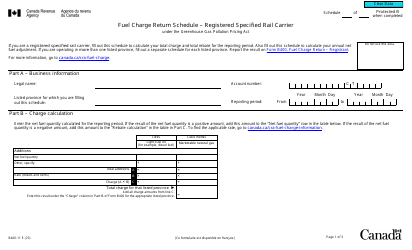

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B400-7

for the current year.

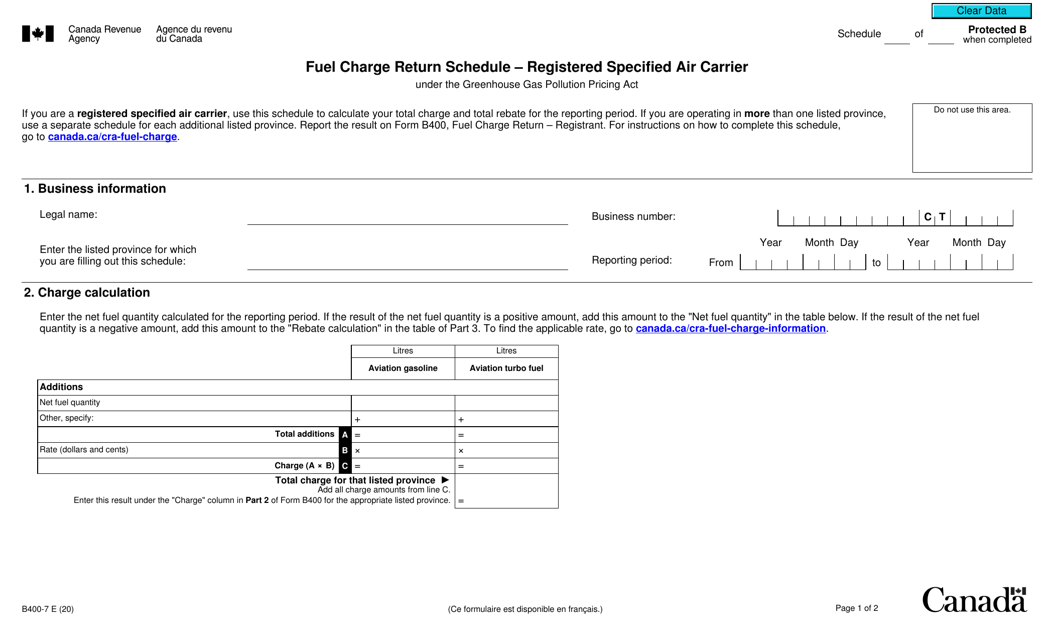

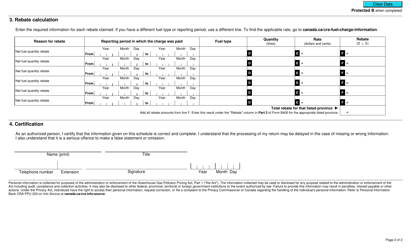

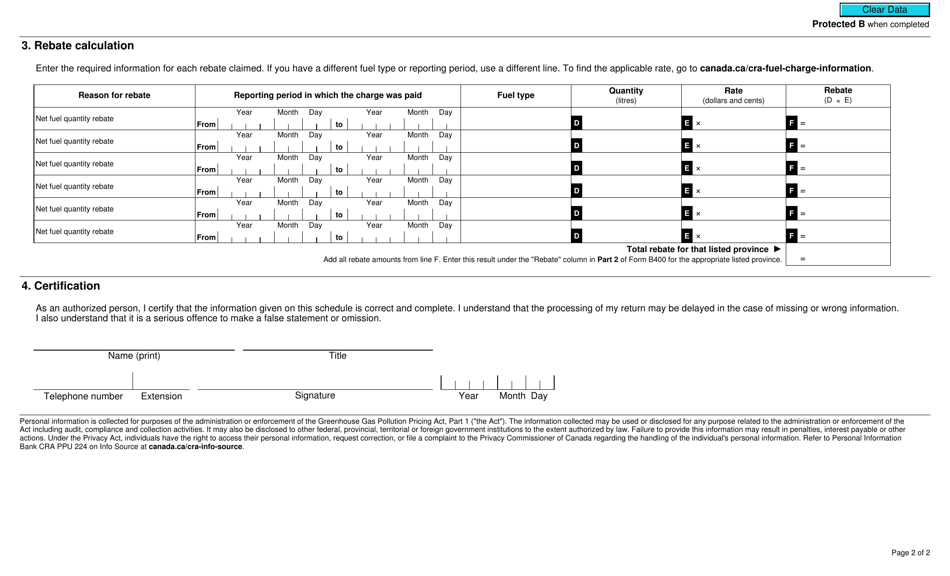

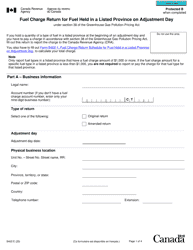

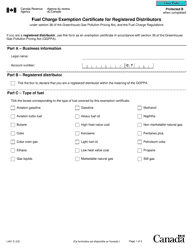

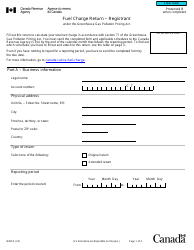

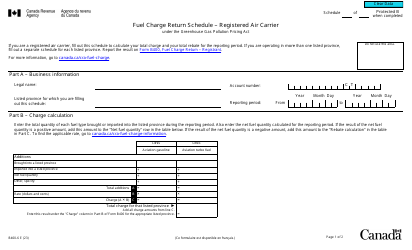

Form B400-7 Fuel Charge Return Schedule - Registered Specified Air Carrier - Canada

Form B400-7 Fuel Charge Return Schedule is used by registered specified air carriers in Canada to report and remit fuel charge amounts to the Canada Revenue Agency (CRA). It helps track and collect the applicable fuel charges paid by air carriers operating in Canada.

The Form B400-7 Fuel Charge Return Schedule - Registered Specified Air Carrier - Canada is filed by registered specified air carriers in Canada.

FAQ

Q: What is Form B400-7?

A: Form B400-7 is the Fuel Charge Return Schedule for Registered Specified Air Carriers in Canada.

Q: Who is required to file Form B400-7?

A: Registered Specified Air Carriers in Canada are required to file Form B400-7.

Q: What is the purpose of Form B400-7?

A: The purpose of Form B400-7 is to report and remit the fuel charge payable by Registered Specified Air Carriers in Canada.

Q: What is a Registered Specified Air Carrier?

A: A Registered Specified Air Carrier refers to an air carrier that is registered under the Excise Tax Act of Canada and is engaged in an international or intercontinental transportation service.

Q: Are there any exemptions from filing Form B400-7?

A: Yes, certain Registered Specified Air Carriers may be exempt from filing Form B400-7. It is recommended to consult the Canada Revenue Agency (CRA) for specific exemption criteria.

Q: How often should Form B400-7 be filed?

A: Form B400-7 should be filed on a monthly basis.

Q: What information is required on Form B400-7?

A: Form B400-7 requires the Registered Specified Air Carrier to report details of fuel purchases, fuel usage, and other related information as specified by the Canada Revenue Agency (CRA).

Q: When is Form B400-7 due?

A: Form B400-7 is due by the end of the month following the reporting period. For example, the form for the month of January is due by the end of February.

Q: Are there any penalties for late filing or non-compliance with Form B400-7?

A: Yes, penalties may be applied for late filing or non-compliance with Form B400-7. It is important to ensure timely and accurate filing to avoid penalties.