This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST531

for the current year.

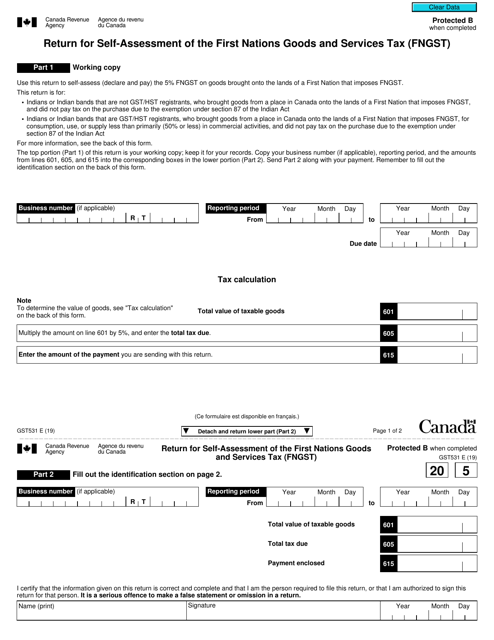

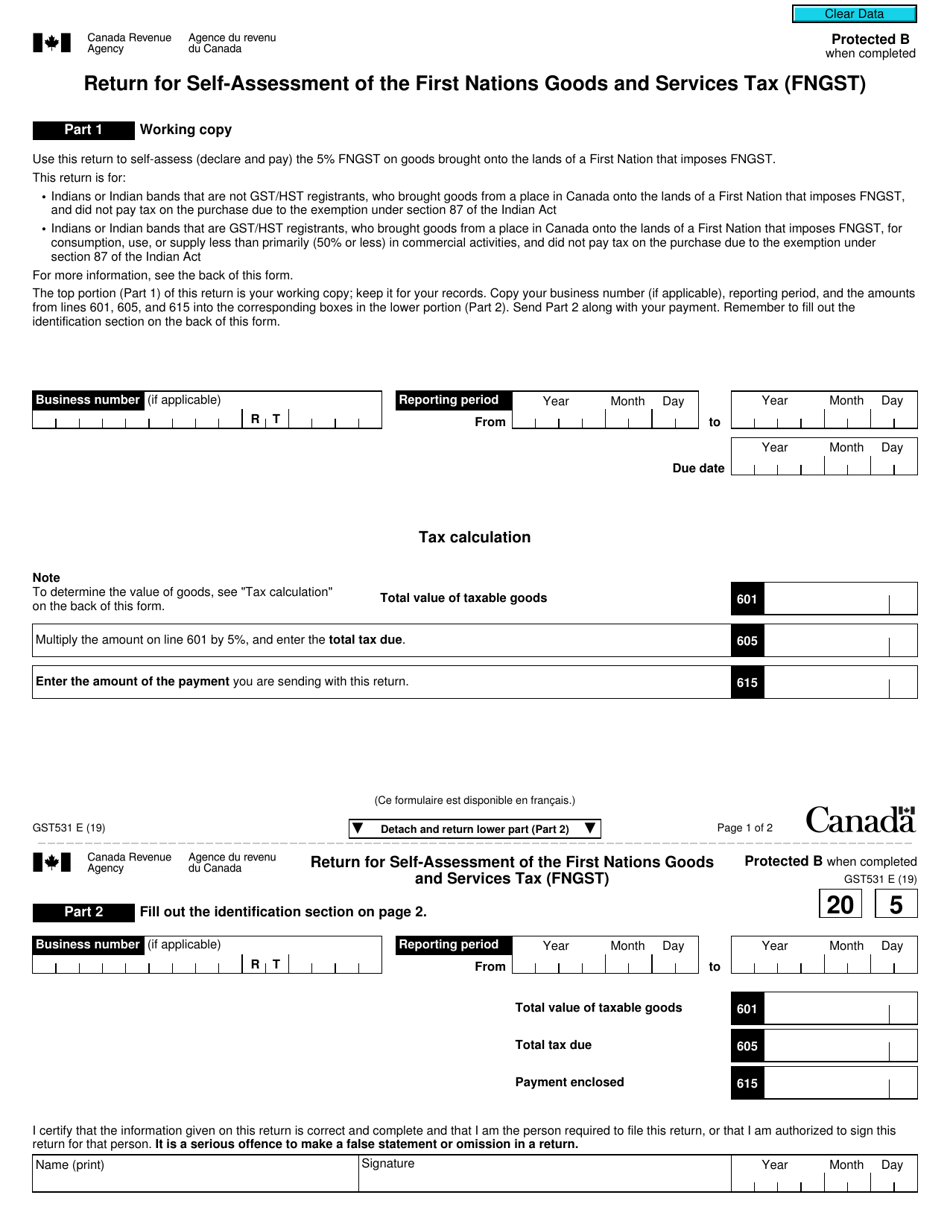

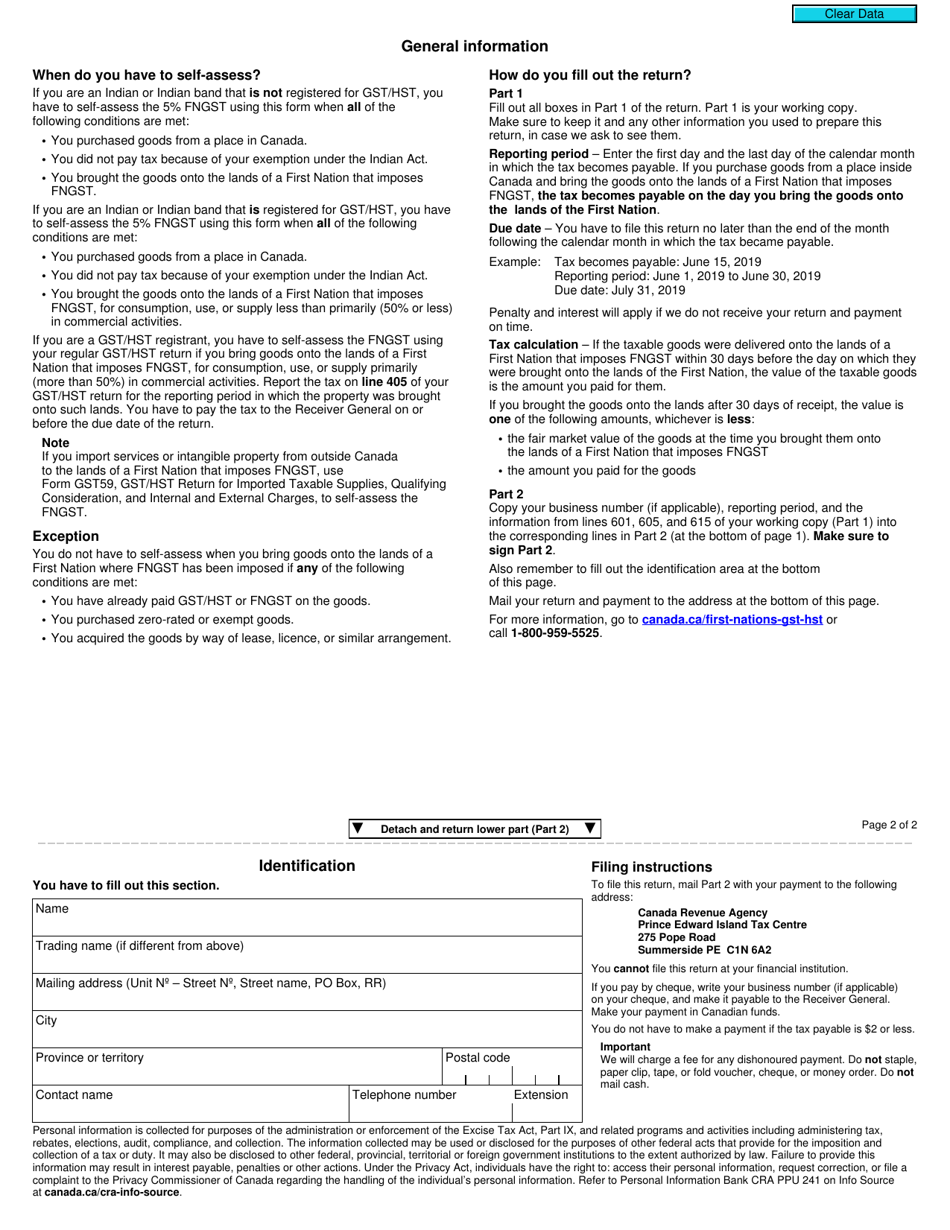

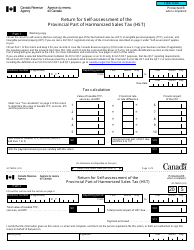

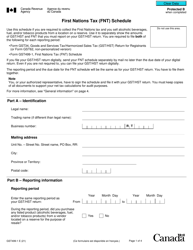

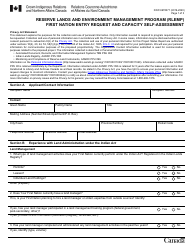

Form GST531 Return for Self-assessment of the First Nations Goods and Services Tax (Fngst) - Canada

Form GST531 is a return form that is used for self-assessment of the First Nations Goods and Services Tax (FNGST) in Canada. It is used by First Nations individuals or businesses to report and remit the FNGST that is collected on the sale or lease of goods or services on reserve lands.

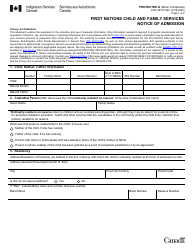

The First Nations goods and services tax (FNGST) return for self-assessment is filed by First Nations governments in Canada.

FAQ

Q: What is Form GST531?

A: Form GST531 is a return for self-assessment of the First Nations Goods and Services Tax (FNGST) in Canada.

Q: What is the First Nations Goods and Services Tax (FNGST)?

A: The First Nations Goods and Services Tax (FNGST) is a tax that applies to goods and services purchased on certain First Nations reserves in Canada.

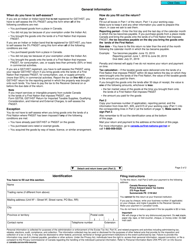

Q: Who needs to file Form GST531?

A: Individuals and businesses that make purchases on certain First Nations reserves in Canada need to file Form GST531.

Q: What are the reporting periods for Form GST531?

A: The reporting periods for Form GST531 are either quarterly or annually.

Q: What information do I need to provide on Form GST531?

A: You will need to provide information about your purchases on certain First Nations reserves, including the amount of tax paid and the total amount of purchases.