This version of the form is not currently in use and is provided for reference only. Download this version of

Form T936

for the current year.

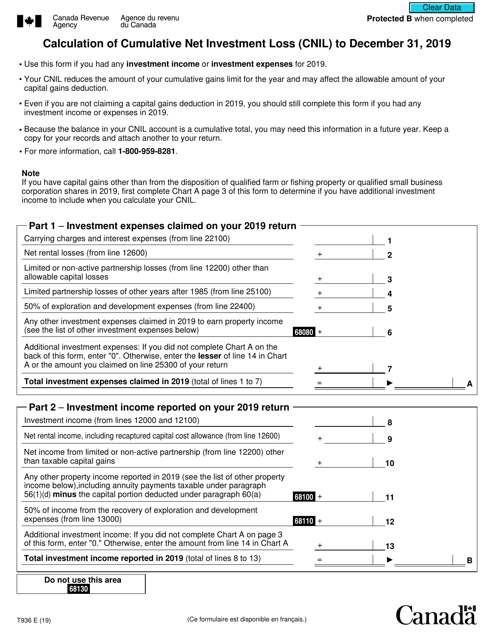

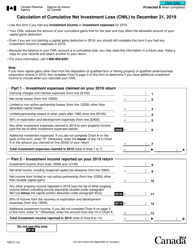

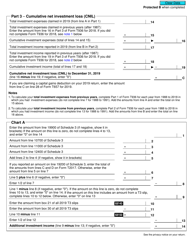

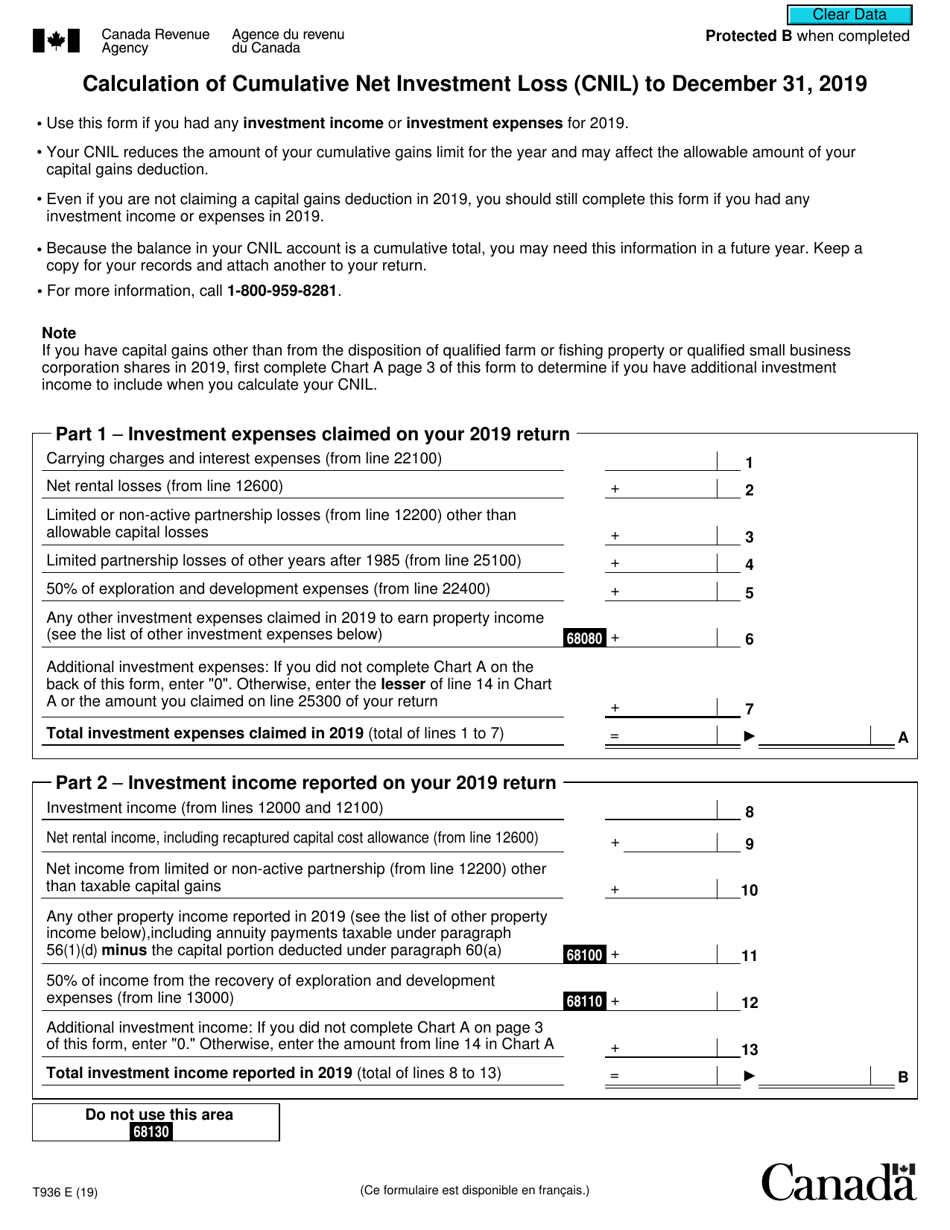

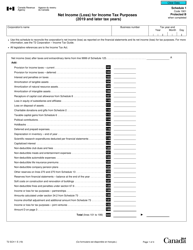

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) - Canada

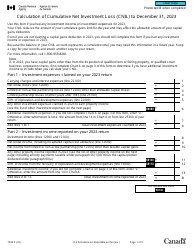

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is used by taxpayers to calculate their cumulative net investment loss. This loss can be carried forward and used to offset any future capital gains.

The Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is filed by taxpayers who have incurred investment losses.

FAQ

Q: What is Form T936?

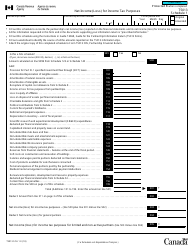

A: Form T936 is a calculation form used in Canada to determine the Cumulative Net Investment Loss (CNIL).

Q: What is the purpose of Form T936?

A: The purpose of Form T936 is to calculate the CNIL, which is a measure used to determine the amount of investment income that can be deducted for tax purposes.

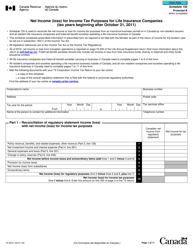

Q: Who needs to file Form T936?

A: Individuals or corporations in Canada who have investment income and want to claim deductions for tax purposes may need to file Form T936.

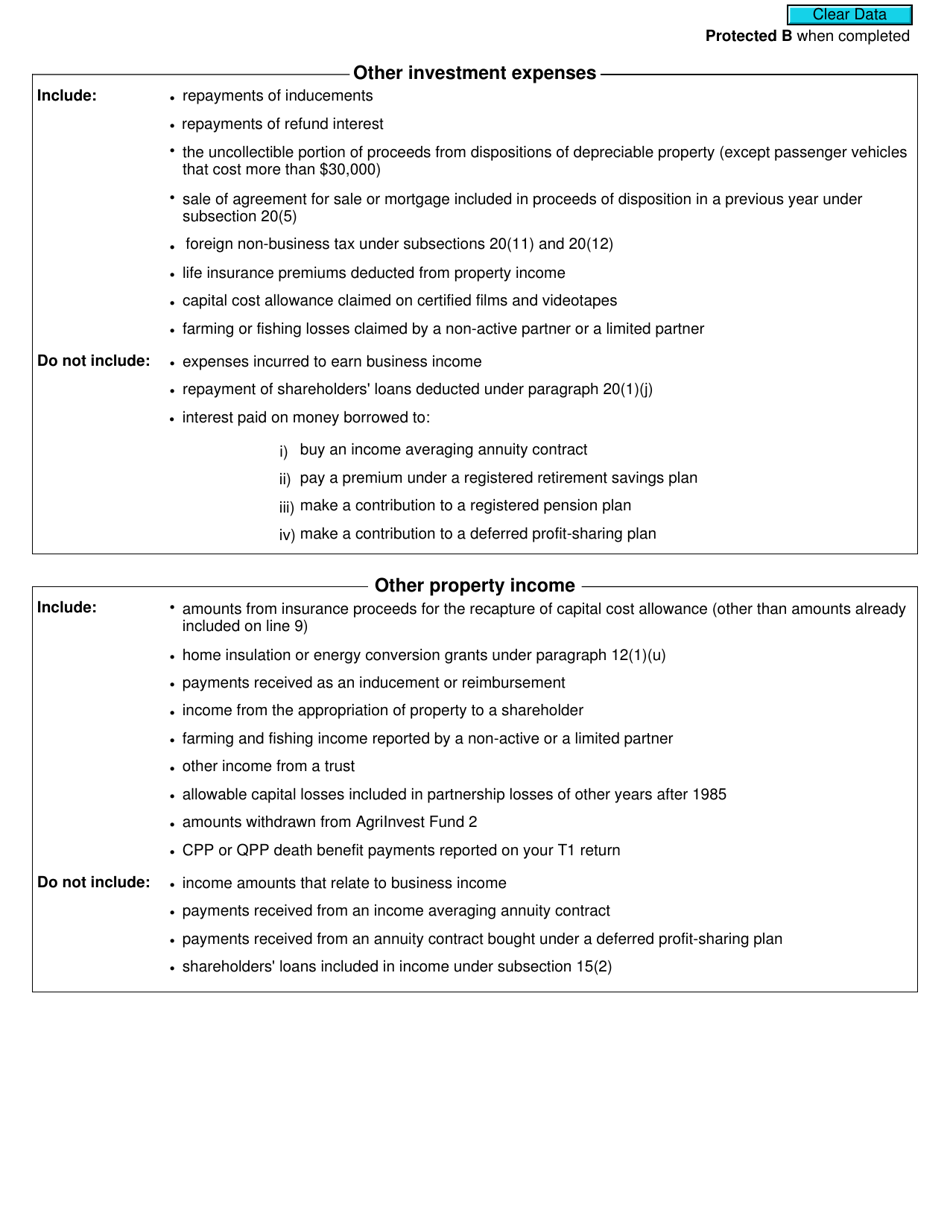

Q: What information is needed to complete Form T936?

A: To complete Form T936, you will need to provide information about your investment income, such as the type of income, the amount earned, and any expenses incurred.

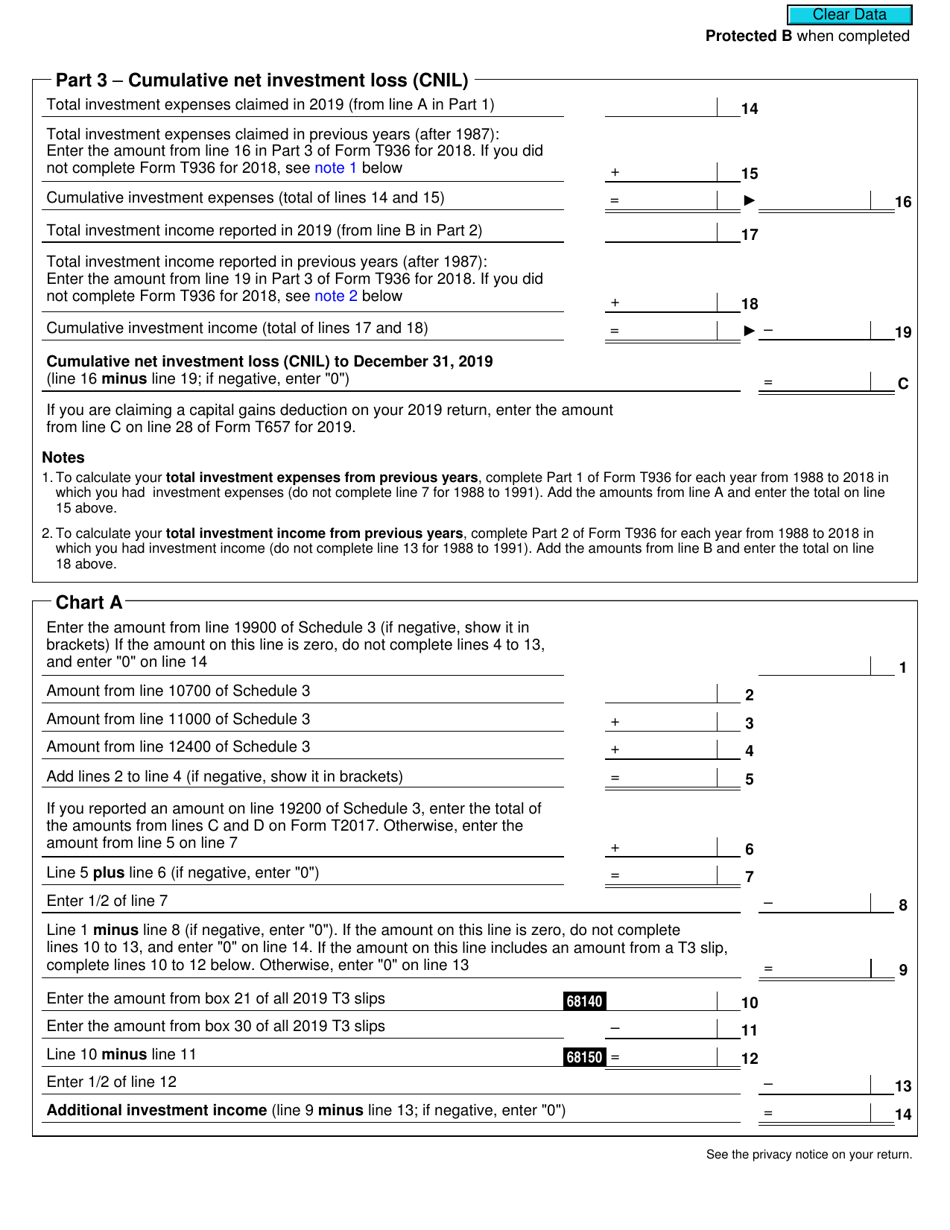

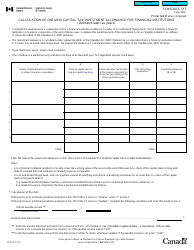

Q: How do I calculate the CNIL?

A: The CNIL is calculated by subtracting the cumulative deductions claimed from the cumulative income earned from various types of investments.

Q: What happens if my CNIL is negative?

A: If your CNIL is negative, it means that you have more deductions than income. This negative amount can be carried forward and used to offset future income.

Q: When is Form T936 due?

A: The due date for filing Form T936 depends on your tax filing deadline, which is typically April 30th for individuals and six months after the fiscal year-end for corporations.

Q: Do I need to submit any supporting documents with Form T936?

A: You may need to submit supporting documents, such as investment statements or receipts, to validate the information provided on Form T936. Keep these documents for your records.

Q: Can I claim the CNIL on my personal tax return?

A: Yes, individuals can claim the CNIL on their personal tax return to offset their taxable income and reduce their tax liability.