This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST21

for the current year.

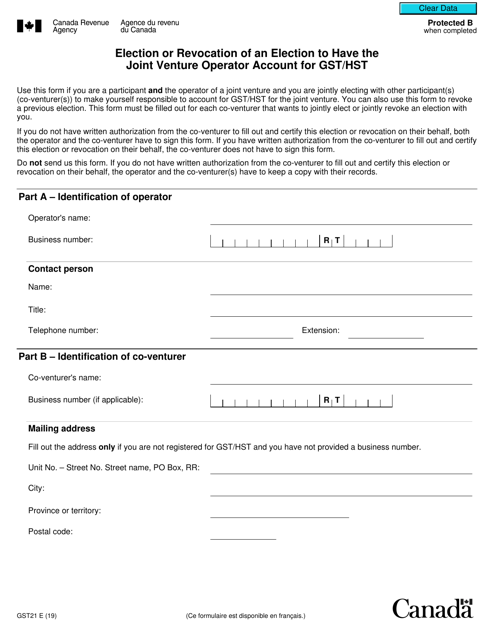

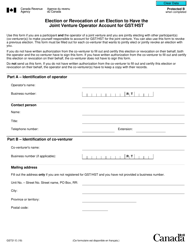

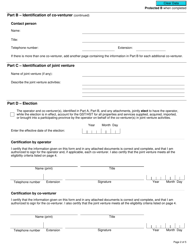

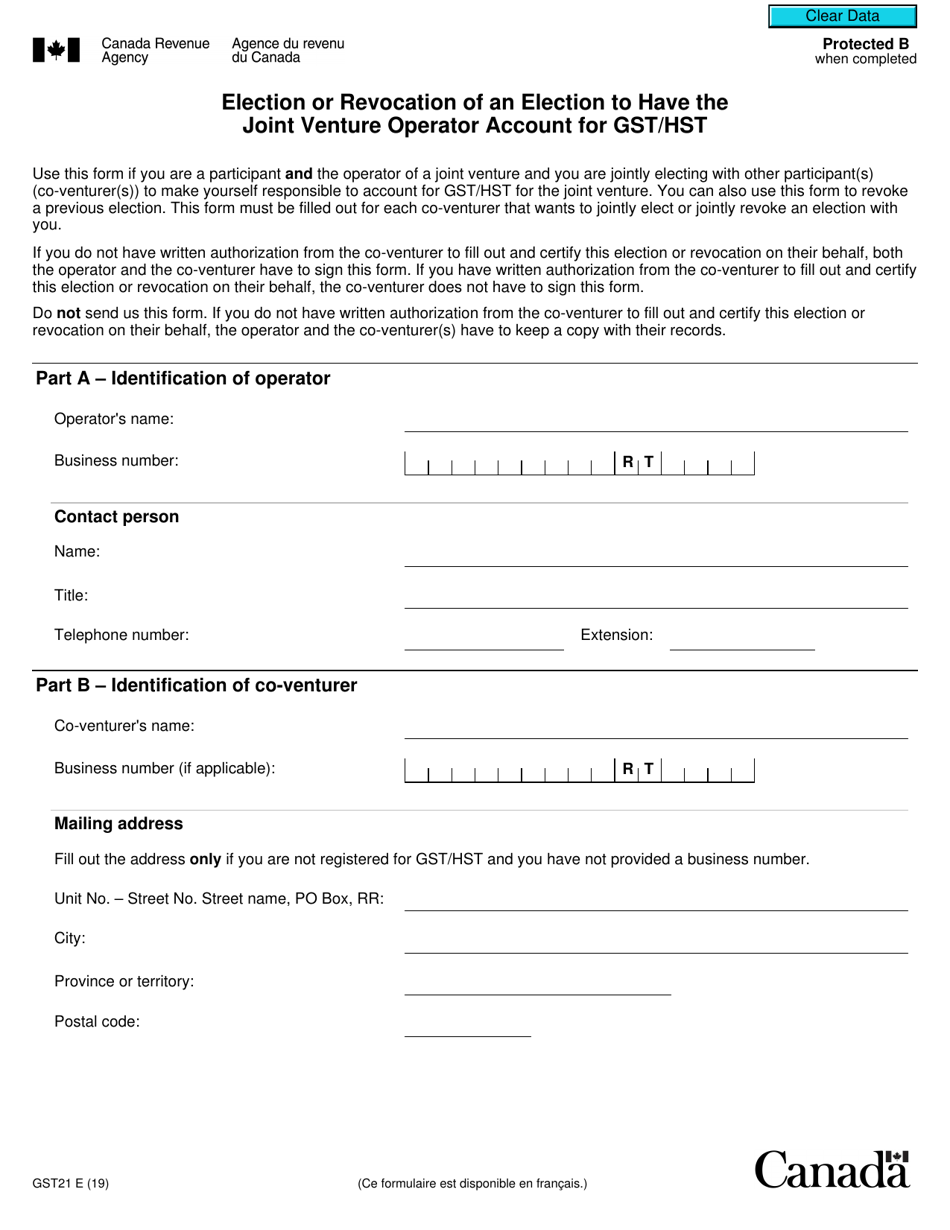

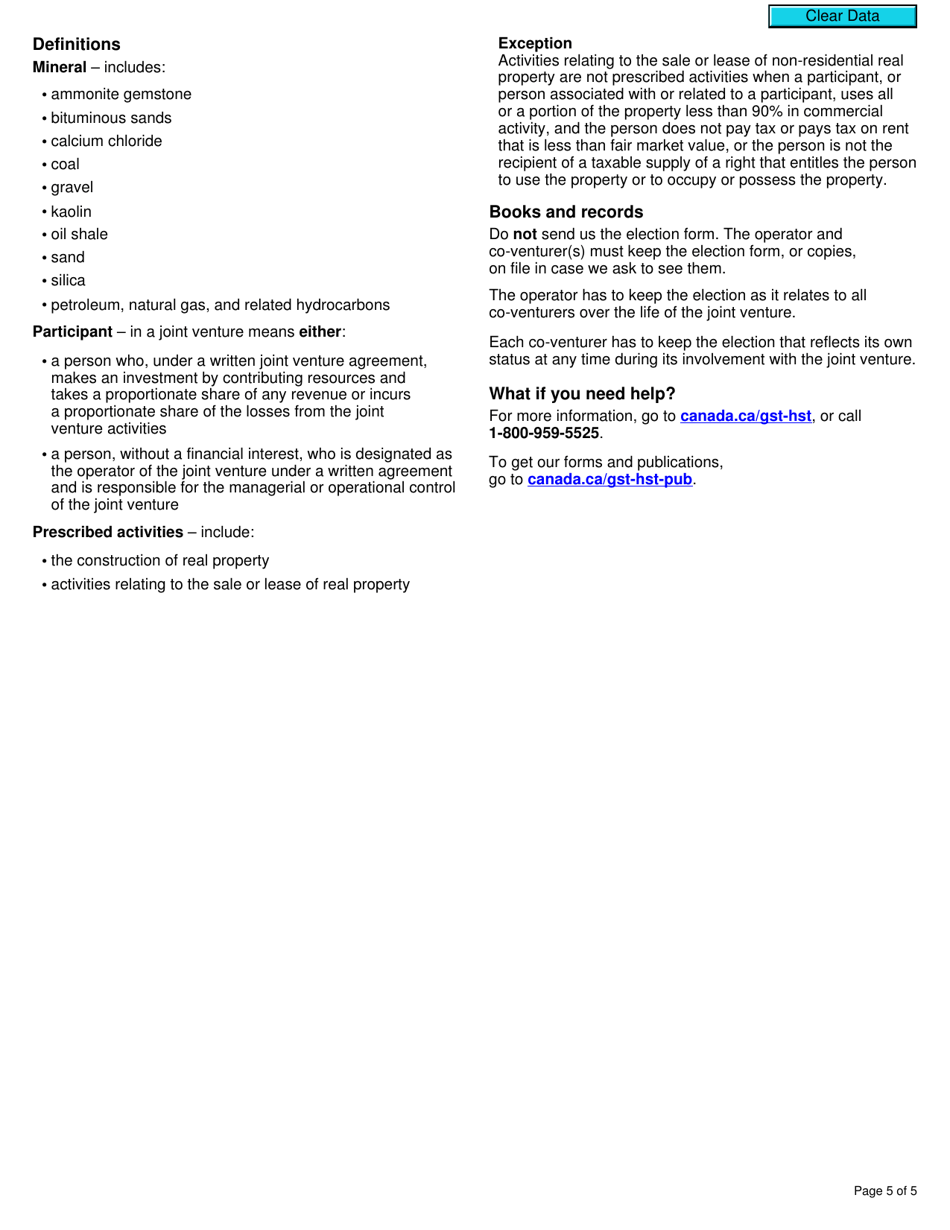

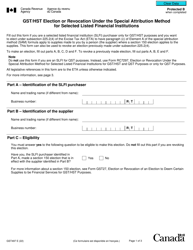

Form GST21 Election or Revocation of an Election to Have the Joint Venture Operator Account for Gst / Hst - Canada

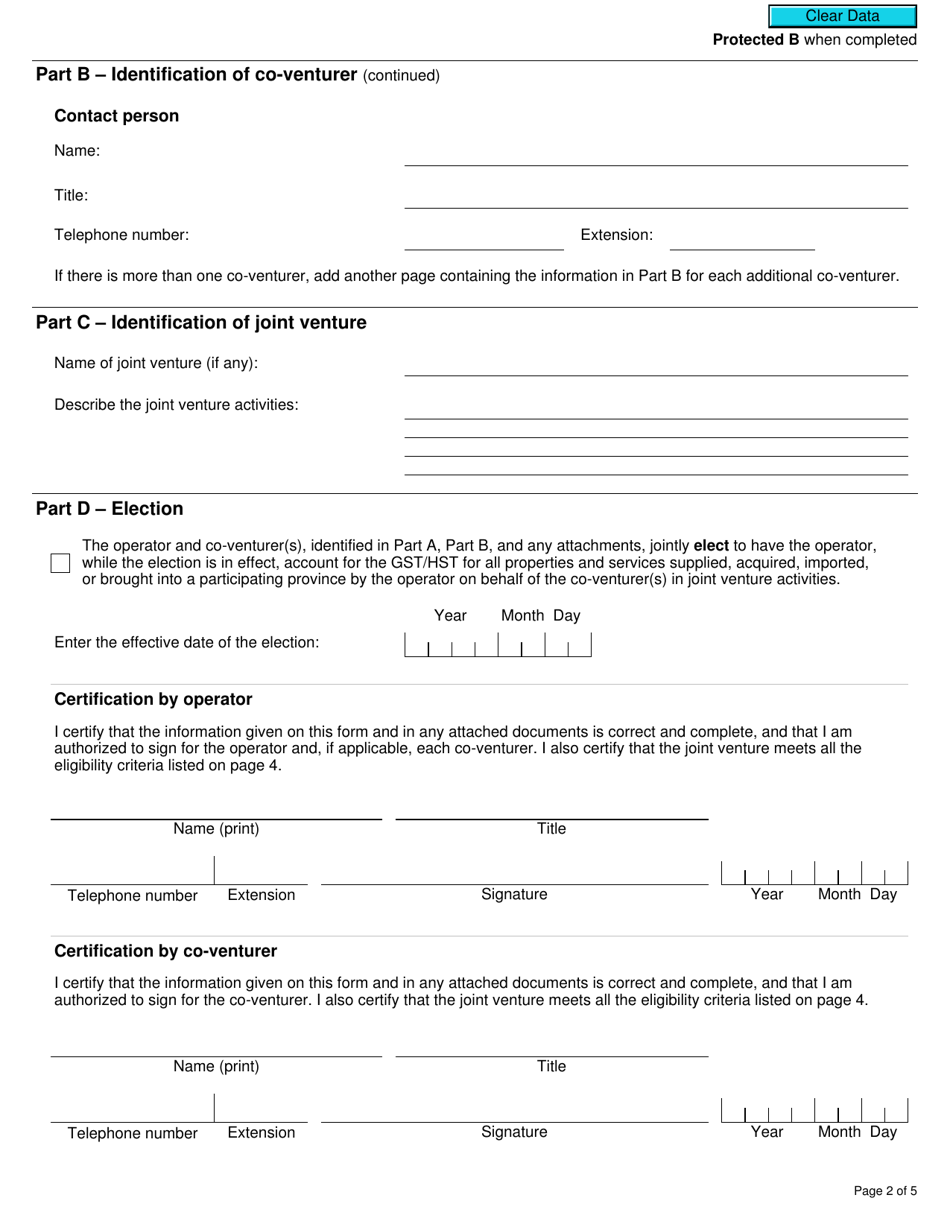

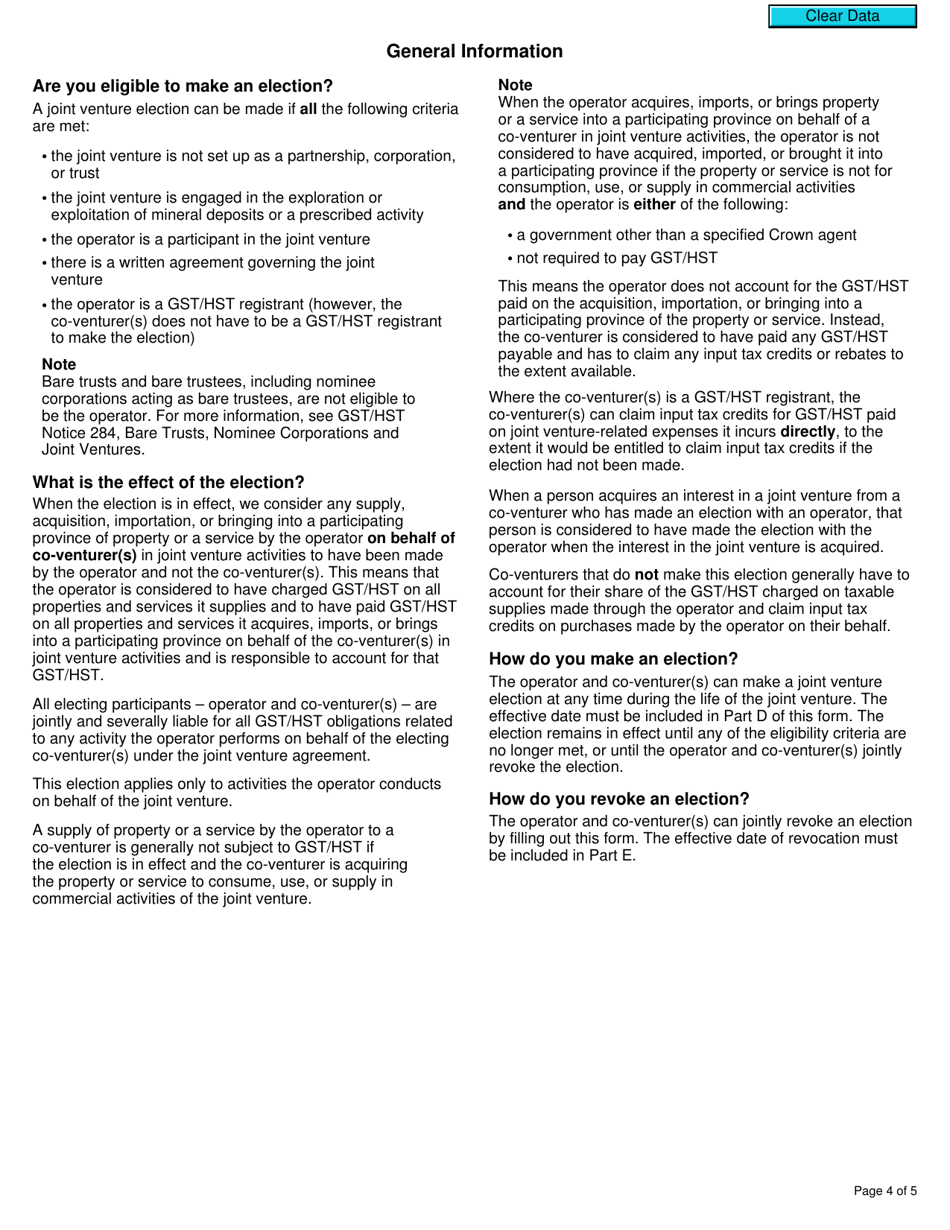

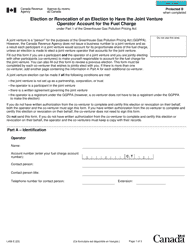

Form GST21 "Election or Revocation of an Election to Have the Joint Venture Operator Account for GST/HST" in Canada is used for making an election or revoking an election to have the joint venture operator account for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

The joint venture operator in Canada files the Form GST21 for election or revocation of an election to have the joint venture operator account for GST/HST.

FAQ

Q: What is Form GST21?

A: Form GST21 is used to make an election or revoke an election to have the joint venture operator account for GST/HST.

Q: What is the purpose of Form GST21?

A: The purpose of Form GST21 is to allow joint ventures to elect or revoke an election for the joint venture operator to account for GST/HST.

Q: Who can use Form GST21?

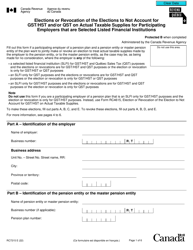

A: Joint ventures in Canada can use Form GST21 to make or revoke an election for the joint venture operator to account for GST/HST.

Q: What does it mean to have the joint venture operator account for GST/HST?

A: When the joint venture operator accounts for GST/HST, they are responsible for collecting and remitting the sales tax on behalf of the joint venture.

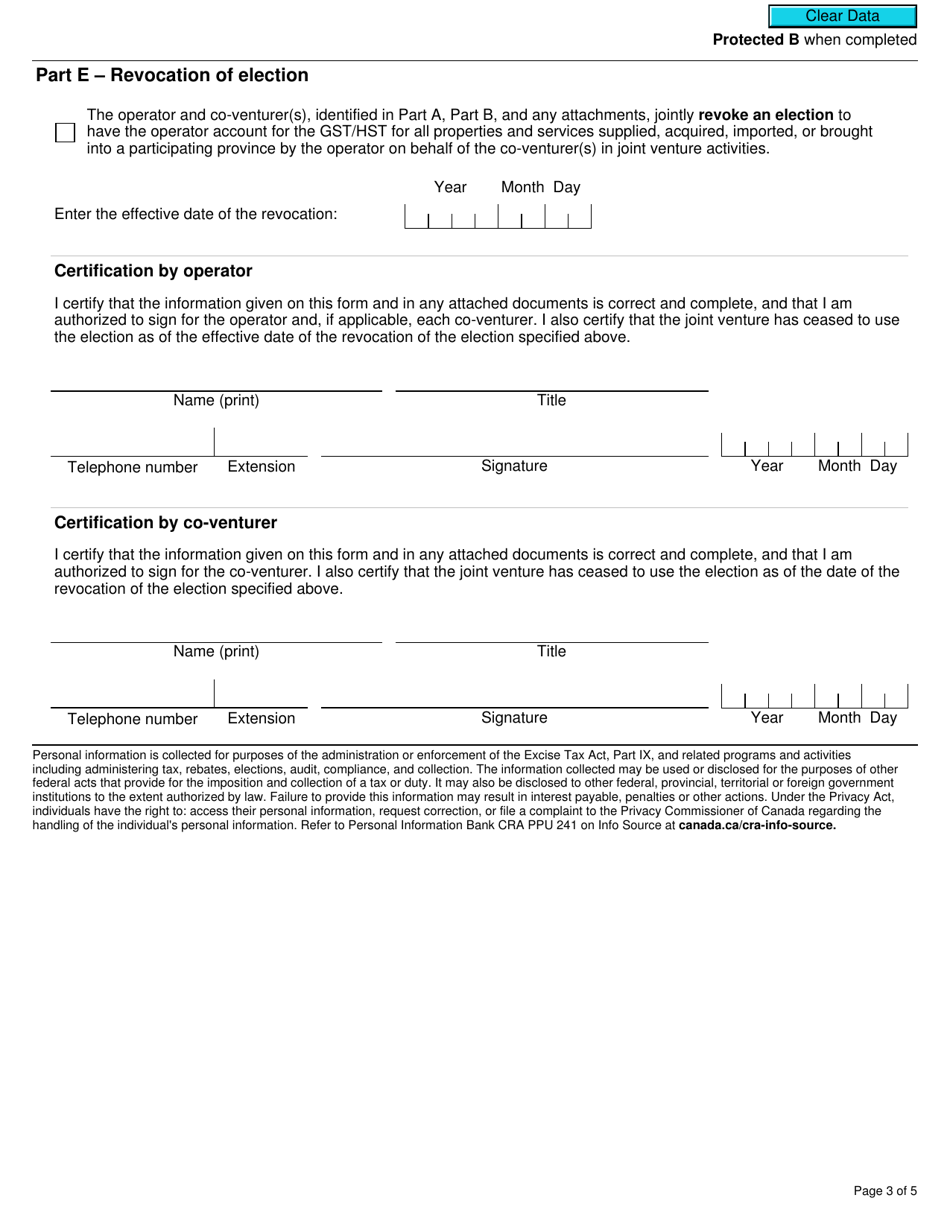

Q: Can an election be revoked once it is made?

A: Yes, an election made using Form GST21 can be revoked at a later date if desired.

Q: Are there any deadlines for filing Form GST21?

A: The CRA requires Form GST21 to be filed within specific time limits. It is important to consult the CRA guidelines or seek professional advice to ensure compliance.

Q: What are the consequences of not filing Form GST21?

A: Failure to file Form GST21 or comply with the CRA guidelines may result in penalties and interest being imposed by the CRA.

Q: Is there a fee for filing Form GST21?

A: There is no fee for filing Form GST21. However, joint ventures may be subject to other GST/HST obligations and fees.

Q: Can I seek professional assistance to complete Form GST21?

A: Yes, it is recommended to seek professional assistance, such as a tax advisor or accountant, to ensure accurate completion of Form GST21.