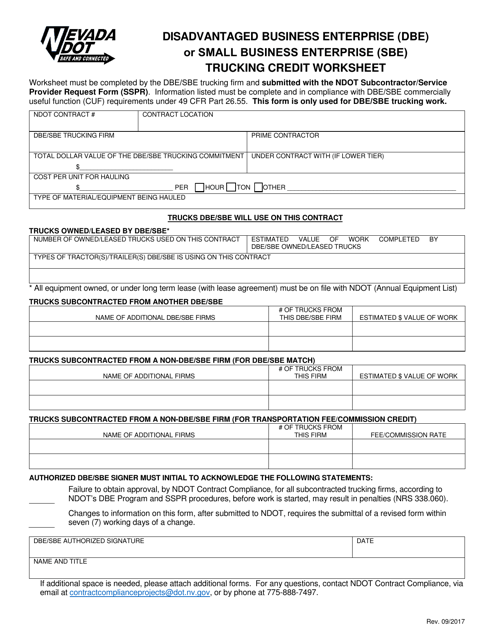

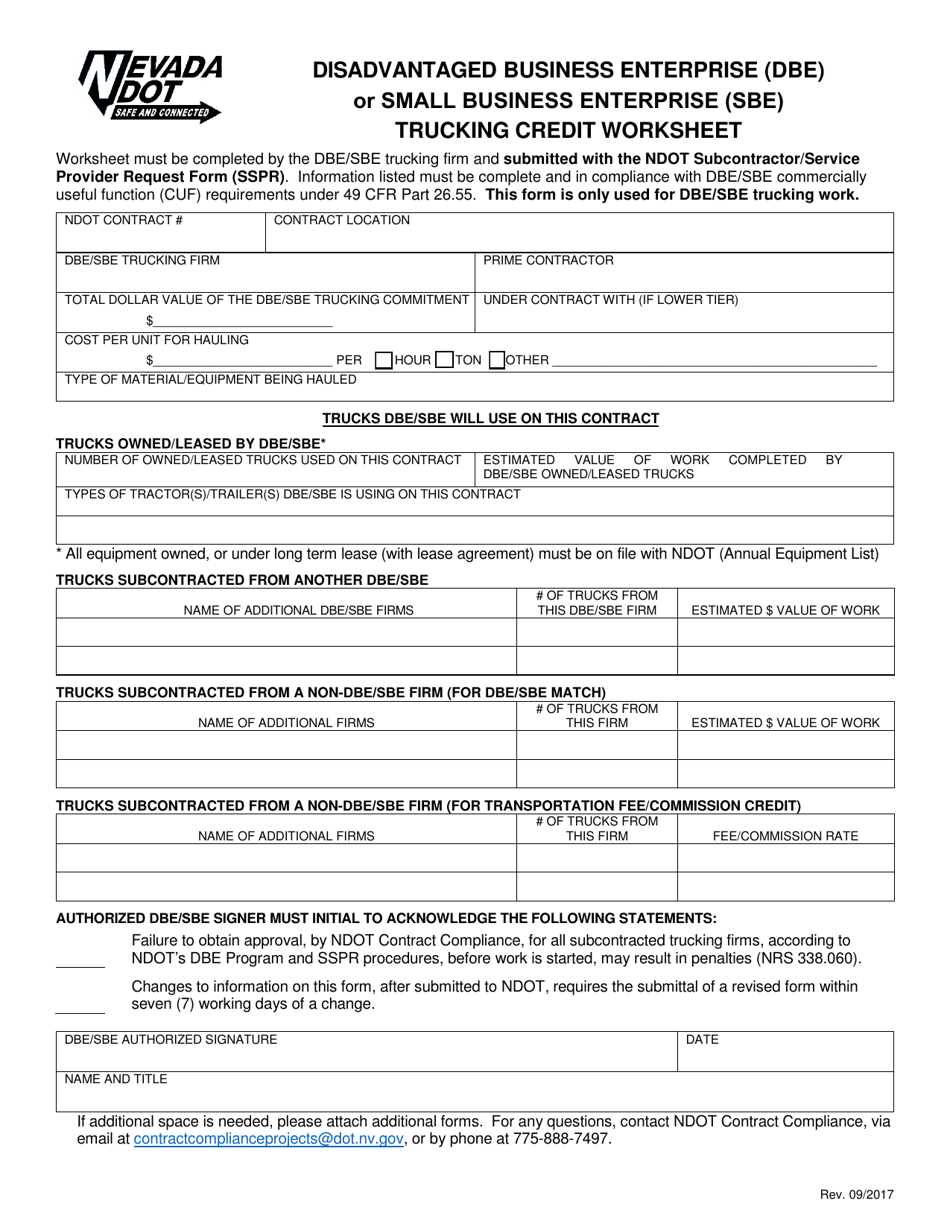

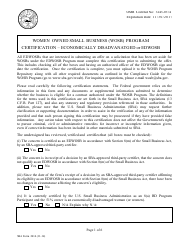

Disadvantaged Business Enterprise (Dbe) or Small Business Enterprise (Sbe) Trucking Credit Worksheet - Nevada

Disadvantaged Small Business Enterprise (Sbe) Trucking Credit Worksheet is a legal document that was released by the Nevada Department of Transportation - a government authority operating within Nevada.

FAQ

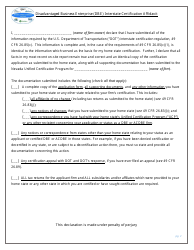

Q: What is the Disadvantaged Business Enterprise (DBE) or Small Business Enterprise (SBE) Trucking Credit Worksheet?

A: The DBE or SBE Trucking Credit Worksheet is a form used in Nevada to calculate tax credits for trucking companies that employ certified Disadvantaged Business Enterprise or Small Business Enterprise truck drivers.

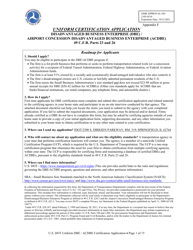

Q: Who can use the DBE or SBE Trucking Credit Worksheet?

A: Trucking companies in Nevada that employ certified Disadvantaged Business Enterprise or Small Business Enterprise truck drivers can use this worksheet.

Q: What is the purpose of the DBE or SBE Trucking Credit Worksheet?

A: The purpose of the worksheet is to calculate tax credits for trucking companies as an incentive for hiring certified Disadvantaged Business Enterprise or Small Business Enterprise truck drivers.

Q: How does the DBE or SBE Trucking Credit Worksheet work?

A: The worksheet includes sections where trucking companies can enter information about their operations, the number of eligible drivers they employ, and the types of jobs performed. This information is then used to calculate the tax credits.

Q: What are the benefits of using the DBE or SBE Trucking Credit Worksheet?

A: Using the worksheet allows eligible trucking companies to determine the amount of tax credits they are eligible for based on the employment of certified Disadvantaged Business Enterprise or Small Business Enterprise truck drivers.

Q: Are there any eligibility requirements to use the DBE or SBE Trucking Credit Worksheet?

A: Yes, trucking companies must employ certified Disadvantaged Business Enterprise or Small Business Enterprise truck drivers to be eligible to use this worksheet.

Q: Are there any limitations to the tax credits calculated using the DBE or SBE Trucking Credit Worksheet?

A: The tax credits may be subject to certain limitations, such as a maximum credit amount or restrictions on the types of taxes they can be applied against. It is recommended to review the specific regulations or consult a tax professional for more information.

Form Details:

- Released on September 1, 2017;

- The latest edition currently provided by the Nevada Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Transportation.