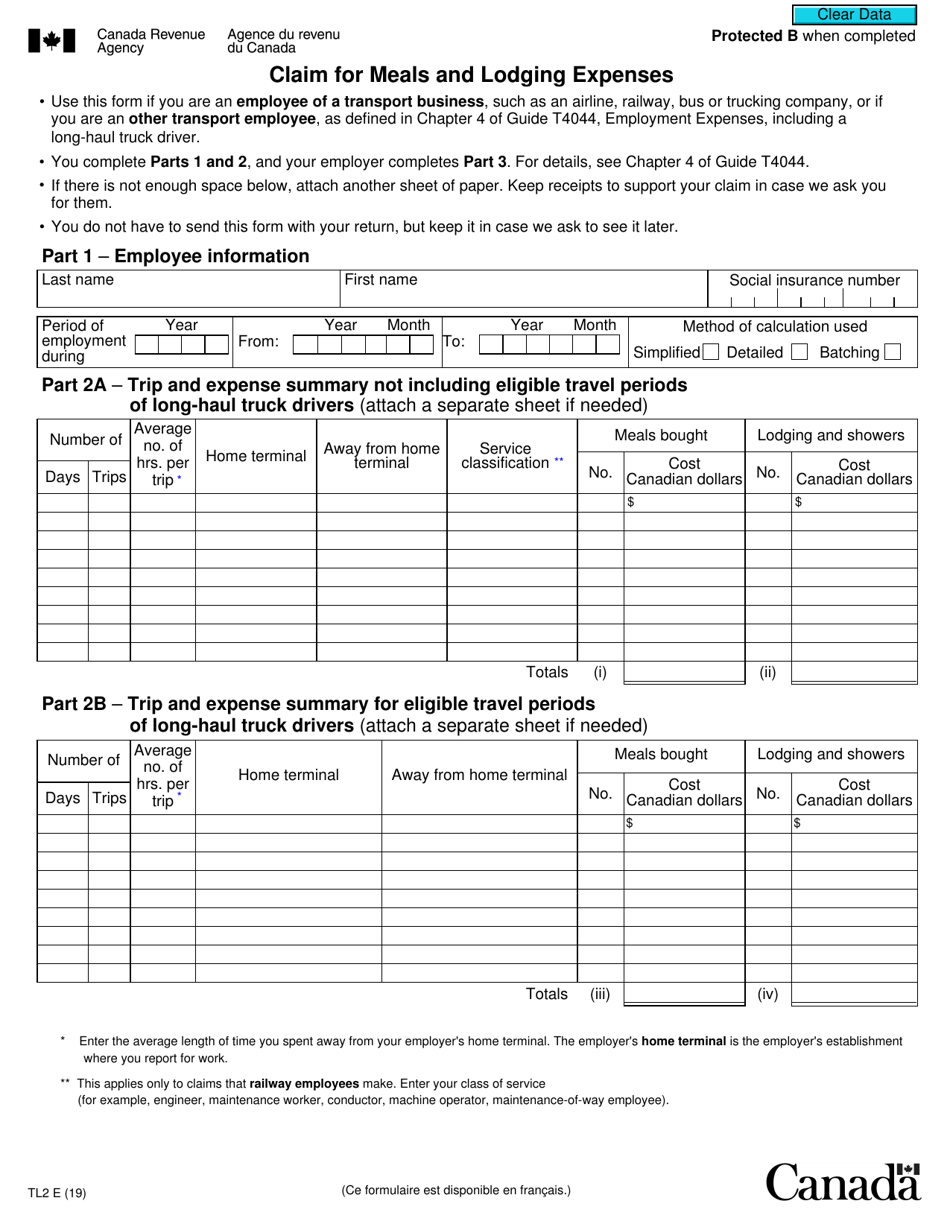

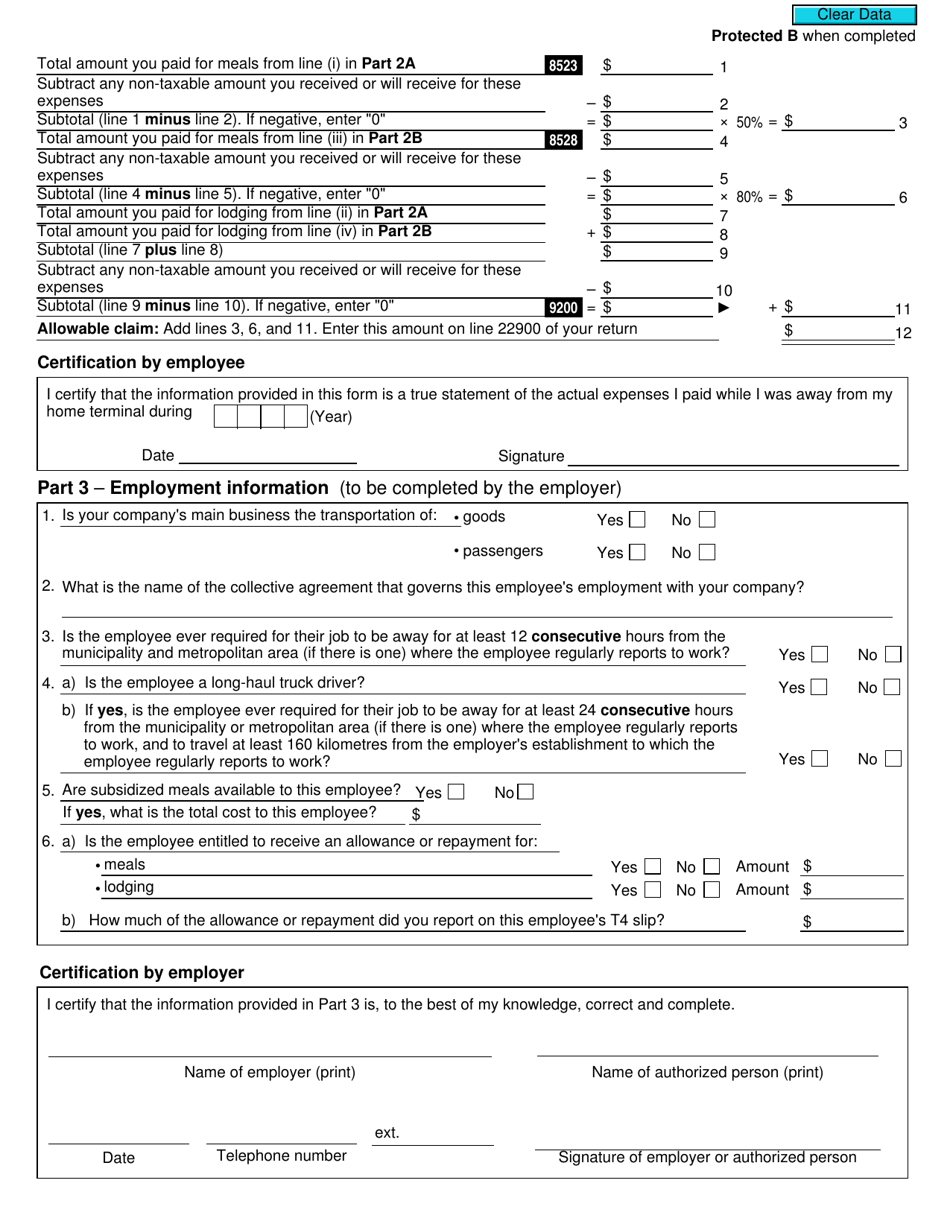

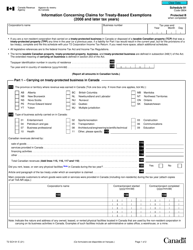

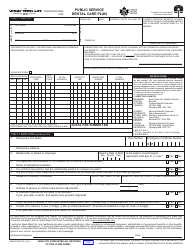

Form TL2 Claim for Meals and Lodging Expenses - Canada

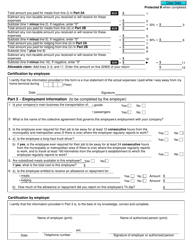

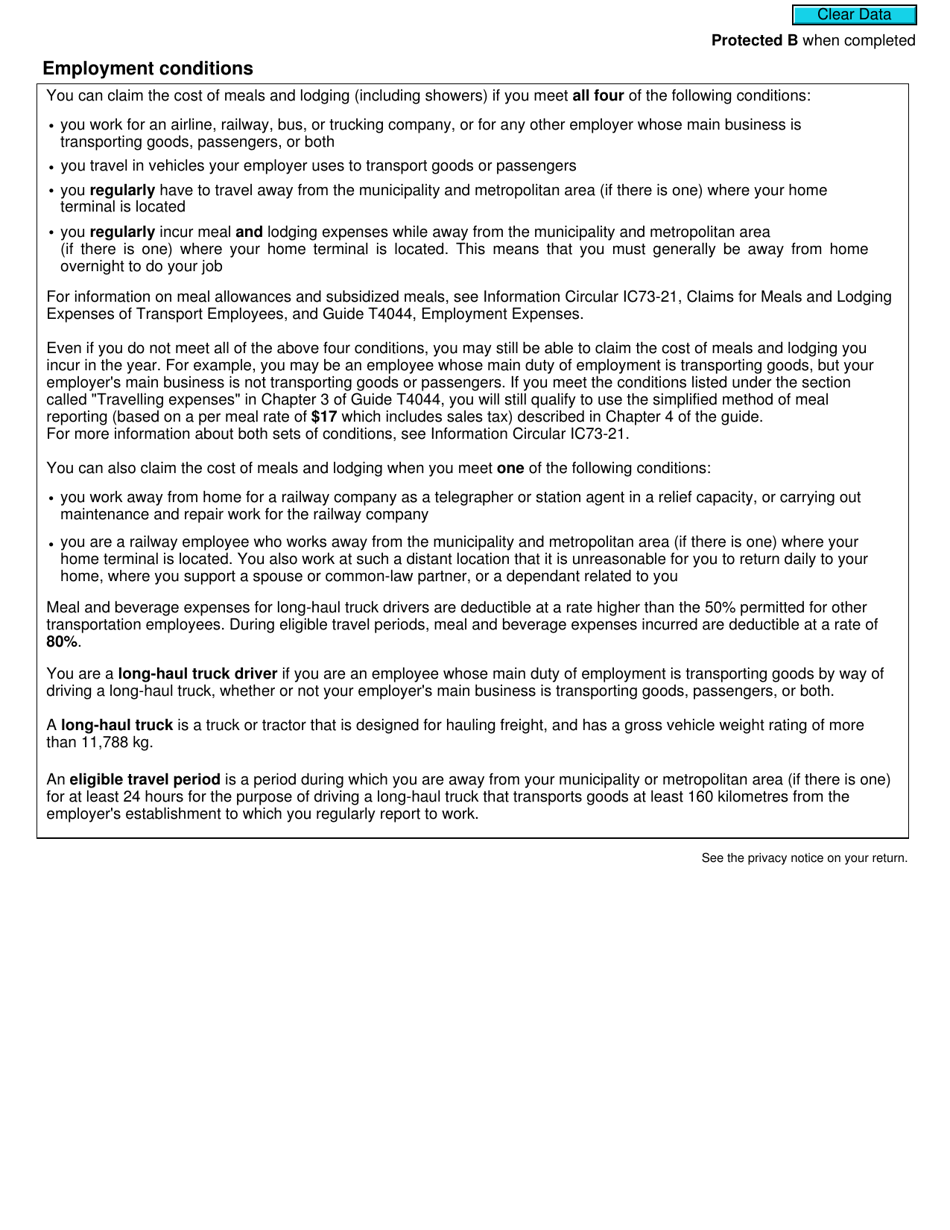

Form TL2 Claim for Meals and Lodging Expenses in Canada is used to claim deductions for meals and lodging expenses incurred by individuals while they are away from their home for work or business purposes.

In Canada, individuals who are employed by a Canadian business can file the Form TL2 Claim for Meals and Lodging Expenses.

FAQ

Q: What is a TL2 claim?

A: A TL2 claim is a claim for meals and lodging expenses incurred while travelling for work.

Q: Who can file a TL2 claim?

A: Any individual who is employed and travels for work purposes in Canada can file a TL2 claim.

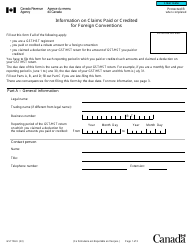

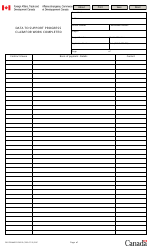

Q: What expenses can be claimed under TL2?

A: Expenses related to meals and lodging can be claimed under TL2.

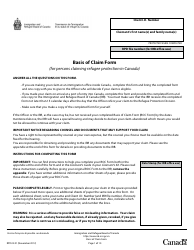

Q: How do I file a TL2 claim?

A: You can file a TL2 claim by completing the necessary forms provided by the Canada Revenue Agency (CRA).

Q: What supporting documents are required for a TL2 claim?

A: You will need to provide receipts and other supporting documents for your meals and lodging expenses.

Q: Is there a limit on the amount I can claim for meals and lodging?

A: Yes, there are limits on the amount you can claim for meals and lodging. The CRA provides specific rates for different locations and durations of travel.

Q: How long does it take to process a TL2 claim?

A: Processing times can vary, but it typically takes several weeks for the CRA to process a TL2 claim.

Q: Can I claim expenses for personal travel as part of a TL2 claim?

A: No, TL2 claims can only be made for expenses incurred while travelling for work purposes.

Q: What happens if my TL2 claim is audited?

A: If your TL2 claim is audited, you may be required to provide additional documentation and explanations to support your claim.

Q: Can I claim TL2 expenses on my personal income tax return?

A: Yes, TL2 expenses can be claimed on your personal income tax return as deductions.