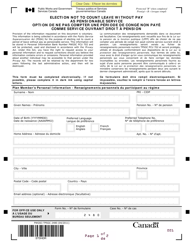

This version of the form is not currently in use and is provided for reference only. Download this version of

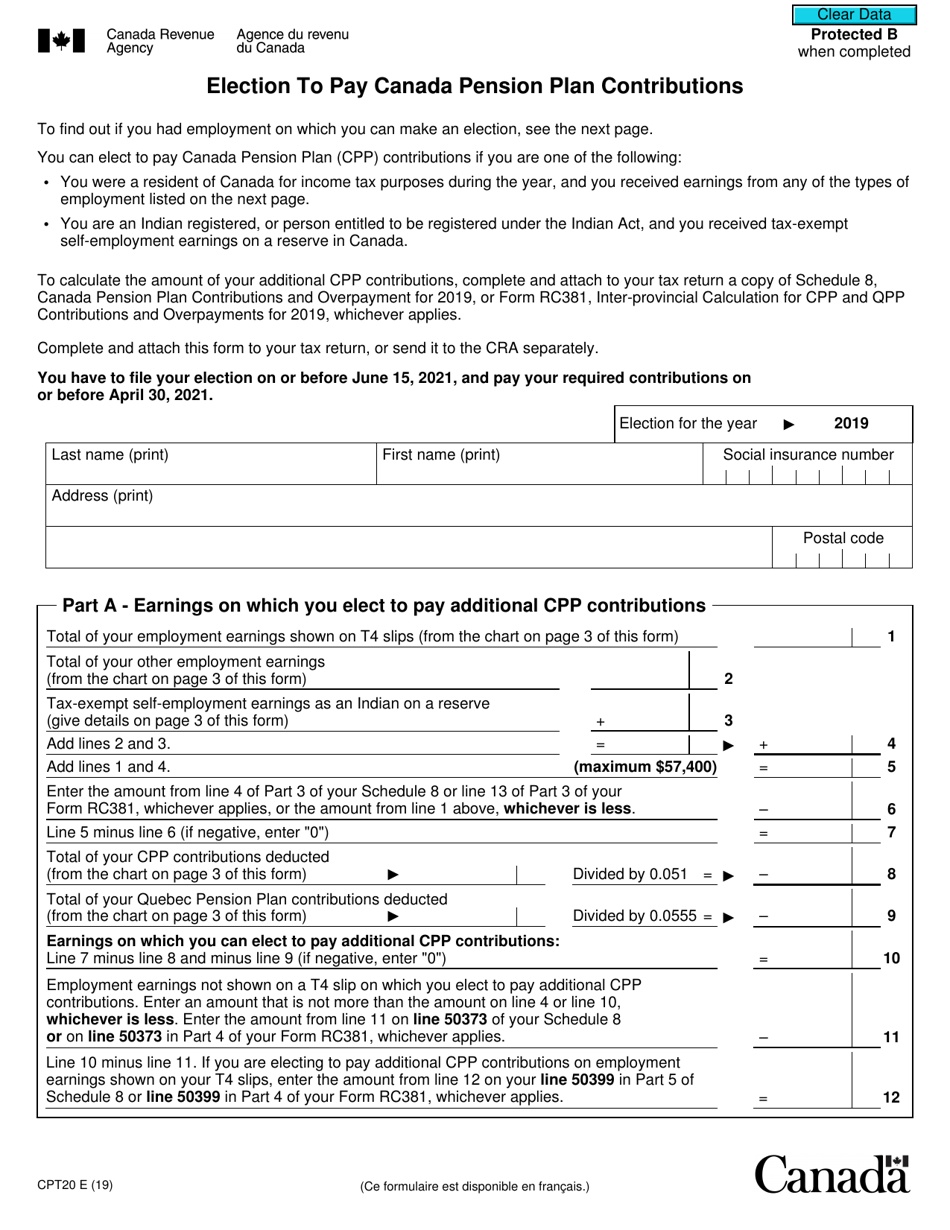

Form CPT20

for the current year.

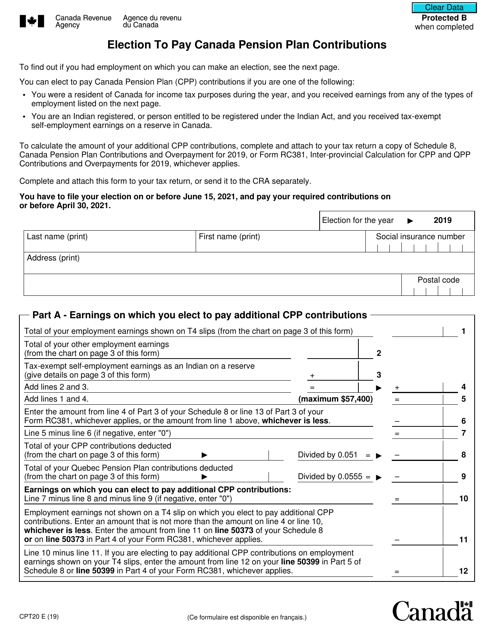

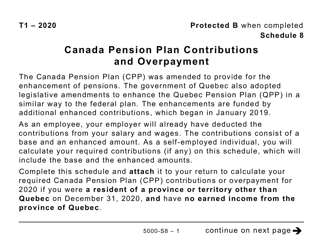

Form CPT20 Election to Pay Canada Pension Plan Contributions - Canada

Form CPT20, also known as the Election to Pay Canada Pension Plan (CPP) Contributions, is used by individuals or organizations to elect to voluntarily contribute to the CPP. This form allows individuals who are not already required to contribute to the CPP to make contributions and build up CPP benefits.

The Form CPT20 Election to Pay Canada Pension Plan Contributions is filed by individuals who are self-employed and wish to contribute to the Canada Pension Plan (CPP).

FAQ

Q: What is the CPT20 Election to Pay Canada Pension Plan Contributions?

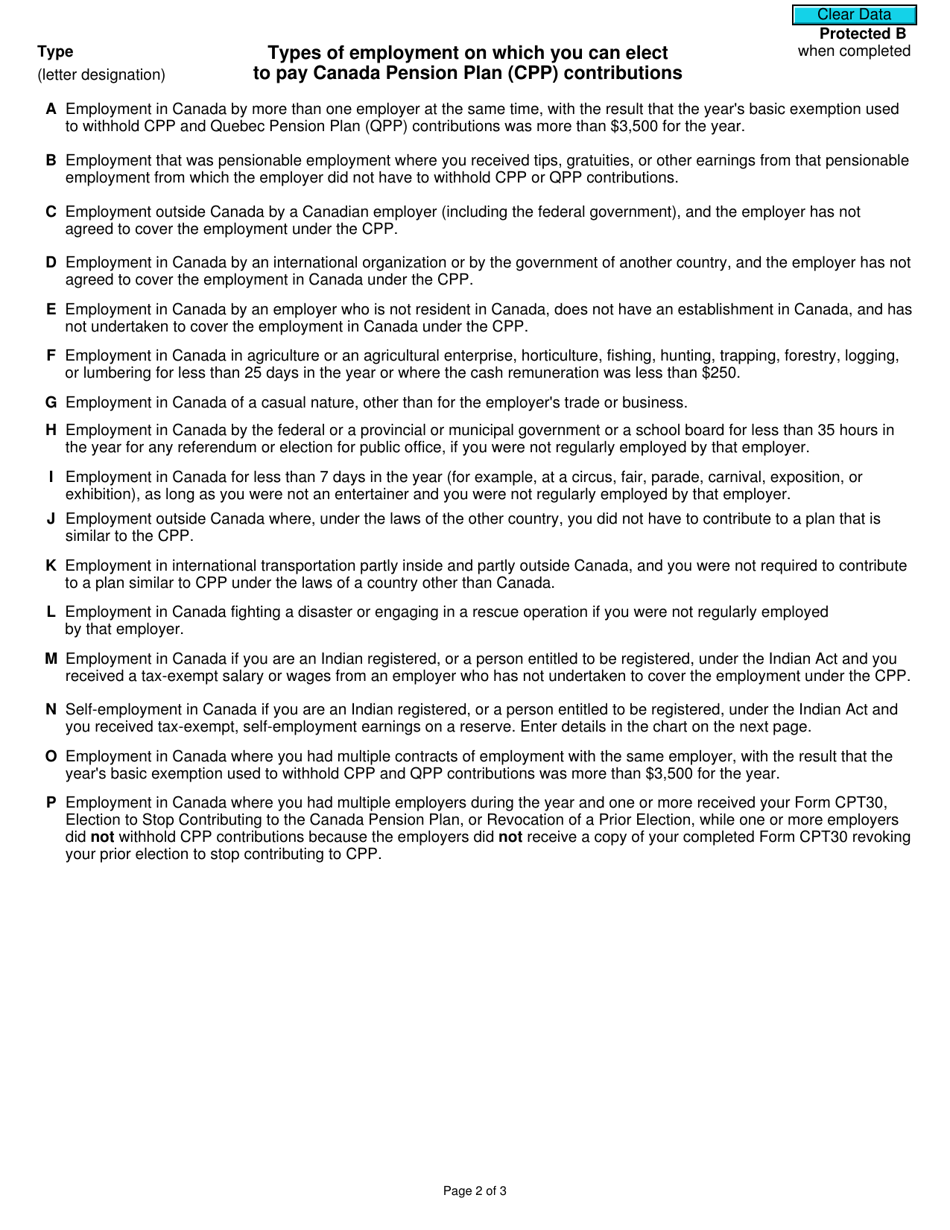

A: The CPT20 Election is a form that allows individuals residing in Canada, but working for a foreign employer, to elect to pay Canada Pension Plan (CPP) contributions.

Q: Who can use the CPT20 Election form?

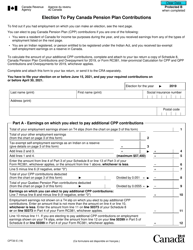

A: The CPT20 Election form can be used by individuals who are residents of Canada for income tax purposes, but are employed by a foreign company.

Q: Why would someone use the CPT20 Election form?

A: Someone would use the CPT20 Election form to ensure they can continue to contribute to the Canada Pension Plan even if they are working for a foreign employer.

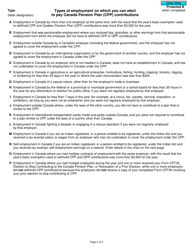

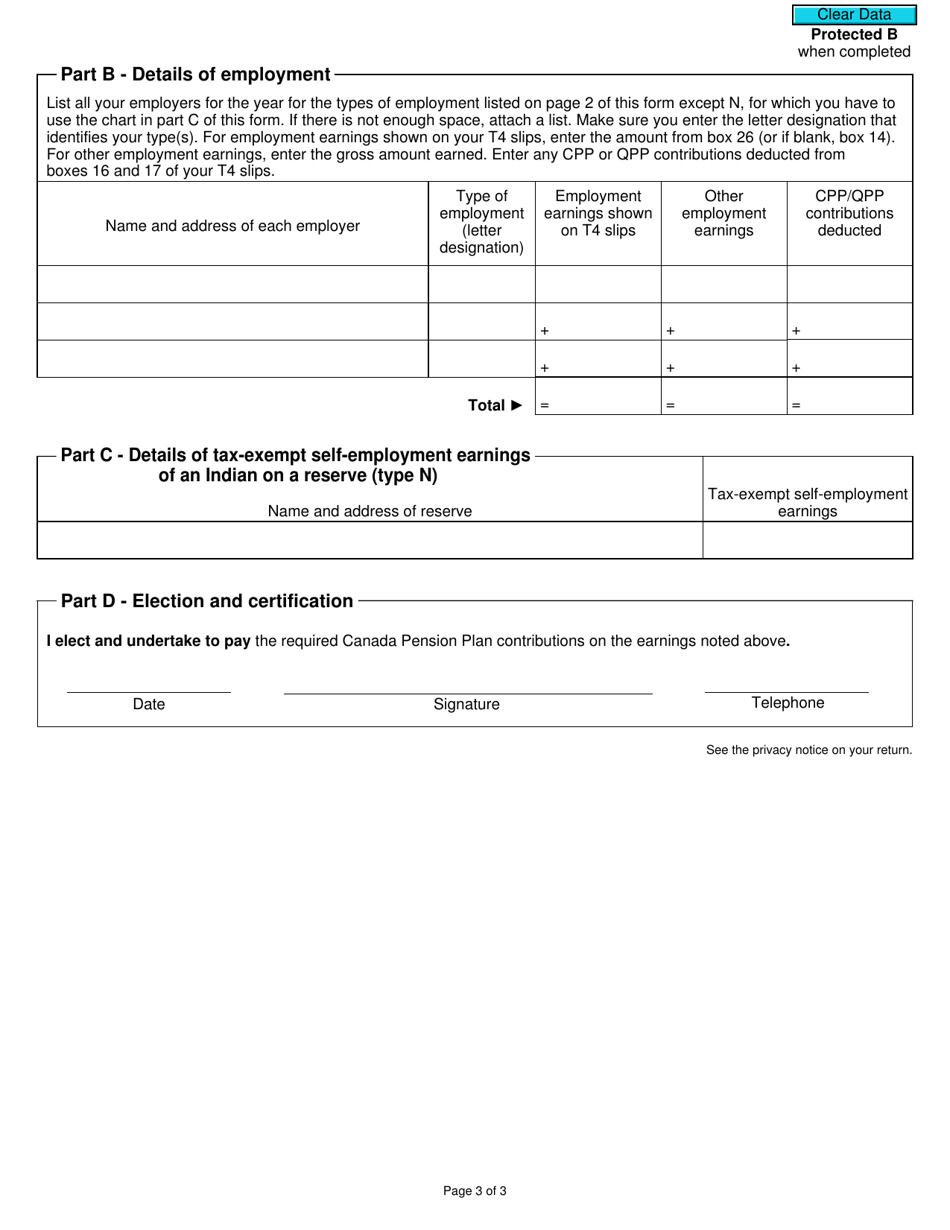

Q: How do I fill out the CPT20 Election form?

A: To fill out the CPT20 Election form, you will need to provide personal information, details about your employment with the foreign employer, and sign the form.

Q: What are the benefits of using the CPT20 Election form?

A: The main benefit of using the CPT20 Election form is that it allows you to continue making contributions to the Canada Pension Plan, which will help ensure you are eligible for CPP benefits in the future.

Q: Are there any deadlines for submitting the CPT20 Election form?

A: Yes, there are deadlines for submitting the CPT20 Election form. It must be filed within two years of the contribution year to which it applies.

Q: Can I cancel or revoke my CPT20 Election once it is submitted?

A: No, once the CPT20 Election form is submitted, it cannot be canceled or revoked.

Q: Is there a fee for submitting the CPT20 Election form?

A: No, there is no fee for submitting the CPT20 Election form.

Q: What happens after I submit the CPT20 Election form?

A: After you submit the CPT20 Election form, it will be reviewed by the Canada Revenue Agency. If approved, you will be required to make regular CPP contributions as a self-employed person.