This version of the form is not currently in use and is provided for reference only. Download this version of

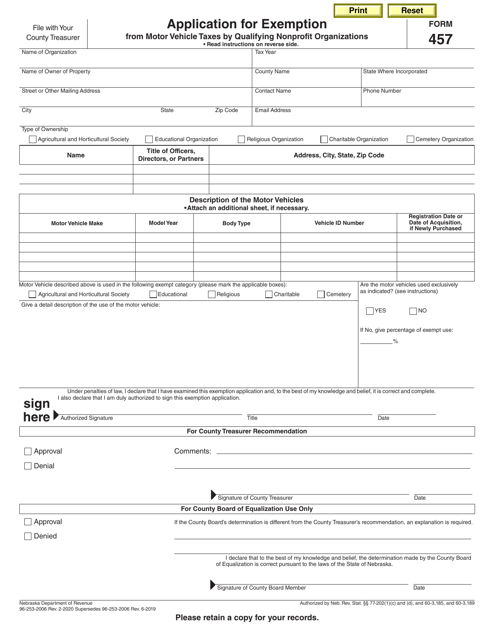

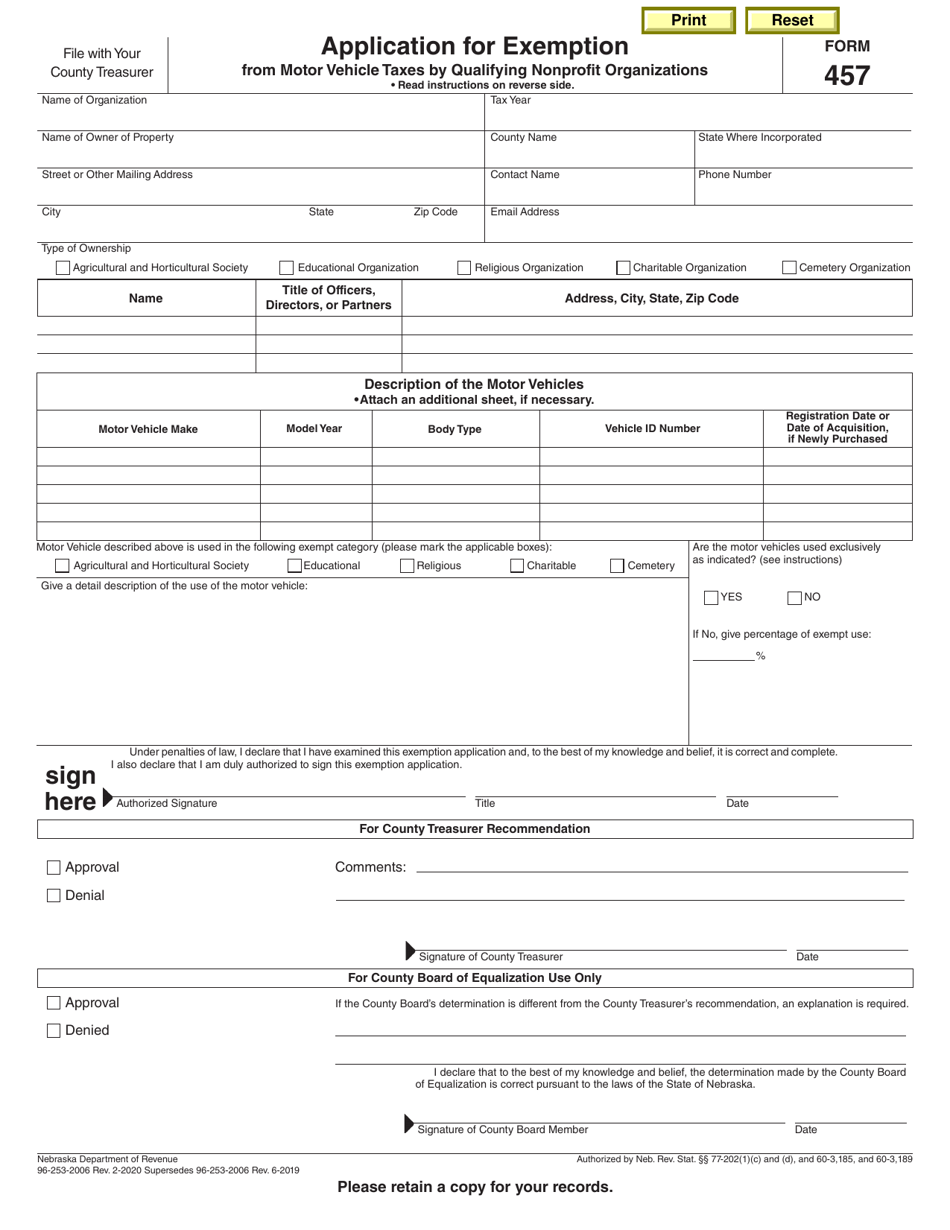

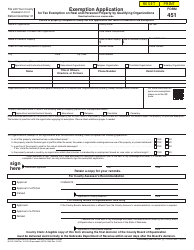

Form 457

for the current year.

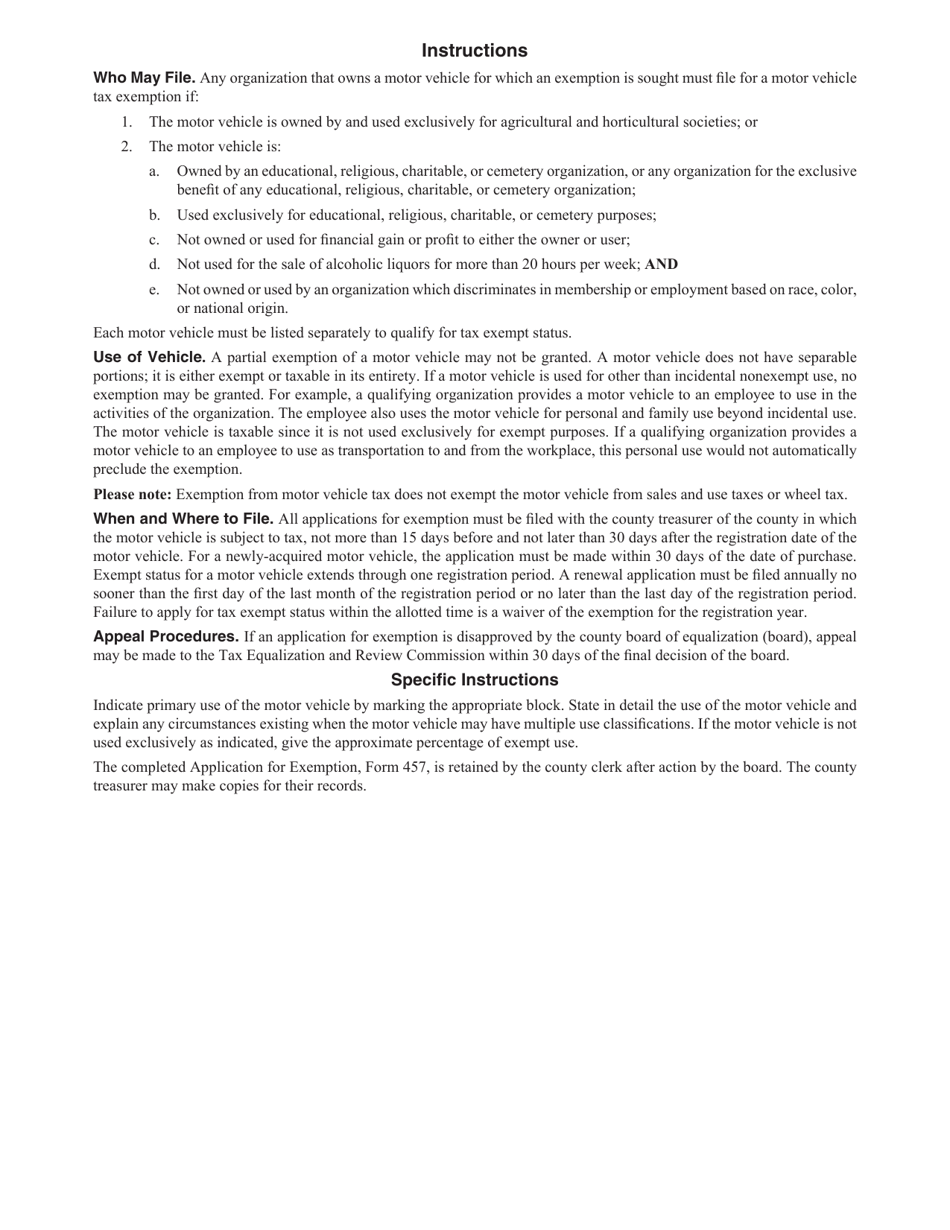

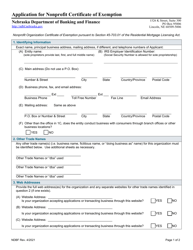

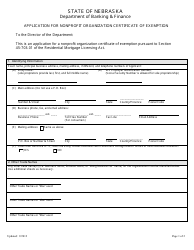

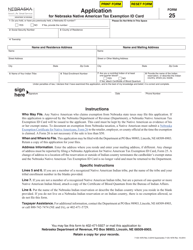

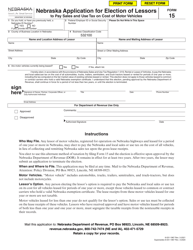

Form 457 Application for Exemption From Motor Vehicle Taxes by Qualifying Nonprofit Organizations - Nebraska

What Is Form 457?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 457?

A: Form 457 is an application used by qualifying nonprofit organizations in Nebraska to request an exemption from motor vehicle taxes.

Q: Who can use Form 457?

A: Form 457 can be used by qualifying nonprofit organizations in Nebraska.

Q: What is the purpose of Form 457?

A: The purpose of Form 457 is to apply for an exemption from motor vehicle taxes for qualifying nonprofit organizations.

Q: How do I qualify for the exemption?

A: To qualify for the exemption, the organization must meet certain criteria set by the Nebraska Department of Revenue.

Q: Is there a fee to file Form 457?

A: No, there is no fee to file Form 457.

Q: What supporting documents are required with Form 457?

A: The organization must submit proof of its nonprofit status, such as a copy of its IRS determination letter.

Q: When should I submit Form 457?

A: Form 457 should be submitted to the Nebraska Department of Revenue on or before December 31st of the year preceding the tax year for which the exemption is sought.

Q: What happens after I submit Form 457?

A: The Nebraska Department of Revenue will review the application and notify the organization of its decision.

Q: How long does the exemption last?

A: The exemption granted by Form 457 is valid for one calendar year.

Q: Can the exemption be renewed?

A: Yes, the organization must submit a new application each year to request a renewal of the exemption.

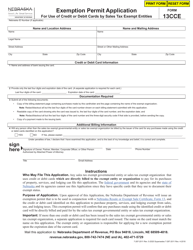

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 457 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.