This version of the form is not currently in use and is provided for reference only. Download this version of

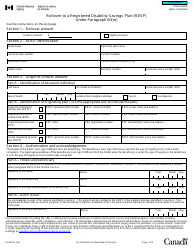

Form T89

for the current year.

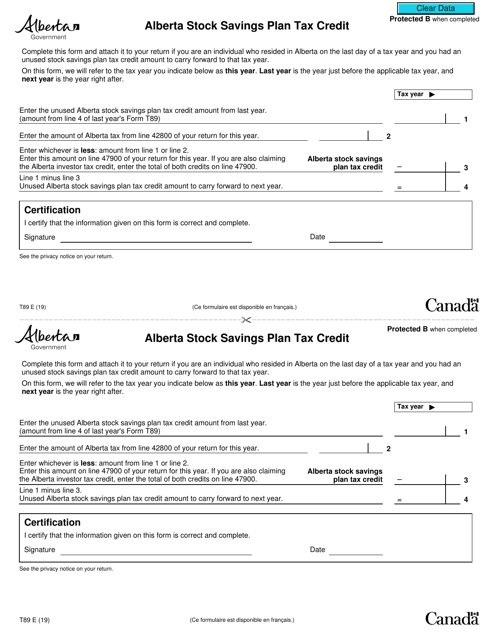

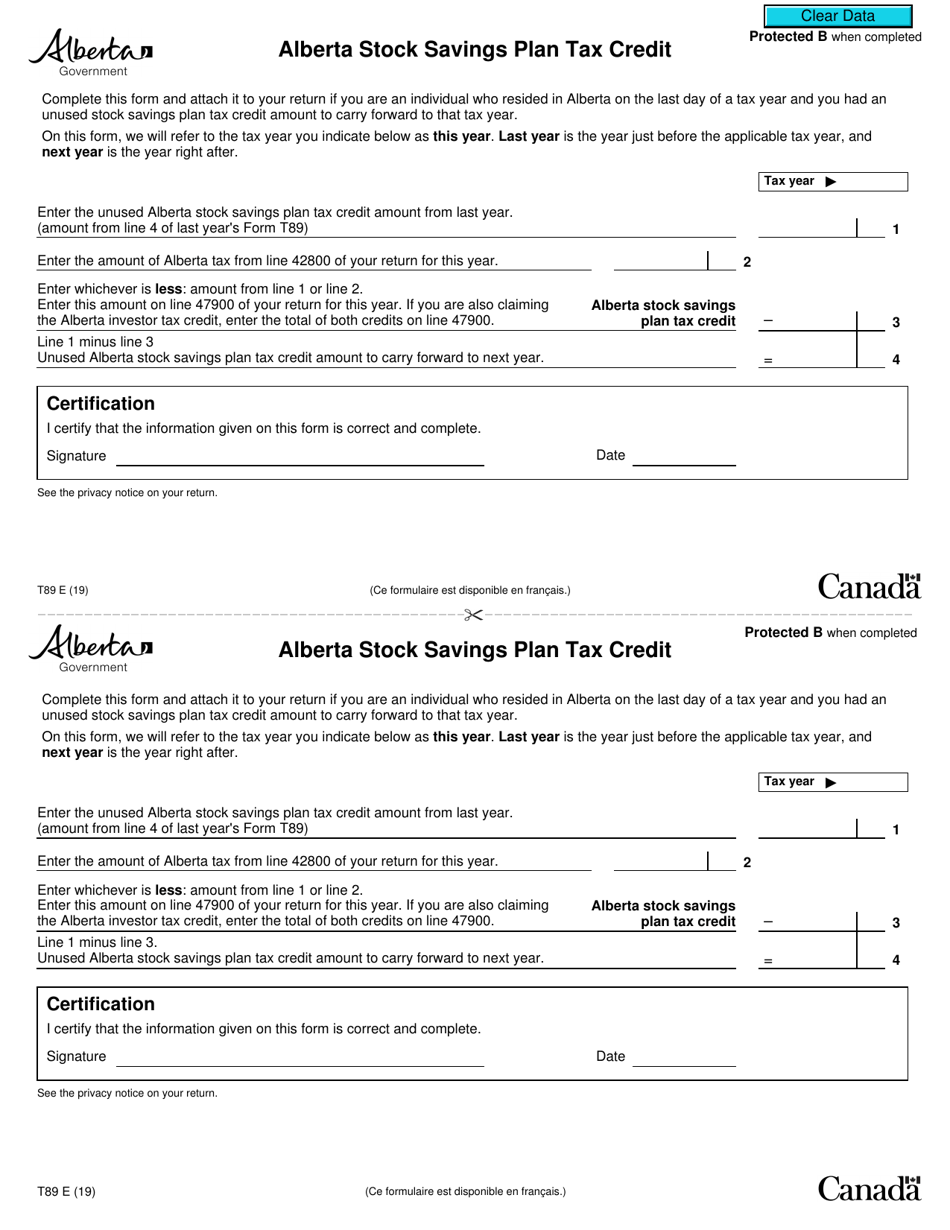

Form T89 Alberta Stock Savings Plan Tax Credit - Canada

Form T89 Alberta Stock Savings Plan Tax Credit is used in Canada for claiming the tax credit related to contributions made to an Alberta Stock Savings Plan. This plan encourages individuals to invest in eligible small businesses in Alberta by providing them with tax credits.

The Form T89 for the Alberta Stock Savings Plan Tax Credit in Canada is filed by individual taxpayers who qualify for the credit.

FAQ

Q: What is the Form T89?

A: Form T89 is a form used in Canada for claiming the Alberta Stock Savings Plan Tax Credit.

Q: What is the Alberta Stock Savings Plan Tax Credit?

A: The Alberta Stock Savings Plan Tax Credit is a tax credit available in Alberta, Canada for individuals who invest in eligible Alberta corporations.

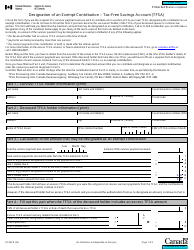

Q: How do I claim the Alberta Stock Savings Plan Tax Credit?

A: To claim the Alberta Stock Savings Plan Tax Credit, you need to complete and file Form T89 with the Canada Revenue Agency.

Q: Who is eligible for the Alberta Stock Savings Plan Tax Credit?

A: Individuals who invest in eligible Alberta corporations and meet certain criteria are eligible for the Alberta Stock Savings Plan Tax Credit.

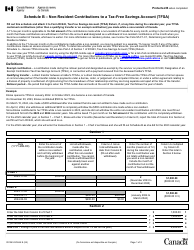

Q: Can I claim the Alberta Stock Savings Plan Tax Credit on my federal taxes?

A: No, the Alberta Stock Savings Plan Tax Credit is specific to the province of Alberta and can only be claimed on your Alberta income tax return.

Q: Are there any limits on the amount of the Alberta Stock Savings Plan Tax Credit?

A: Yes, there are limits on the amount of the Alberta Stock Savings Plan Tax Credit that can be claimed. The specific limits vary based on individual circumstances.

Q: What is an eligible Alberta corporation?

A: An eligible Alberta corporation is a corporation that meets certain criteria set out by the Alberta government. These criteria often include factors such as the corporation's primary business activities and the location of its head office.

Q: Can I carry forward unused Alberta Stock Savings Plan Tax Credits?

A: Yes, unused Alberta Stock Savings Plan Tax Credits can be carried forward and claimed in future years.