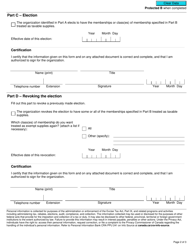

This version of the form is not currently in use and is provided for reference only. Download this version of

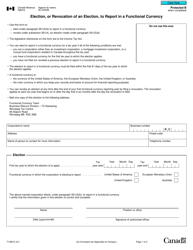

Form GST24

for the current year.

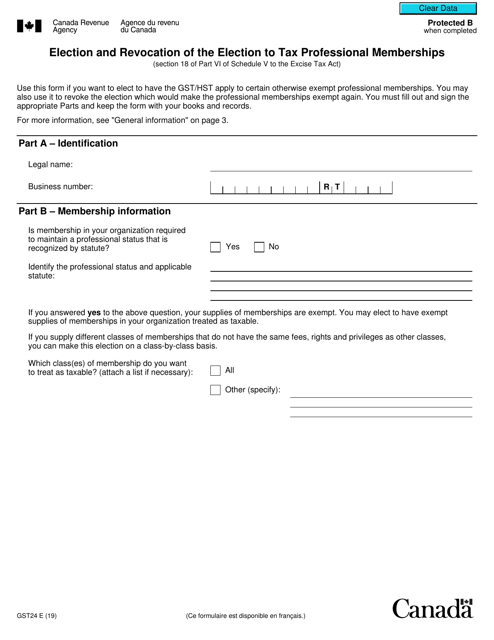

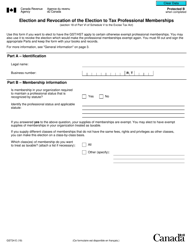

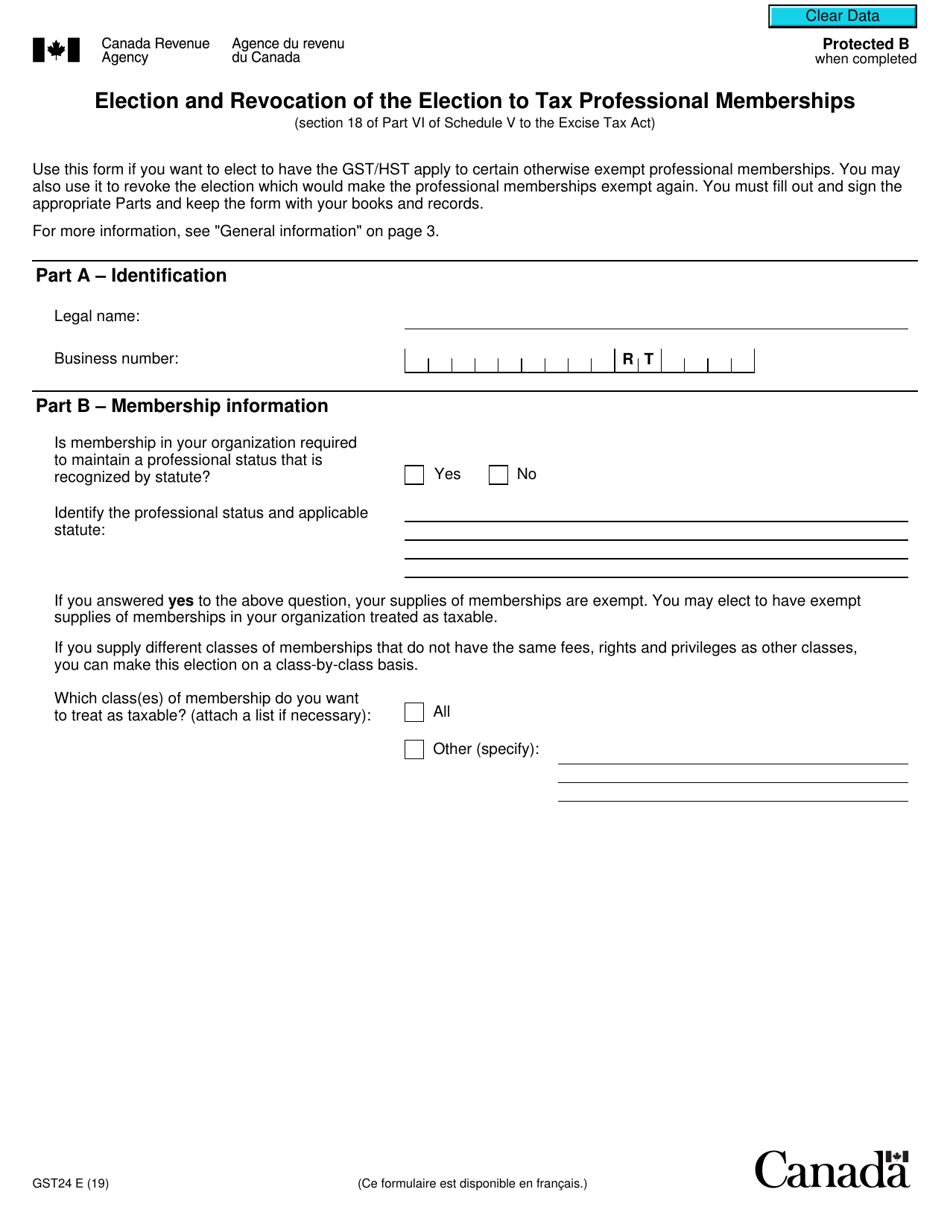

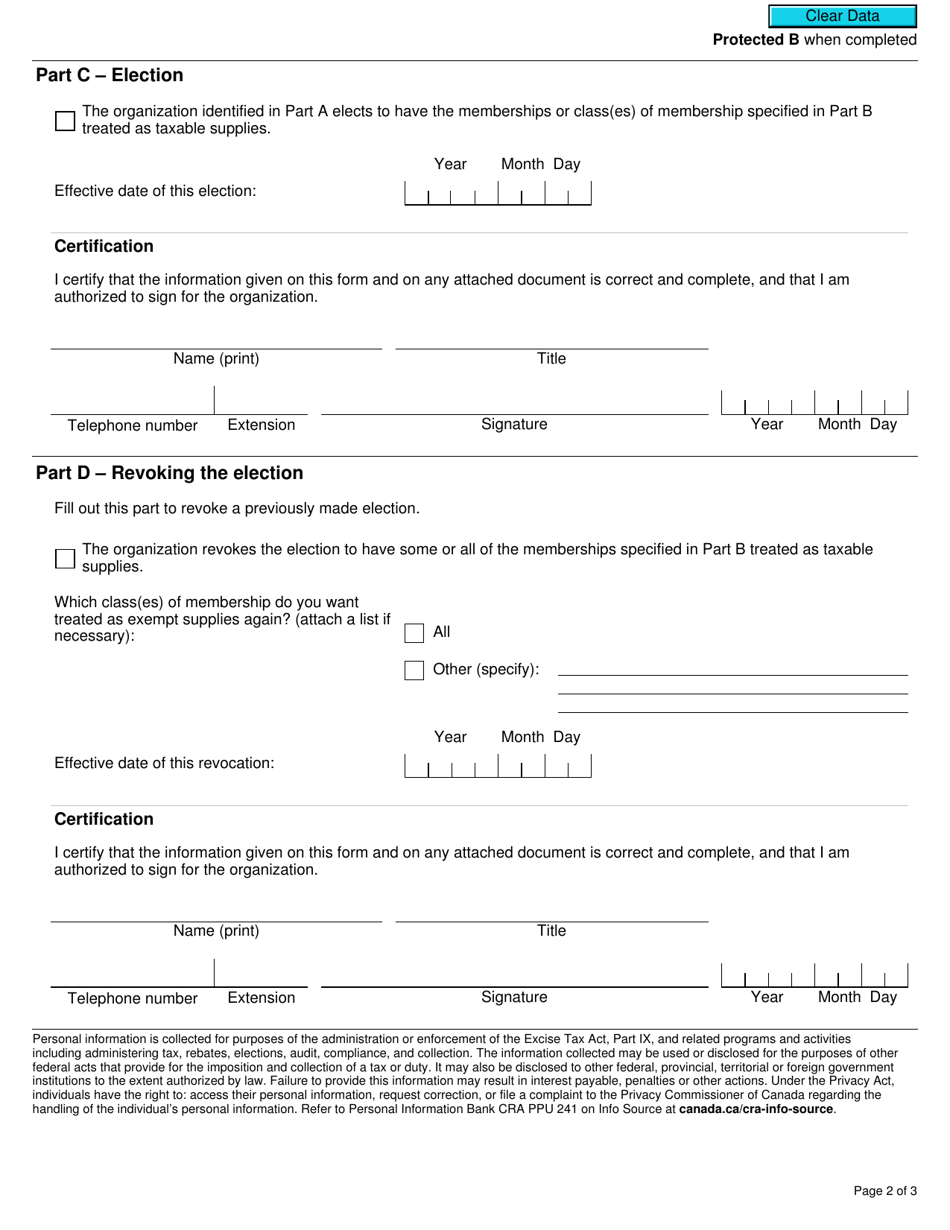

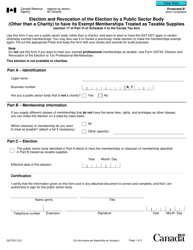

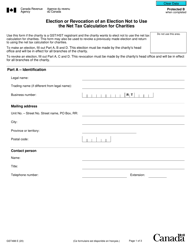

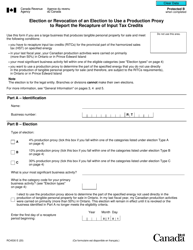

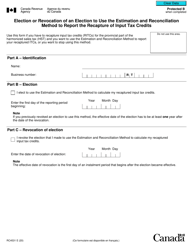

Form GST24 Election and Revocation of the Election to Tax Professional Memberships - Canada

Form GST24 Election and Revocation of the Election to Tax Professional Memberships in Canada is used by corporations and partnerships to elect whether or not to tax professional memberships as a taxable benefit for their members. This form is used for GST/HST purposes.

The form GST24 Election and Revocation of the Election to Tax Professional Memberships in Canada is filed by the individual or business making the election or revocation.

FAQ

Q: What is GST24 form used for?

A: GST24 form is used for election and revocation of the election to tax professional memberships in Canada.

Q: Who needs to file GST24 form?

A: Individuals who are tax professionals and want to elect or revoke the election to tax professional memberships need to file GST24 form.

Q: What is the purpose of electing to tax professional memberships?

A: Electing to tax professional memberships allows tax professionals to claim input tax credits on their membership fees.

Q: Can I revoke the election to tax professional memberships?

A: Yes, you can revoke the election by filing a new GST24 form indicating that you no longer want to tax professional memberships.