This version of the form is not currently in use and is provided for reference only. Download this version of

Form B400-5

for the current year.

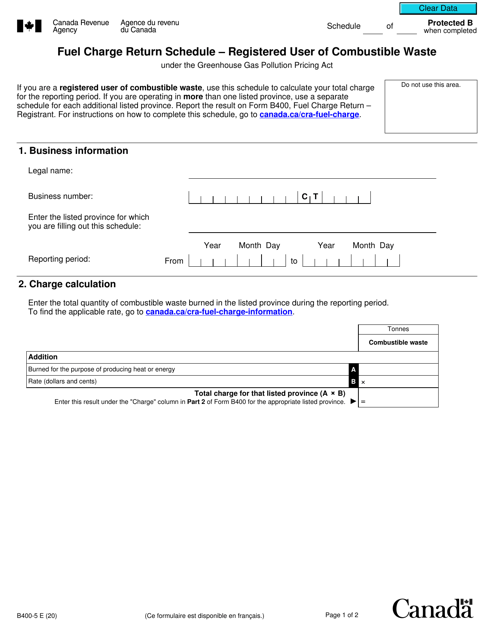

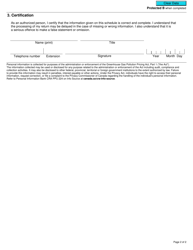

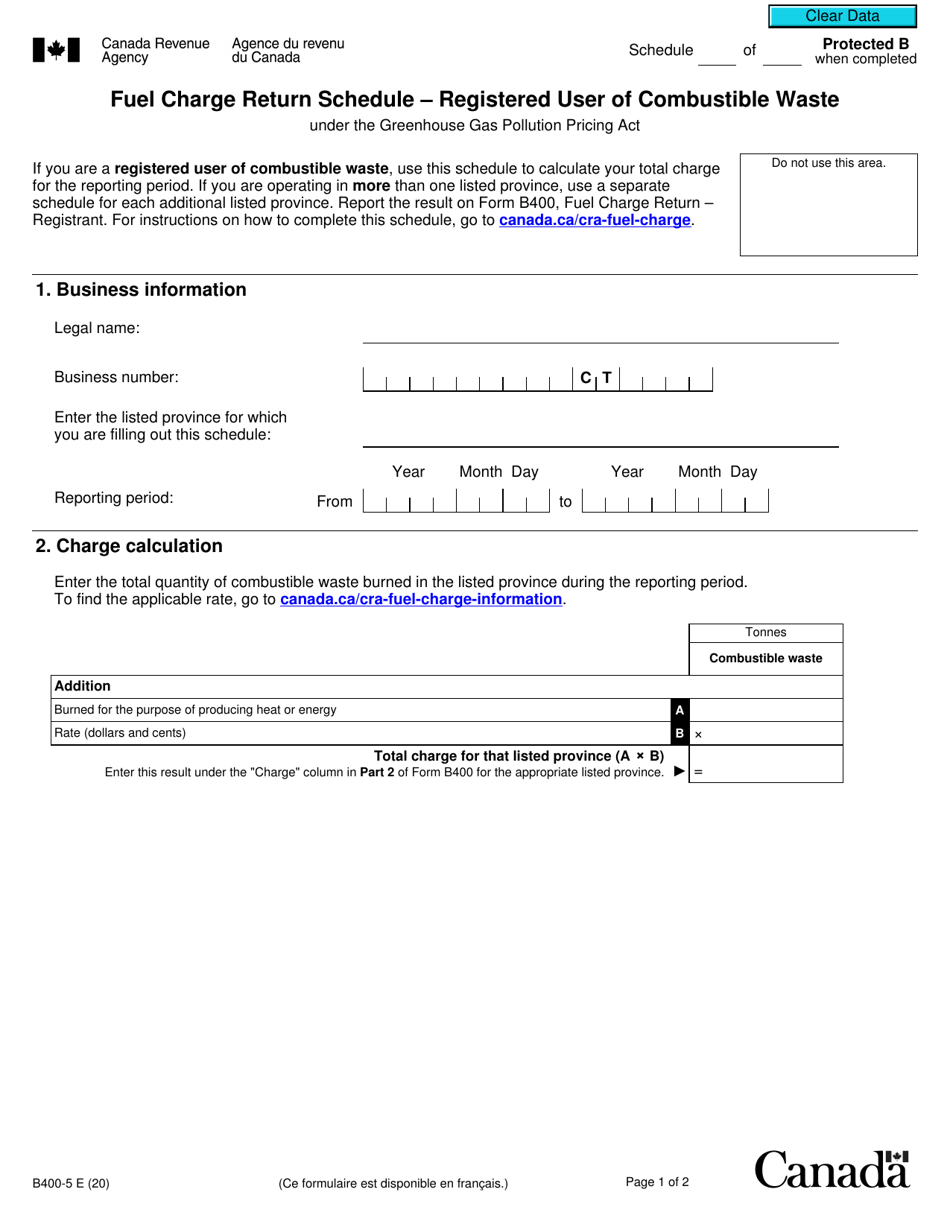

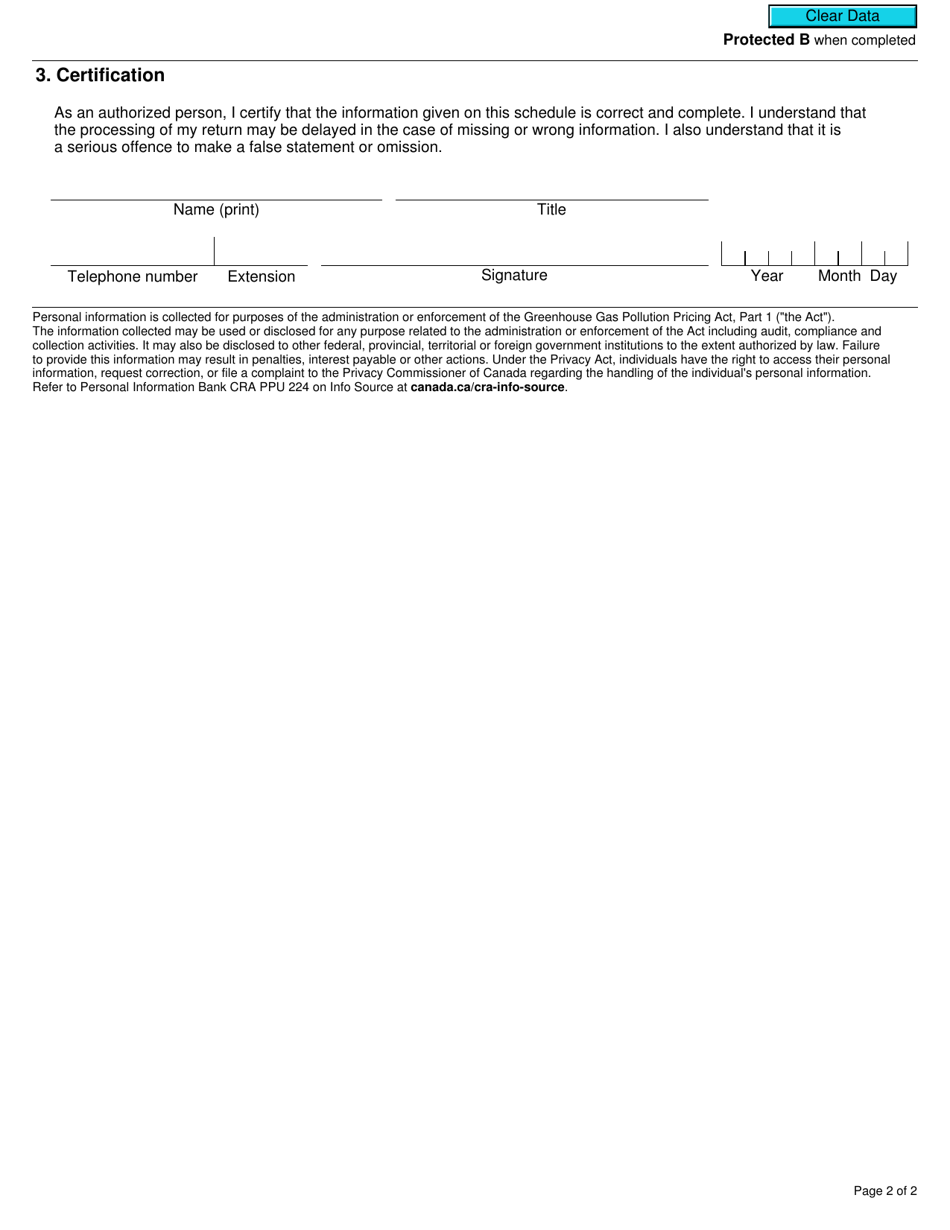

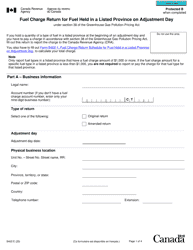

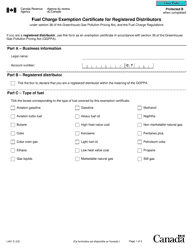

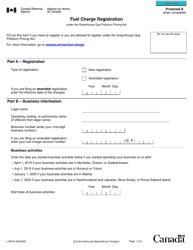

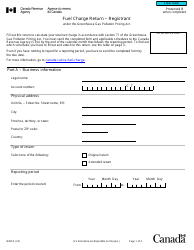

Form B400-5 Fuel Charge Return Schedule - Registered User of Combustible Waste - Canada

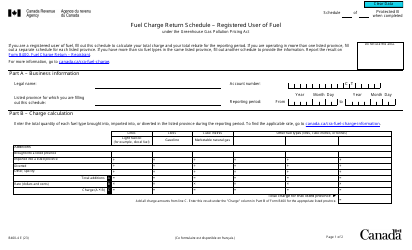

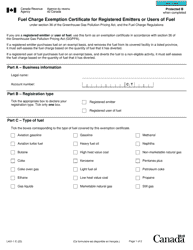

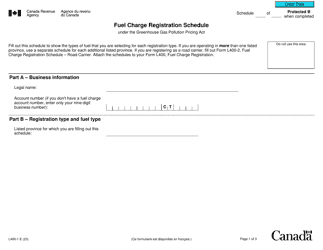

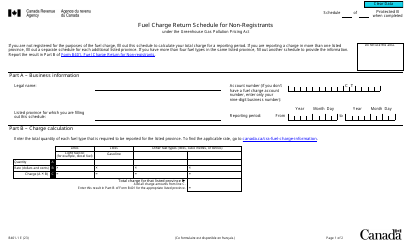

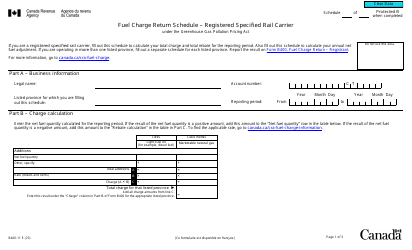

The Form B400-5 Fuel Charge Return Schedule is used by registered users of combustible waste in Canada to report and calculate the fuel charge payable on the production, import, and supply of combustible waste.

The Form B400-5 Fuel Charge Return Schedule is filed by registered users of combustible waste in Canada.

FAQ

Q: What is the Form B400-5 Fuel Charge Return Schedule?

A: The Form B400-5 Fuel Charge Return Schedule is a document used by registered users of combustible waste in Canada to report their fuel charges.

Q: Who needs to use the Form B400-5 Fuel Charge Return Schedule?

A: Registered users of combustible waste in Canada need to use the Form B400-5 Fuel Charge Return Schedule.

Q: What is a registered user of combustible waste?

A: A registered user of combustible waste is a person or entity that produces, imports, or sells combustible waste in Canada.

Q: What are fuel charges?

A: Fuel charges are fees assessed on combustible waste to help reduce carbon emissions and environmental impact.

Q: What information is required in the Form B400-5 Fuel Charge Return Schedule?

A: The Form B400-5 Fuel Charge Return Schedule requires information such as the user's registration number, amount of combustible waste produced, and the corresponding fuel charge.

Q: When is the Form B400-5 Fuel Charge Return Schedule due?

A: The due date for the Form B400-5 Fuel Charge Return Schedule varies and is generally specified by the Canada Revenue Agency.

Q: What are the consequences of not filing the Form B400-5 Fuel Charge Return Schedule?

A: Failure to file the Form B400-5 Fuel Charge Return Schedule may result in penalties and potential legal consequences.