This version of the form is not currently in use and is provided for reference only. Download this version of

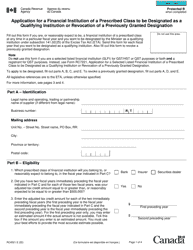

Form GST118

for the current year.

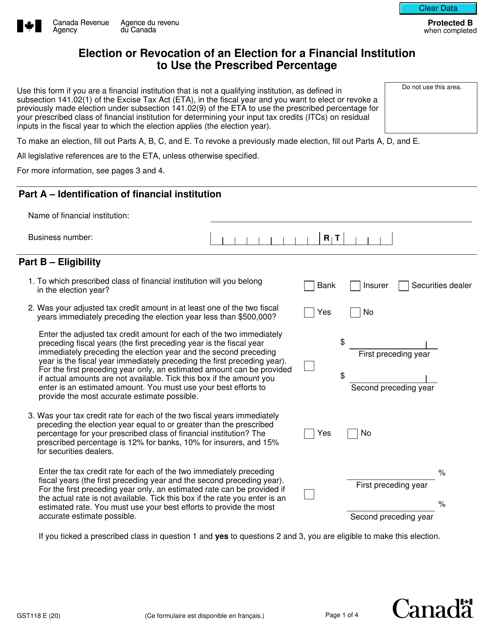

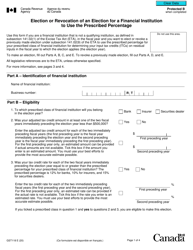

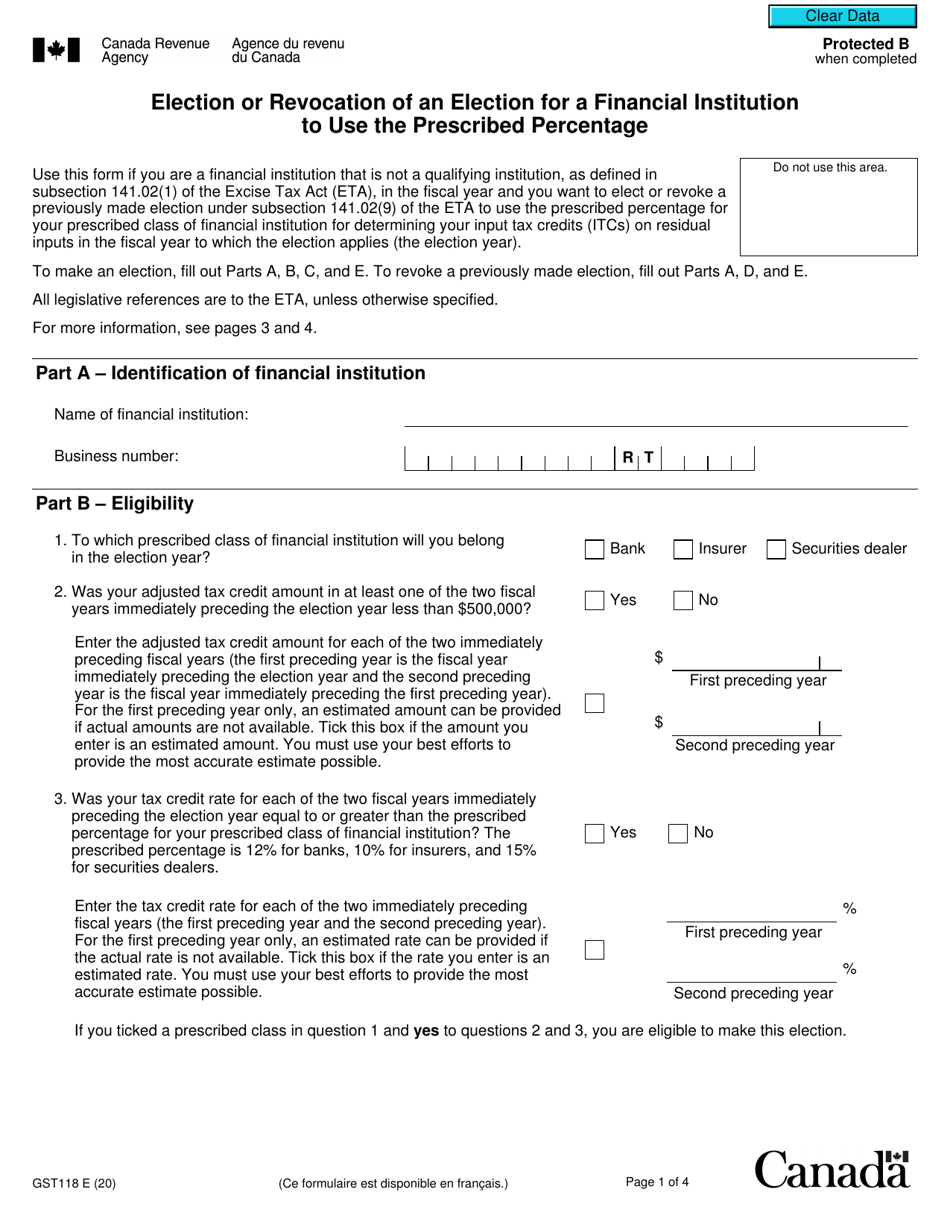

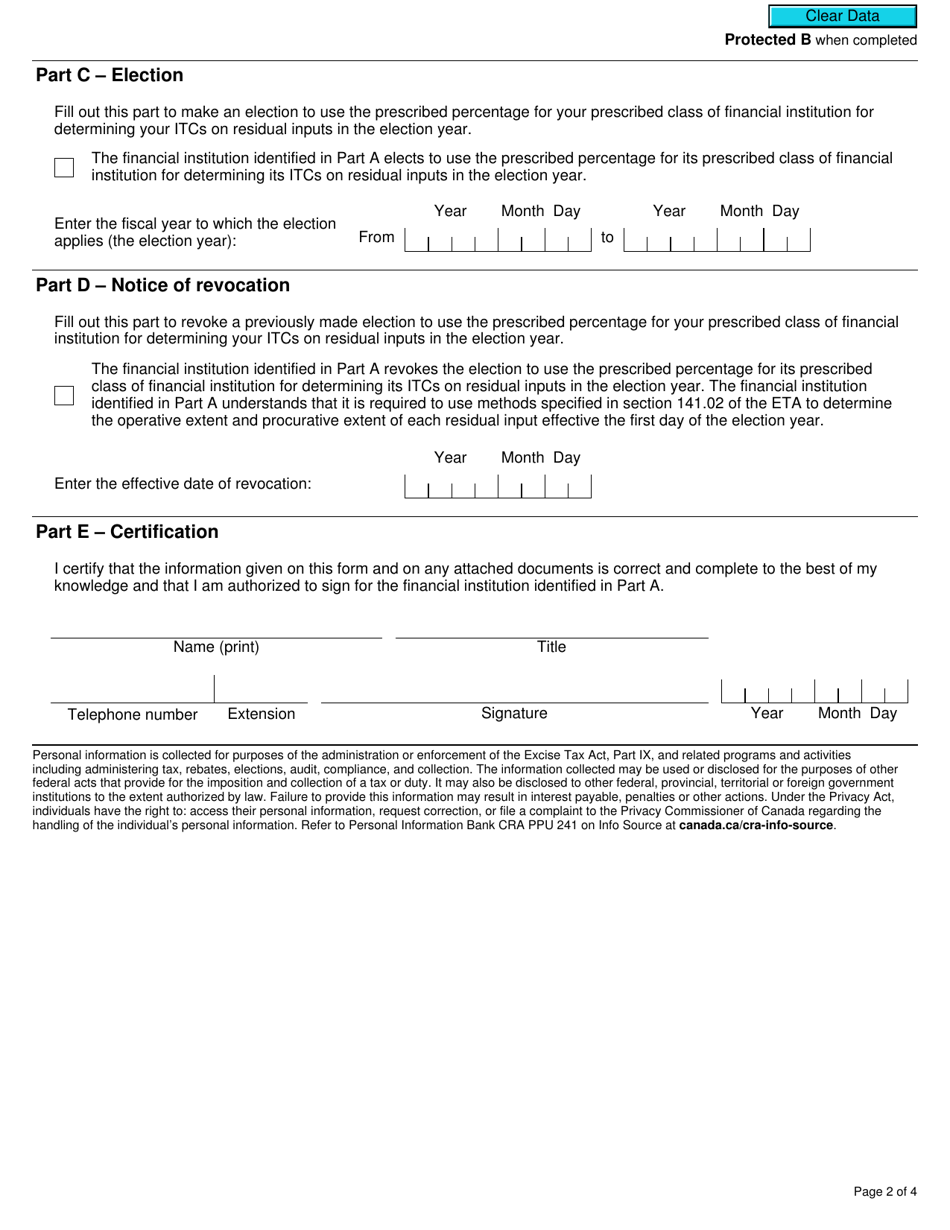

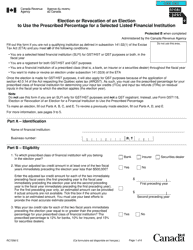

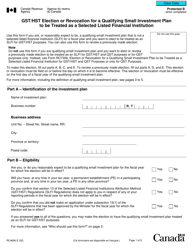

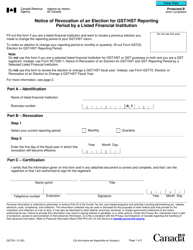

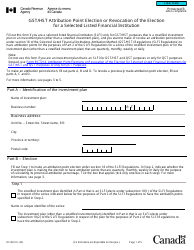

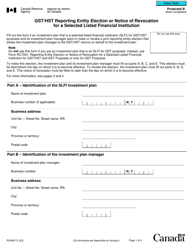

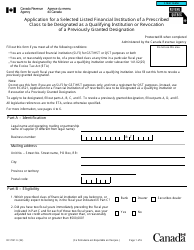

Form GST118 Election or Revocation of an Election for a Financial Institution to Use the Prescribed Percentage - Canada

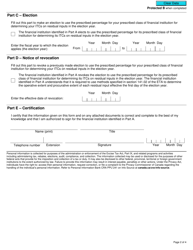

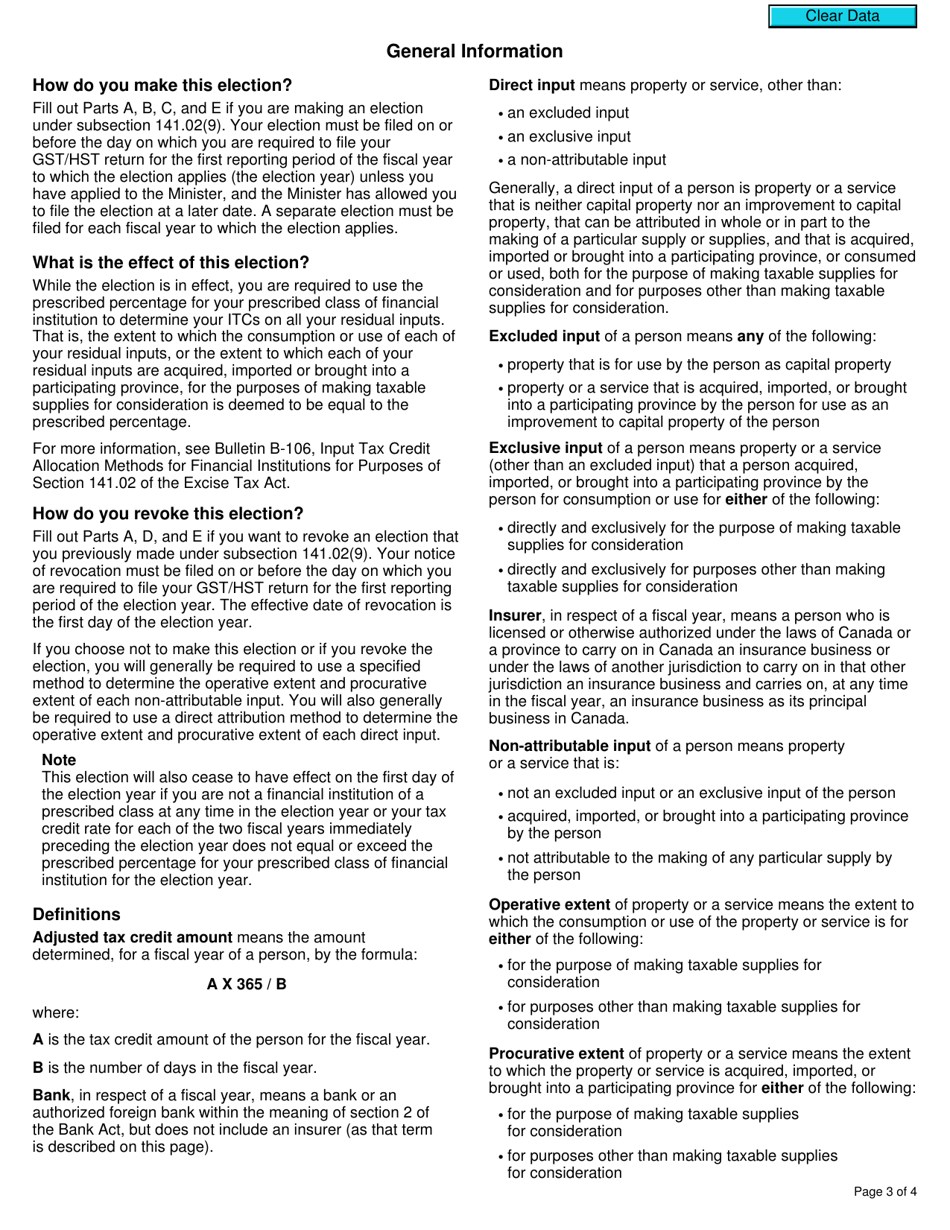

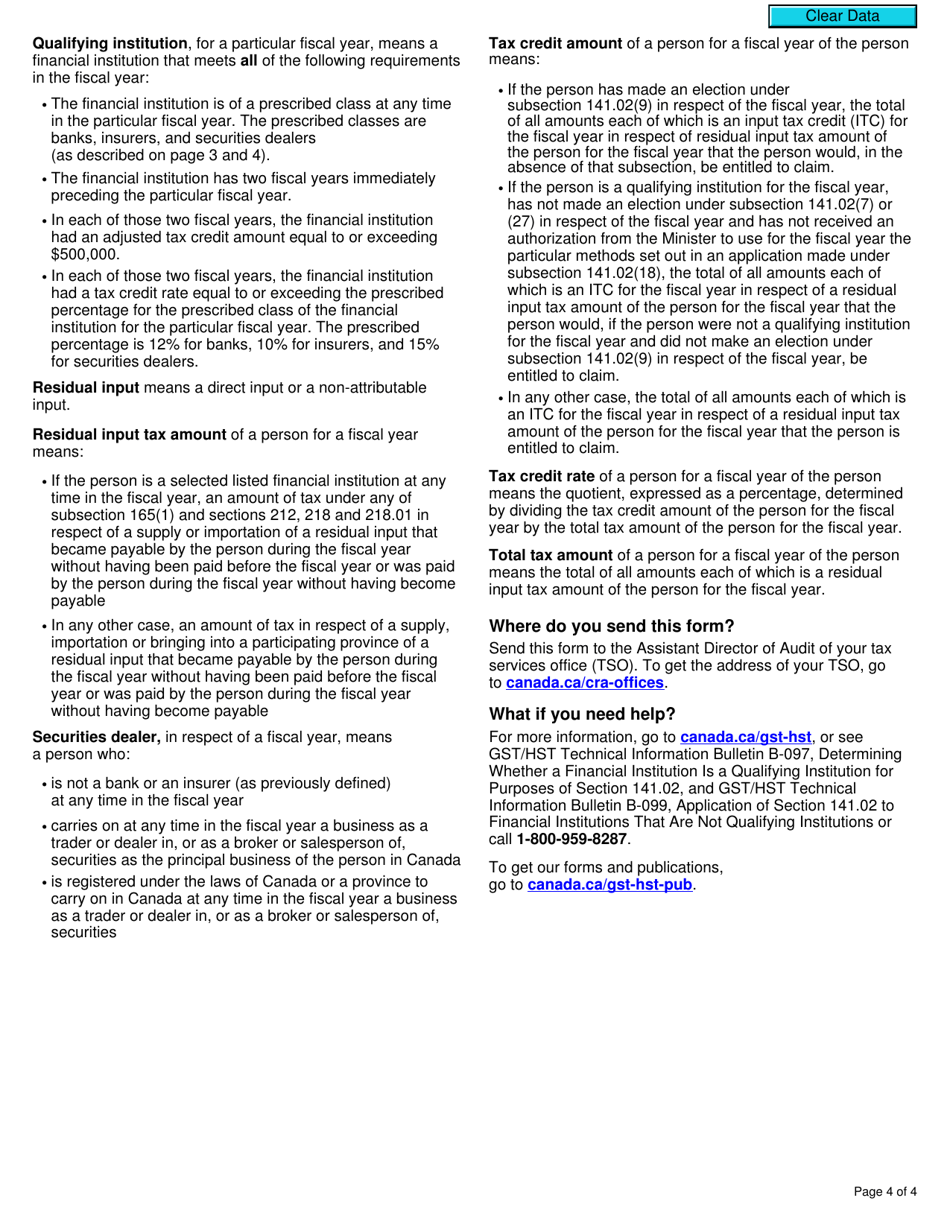

Form GST118 is used in Canada for financial institutions to elect or revoke their election to use the prescribed percentage method to calculate their input tax credits (ITCs) for goods and services tax/harmonized sales tax (GST/HST) purposes. The prescribed percentage method allows financial institutions to claim ITCs based on a prescribed percentage of the GST/HST paid on inputs, rather than tracking and documenting the actual GST/HST paid on each input.

The Form GST118 Election or Revocation of an Election for a Financial Institution to Use the Prescribed Percentage in Canada is filed by the financial institution itself.

FAQ

Q: What is the Form GST118?

A: The Form GST118 is the Election or Revocation of an Election for a Financial Institution to Use the Prescribed Percentage.

Q: What is a financial institution?

A: A financial institution is a type of business that provides financial services, such as banks, credit unions, and investment firms.

Q: What is the prescribed percentage?

A: The prescribed percentage is the percentage of input tax credits that a financial institution is allowed to claim.

Q: Why would a financial institution use the prescribed percentage?

A: A financial institution may choose to use the prescribed percentage in order to simplify their GST/HST accounting and reporting.

Q: Can a financial institution change their election?

A: Yes, a financial institution can revoke their election to use the prescribed percentage or make a new election at any time.

Q: Are there any eligibility requirements for using the prescribed percentage?

A: Yes, a financial institution must meet certain criteria, such as being a resident of Canada and being engaged primarily in financial services.

Q: What are the implications of using the prescribed percentage?

A: Using the prescribed percentage affects how a financial institution calculates and remits GST/HST.

Q: Is there a deadline for filing the Form GST118?

A: The deadline for filing the Form GST118 is usually the same as the financial institution's GST/HST return filing deadline.

Q: Who should I contact if I have questions about the Form GST118?

A: If you have questions about the Form GST118, you should contact the Canada Revenue Agency (CRA) or consult a tax professional.