This version of the form is not currently in use and is provided for reference only. Download this version of

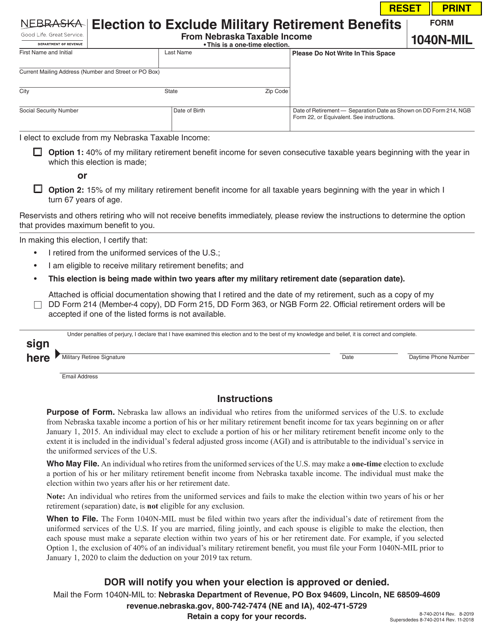

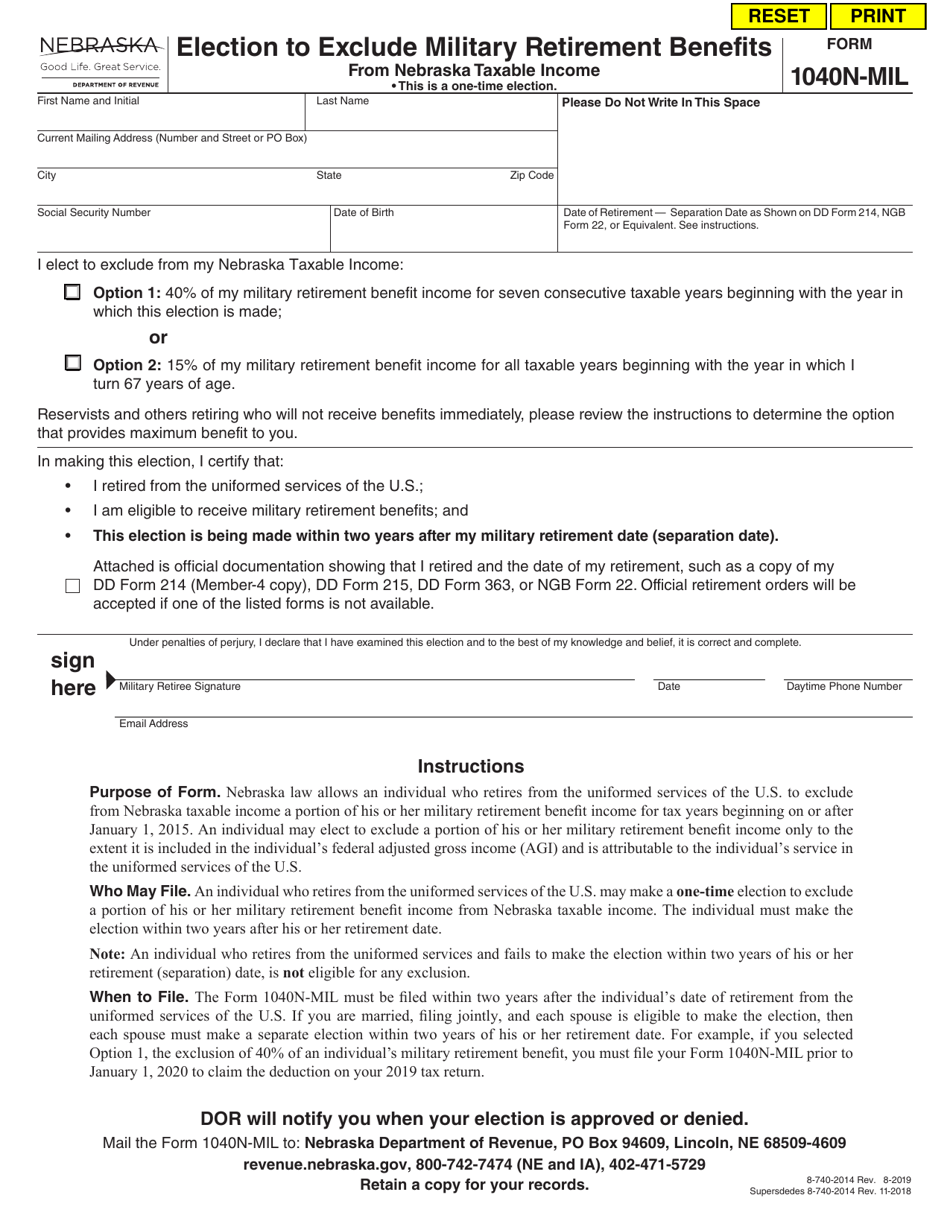

Form 1040N-MIL

for the current year.

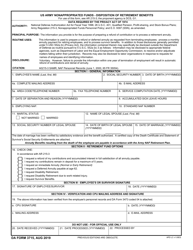

Form 1040N-MIL Election to Exclude Military Retirement Benefits From Nebraska Taxable Income - Nebraska

What Is Form 1040N-MIL?

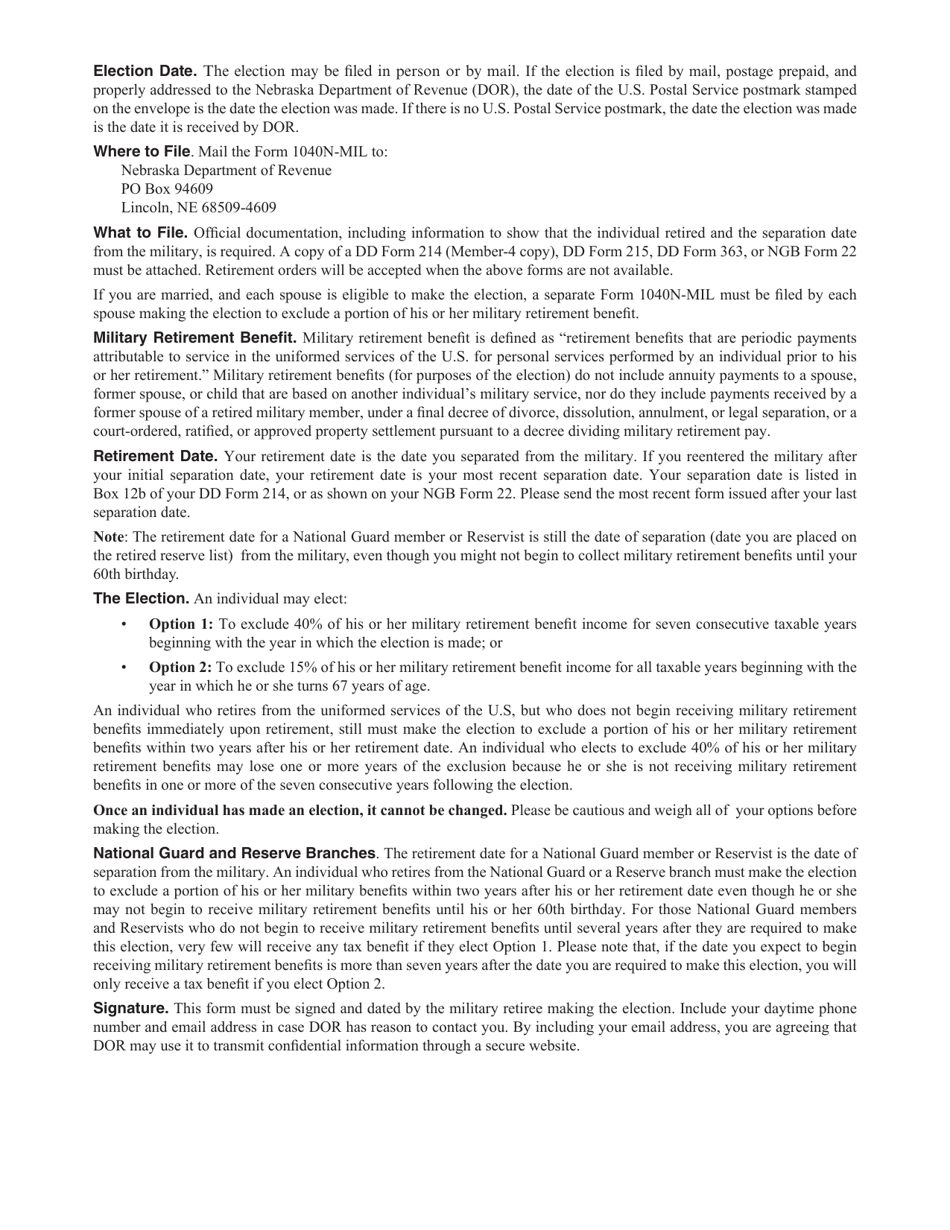

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040N-MIL?

A: Form 1040N-MIL is a tax form used in Nebraska.

Q: What is the purpose of Form 1040N-MIL?

A: The purpose of Form 1040N-MIL is to elect to exclude military retirement benefits from Nebraska taxable income.

Q: Who is eligible to use Form 1040N-MIL?

A: Active duty military personnel or retiree receiving military retirement benefits in Nebraska are eligible to use Form 1040N-MIL.

Q: What is the benefit of excluding military retirement benefits from taxable income in Nebraska?

A: Excluding military retirement benefits from taxable income can reduce the amount of taxes owed in Nebraska.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040N-MIL by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.