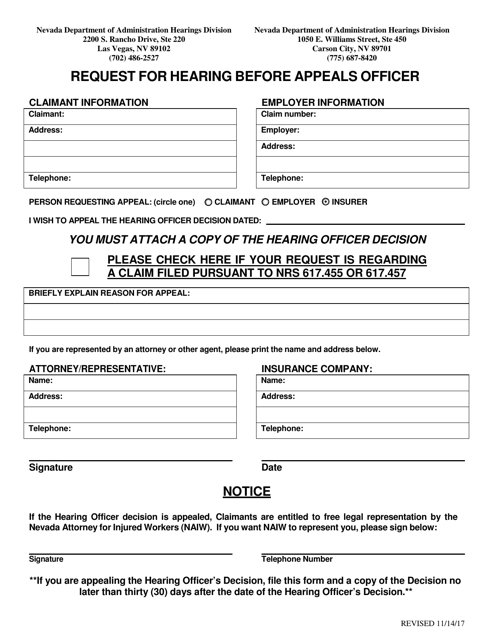

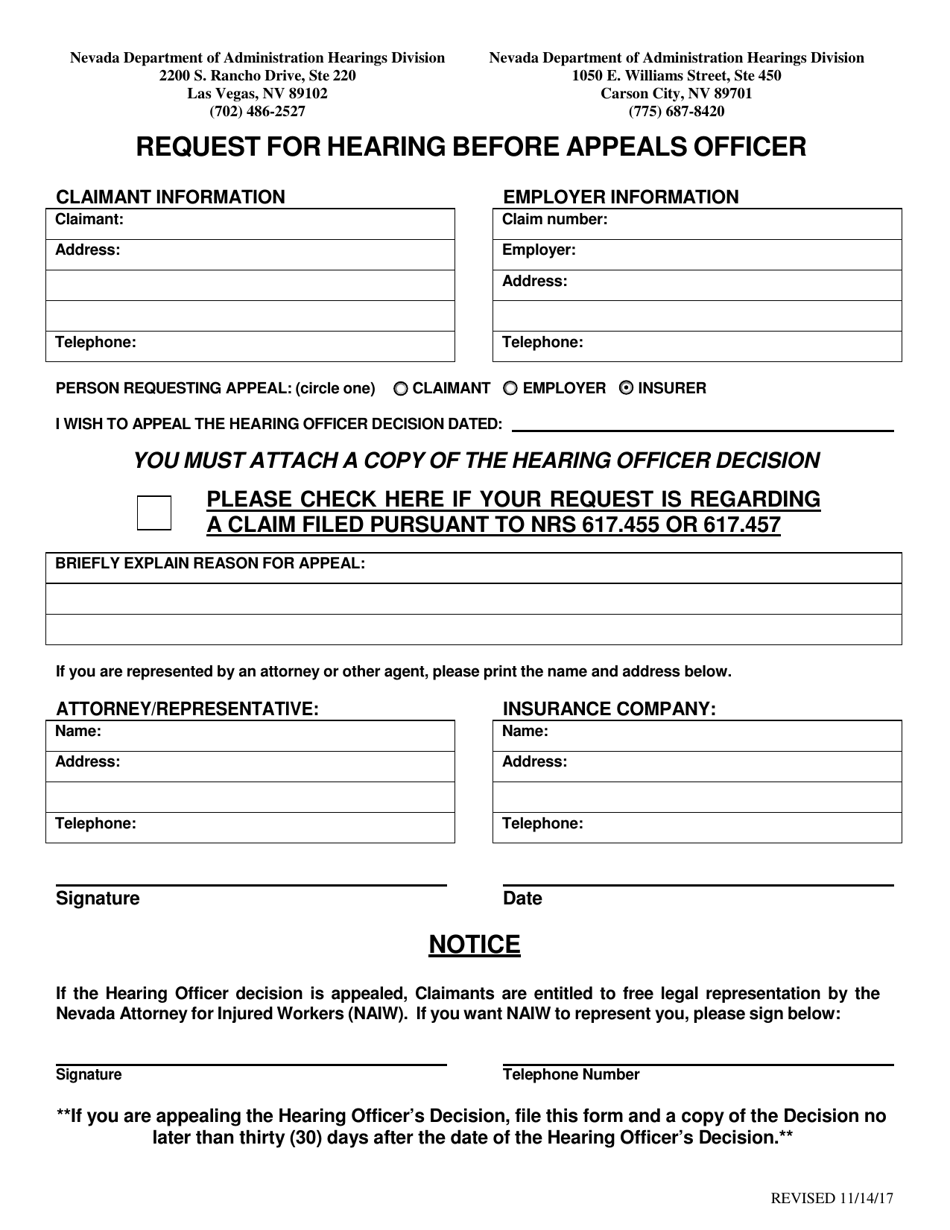

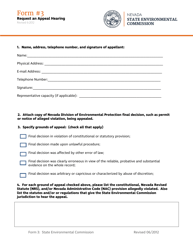

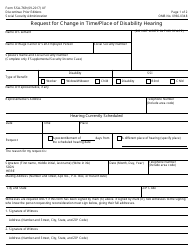

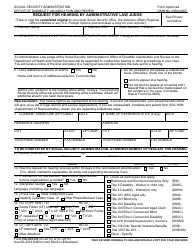

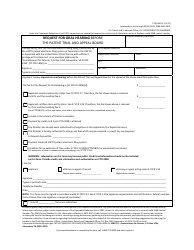

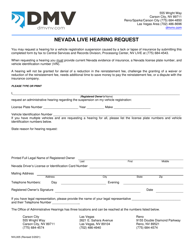

Request for Hearing Before the Appeals Officer - Nevada

Request for Hearing Before the Appeals Officer is a legal document that was released by the Nevada Department of Administration - a government authority operating within Nevada.

FAQ

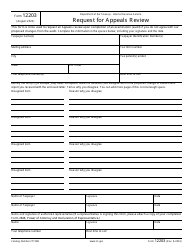

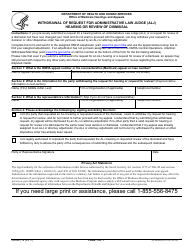

Q: What is a Request for Hearing Before the Appeals Officer?

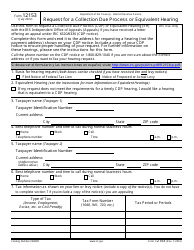

A: A Request for Hearing Before the Appeals Officer is a formal process for individuals in Nevada to request a hearing to dispute a tax-related decision made by the IRS.

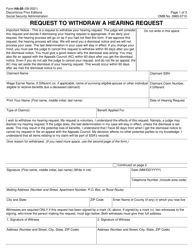

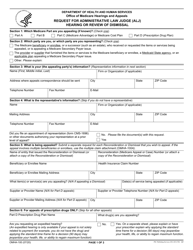

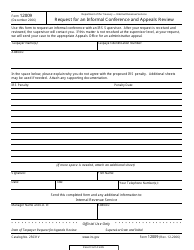

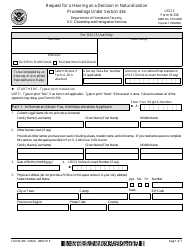

Q: How do I file a Request for Hearing Before the Appeals Officer in Nevada?

A: To file a Request for Hearing Before the Appeals Officer in Nevada, you need to complete and submit Form 12153, along with any supporting documentation, to the IRS.

Q: What should I include in my Request for Hearing Before the Appeals Officer in Nevada?

A: In your Request for Hearing Before the Appeals Officer in Nevada, you should include your contact information, the tax year(s) and type(s) of tax involved, a clear explanation of why you disagree with the IRS decision, and any supporting documents.

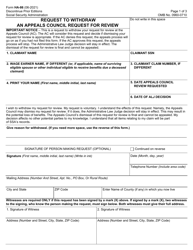

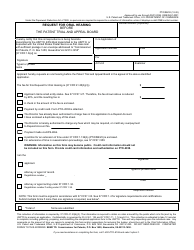

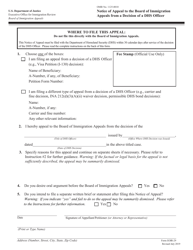

Q: What happens after I file a Request for Hearing Before the Appeals Officer in Nevada?

A: After you file a Request for Hearing Before the Appeals Officer in Nevada, the Appeals Officer will review your case and schedule a hearing, either in person or over the phone, to allow you to present your argument.

Q: Can I have representation during the hearing?

A: Yes, you have the right to have representation, such as a tax professional or attorney, during the hearing.

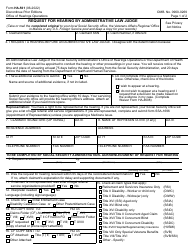

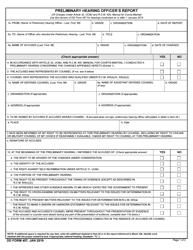

Form Details:

- Released on November 14, 2017;

- The latest edition currently provided by the Nevada Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Administration.