This version of the form is not currently in use and is provided for reference only. Download this version of

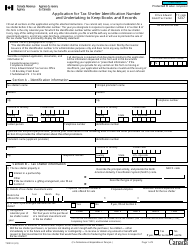

Form L400-3

for the current year.

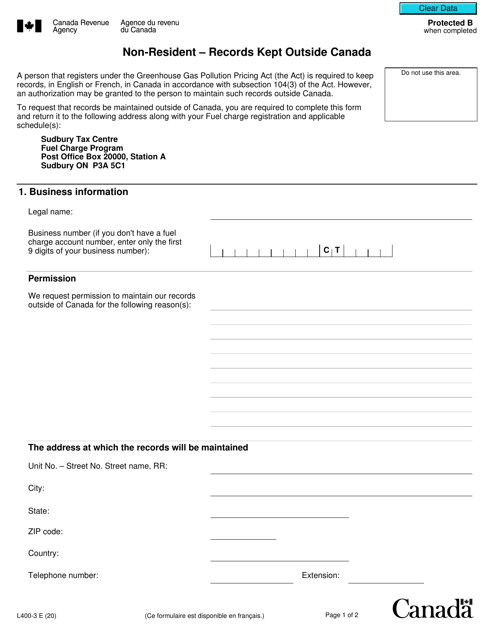

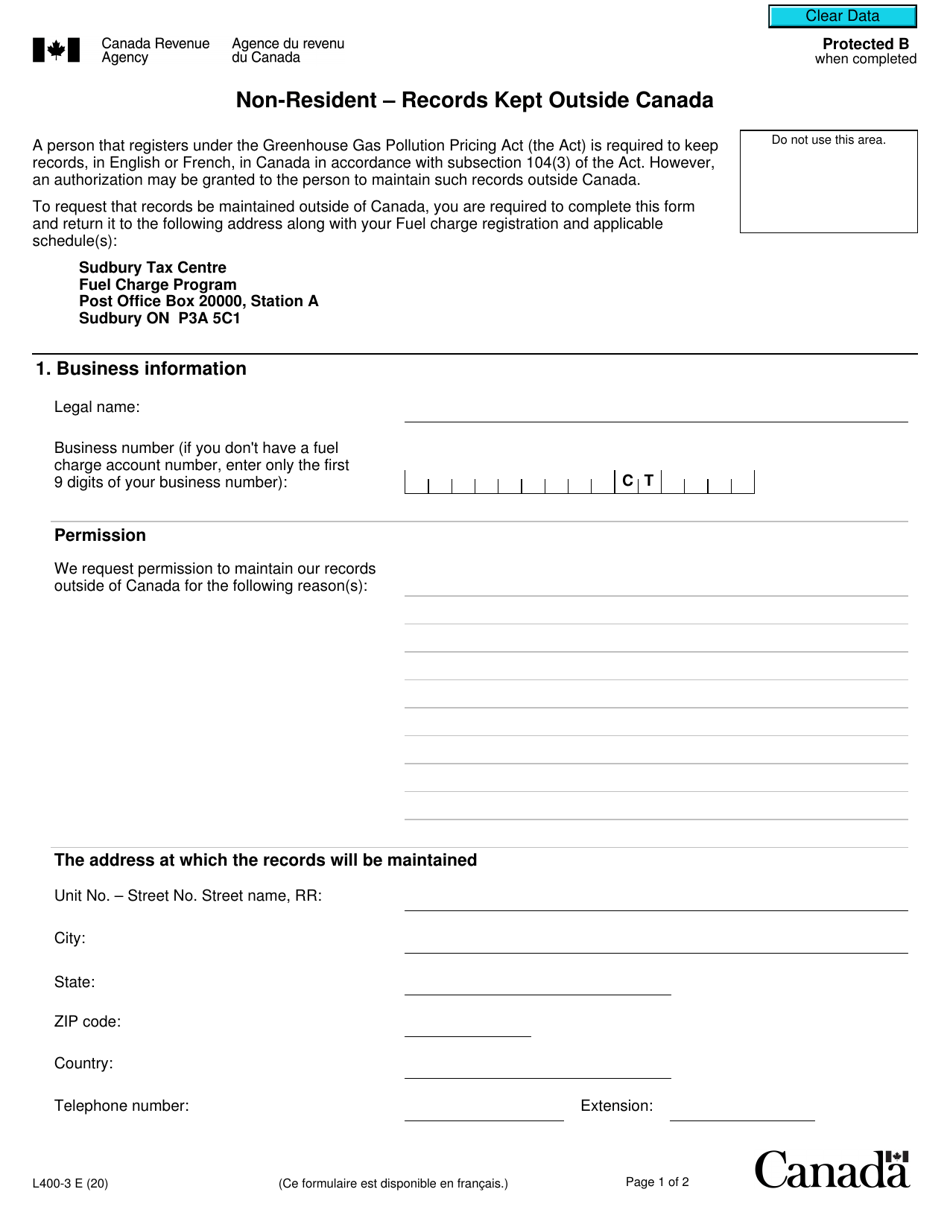

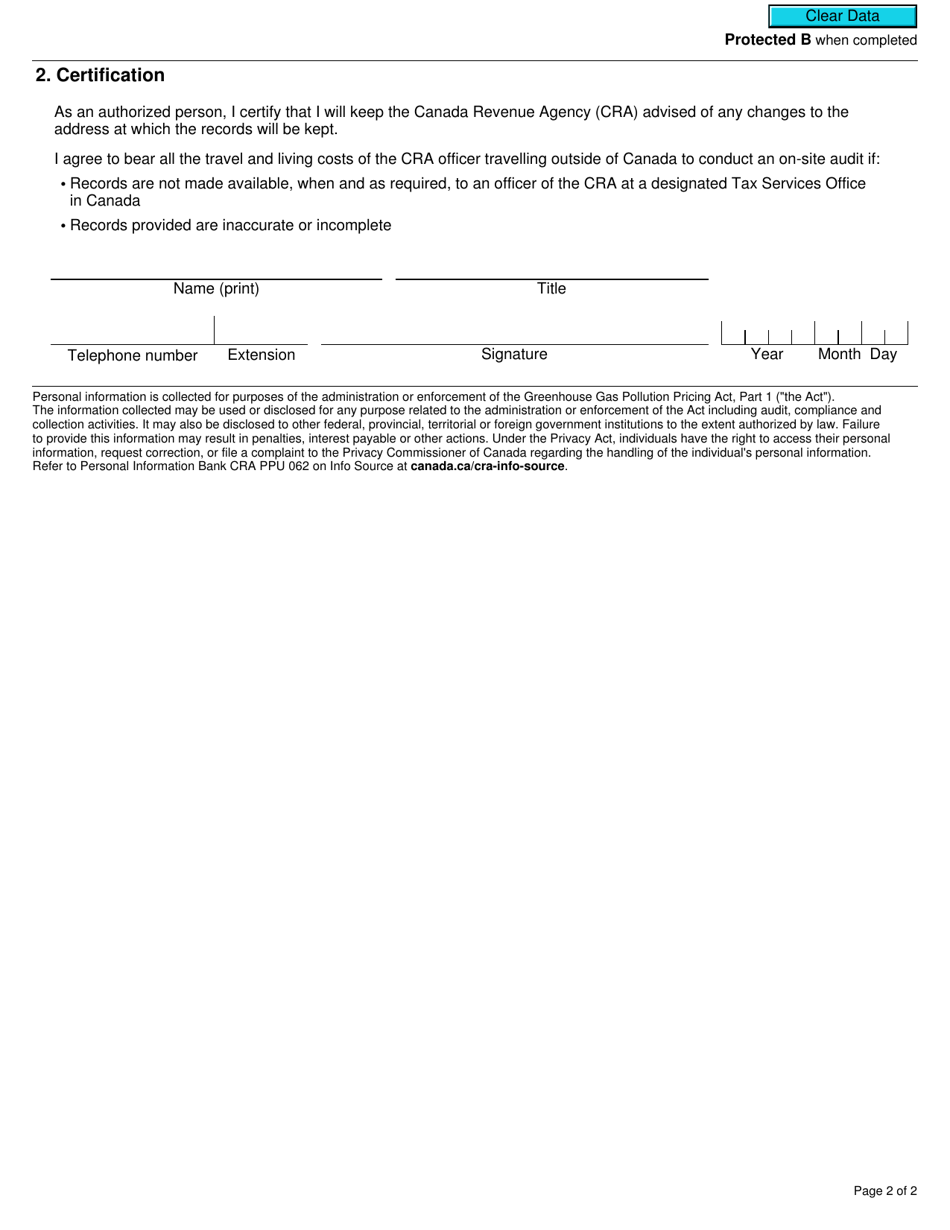

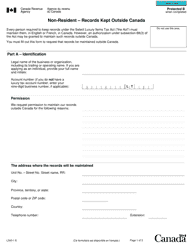

Form L400-3 Non-resident - Records Kept Outside Canada - Canada

Form L400-3 Non-resident - Records Kept Outside Canada is used by non-resident businesses to report their Canadian income and expenses, where their records are kept outside Canada. This form helps the Canadian tax authorities in assessing and verifying the accuracy of the reported information.

The Form L400-3 Non-resident - Records Kept Outside Canada in Canada is filed by non-resident individuals or companies who maintain their records outside of Canada.

FAQ

Q: What is Form L400-3?

A: Form L400-3 is a tax form used by non-residents of Canada to report that their books and records are kept outside of Canada.

Q: Who needs to file Form L400-3?

A: Non-residents of Canada who keep their books and records outside of Canada need to file Form L400-3.

Q: What does Form L400-3 require?

A: Form L400-3 requires non-residents of Canada to provide details about their books and records and the location where they are kept outside of Canada.

Q: Why is Form L400-3 important?

A: Form L400-3 is important because it allows the Canadian tax authorities to verify that the books and records of non-residents are kept outside of Canada as required by law.

Q: When should Form L400-3 be filed?

A: Form L400-3 should be filed with the Canadian tax authorities by the deadline specified by the tax authorities.

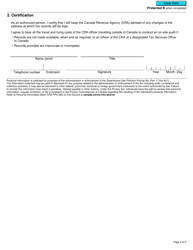

Q: Are there any penalties for not filing Form L400-3?

A: Yes, there may be penalties for not filing Form L400-3 or for providing false or misleading information on the form.

Q: Can I submit Form L400-3 electronically?

A: No, Form L400-3 cannot be submitted electronically. It must be filled out and mailed or hand-delivered to the tax authorities.

Q: Is Form L400-3 only for businesses?

A: No, Form L400-3 is not only for businesses. It is also used by individuals who are non-residents of Canada and keep their books and records outside of Canada.

Q: What should I do if I have questions or need assistance with Form L400-3?

A: If you have questions or need assistance with Form L400-3, you can contact the Canada Revenue Agency or consult with a tax professional.