This version of the form is not currently in use and is provided for reference only. Download this version of

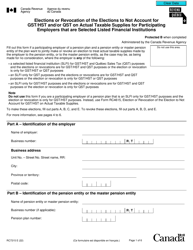

Form GST59

for the current year.

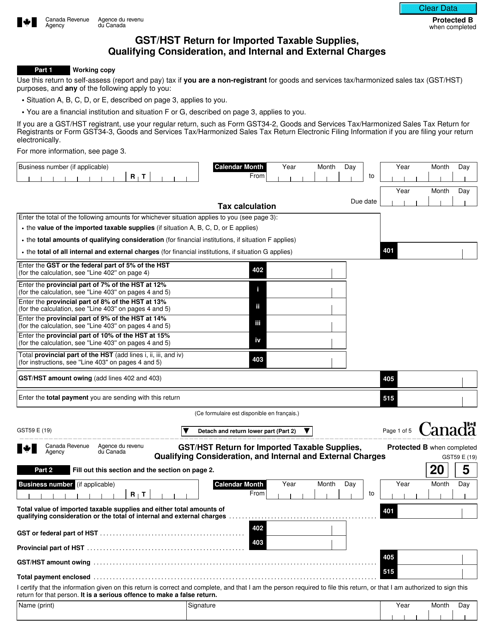

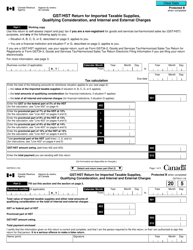

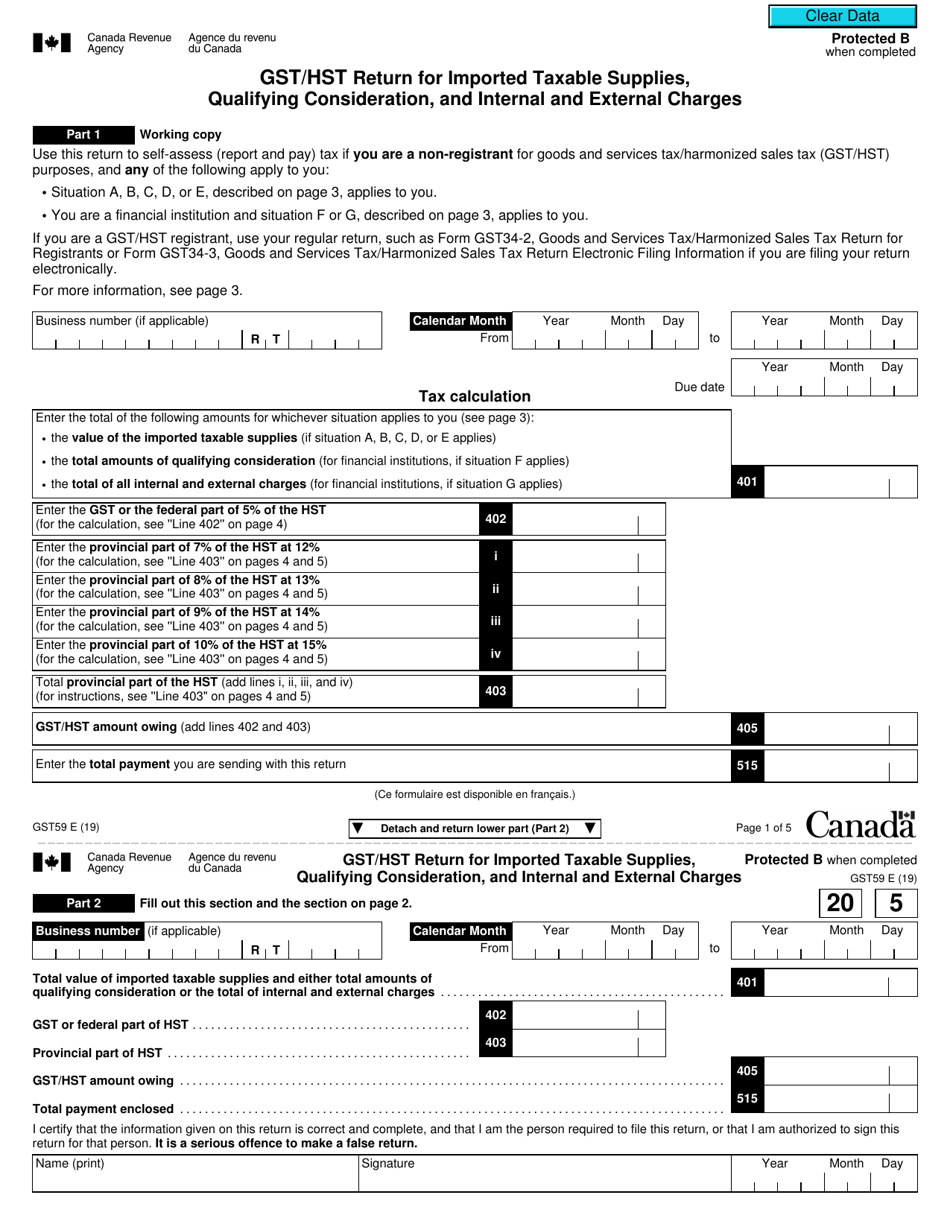

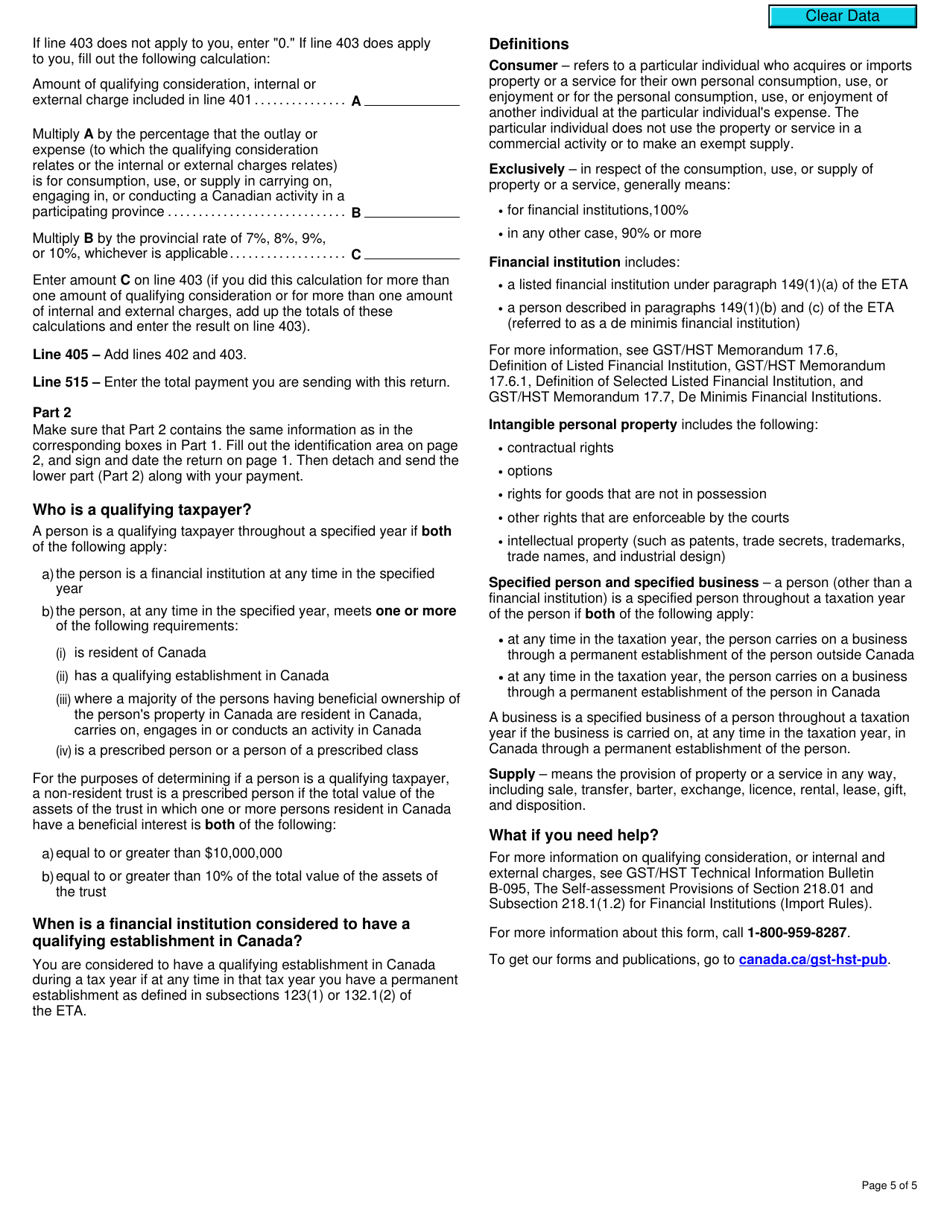

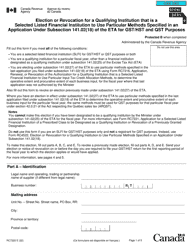

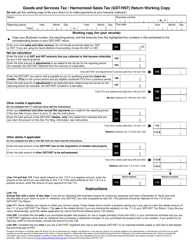

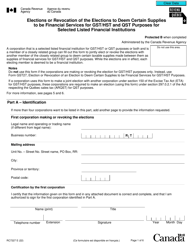

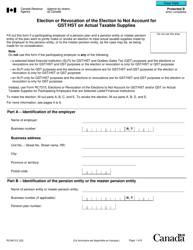

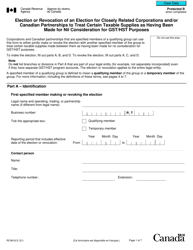

Form GST59 Gst / Hst Return for Imported Taxable Supplies, Qualifying Consideration, and Internal and External Charges - Canada

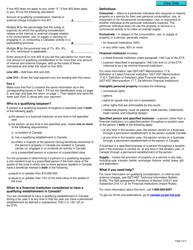

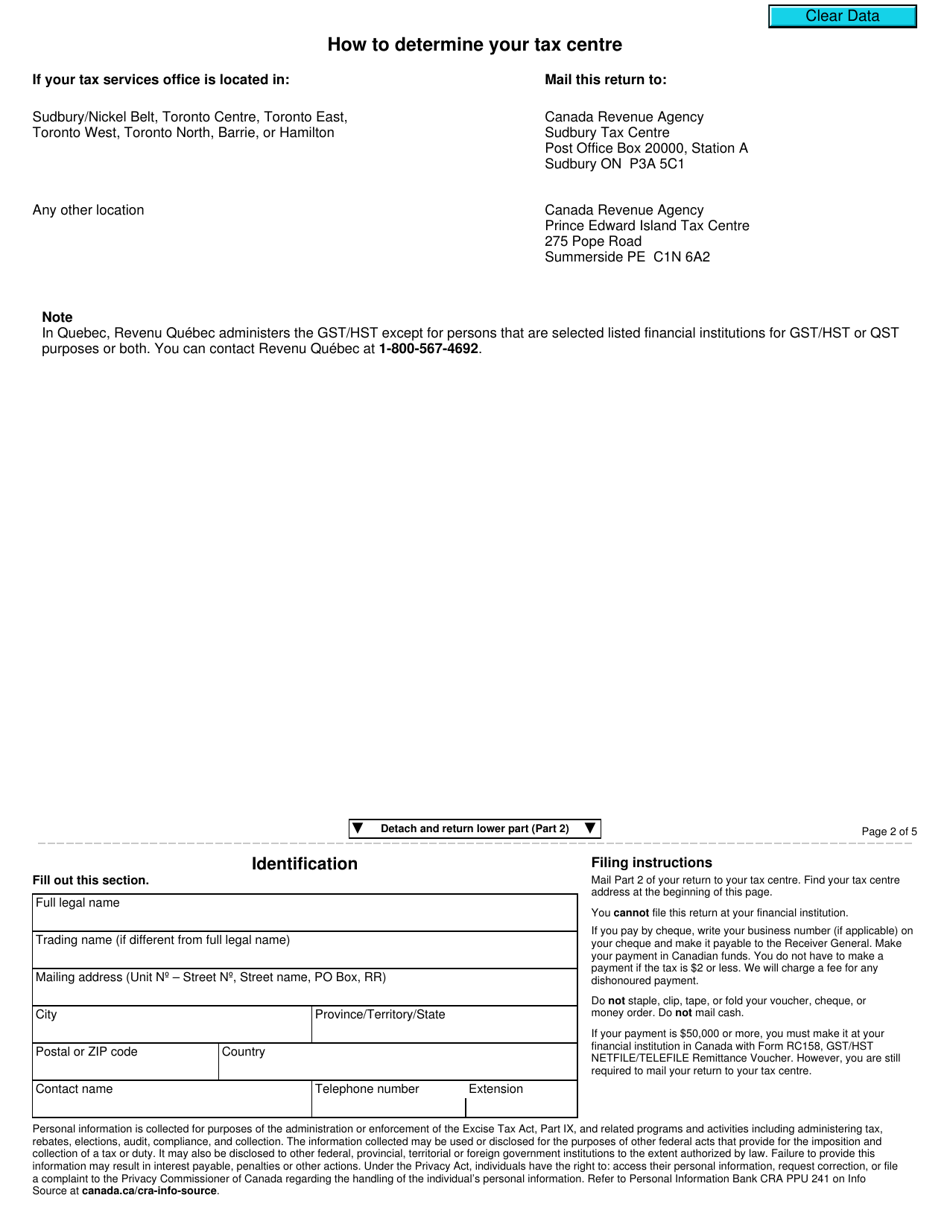

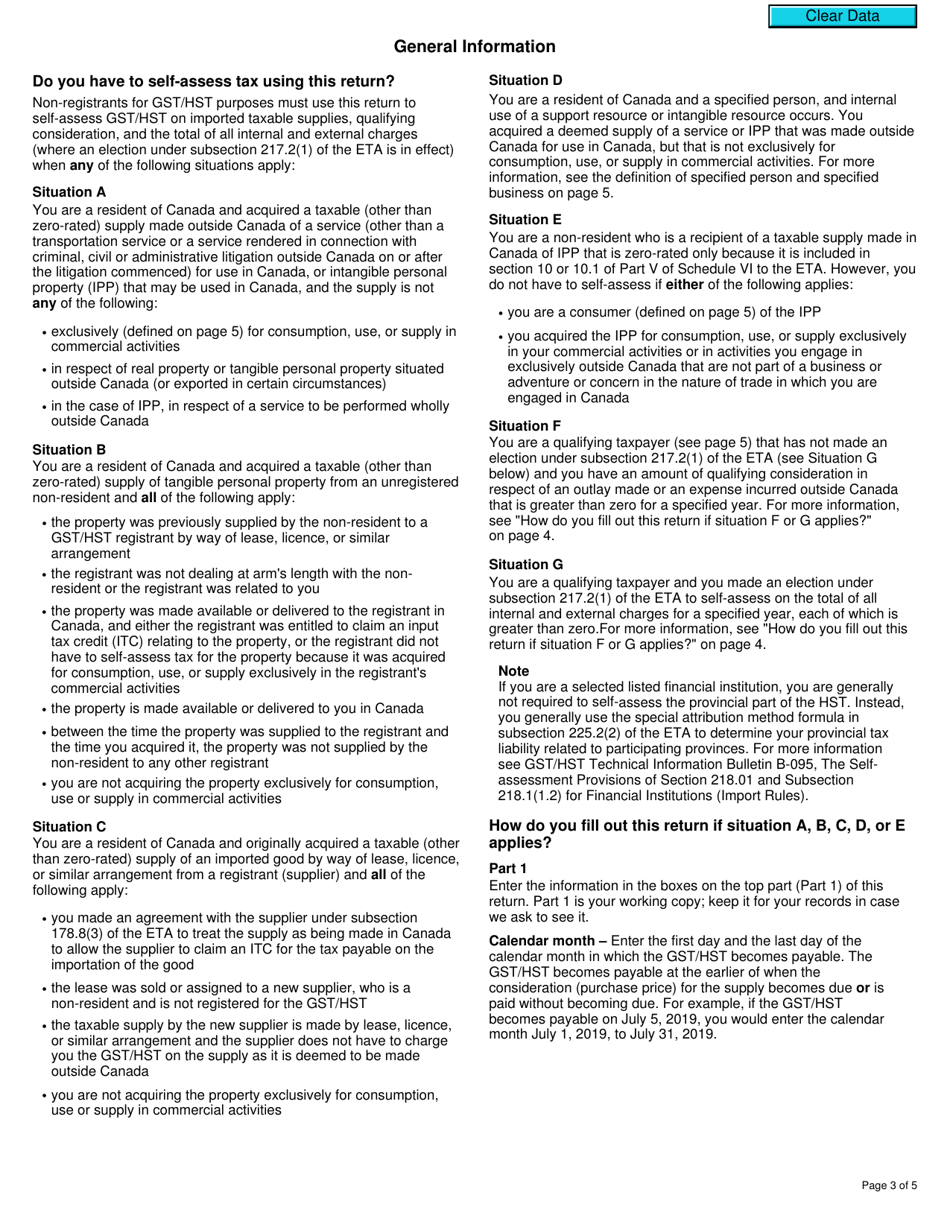

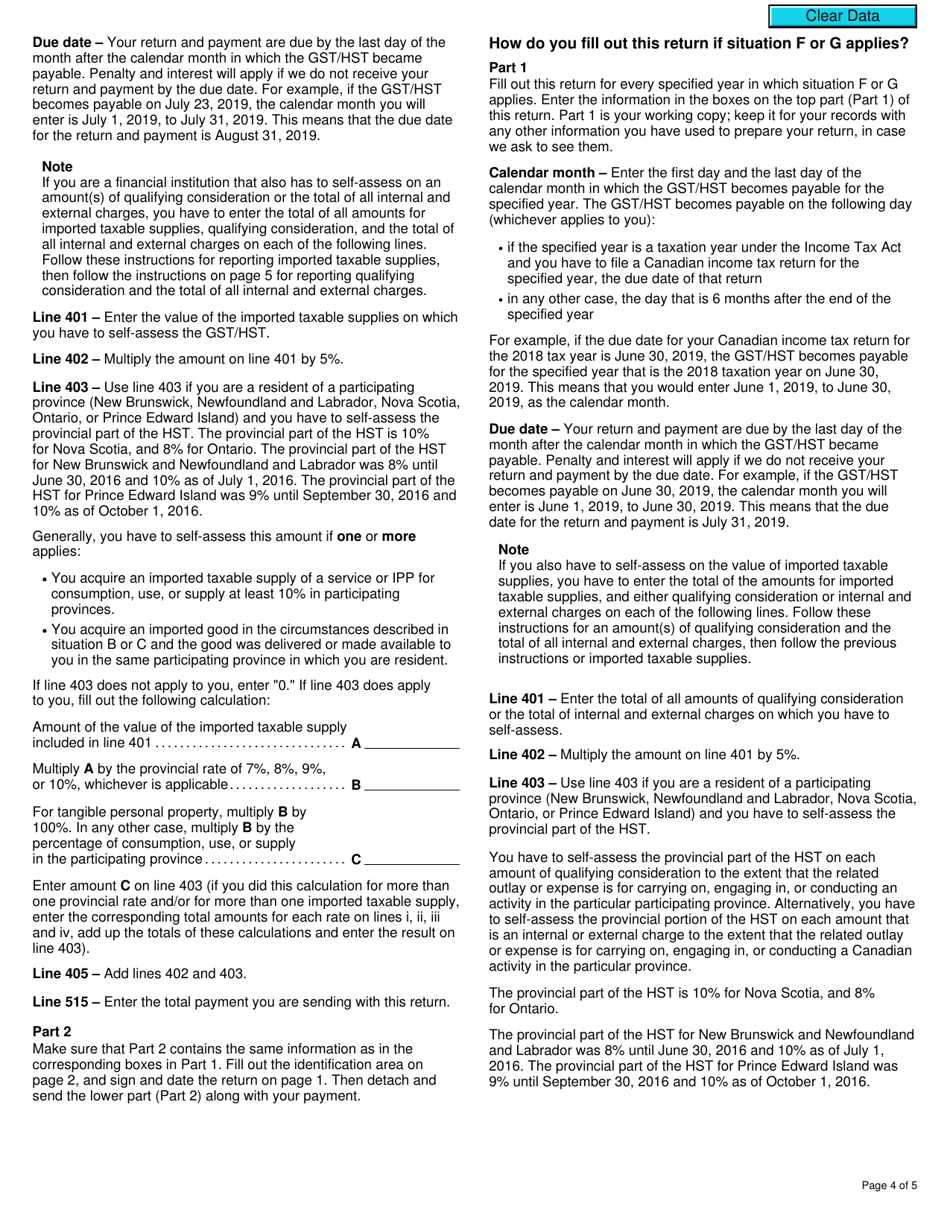

Form GST59, GST/HST Return for Imported Taxable Supplies, Qualifying Consideration, and Internal and External Charges, is used in Canada to report imported taxable supplies made by a non-resident person, as well as to claim a refund for qualifying consideration and recover input tax credits for internal and external charges related to the imported supplies.

The Form GST59 GST/HST Return for Imported Taxable Supplies, Qualifying Consideration, and Internal and External Charges in Canada is filed by businesses that have imported taxable supplies and need to report and remit the GST/HST on those supplies.

FAQ

Q: What is Form GST59?

A: Form GST59 is a GST/HST Return for Imported Taxable Supplies, Qualifying Consideration, and Internal and External Charges in Canada.

Q: What is the purpose of Form GST59?

A: The purpose of Form GST59 is to report imported taxable supplies and certain charges for GST/HST purposes in Canada.

Q: Who should use Form GST59?

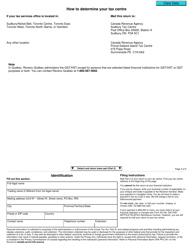

A: Form GST59 should be used by businesses that are registered for GST/HST and have imported taxable supplies with qualifying consideration and internal or external charges.

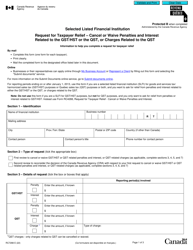

Q: What information is required on Form GST59?

A: Form GST59 requires information such as the importing business's name, business number, total consideration, and details of imported taxable supplies and charges.