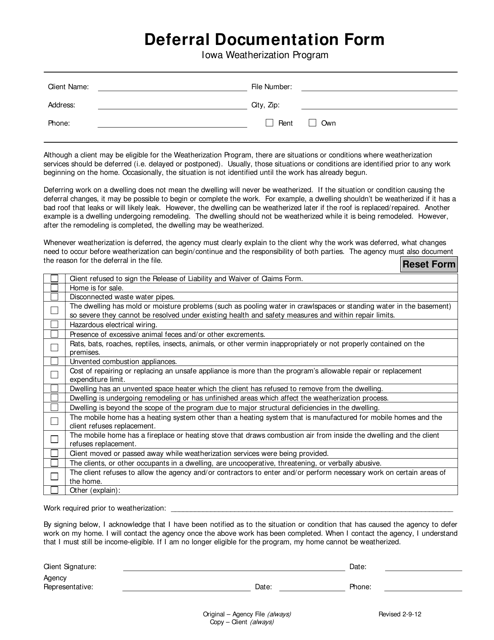

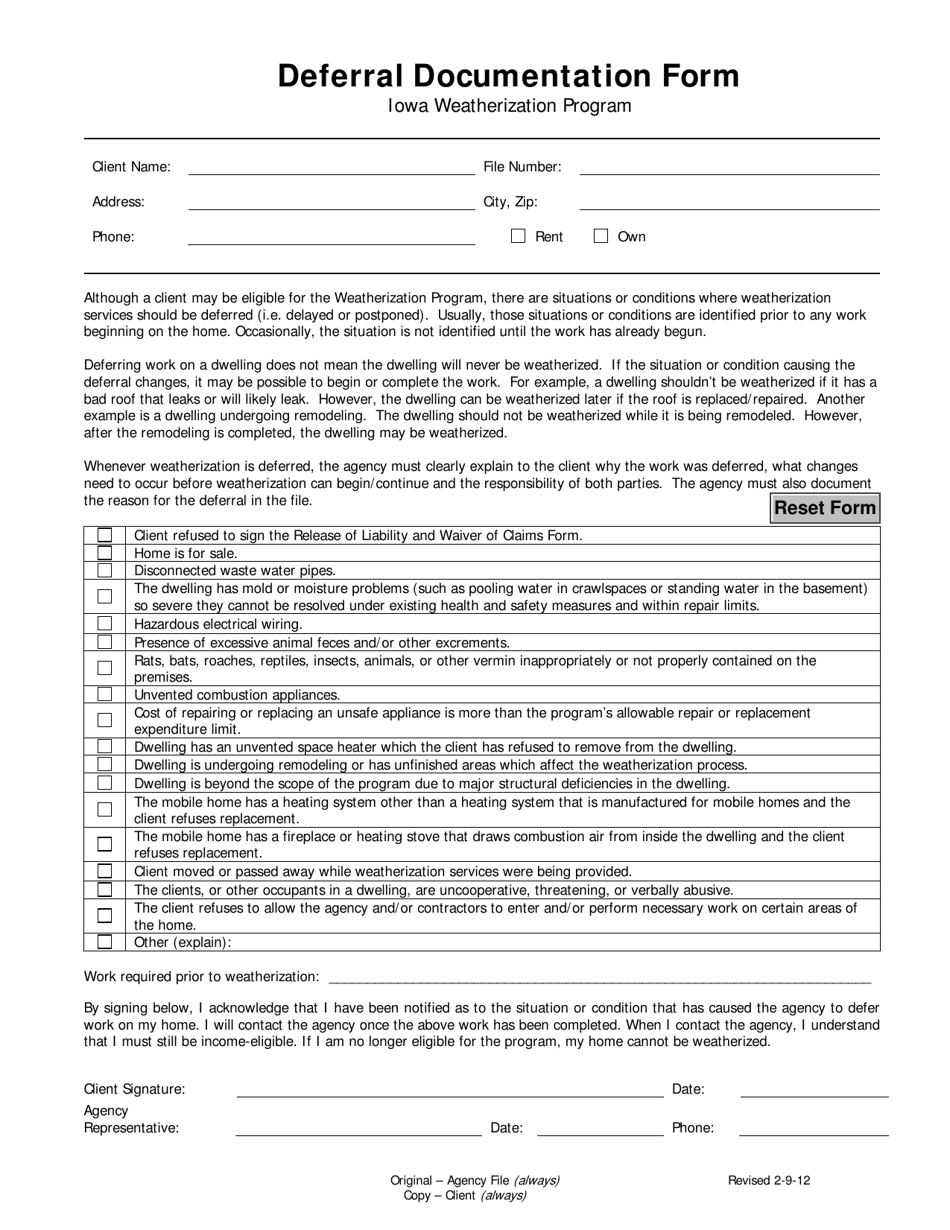

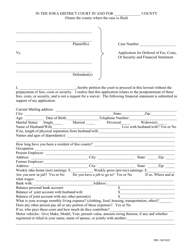

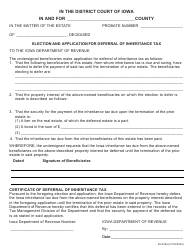

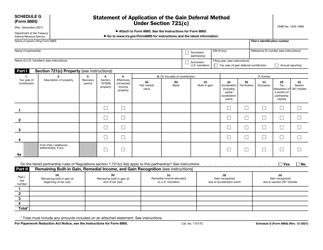

Deferral Documentation Form - Iowa

Deferral Documentation Form is a legal document that was released by the Iowa Department of Human Rights - a government authority operating within Iowa.

FAQ

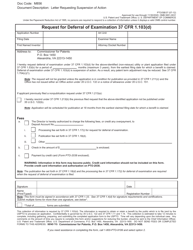

Q: What is a Deferral Documentation Form?

A: A Deferral Documentation Form is a form used in Iowa to request a deferral on property taxes.

Q: How do I request a deferral on property taxes in Iowa?

A: You can request a deferral by filling out a Deferral Documentation Form and submitting it to your local tax assessor's office.

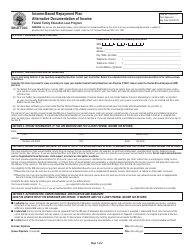

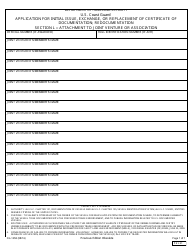

Q: Who is eligible for a deferral on property taxes in Iowa?

A: Eligibility for a deferral depends on factors such as age, income, and disability. The specific criteria may vary, so it's best to check with your local tax assessor's office for exact requirements.

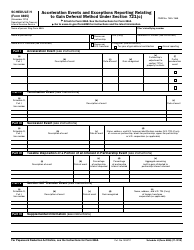

Q: What is the purpose of a deferral on property taxes?

A: The purpose of a deferral is to provide temporary relief for eligible individuals who are unable to pay their property taxes.

Q: Is a deferral on property taxes in Iowa the same as a forgiveness or waiver?

A: No, a deferral is not the same as forgiveness or waiver. It is a temporary delay of payment, and the deferred taxes must eventually be paid.

Q: Are there any penalties or interest associated with a deferral on property taxes in Iowa?

A: Yes, there may be penalties and interest charged on deferred taxes. It's important to review the terms and conditions of the deferral program to understand any additional costs.

Q: Can I sell my property if I have a deferral on property taxes in Iowa?

A: Yes, you can sell your property while having a deferral. However, the deferred taxes will need to be paid upon the sale of the property.

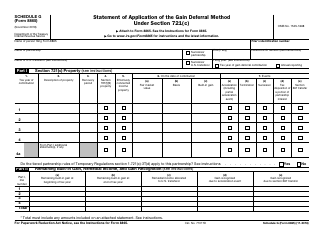

Form Details:

- Released on February 9, 2012;

- The latest edition currently provided by the Iowa Department of Human Rights;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Human Rights.