This version of the form is not currently in use and is provided for reference only. Download this version of

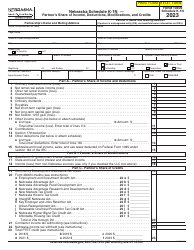

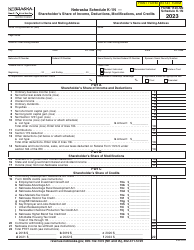

Form 1041N Schedule K-1N

for the current year.

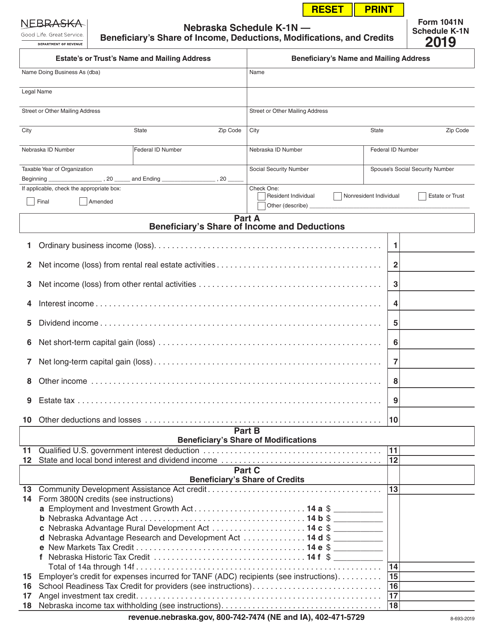

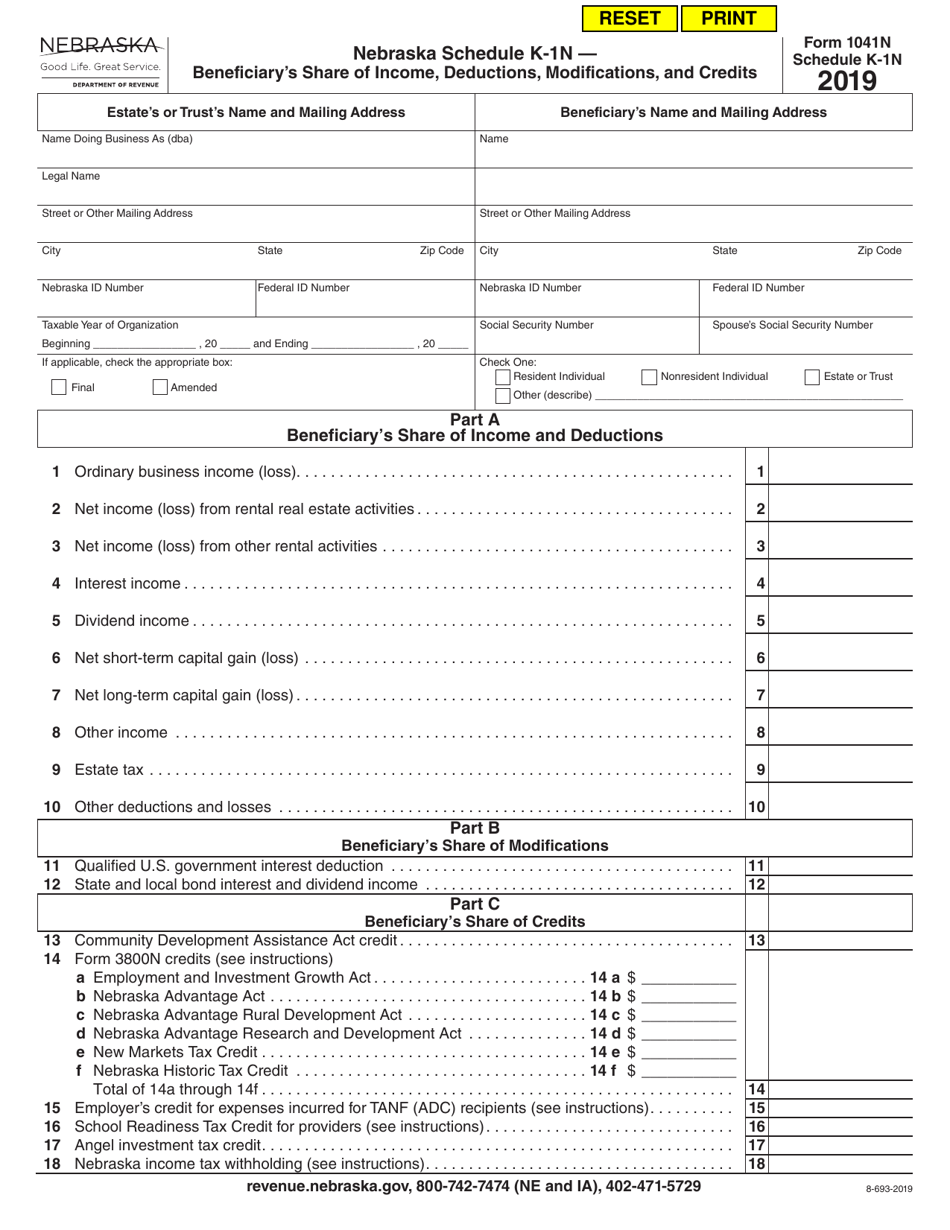

Form 1041N Schedule K-1N Beneficiary's Share of Income, Deductions, Modifications, and Credits - Nebraska

What Is Form 1041N Schedule K-1N?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 1041N, Nebraska Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041N Schedule K-1N?

A: Form 1041N Schedule K-1N is a tax form used by beneficiaries of a trust or estate in Nebraska to report their share of income, deductions, modifications, and credits.

Q: Who should file Form 1041N Schedule K-1N?

A: Beneficiaries of a trust or estate in Nebraska should file Form 1041N Schedule K-1N to report their share of income, deductions, modifications, and credits.

Q: What information is reported on Form 1041N Schedule K-1N?

A: Form 1041N Schedule K-1N reports the beneficiary's share of income, deductions, modifications, and credits from a trust or estate in Nebraska.

Q: When is the deadline to file Form 1041N Schedule K-1N?

A: The deadline to file Form 1041N Schedule K-1N is the same as the deadline to file the trust or estate's tax return, which is usually April 15th.

Q: Is there a fee to file Form 1041N Schedule K-1N?

A: No, there is no fee to file Form 1041N Schedule K-1N.

Q: Do I need to include a copy of Form 1041N Schedule K-1N with my tax return?

A: No, you do not need to include a copy of Form 1041N Schedule K-1N with your tax return. However, you should keep it for your records.

Q: What should I do if I have questions or need assistance with Form 1041N Schedule K-1N?

A: If you have questions or need assistance with Form 1041N Schedule K-1N, you can contact the Nebraska Department of Revenue or consult a tax professional.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041N Schedule K-1N by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.