This version of the form is not currently in use and is provided for reference only. Download this version of

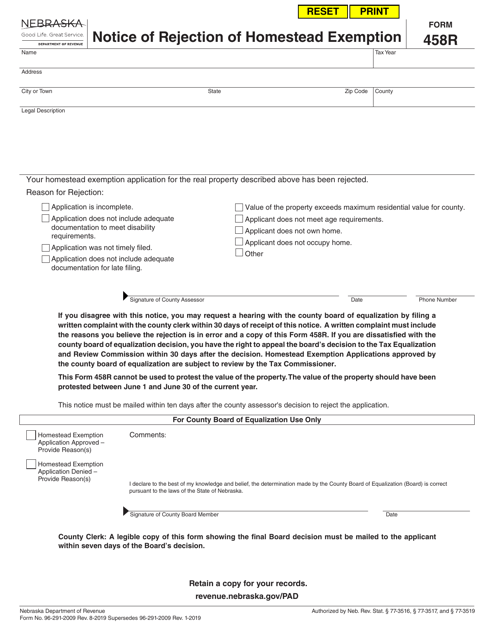

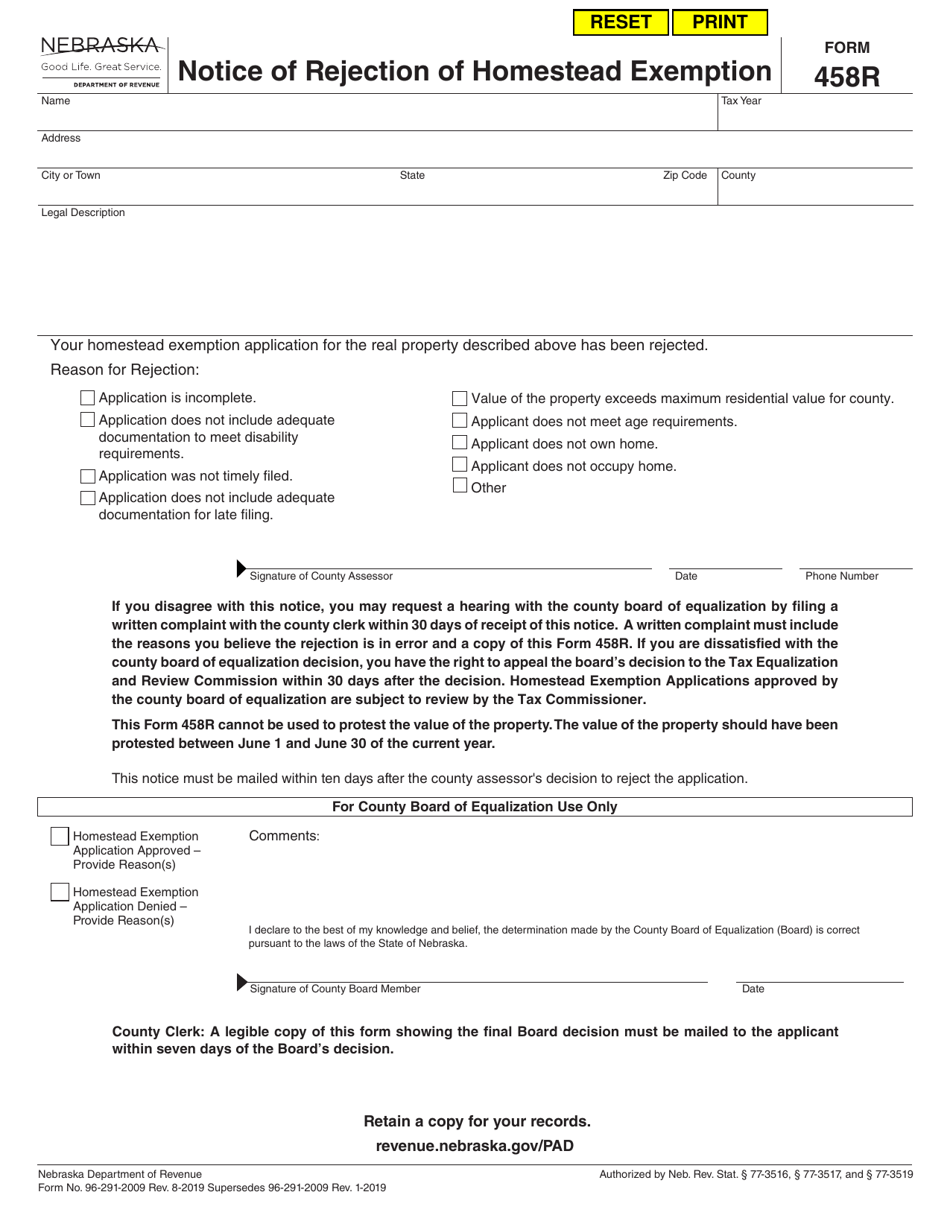

Form 458R

for the current year.

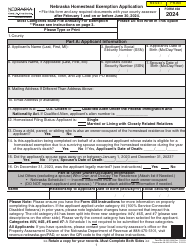

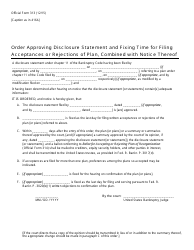

Form 458R Notice of Rejection of Homestead Exemption - Nebraska

What Is Form 458R?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 458R?

A: Form 458R is a Notice of Rejection of Homestead Exemption.

Q: What is the purpose of Form 458R?

A: The purpose of Form 458R is to inform the property owner that their application for homestead exemption has been rejected.

Q: Who needs to file Form 458R?

A: Property owners who have applied for homestead exemption and have been rejected need to file Form 458R.

Q: What information is required on Form 458R?

A: Form 458R requires the property owner's name, address, and a brief explanation of the reason for the rejection.

Q: What should I do if I receive Form 458R?

A: If you receive Form 458R, you should review the reason for the rejection and contact the county assessor's office for further clarification or appeal options.

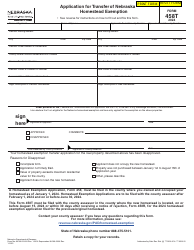

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 458R by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.