This version of the form is not currently in use and is provided for reference only. Download this version of

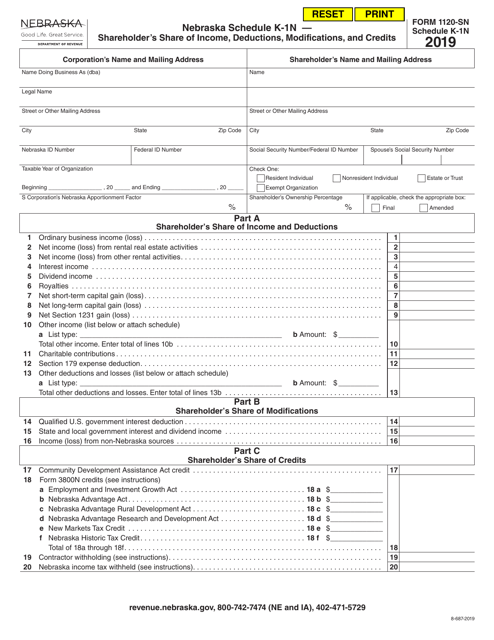

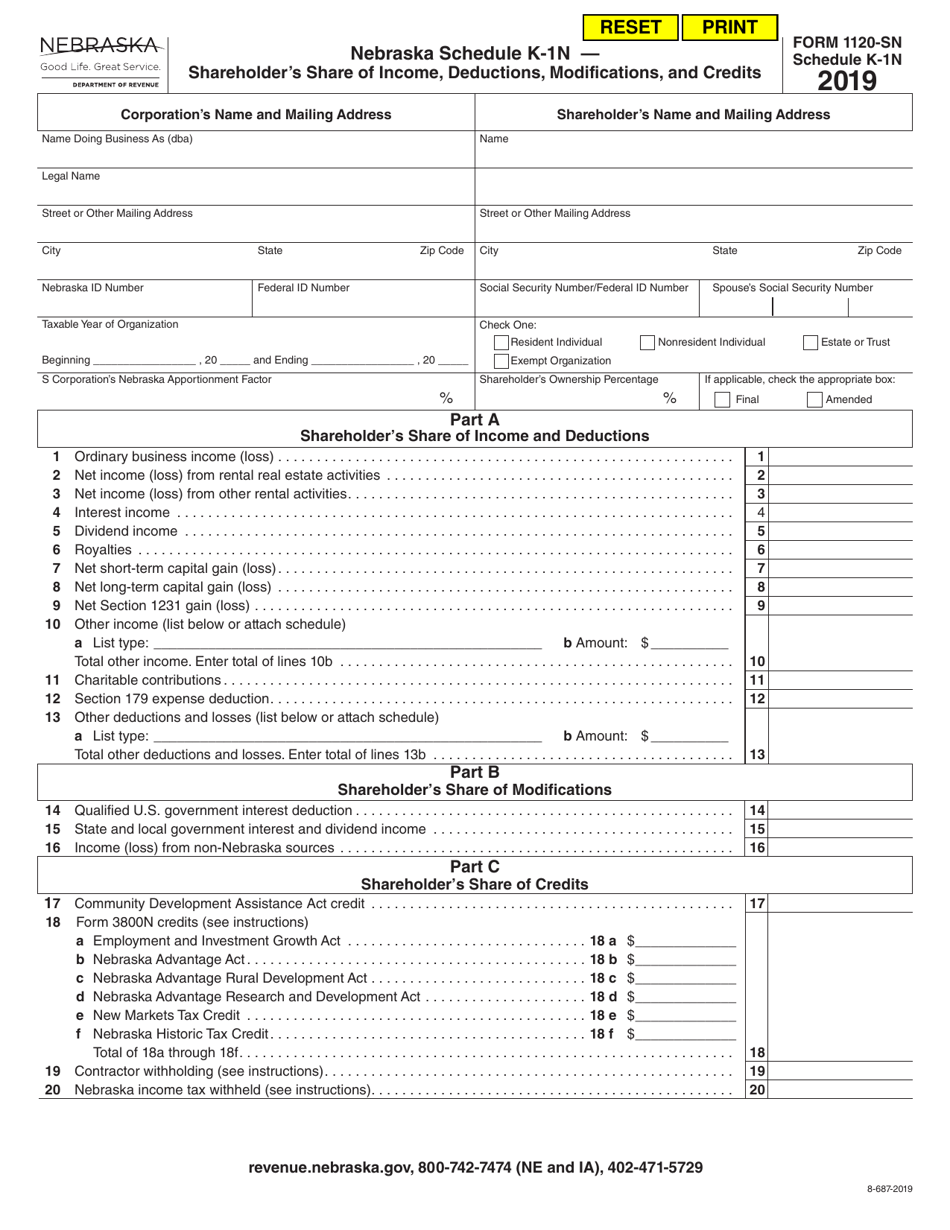

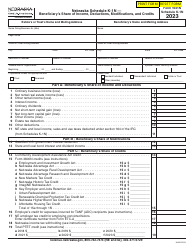

Form 1120-SN Schedule K-1N

for the current year.

Form 1120-SN Schedule K-1N Shareholder's Share of Income, Deductions, Modifications, and Credits - Nebraska

What Is Form 1120-SN Schedule K-1N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120-SN Schedule K-1N?

A: Form 1120-SN Schedule K-1N is a document used to report a shareholder's share of income, deductions, modifications, and credits specifically for Nebraska state taxes.

Q: Who is required to file Form 1120-SN Schedule K-1N?

A: Shareholders of S corporations that operate in Nebraska and have income, deductions, modifications, or credits that are specific to Nebraska state taxes must file Form 1120-SN Schedule K-1N.

Q: What information is included in Form 1120-SN Schedule K-1N?

A: Form 1120-SN Schedule K-1N includes information about the shareholder's share of income, deductions, modifications, and credits for Nebraska state taxes.

Q: When is the deadline to file Form 1120-SN Schedule K-1N?

A: The deadline to file Form 1120-SN Schedule K-1N is the same as the deadline for filing the Nebraska S corporation return, which is generally on or before March 15th.

Q: What should I do if I have questions or need assistance with Form 1120-SN Schedule K-1N?

A: If you have questions or need assistance with Form 1120-SN Schedule K-1N, you can contact the Nebraska Department of Revenue directly for guidance and support.

Q: Is there a filing fee for Form 1120-SN Schedule K-1N?

A: No, there is no filing fee associated specifically with Form 1120-SN Schedule K-1N. However, there may be other fees or taxes that apply to S corporations in Nebraska.

Q: Do I need to attach Form 1120-SN Schedule K-1N to my federal tax return?

A: No, Form 1120-SN Schedule K-1N is only required for Nebraska state taxes and does not need to be attached to your federal tax return.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120-SN Schedule K-1N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.