This version of the form is not currently in use and is provided for reference only. Download this version of

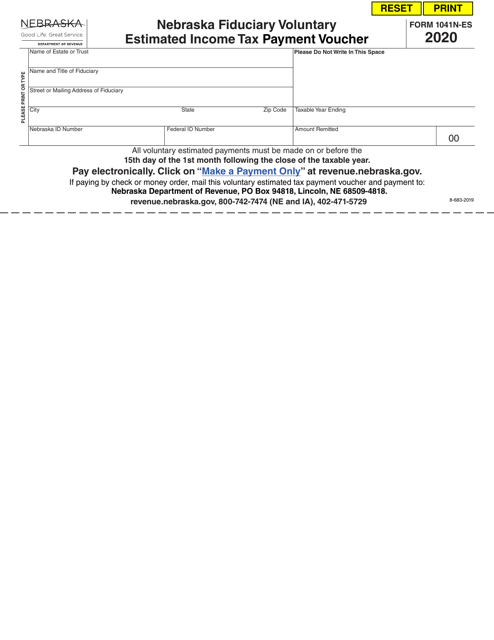

Form 1041N-ES

for the current year.

Form 1041N-ES Nebraska Fiduciary Voluntary Estimated Income Tax Payment Voucher - Nebraska

What Is Form 1041N-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041N-ES?

A: Form 1041N-ES is the Nebraska Fiduciary Voluntary Estimated Income Tax Payment Voucher.

Q: Who needs to use Form 1041N-ES?

A: Fiduciaries in Nebraska who need to make estimated income tax payments for an estate or trust should use Form 1041N-ES.

Q: What is the purpose of Form 1041N-ES?

A: Form 1041N-ES is used to make voluntary estimated income tax payments for fiduciaries in Nebraska.

Q: When should Form 1041N-ES be filed?

A: Form 1041N-ES should be filed on a quarterly basis, with payments due on April 15th, June 15th, September 15th, and January 15th.

Q: Do I need to include payment with Form 1041N-ES?

A: Yes, you must include your payment when submitting Form 1041N-ES.

Q: What happens if I don't file Form 1041N-ES?

A: Failing to file Form 1041N-ES or make estimated tax payments may result in penalties and interest being assessed by the Nebraska Department of Revenue.

Q: Can I request an extension to file Form 1041N-ES?

A: No, Nebraska does not allow extensions for filing Form 1041N-ES.

Q: Are there any special instructions for completing Form 1041N-ES?

A: You should carefully follow the instructions provided with Form 1041N-ES to ensure accurate completion.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041N-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.